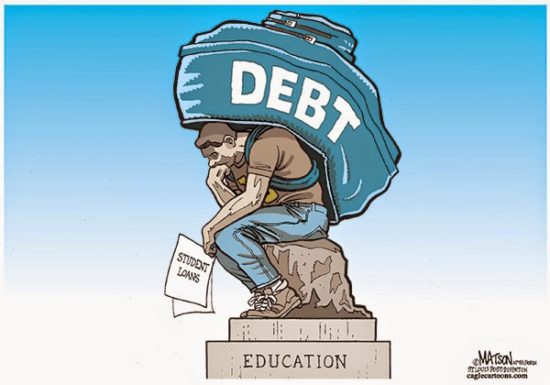

The staggering amount of student loan debt has been crippling fresh graduates with increased intensity over the past several years. Last year, more than two-thirds of college students graduated with debt, owing $35,000 each, on average. Government scholarship and loan programs have failed to keep up with the rising tuition costs. Even though the costs of attending college skyrocketed, household incomes have largely remained flat since 2000, causing 27.2% of college students to graduate with excessive debt (over $45,000) (Kantrowitz).

Even though filing student loans for bankruptcy is significantly more difficult than filing for other types of bankruptcy, it is still possible under Chapter 11 and Chapter 13. Chapter 11 bankruptcy, if successful, relieves the debtor of any obligation to repay and stops collection efforts. The requirements to file for Chapter 11 bankruptcy for student loans were outlined in the 1987 court case of Brunner v. New York State Higher Education Services Corporation. The court case established the Brunner Test as a response to an increased number of bankruptcy filings among fresh college graduates and a legal precedent: Bryant v. Pennsylvania Higher Educ. Assistance Agency, North Dakota State Bd. of Higher Educ. v. Frech, and Marion v. Pennsylvania Higher Educ. Assistance Agency (Fletcher et al. 42) (Bruner).

The Test consists of three prongs. First, the debtor has to prove “undue hardship” or that they cannot maintain a “minimal” standard of living if forced to repay their student loans (Brunner). The requirement was further defined and upheld in Susan M. Shaffer v. US Department of Education in 2011, where “the… court…concluded [that] the educational loan debts debtor owed to the United States Department of Education would impose an undue hardship on debtor and a judgment determining those debts were discharged” (Sahuffer).

Secondly, debtor must prove that their current state of affairs is likely to persist, rendering them unable to improve their debt-repaying capabilities (Brunner). In Long v. Educational Credit Management Corp., Long, a single mother with serious mental health ailments, obtained a discharge of her student loans (Fletcher et al. 42).

Thirdly, debtor has to make “good faith” efforts to repay the loans (Brunner). In Roth v. Educational Credit Management Corp, a debtor sought to discharge $95,000 of student loans incurred over the period of 15 years stating she had a history of physical and mental medical conditions. The bankruptcy court held that “failure to negotiate or accept an alternate payment plan is not dispositive” of a finding of good faith. But after reconsideration, the court remanded the case with instructions to grant a discharge of the debtor’s student loans. (Fletcher et al. 42).

If a plaintiff is not successful in getting their student loans discharged under Chapter 11 bankruptcy, they can file bankruptcy under Chapter 13. This will allow the debtor to negotiate a repayment plan with creditors based on future income. When repayments are negotiated through bankruptcy court, collectors cannot take action (Aiello and Behrens 3).

There are both pros and cons to going through with the process of filing for student loan bankruptcy and they differ based on the chapter used. Going through the Chapter 11 bankruptcy process for student loans allows the debtor to clear all their student loan debt and start with a new slate. Additionally, bankruptcy granted under Chapter 11 allows the plaintiff to have more discretionary income which they can use to get out of the cycle of poverty, acquire assets, and support their family. Staggering amount of student debt has been preventing young adults from pursuing marriage among 24-year olds. The willingness to build a family decreased 3-4% for every $10,000 in student debt owed (Gicheva 207). Filing for Chapter 13 bankruptcy allows the plaintiff to negotiate a payment plan that works for them. This option is especially beneficial to those who have other outstanding debts such as mortgages, car payments, credit card debt, or medical bills, as it allows them to manage their debt more efficiently.

There are several drawbacks to declaring student loan bankruptcy. Chapter 11 bankruptcy status is extremely difficult to obtain. The courts have largely adhered to the Brunner decision, causing those who have questioned it to incur high court and lawyer fees and waste valuable time. If the plaintiff is successful, bankruptcy status will remain on their record from seven to ten years and affect their access to credit. Additionally, as soon as bankruptcy is declared, many banks suspend the person’s credit cards. The main drawback of filing for Chapter 13 bankruptcy is the fact that the plaintiff still has to repay the debt, causing no elimination of economic hardship, just reduction of it to manageable levels.

Even though filing student loan bankruptcy is possible under Chapter 11 and Chapter 13, the Brunner test makes it extremely difficult to obtain. Those who are successful under Chapter 11 no longer have to pay off the rest of their debt but will have bankruptcy status on their record for seven to ten years, affecting their ability to borrow. If the plaintiff is not successful obtaining bankruptcy status under Chapter 11, they can file under Chapter 13, negotiating a more reasonable repayment plan through the bankruptcy court and if approved they are free to repay without pressure from the creditors. Their burden is alleviated but not removed. With rapidly growing student loan debt due to increased tuition costs and stagnating wages, the Brunner test needs to be relaxed to reflect the current state of affairs.

Please look at some of our custom writing services:

– Custom Essays

– Order Essay Services

– Essay Writing Help Online

– Write My Essay

– Essay Writers for Hire

– Academic Essay Writing

– Best Essay Writing Services

– Essay Writing Services UK

Peachy Essay essay services team offers a wide range of services including English Essay Writing Services. More importantly, our team of experienced writers working at Education Writing Help offer the following services:

– Education Assignment Writing Services

– Education Essay Writing Service

– Education Dissertation Writing Service