PRINCIPLES OF FINANCE

Introduction

The financial analysis of the financial statements of a company is dependent on the critical examination of the financial facts and figures in the corporate environment of the company. However, it may be argued that general position and competition of the market also impacts the success of a business along with the risk factors involved in the business process. This report will critically analyse the major risk factors along with the proper evaluation of the financial position of the company of Al Jazeera Steel Products in Oman while computing various kinds of ratios for better evaluation of the company.

1. Description of the general position of the business and business environment of Al Jazeera Steel products SAOG

Industry

The company of Al Jazeera Steel Products SAOG have been engaged in the industry of trading and manufacturing the steel products in the market of Oman while distributing the steel products in the GCC locations as well as various other European countries. However, it may be argued that the steel industry of the country is complex in nature. The steel industry of Oman is largely regulated under various Royal Decree of the Sultanate of Oman while the industry is increasing rapidly beyond the GCC countries. It may be stated that Steel industry has various risks involved which is eliminating various new comers in the business (Market., 2019).

Major products and services

The major products of the company include the various kinds of steel products which are majorly traded in th4e country as well as distributed throughout the GCC locations. However, it may be critically stated that the company of Al Jazeera Steel Products have also involved in the business of manufacturing various types of steel products which have significantly improved the chances of exports of the company (SAOG, 2019). On the other hand, it may be mentioned that Al Jazeera Steel Products have manufactured various products which are used in the construction business of the country due to its high quality and durability.

Markets

The market of the company has been found to be increasing with the major aspects of the export quality procedures while the revenue of the company has been increasing substantially. The company has recorded a revenue of RO116,145,843 for the year 2018 which has significantly increased in the year. On the other hand, it may be stated that market penetration of the company has been improved with the factors of the major effectiveness of the company in its marketing strategies. It is to be stated that the company is largely targeting the markets of Europe, Asia and the GCC countries including UAE and Saudi (SAOG, 2019).

Geographic locations

The company is operating in the geographical locations of the Sultanate of Oman while headquarter of the company is situated in the Suhar Industrial Estate. The company has been engaged in the business in the countries of GCC as well as major European nations. The manufacturing units of the company have been situated across the various areas of the country.

Major competitors

The major competitors of the company include Muscat Steel, Assarain Group, Sohar Steel and Oman Steel in the domestic market of the Sultanate of Oman. However, it may be stated that the global competitors include various international steel brands and products which are constantly posing complex threats to the company while impacting the sales of the company (SAOG, 2019).

2. Risk analysis of the company of Al Jazeera Steel products

Business Risk

The major business risks of the company of Al Jazeera Steel Products may be stated as complex business environment in the GCC countries which are often affected by the political pressure as well as adverse international relations between the GCC and Europe. On the other hand, the change in laws and legal structure of the company may be affecting the company in a significant way. It may be stated as essential to the company that the company organises a proper business risk management policy in order to eliminate the risk factors of changing policy and legal environment (Thuong, 2019).

Market Risk

The major market risk includes the factors of the competition in the market which has the significant potential to affect the revenue of the company in the coming years. The competition in the market is responsible for the adverse risk factors in the competitive environment of the company. The competitor of the company often organises same pricing strategies which are able to affect the mindset of the customers. The customers are largely affected by the promotional activities performed by the competitors while the company of Al Jazeera Steel Products is also critically affected in the complex scenario.

Interest rate Risk

The risk of interest rates are highly influential to the market of the company as the rise in interest rates will ensure that the company will not be able to acquire more debt funds in the company which are largely needed for future expansion of the company. The funding of new projects of the company will become a complete process due to the increase in the finance costs or interest rates of the bank loan as well as long term debts.

3. Computation of the financial ratios

a) Liquidity ratios

| Liquidity ratios for Al Jazeera Steel Products | ||

| 2018 ( Amount in RO ) | 2017 ( Amount in RO ) | |

| Current Ratio

= Current Assets / Current Liabilities |

( 53619586 / 26467584 ) | ( 49709450 / 23320497 ) |

| 2.03 | 2.13 | |

| Quick Ratio

= ( Current Assets – Inventories ) / Current liabilities |

( ( 53619586 – 20913467 ) / 26467584 ) | ( ( 49709450 – 15452865 ) / 23320497 ) |

| 1.24 | 1.47 | |

Table 1: Liquidity ratios for Al Jazeera Steel Products

(Source: Created by Self)

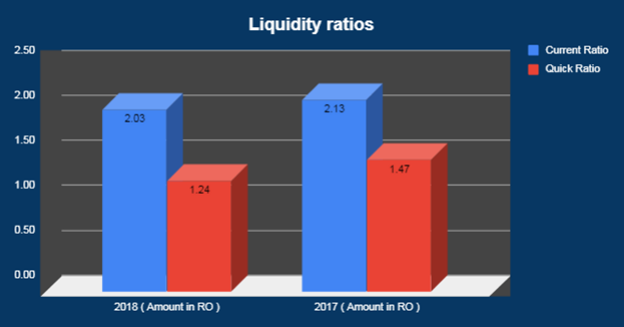

Figure 1: Liquidity ratios for Al Jazeera Steel Products

(Source: Created by Self)

According to the above table, it may be stated that liquidity ratios of the company have declined in the year 2018 as compared to the year 2017. In the year 2017, the company has been able to manage the liquidity ratios at par with the industry standards which has contributed to the short term solvency of the company. However, it may be argued that Al Jazeera Steel Products has maintained the current ratio as well as quick ratio above the industry level which has ensured the on time payment of the daily expenses of the company or the short term liabilities.

b) Solvency ratios

| Solvency Ratios for Al Jazeera Steel Products | ||

| 2018 ( Amount in RO ) | 2017 ( Amount in RO ) | |

| Debt Ratio

= Total Debts / Total Assets |

( 1477368 / 71870833 ) | ( 1402052 / 68862627 ) |

| 0.021 | 0.020 | |

| Debt to Equity Ratio

= Total Debts / Shareholders’ equity |

( 1477368 / 43925881) | ( 1402052 / 44140078 ) |

| 0.03 | 0.03 | |

| Interest Coverage Ratio

= EBIT / Interest payments |

( 3269921 / 1051593 ) | ( 5518871 / 696681 ) |

| 3.11 | 7.92 | |

Table 2: Solvency Ratios for Al Jazeera Steel Products

(Source: Created by Self)

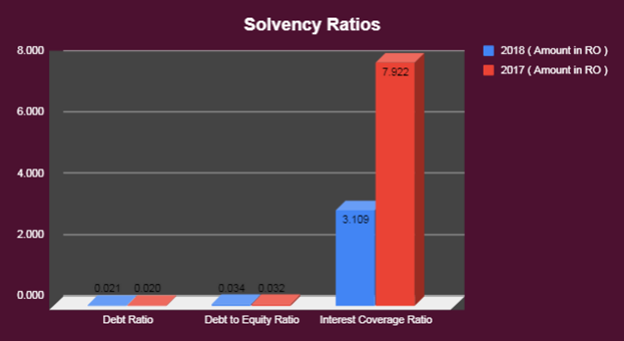

Figure 2: Solvency Ratios for Al Jazeera Steel Products

(Source: Created by Self)

As per the above table and figure, it may be mentioned critically that the Al Jazeera Steel Products has increased the contribution of the debts in the funding of the total assets as the financing of the total assets have been increased with the use of debts or long term borrowings. On the other hand, it may be mentioned that interest coverage ratios have also decreased significantly while the profits of the company have decreased along with the substantial increase of the interest expenses (Market., 2019) (SAOG, 2019) (Thuong, 2019)in the company. The debt equity ratio has remained constant for the year 2018 as the company has used equity funding in the operations.

c) Profitability ratios

| Profitability Ratios for Al Jazeera Steel Products | ||

| 2018 ( Amount in RO ) | 2017 ( Amount in RO ) | |

| Earnings per Share ( EPS )

= Profits for the year / Total number of outstanding shares |

( 2780311 / 126377772.7 ) | ( 4713189 / 124031289.5 ) |

| 0.022 | 0.038 | |

| Net Profit ( Loss ) Margin

= Net profit ( Loss ) / Total revenue |

( 2780311 / 116145843 ) | ( 4713189 / 96620476 ) |

| 2.39% | 4.88% | |

| Gross Profit Margin

= Gross Profit / Total Revenue |

( 12198916/ 116145843 ) | ( 13338014 / 96620476 ) |

| 10.50% | 13.80% | |

| Return on Investment (ROI)

= EBIT / Capital Employed |

( 2780311 / ( 71870833 – 26467584)) | ( 4713189 / ( 68862627 – 23320497 )) |

| 6.12% | 10.35% | |

| Return on Equity (ROE)

= Net Income ( Loss ) / Shareholders’ equity |

( 2780311 / 43925881 ) | ( 4713189 / 44140078 ) |

| 6.33% | 10.68% | |

Table 3: Profitability Ratios for Al Jazeera Steel Products

(Source: Created by Self)

Figure 3: Profitability Ratios for Al Jazeera Steel Products

(Source: Created by Self)

According to the above table and figure, it may be stated that profitability ratios of the company of Al Jazeera Steel Products have deteriorated significantly in the year 2018 while the EPS has decreased potentially as well as the Net profit margin of the company. The company has indicated that the Net Profit Margin has decreased significantly along with t hew gross profits of the company. However, it may be stated that ROE has decreased which have impacted the overall profitability of the company.

Conclusions

According to the above discussion, it may be critically mentioned that profits of the company have been decreased while the current ratio of the company have also decreased. On the other hand, it may be stated that market of the company have been observed as complex and dynamic which has the ability to impact the overall operations of the company.