Introduction

JP Morgan Chase, previously known as J.P. Morgan and Company, Inc., is an American financial institution established through a merger between J.P. Morgan & Co. and the Chase Manhattan Corporation in 2000. The corporation has its history from JP Morgan and Company, Inc., which was formed in 1859. With the merger in the 20th century, the two companies had been able to assimilate small-business and personal banking with government securities, investment banking and commercial banking. Although the company has recorded tremendous success in the financial sector, it faced a setback in 2008. It incurred losses ranging into millions of dollars as a result of the financial crisis. This study illustrates the history of JP Morgan Chase, the various mergers it has undergone over the years, including the effect of the Gramm-Leach Bliley Act on its operations and how the company had been able to respond to the Covid 19 pandemic.

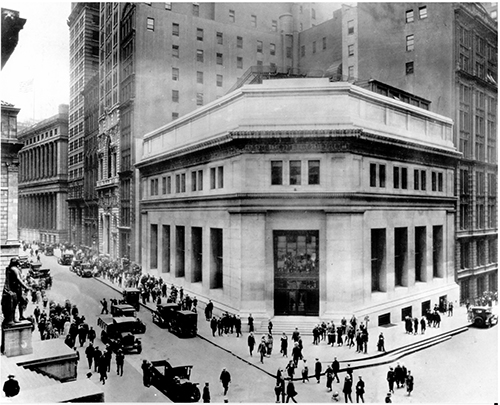

History of the JP Morgan Chase

J Morgan Chase, one of the largest and oldest known financial institutions globally, has a history that dates back to 1799, when its predecessor was established in New York City. The financial institution has its foundation in more than 1200 predecessor firms. The primary heritage institutions include J.P Morgan, chemical, Chase Manhattan, Manufacturers Hanover and Bank one, National Bank of Detroit and First Chicago, which are closely associated with innovations in finance in the US and global economies. The institution started as an investment bank. The Bank of Manhattan Company was the oldest predecessor of the J Morgan Chase. The Bank of Manhattan Company, a predecessor of the J Morgan Chase, was established in 1799 as a strategy to help Jefferson in his election in 1800. J.P Morgan & Co. was established in 1871 as an agent of European investors (Chase, 2017).

Various mergers shaped the establishment of JP Morgan Chase. The Chemical Banking Corporation merged with Manufacturers Hanover Corporation in 1991 to form Chemical Banking Corporation, the second-largest banking firm in the US. This process was followed by the merger between Chemical Banking Corporation and Chase Manhattan Corporation to form the Chase Manhattan Corporation. In 2000, there was a merger between the Chase Manhattan Corporation and J.P Morgan & Co. Incorporated, an action that combined the four of the oldest and largest financial institutions in the US. In close proximity was the merger between J.P. Morgan & Co. and Bank One Corporation in 2004. In the quest to strengthen its financial capabilities, J.P. Morgan & Co. acquired Bear Stearns Companies Inc. in 2008. It also acquired certain liabilities, assets and deposits of Washington Mutual’s banking operations. This acquisition boosted Chase’s business network into Florida, California and Washington State. By 2010, J.P. Morgan has full access to its joint venture in the UK, one of the largest financial institution in Britain (BOTIȘ, 2013).

How was JP Morgan Chase affected by the Gramm-Leach-Bliley Act of 1999?

The Gramm-Leach Bliley Act, which came into force in 1999, brought tremendous changes to financial institutions by developing new means of conducting business. The Act repealed the Glass-Steagall Act, which was ineffective in safeguarding the interests of the consumer. With the passing of the Gramm-Leach Bliley Act, JP Morgan Chase was involved in activities such as insurance handwriting, deposit making and loan taking, investment banking, merchant banking, and brokerage services. The Act’s provisions were beneficial to JP Morgan Chase as it was able to take advantage of the economies of scale and scope and revenue efficiencies of the various operations. This advantage was absent in the previous Act. The GLBA enabled JP Morgan Chase to merge and consolidate its resourcing by acquiring different firms to expand to its current form. It allowed a new corporate form among insurance, banks, and security firms, increasing diversification within financial institutions (Akhigbe & Whyte, 2004).

How was JP Morgan Chase involved in the financial crisis of 2008-2009?

According to the economists, the financial crisis of 2008-2009 was not due to enigmatic and ethereal forces but a consequence of fraud in the financial market. The fraudulently selling mortgage derivatives caused the situation by other Wall Street banks and JP Morgan to investors. Although AIG has insured the mortgage derivatives, the fraudulent loans burst, and no institution had sufficient capital to cover the losses. AIG was unable to cover the mortgage derivatives as agreed. JP Morgan escalated the situation by acquiring Washington Mutual, one of the most active retail mortgage lenders. The bank went ahead to acquire Bear Stearns to secure it from collapsing. The company failed in doing due diligence by implementing a flawed process. JP Morgan was negligent in allowing the selling of mortgages that did not conform to the underwriting standards. The effects of defective mortgages were extended to the American taxpayers.

Furthermore, JP Morgan and the companies it acquired were offloading fraudulent mortgages to other companies. During the financial crisis, JP Morgan was the only company that made a profit at the expense of other companies and the taxpayers. It was found liable for the misdeeds and fined $ 13 billion (Hearit, 2018).

How JP Morgan Chase has responded to the Covid-19 pandemic

The institution has put in place a strategy to respond to the needs of its customers who are experiencing financial constraints because of the pandemic. It is now easy to enrol in a payment assistance program. Up to now, the company has helped in assisting with over 1.5 million customer accounts, including home lending, deposit and auto lease, credit card, and loan accounts. The company has given a grace period for mortgage payments. Those who had delayed payment are not liable to a late fee or penalty and approving more than $45 billion as new credit to clients affected by Covid-19, including funding to hospital and healthcare companies, nonprofits organizations, educational institutions and local governments.

How Covid 19 pandemic has affected the JP Morgan Chase

The low interest rates imposed as a result of Covid-19 has reduced the JP Morgan Chase banking profitability in mature markets, which has forced the institution to move towards commission-based income. The immediate effects of the pandemic on JP Morgan Chase in the global economy have been the increased credit risk. Due to the economy’s contraction, there are adverse consequences on credit quality due to loan loss provisions. Covid 19 has led to high volatility and instability in capital markets. The financial institution valuation has dropped since the inception of Covid 19.

Conclusion

Over the years, the financial institution has grown to become one of the largest firms in the US. From its inception in 1799, the institution has made several essential mergers that have boosted its growth, making it a significant entity in the global financial market. Its growth has not been without controversy; the company is accused of causing the 2008-2009 financial crisis, which had a heavy toll on taxpayers and investors in the US. This accusation led to a civil suit in which the company was required to pay $13 billion as a penalty for their misdeeds in the financial crisis. Nevertheless, the company has redeemed its name following the start of the Covid 19 pandemic. A financial plan has introduced a strategy in which it assists customers who are in financial difficulties. Moreover, the company had introduced a system of allowing a grace period for the mortgage payments and not imposing penalties on late payments. They have also put in place low-interest rates on the mortgages to cushion those affected by the pandemic.