China To Russia

International Business Environment and Trade

Introduction:

Marine Shipping, popularly referred to as water transport of goods is the process of logistically transporting goods or passengers in a watercraft like a boat, barge, ship boat or a cruise through a body of water like a lake, river, sea or an ocean (Moreira, 2019). It is commonly used for transport of non-perishable goods like electronics, automobiles, ammunition, furniture, timber, etc. This mode of transport was first started in the 19th century when people used steam ships. Such steam to run the ship was produced with the use of coal or wood. In the present scenario most of the ships which are used today for importing and exporting use bunker fuel (which is a kind of refined type of petroleum). For trans-continental shipping, transport via water is much cheaper than transport via air. Till date it remains the largest carrier of freight around the globe (Hu, 2019). Many travelers from various parts of the world are still fascinated to travel through the mighty waters and view a cruise journey as a recreational or entertainment activity. Maximum of ship transports are outside national borders i.e. international in nature. This mode of transport suffers from certain limitations like – late delivery of cargo, susceptible to natural disasters and is prone to uncertainty regarding changing or fluctuating foreign exchange rates (Cheng, 2019). In the 20th century, the concept of containerization was brought into light which is the packaging of goods to be transported into large containers. Each countries’ customs managed ports are responsible for docking ships and ensuring everything is done according to the procedures as regulated by the specific governments of such countries. In this paper, a scenario of import of machinery and equipment from China to Russia is taken to assist us in better understanding of the process.

Import from China in to Russia:

The People’s Republic of China (PRC) usually called as China has recently been in news for its efficient massive population utilization and also is known for their level of achieving economies of scales in manufacturing sector (Pan, 2019). Russia technically known as the Russian Federation is the globe’s largest nation which is has both Europe and Asian countries as its neighbours (Baskakova, 2019). The aim of this paper is to facilitate better understanding of the importing and exporting situations in the world, and for the benefit of this purpose trading scenarios an organization will face if it deals in importing goods which are capital in nature like machinery and equipment from China to Russia is considered. Russia is popularly known for importing packaged drugs and medicaments, automobiles, parts of automobiles, aircrafts like planes and helicopters, etc. The shortest distance between China and Russia is 12960 nautical miles i.e will take 54 days to reach, if the vessel speed is 10 knots.(Appendix)

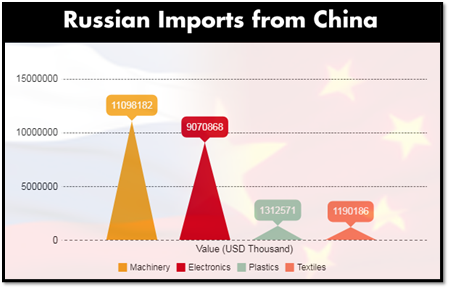

Figure 1: Imports from China to Russia (Moiseev, 2018)

Checklist:

- Russian Customs Freight Declaration:

For every item to be imported, the importer business shall complete and submit the Russian Customs Freight Declaration which shall be supported by other required documentation like contracts, invoices, certificate of origin, import licenses, sanitary certificates, other licenses, safety and security declaration certificates, etc. All such documents are expected to be submitted online – electronically. Such a link can be accessed from the Russia’s Federal Customs Service’s Website (Leger, 2019).

- Import License:

The Russian Ministry of Industry and Trade issues the import licenses in accordance with the unified Eurasian Economic Union (EEU)’s rules. The Eurasian Economic Union (EEU) is the one who maintains a list of permitted goods which can be dealt by the importers and exporters of Russia. Certain limitations and prohibitions on goods are also mentioned in the same list. Such classification is done in order to control and monitor the transport of goods which are titled as sensitive by the international community or the member states.

- Issuance of transaction passport:

Such a transaction passport is issued both to the importer as well as the exporter by the Ministry of Industry and Trade of the Russian Government. This is done to ensure that hard currency revenue are repatriated back into Russia. It also ensures whether the goods or carriage in question are actually physically received and whether they have been valued properly (Gorbunova, 2018).

- Specific Import Procedures:

For certain particular products like jewellery, pesticides, electrical materials and precious materials, etc which are almost three percent of the goods imported in to Russia, there is a specific licensing system. These are not issued by the Ministry of Industry and Trade but are issued by the Ministry pf Economic Development and comes under the purview of the State Customs Committee and not the Central Customs Committee (Balandina, 2019).

- Importing Samples:

The importing and dealing in certain goods required the importers to present the samples of such goods to the customs authorities along with the above documentation. Such samples are usually exempt from paying customs duties. For instance importing of samples of medicines and biological samples require the importer to submit them to the concerned authorities along with their certificates.

- Taxes on Imports and Customs Duties:

There is threshold on customs duty similar to the concept of tax bars in Income tax. Carriages imported up to CIF value of RUB 5000 can enter the national borders without any tax or duty. Different categories of goods have different tariff rates for example, the average customs duty is 7.8 percent of the value of goods (such goods exclude agricultural produce). Certain goods like food stuffs, finished goods and agricultural products have higher tariff rates like 20 percent, 15 percent and 25 percent respectively.

The above conditions are only applicable to imports from countries which enjoy the Most Favoured Nation Clause (MFN). Such a clause include majority of third world countries, European Union, etc. The country has also entered into free trade agreements with Serbia and the CIS countries. In order to encourage trade between Russia, Belarus and Kazakhstan – a common economic area has also been created under the Eurasian Economic Community Framework. The Customs of Russia uses a Harmonized Customs System of classification under which 11032 tariff lines were created. All the taxes and duties derived out of this arrangement are collected by the State Customs Committee. Such a payment is made in cash while submitting the Customs Declaration form (Yessentayeva, 2019).

- Import General Manifest:

When the shipment reaches the importing country’s port, either the customs broker or the importer files the Import General Manifest (IGMS) with Russia’s customs authorities at the destination port. Important documents at this point include the commercial invoice, the bill of lading, the cargo arrival notice, packaging list, other certificates, freight certificate, etc. This whole process takes around two to three business days. With the right and complete documentation one can smoothly finish all the procedures and take a delivery of their shipment. If the importer is unable to complete the custom’s clearance procedures on time they would have to pay the Russian Government a sum of money as storage charges (Fedorenko, 2019).

- Labelling requirements:

The labels of such goods shall clearly mention the mandatory details required by the Ministry of Industry and Trade and these include the nature of goods being imported, the value of such goods as on so and so date of shipment, the category under which the goods fall, the allocated number and prescribed rates for such category, safety certificate regarding its transport, etc.

- Inspection:

After the above procedures are done with, the Russian Customs Authorities might require to check the goods in the cargo in order to ensure the safety and sanctity of their country. A thorough check in order to minimize the illegal shipment of restricted goods into the national borders should be expected by the importer.

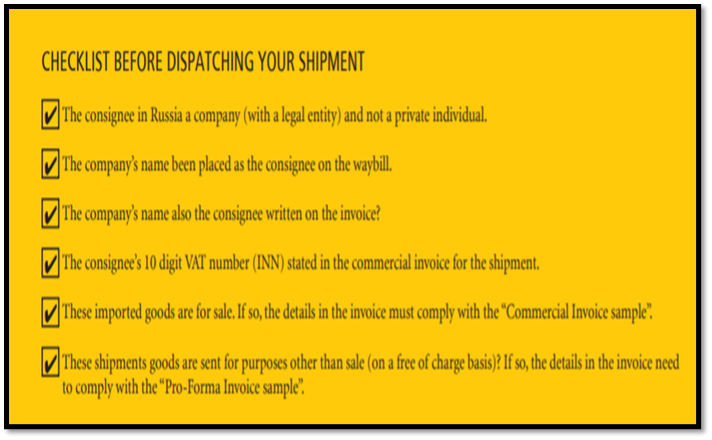

Figure 2: Checklists for exporting in China (Maheta, 2018)

Documentation, Laws and Regulations:

It is inevitable for a company or business to have a right and complete customs documentation file in order to take delivery of its goods from the Customs on time. Inaccurate or incomplete documentation leads to charging of extra costs, delay in delivery of goods, prevents negotiation among the parties to the import-export contract and increases risks of damage of goods. It is always advised to involve a freight-forwarder in the process as he or she will already be equipped with the necessary knowledge and skills needed for the process (Dar, 2019).

The following documents are required for customs clearance at the Russian Customs port at the time of importing from goods from foreign countries:

- Invoice:

A commercial invoice including details of the nature of the product, value of the product and other necessary specifications of the product is necessary to be printed in Russian or either can have a translated version of English into Russian can be attached.

- Packaging list:

This is statement presenting the right details regarding the product features, the size of the units and the weight of the package as a whole and as individual units.

- Certificate of Origin:

A form – A is to be filled for countries which come under the category of ‘Developing’ and lie outside the CIS purview. This helps in determining the tariff preferences in the process of classifying countries into developing and least developed countries

- Quality Certificate:

A quality proof certificate issued by the producers or manufacturers or consignor needs to be attached with the documents.

- Specific certificates:

For particular products the Ministry of Industry and Trade of Russia requires different certificates. For instance, for animal products a veterinary certificate is required. Similarly for plant products, a pest control certificate is mandatory and for species under the threat of extinction especially wild flora and fauna requires a CITES Resolution (Xing, 2019).

- Registration certificate

Some goods which fall under the category of exempted goods from excise duty needs to produce a letter from the bodies of Sanitary Inspection to ensure alcohol-related is not present in the shipment.

- Power of Attorney:

The importer might hire a freight forwarder to deals with all custom’s procedures on behalf of the importer. Power of Attorney (POA) is a statement of declaration authorized by the importer saying a particular individual or entity has the power to act in the best interest of the importer.

- Insurance Copy:

Insurance is mandatory to be taken on the goods in the shipment. Usually it is taken by the supplier in China and the bill is forwarded to the importer in Russia. Ultimately the importers usually are responsible for paying the burden of the insurance cost.

- Bill of lading:

It is a written statement issued by the Chinese carriage company at the time of loading the shipment acknowledging that it has received the cargo or goods for transport to Russia via the International sea route.

- Import Deal Passport

- General Director and Chief Accountant’s passports

- The contract between both parties to the import-export deal

- Copy of CRR and TIN

- Certificate of Conformity:

This certificate guarantees that the goods meets the safety and security standards as required by the Russian Customs Authorities.

- Declaration of Conformity

- Proof of Payment (only in case of advance payment)

- Other required permits

- Catalogs, price list and specifications of the products in shipment

- Receipts of tax payments in accordance with the State Rules

- Special paperwork on dangerous goods under transit

- Statement of Valuation as deemed by the manufacturer or producer or consignor as on the date of loading on to the ship.

- Certificate of Conformity

- A certificate of analysis which specifies the percentage of chemical elements within each product unit.

Letters of Credit, Insurance, Risk and Dealing with Disputes:

It is obvious that transiting through the waters face an array of risks and uncertainties inbuilt in them. Though such risks are nor restricted to only water transport, they are believed to be more in the sea route. In this scenario, China has the uncertainty and risk of not receiving the payment for supplying of such goods to the Russian business entity and on the other hand, Russia has the risk of not receiving the goods or receiving goods which do not meet the specifications of the order after paying the amount for it (Dimitrov, 2019). There are quite a few ways for decreasing this kind of risks and threats. One of the ways of mitigating such risks is the use of Letter of Credit. It extends guarantee to the importer that his or her payment won’t be transferred to the manufacture’s bank account in China until goods are received by them. At the same time, the seller or exporter is guaranteed that the required funds from the importer are collected and are in the custody of the bank. This kind of settlement is also known as Documentary Credit (Zamman, 2018). Mostly the history has seen the importers asking the exporters to produce a letter of credit on the goods being shipped and not the other way round. It is evident that the commercial bank or the financial institution involved in this kind of set up must be making a benefit out of this arrangement. As a premium for the risk being borne by the commercial bank, they charge a commission or fixed price on the transaction depending on the country in which it is being availed (Scheltjens, 2018). The kinds of letters of credit include back-to-back letters of credits, standby letters of credits, transferable letters of credits, non-transferable letters of credits, confirmed letters of credits and unconfirmed letters of credits.

Such risks and uncertainties associated with the transportation through waterways can be overcome by using an insurance cover. In some countries, it is mandatory to take a minimum amount of insurance on the goods to be transferred (Sarbani, 2018). Such insurance related documents shall be attached with the other documentation at the time of loading and unloading the packages. It is common that when two parties are involved in a transaction, there exists a chance of occurrence of a conflict. Such conflicts can be overcome by first understanding each other’s legal and business environment and then by clearly mentioning every clause in relation to the shipment clearly in the contract. It is always advisable to consult the Russian Consulate, Russian Diplomatic missions, international trade associations and the foreign country’s representative in the state for suggestions and clarifications with regard to specific doubts.

Conclusion:

The paper explores the import-export scenarios in two of the world’s largest countries – Russia and China. The paper starts with explaining the legal and current political characteristics of both the countries. It then goes on to identify the kind of goods imported into Russia. Every country has specific checklists which the importer or his/her freight forwarder has to fulfill before importing goods from a foreign country via international waters. There are specific set of documents which are needed by the governmental authorities at the time of loading and unloading of the shipment which are mentioned in detail above. A voyage in the sea is always known for uncertain situations like a ship wreck or a bad sea on a specific day. In order to cover for such unforeseen scenarios it is advisable by industry experts as well as certain governments to take an insurance cover for the goods in shipment.