Credit risk is the oldest and biggest risk that bank, by virtue of its business nature inherits. This study first identifies the importance of Credit Risk management for commercial banks and then tries to find out the existing procedures for credit risk management that are followed by the different commercial banks in Macedonia. The credit risk portfolios of the banks in Macedonia are investigated according to the bank’s size – according to the banks’ classification in three groups – large, medium and small. The future of banking will undoubtedly rest on risk management dynamics. Only those banks that have efficient risk management system will survive in the market in the long run. The effective management of credit risk is a critical component of comprehensive risk management essential for long-term success of a banking institution. This thesis is concluded with some guidelines that will help commercial banks to sustain in the volatile market, especially focusing on the banks’ size in the context of credit risk management.

Keywords: Credit, Risk Management, Basel II/III, Credit risk scoring, Credit risk rating, Credit Portfolio, Macedonian banking sector

INTRODUCTION

Credit extension is critical to banks operations, measuring significantly within the asset of the balance sheet. It has the capability of creating huge profit, and just as high risk. Research studies demonstrate that credit risks are the most highly registered in time by banks, regarding losses. Credit risk is an investor’s risk of loss arising from a borrower who does not make payment as promised (Bluhn, et.al. 2002).

Loans that constitute a large proportion of the assets in most banks’ portfolios are relatively illiquid and exhibit the highest credit risk (Koch and MacDonald, 2000). The management of credit risk in banking industry takes after the procedure of risk identification, estimation, evaluation, monitoring, and control. It includes identification of potential risk elements, estimate their consequences, monitor activities related to identified risk factors and integrate control measures to avoid or decrease the undesirable impacts. This procedure is applied within the strategic and operational management of the bank.

For most banks, loans are the biggest and most obvious source of credit risk; nonetheless, different sources of credit risk exist all through the operations of a bank, incorporated in the banking book and in the trading book, and both on and off the balance sheet. Banks are increasingly facing credit risk in different money related instruments other than loans, including acceptances, interbank transactions, trade financing, foreign trade exchanges, securities, equities,

and in the extension of commitments and guarantees, and the settlement of transactions. The objective of risk management is to reduce the impacts of various types of risks identified to a preselected domain to the level accepted by rules and standards. It may refer to various sorts of risks brought on by environment, innovation, individuals, associations and governmental issues.

Goodhart (1998) states that poor credit risk management which results in undue credit risk causes bank failure. Chimerine (1998) concurs with Goodhart. This results in insolvency of banks and reduces funds available for new investments, which eventually leads to bank failure. Goodhart et al (1998) connected lending to the causes of bank failure. Irregular meetings of loan committees, false loans, large treasury losses, money laundering in large amounts, contribute to bank failure.

The ability of banks to quantify credit risk obviously has the potential to greatly improve risk management capacities. With the estimated credit loss, the bank can choose how best to deal with the credit risk in a portfolio, for example, by putting aside the suitable loan loss reserves or by selling loans to reduce risk. Andersen, J. et al., (2003) explain that to a greater degree the use of credit risk models will enable the banks to undertake portfolio management, which takes due account of the varying impact of business cycles on lending. It is imperative to note, however, that in the process of banks to make a choice to grant credit they will keep on relying upon an assessment of the actual risk with an exposure details. Effective system that ensures repayment of loans by borrowers is critical in dealing with asymmetric information problems and in reducing the level of loan losses, thus the long term success of any banking organization (Basel, 1999; IAIS, 2003). Effective credit risk management involves establishing an appropriate credit risk environment; operating under a sound credit granting process; maintaining an appropriate credit administration that involves monitoring process as well as adequate controls over credit risk (Basel, 1999; Greuning and Bratanovic, 2003; IAIS, 2003). It requires top management to ensure that there are proper and clear guidelines in managing credit risk, i.e. all guidelines are properly communicated throughout the organization; and that everybody involved in credit risk management (CRM) understand them.

Considerations that frame the basis for sound CRM framework include: policy and strategies (rules) that clearly layout the scope and allocation of a bank credit facilities and the way in which a credit portfolio is overseen, i.e. how loans are approved, assessed, managed and

collected. (Basel, 1999; Greuning and Bratanovic, 2003; PriceWaterhouse, 1994). Screening borrowers is an activity that has widely been recommended by, among others, Derban et al (2005). This suggestion has been widely put to use in the banking sector as credit evaluation. According to the information theory, an accumulation of reliable information from forthcoming borrowers becomes critical in achieving successful screening.

Considering the importance and the role of managing risks in the modern banking systems, the aim of this research is to gain better understanding of risk management procedures. Banks face different elements of risk and they should be properly identified, understood, measured and managed. In addition to the overview of the basic concepts of banking risks, the thesis will focus on credit risk management, the methods used by banks for efficient credit risk management, and analysis of the action they take to control credit risk. Credit risk is the most obvious risk of a bank by the nature of its activity. In terms of potential losses, it is typically the largest type of risk. A separate analysis will be made for the banking system in Macedonia. A research will be done on how domestic banks deal with credit risk, with particular reference to the credit portfolio of Macedonian banks (large, medium and small size banks) during the period 2007 – 2014.

The objective is to study the main trends in credit risk management, how credit risks influence banking operations, how to evaluate and control credit risk, credit portfolio of Macedonian banks, the advantages and shortcomings of Macedonian banks in dealing with credit risk, and differences due to the size of the banks. More specifically, the thesis has the following objectives:

Define risk as a concept, and introduce risk procedures related to bank operations – management, assessment, evaluation and control

Define credit risk of banks and its management

Analysis of Basel II/III regulations

Analysis of the banking sector in Macedonia, and credit risk management of Macedonian banks

Research the credit risk management differences due to the banks’ size in Macedonia

Given the complexity of the research topic, a theoretical elaboration will be given on different aspects of credit risk management. For the purpose of this research extant literature related to the topic from different databases, websites and other available sources was collected. A systematic review of collected literature was done in detail. A literature review using an archival method is adopted as it enables us to structure research and to build a reliable knowledge base in this field.

The research will include analysis of the credit risk evaluation and credit risk indicators in Macedonian banks. The review will include banks classified according to the size – the group of large, medium and small banks in Macedonia. In the research of the subject matter scientific methods employed in social sciences will be applied. Besides the theoretical studies, the analytical, statistical and comparative method will be used. During the writing of the thesis, also, other methodological procedures will be involved, resulting both in theoretical and practical knowledge. Conclusions should be drawn using inductive and deductive methods.

The paper has the following structure: Chapter 2 presents a theoretical elaboration on the main problem areas of the thesis. This section provides a review on risk management and procedures related to credit risk in banks. Additionally, an overview of Basel II/III regulations is given, as well as an overview of the empirical literature regarding the banks’ size and credit risk. Chapter 3 considers the credit risk management in the Macedonian banking sector. First, the banking system of Macedonia is analyzed. Then, an analysis of the regulatory framework for the credit risk management in Macedonian banking sector follows. Lastly, the thesis provides a research on credit risk portfolio of the banks for the period 2007-2015, with particular reference to the differences due to banks’ size. The last chapter gives concluding remarks about the results and presents future recommendations.

THEORETICAL CONSIDERATIONS AND LITERATURE REVIEW

The objective of this paper is to establish the theoretical background of the topic treated within the thesis and provide a review of the empirical literature. The first part of this chapter deals with the basic concepts of risk management. The purpose of this part is to define risk and risk management, to provide guidelines on risk assessment procedures and to establish a framework for evaluation and controlling risks. The second part provides a more detailed analysis on credit risk management. This chapter explains the procedures of credit scoring and credit ratings and presents the basic concepts on credit risk management. The last part reviews the Basel II/III Accords.

Risk management

It is undeniable that the risks faced by banks have increased in recent years. Financial markets have become more volatile and this has exposed the banks to greater fluctuations to interest rates and exchange rates. The process of deregulation in many countries has bitten into banks’ traditional sources of income, thus both encouraging and permitting them to diversify into other types of business activity, including property trading in securities, foreign exchange and new products. These developments have increased the pressure on management to control their risks in a more proactive manner.

Defining risk and risk management

Risk is part of everybody’s daily life, it’s part of the choices we make. The word risk is commonly used to express certain likelihood (probability) that an undesired occasion will happen. These matters are very subjective to each individual, and this is not diverse in technical undertakings. Distinction in perception on this issue can prompt diverse identifications of risks and consequently different outcomes of risk evaluation. A few definitions that can be found in literature are expressed underneath:

Literal definition of Risk and Safety Risk [dictionary]:

The chance of injury, damage or loss; dangerous chance; hazard

Insurance: the chance of loss; the degree of probability of loss; the amount of possible loss to the company

Risk – Any occurrence likely to adversely affect the attainment of project objectives (INCOSE, 2002)

Risk is a probability, a mathematical quantity that can be measured, calculated or estimated

Risk – The probability of an undesired outcome

Risk – Probability of failure times the severity of the consequences

Risk is either a condition of, or a multi-dimensional measure of, exposure to unpredictable loss or losses (Yellman, 2000)

Risk is an undesirable situation or circumstance that has both a likelihood of occurring and a potential negative consequence on the project (ESA/ESTEC, ECSS standard, 2000).

Technical Risk denotes the risk that a project will fail to meet its performance criteria (Pennock & Haimes, 2002)

Performance Risk, or technical risk, is uncertainty that a product design will satisfy technical requirements and the consequences thereof

Credit risk management in the Macedonian banking sector

The banking system of the Republic of Macedonia

The banking system of Republic of Macedonia consists of financial institutions and legal rules (regulations) through which the banking activities in Macedonia are conducted and regulated. The banking system is part of the overall financial system in Macedonia. It consists of the National Bank of Macedonia, commercial banks, savings houses and deposit insurance fund, and laws and regulations regarding the banking activities.

Macedonia inherited the banking system of former Yugoslavia, owned by the state and with a structure which matched the former planned economy. The monetary independence of Macedonia was in line with the adoption of legislation in the field of monetary policy and foreign exchange policy of 26 April 1992. That act laid the foundations of the banking system in Macedonia. However, restructuring of the Macedonian banking system started relatively late, in 1995, through the write-off of old foreign currency savings, claims and liabilities in terms of foreign loans and rehabilitation of the largest Macedonian bank – Stopanska Banka – Skopje (Nikolovska, 2009).

The establishment of the National Bank of Republic of Macedonia established conditions for the development of new relations in the banking system based on the following principles:

Construction of a new comprehensive legislation;

Equal conditions for the establishment of a bank, regardless of the status of the founder, its origin and type of ownership;

Adjusting the banks to the conditions of market economy;

Safety and protection of savings.

The main objective of these principles was to create a healthy banking system, as a precondition for gaining the trust of the citizens.

The banks in Macedonia, according to the permission for founding and operating issued by the Governor of the National Bank, may perform the following activities (Banking Law):

1. accepting deposits and other repayable sources of funds,

2. lending in the country, including factoring and financing commercial transactions,

3. lending abroad, including factoring and financing commercial transactions,

4. issuance and administration of means of payment (payment cards, checks, traveler’s checks, bills of exchange),

5. issuance of e-money, if regulated by special law,

6. financial leasing,

7. currency exchange operations,

8. domestic and international payment operations, including purchase and sale of foreign currency,

9. fast money transfer,

10. issuance of payment guarantees, backing guarantees and other forms of collateral,

11. lease of safe deposit boxes, depositories and depots,

12. trade in instruments on the money market,

13. trade in foreign assets, including trade in precious metals,

14. trade in securities,

15. trade in financial derivatives,

16. asset and securities portfolio management for clients and/or investment counseling for clients,

17. providing custody services for property of investment and pension funds,

18. purchasing and selling, underwriting or placement of securities issue,

18-a) holding securities for clients,

18-b) counseling for legal entities about structure of capital, business strategy or other related issues or providing merger or acquisition services to legal entities;

19. sale of insurance policies,

20. intermediation in concluding credit and loan agreements,

21. processing and analyzing information on the legal entities’ creditworthiness,

22. economic and financial consulting, and

23. other financial services specified by law allowed to be performed exclusively by a bank.

In order to increase the competition between banks, at the beginning of the transition period the barriers for entering the banking sector were reduced through the installation of more liberal legislation for establishing banks. That resulted in increase in the number of banks, from 5 banks to 20 banks, 1 branch of a foreign bank and 17 savings banks. The trend of increasing the number of banks and savings banks in the first years of the transition, was combined with the process of consolidation of the banking system (Trpeski, 2003).

In accordance with the current legislation, the banking system has a universal character and is comprised of:

National Bank of Macedonia

Commercial banks

Macedonian Bank for Development Promotion (MBPR)

Savings houses

Deposit insurance fund

The specialized institutions, unlike banks, which are characterized by universal character, are specific in terms of their fundamental objective. The Macedonian Bank for Development is a

development bank that aims to support and stimulate the development of the Macedonian economy in line with the strategic policies, objectives and priorities of Macedonia (Law on the Macedonian Bank for Development Promotion). It is a joint stock company in which the Republic of Macedonia is the only shareholder.

The Deposit Insurance Fund has an important role of supporting the banking system, increasing the savings and encouraging investments. With the guarantee of household deposits in the commercial banks and savings banks, the citizens regain confidence in the banking sector after the bad experiences with the frozen deposits in the old system.

In 2015, the banking system of Macedonia was composed of fifteen banks and four savings banks.

The banking network in 2015 consisted of 427 business units spread across almost all the cities in the country. Compared with the previous year, this number decreased by two business units. Most business units are concentrated in the Skopje region. Compared with other regions, this region still offers the best access to banking services, measured by the number of residents per business unit (NBRM, 2016).

According to the NBRM, the banks in the country are divided into three groups – large, medium and small – according to total assets. The following banks are operating in Macedonia (2015):

Large banks are: Komercijalna Banka AD Skopje, Stopanska Banka AD Skopje, NLB Tutunska Banka AD Skopje, Ohridska Banka AD Ohrid.

Medium-sized banks are: Macedonian Bank for Development Promotion AD Skopje, ProCredit Banka AD Skopje, Stopanska Banka AD Bitola, TTK Banka AD Skopje, Universal Investment Bank AD Skopje, Halk Banka AD Skopje, Sparkasse Banka Makedonija AD Skopje.

Small banks include: Alpha Banka AD Skopje, Eurostandard Banka AD Skopje, Kapital Banka AD and Central Cooperative Bank AD Skopje.

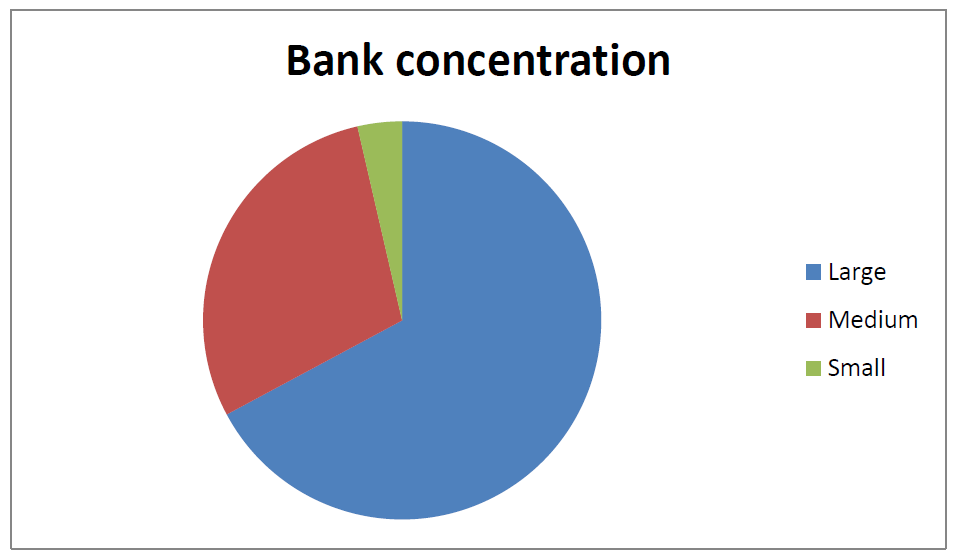

The Macedonian banking system, is characterized by high concentration on certain criteria. According to the indices for measuring the concentration (Herfindahl index and CR5 indicator) in Macedonia there is a relatively high concentration, which is particularly evident in the banking activities with the population. Thus at the end of 2015, the concentration of the banking system by the size of total assets amounted to (NBRM, 2016):

The participation of the group of large banks accounted for 67.1%

Medium banks had a share of 29.2%

The participation of the group of small banks amounted to 3.6%.

At the end of 2015, the three largest banks in Macedonia occupied almost two thirds of the total assets of the banking system, where the largest bank had a share of 22.9%, while the share of the smallest bank accounted for 0.7% of total assets of the banking system of Macedonia (NBRM, 2014).

In 2015, in the total loans to non-financial entities, large banks participated with 70.1%, medium-sized banks with 26.4% and small banks with 3.5%. Also, the concentration is expressed as measured by the share in total deposits of non-financial entities, where the large banks participated with 73.7%, medium-sized banks had a share of 22.7% and small banks had a share of only 3.6%. Data on concentration under capital and reserves were again in favor of big banks, which had a share of 64.2%, the medium-sized banks participated with 31.4% and small banks had a share of only 4.3% of the total capital of the banking system.

Figure 1 Bank concentration by total assets, 2015

Source: https://www.nbrm.mk/

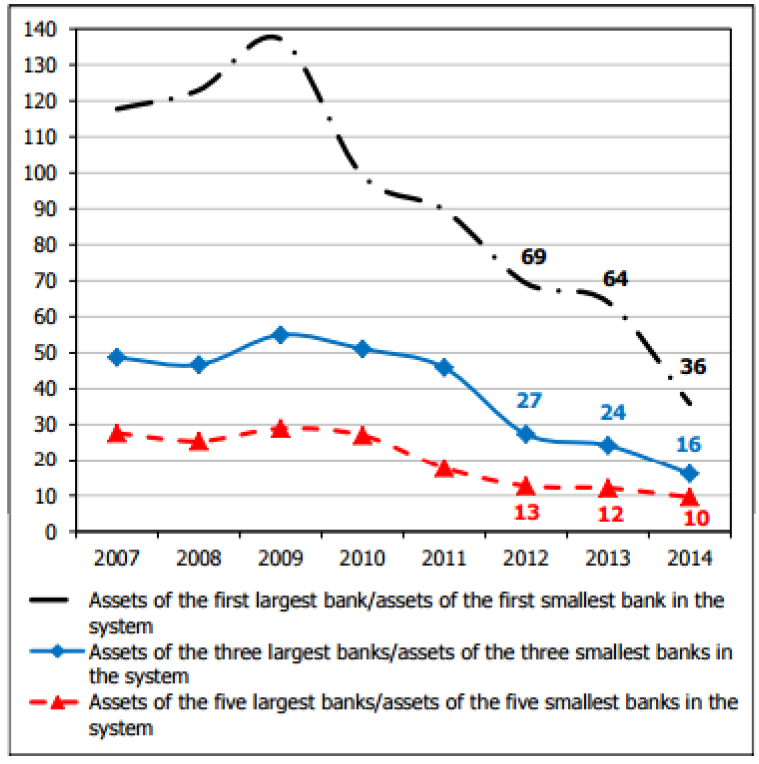

Concentration in the banking system is relatively high, although there is a continuous downward trend. Due to high concentration there are several systemically important banks, whose performances play a crucial role for the overall banking system and domestic economy. In 2014, one bank was acquired by another (third acquisition in the last seven years), which coupled with the accelerating growth of the activities of the smaller banks in the system reduced, to some extent, the still high differences between individual banks in the system. These developments enabled bringing the structure of assets and sources of funding for smaller banks closer to the structure of the activities common for the overall banking system. However, smaller banks still do not create sufficiently high and stable income that would provide positive financial results and long-term prospects for survival. Hence, some of them are very likely to face the need of changing the business model or the operating strategy.

Bank concentration

Large

Medium

Small

Figure 2 Indicators of concentration in the banking system and level of activity among smaller banks in number of times

Source: https://www.nbrm.mk/, Report on risks in the banking system of the Republic of Macedonia in 2014, 2015

Foreign shareholders are predominant in the ownership structure of banks (in 2014 this share was 76.2%). Seven Macedonian banks are subsidiaries of foreign banks, five of which are based in the Euro area (market share of subsidiaries of foreign banks based in the Euro area is 50.6%). Analyzed by country of origin of the foreign bank, the highest is the market share of the Macedonian banks owned by banks based in Greece. Although this neighboring country is facing severe debt crisis and banks there face problems and significant outflows of deposits, it did not affect the stability of the Macedonian banks, which are separate and independent legal entities established in the Republic of Macedonia, with their own capital and management bodies.