ABSTRACT

This research work is based on the grouping of recipients and recipients of different groups. It also covers the financial benefits and ramifications of consolidations and purchases, as organizations seeking consolidation and acquisition will find others to find adequate resources and how they continue in the mixed cycle. As agreements become more complex and innovative, the individuals who support them are turning out to be the keys to the extent of consolidation and construction. Aligning data and letter innovation across the phases of the coordination cycle is critical to recognizing the benefits of a consolidation and construction phase. This claim is confirmed by an arcade writing studio for example just like professionals and a great example of a money management association.

The analysis strategy used was selective information, a factual method in which chi-squared and invalid theory were used to obtain the final result. From the survey released to case group staff, it turns out that most of them are used to consolidation and construction one way and another, they will ensure a safe and fearless career of consolidation and edification. It demonstrates that consolidation and construction strategies improve hierarchical stability in a troubled economy; it has also limited the severity of the conflict by expanding the power of the organization’s business segments.

The research findings reveal that M&A plays an important role for success and entry of international business. Through M&A, company can enhance profitability through reduction of cost. Company also gains power after successful M&A; but it faces integration issues due to different cultures, way of work and leadership style under which employees are working.

Chapter one: Introduction

Background research

Modern day organizations are facing very difficult situations in different business domains. The challenges have also increased because of the increase in the competition in several markets. The challenges are even bigger for the organizations that are operational at global level or say are impacted by the global factors (Yılmaz and Tanyeri, 2016). This is why companies are making different kinds of strategies to make sure that they are able to increase their resource base and accordingly enhance their ability to face the challenges. It is also seen that there are many companies that are unable to survive alone and due to this they are choosing various kinds of growth strategies that can help them in surviving the turbulence in the market. The higher the power of the companies in terms of resources and money they have, the higher is their chance that they can gain bigger control in the market. It is seen that there are larger numbers of players in the market and they are colliding with each other in such a manner that they are cutting throats of each other. In this environment establishing or sustaining in the new markets could be a much bigger challenges for the company. Due to this it has been seen that companies are adding to their sources by adding more numbers of investors or partners with them. The company that has bigger financial base are more likely to succeed or turn the trends in the market. This is why the companies are using the approaches such as Merger & Acquisitions (Marks and Mirvis, 2011). It is not the new concept rather than that it is an older concept that deals with the fact that more the numbers of partners the more is their chance to succeed in the international market. Business alliances have been successful over the years especially the partnership model but the biggest drawback of it is that it reduces the chances of the companies to gain profits in the long term as creating coordination between the companies making partnership with each other is lower. This is why Merger & Acquisition has become one of the most effective growth strategies for the companies especially when they are planning to expand their business into new area, industry or region of the world (Xu, 2017).

Merger & Acquisition is generally understood as the strategy in which bigger companies either acquires the other firm or they merge with other firm to make a bigger firm as a whole. Merger and acquisition gives long term benefits to the companies and has the potential to give long term advantages to the companies over the other rivals. There are certain challenges also that are associated with following strategies especially when it is a cross-border merger and acquisition. It is always essential for the management to make sure that they have a plan before getting into any kinds of merger and acquisitions. Data has showed that in the past three decades, Cross-border mergers and acquisition have increased (Brakman, et al 2013). There are multiple reasons for it but it is also the fact that the success ratio of the mergers and acquisitions has not been so much higher. In the planning of growth strategies it is always critical that firms uses the resources available with each other to ensure that they are able to reduce the challenges faced by each other. This allows them to overcome their own failures and weaknesses and hence they can act as a bigger player in the market. The role of employees and the leadership becomes more critical in successfully conducting mergers and acquisition. Since many types of changes are going through at the time of merger and acquisition hence it is critical for the management to make sure that they makes plans accordingly so that these changes does not brings any kinds of instabilities in the work process(Kansal and Chandani, 2014). In this research paper there will be analysis of the effectiveness of the merger and acquisition in order to understand the importance of mergers and acquisition in conducting international business. Primary and secondary data will be used in this research report to understand the merger and acquisition importance.

Aims and objectives

Research aim

The objective of this research is to understand the concept merger and acquisition and explain the way it impacts in business organizations at international stage.

Research objectives

The objectives of this research are following,

- To understand the concept of merger or acquisition

- To explore the processes of merger

- To assess the needs of merger and acquisition

- To find out the impact of it on International business expansion

Research questions

The research questions that arise are

- What is merger or acquisition?

Merger and acquisition is the term associated with either joining or overtaking an existing company to quickly enter into the market.

- How mergers are operated?

- How important it is for business houses to acquire existing venture?

- How merger and acquisition is beneficial for business houses?

Chapter Three: Research Methodologies

Purpose of the study

The main purpose of this study is to identify role of mergers and acquisitions for growth of international business. Companies usually have a doubt regarding whether they should go for mergers or acquisitions while entering into the international market. The present study will recommend the ways to identify the constraints through which it will be easy for international companies to decide whether they should chose merger or take aggressive step in acquiring the small or non-performing company. In the journal article written by Rottig (2007), he found that while acquiring or merging with company, emotions of employees also get effected. Thus, this study will also identify whether the statement given by Rottig has any association with mergers and acquisition in today’s real world.

Rationale of the research

Expansion of business is always profitable for a business organization, but to do so it has to go through several drawbacks. While a company tries to expand internationally the primary issue that occurs is to find a suitable market for expansion. In the process one has to take care if the market is viable of subscribing to the product it is going to present (Araújo et al., 2018). Another problem is setting up a whole new infrastructure in a new country and recruiting a new workforce along with training them according to the strategy of the company. The biggest problem is creating own recognition in the new market. In such situation if the foreign player acquires an existing player, this huge burden reduces a lot as an existing company in a market has an already set up business infrastructure and a trained workforce.

The foremost reason for merger in today’s market is growth. It gives a company an instant opportunity to expand without much hassle in every aspect whether legal or infrastructural (Park et al., 2016). It also gives the bigger company access to the intangible assets of the acquired company such as business plans and reputation. It also brings out the local talents to international market. On the other hand, the acquired company gets to use the bigger brand value of the prime company. However, it is important to understand the advantages disadvantages of merger and acquisition for a business to grow in international market. In the proposed research the various ways of merger and acquisition and impact of it on international business will be discussed.

The scope of research

This research completely focuses on Advantages of Merger and acquisition in expansion of a business in International market. There might be some other effective method of doing so, that has been deliberately ignored in the research. There also might be some limitations of Merger and Acquisition that has been excluded in the report.

Research strategy

Research strategy is a pre-planned guideline to conduct a research study, collecting data, analyzing it to reach a suitable conclusion. It also includes several steps to collect data and analyze the data to observe the anomalies and point out remedies to address it. There are different methods to conduct a research i.e. Focus group, Case study, Quantitative survey, and Qualitative interview. Every method has its flaws and advantages. To avoid any flaws and gather all the advantages and reduce biased data, a mixed method, but mostly qualitative and quantitative methods, has been adopted conduct this research paper. As it is not possible to conduct a practical face-to-face interview or market research due to Covid-19, an online method will be used to conduct this research through online survey and Skype interview.

Methods and techniques of data collection

Data collection is a process of gathering information to be analysed so that some statement can be supported. There are three types data collection that is primary, secondary and mixed. Primary data collection is when data are collected from first hand sources such as surveys, interview while secondary data collection means when data are collected from existing data, such as government report or previous researches. Mixed data collection is when a reconciled method is used to collect data. In this research a mixed data collection method has been used. Use of mixed data collection gives us multiple aspect of the topic. It also broadens our point of view to give us an open knowledge on the topic.

Methods and techniques of data analysis

For this research, a mixed method of data collection has been used to analyze the data where primary data collected into excel sheets and analyzed by using various tools such as pie charts, histograms, pivot table, chi-square test, descriptive analysis, and hypothesis testing. For secondary data; seven different journal articles written on mergers and acquisitions has reviewed in the form of Thematic.

Sample Design and Size

The sample for this research has been randomly collected through Skype interview simply by filling the form by participants. Overall out of 160 approached people, only 50 take participation in this survey process. Here, Stratified sampling has used due to diversified population in the form of profession; administrator, finance, HR, and personal department managers. The population is also categorised based on male and female to cover maximum population while presenting conclusive statement based on the analyses of result.

For primary data; questionnaire has been used as primary source to collect responses of 50 participants based on 19 different questions. Majority of questions of the survey needs to answer either in yes or no by the participants. Thus survey takes few minutes of participants, which makes their interest in participating and answering the questions of survey. It was taken into concern that, questionnaire should not either be very lengthy or too short.

Conclusion

All the results found through data analyses in Chapter Four: Findings has discussed in Chapter Five: Discussion separately for Primary and secondary data sources. Finally based on discussion and justification of result; a conclusive statement with recommendation to future scope of the study is covered in last chapter which is Chapter Six: Conclusion and Recommendations.

Chapter Four: Research Findings

Introduction

This chapter shows the results from the data collected from two sources; primary and secondary. For primary data different tools such as; descriptive statistics, chi-square, and pie charts have been used. For secondary analyses; seven different thematic study based on journal articles have been done.

Results

Descriptive statistics

| Mean | Standard deviation | Result | |

| Q5a. | 7.777778 | 6.045681479 | |

| Q5b. | 6.241379 | 3.101326587 | |

| Q6 | 2 | No | |

| Q7 | 1.84 | Yes | |

| Q8 | 1.42 | No | |

| Q9 | 1.42 | No | |

| Q10 | 1.42 | No | |

| Q11 | 1.42 | No | |

| Q12 | 1.56 | Yes | |

| Q13 | 1.44 | No | |

| Q14 | 1.38 | No | |

| Q16 | 1.34 | No | |

| Q17 | 1.515152 | Yes |

Interpretation: The result shows that majority of responses collected is no for most of the questions. This means, the opinion of all participants is in one way, and easy to conclude.

Chart Analyses

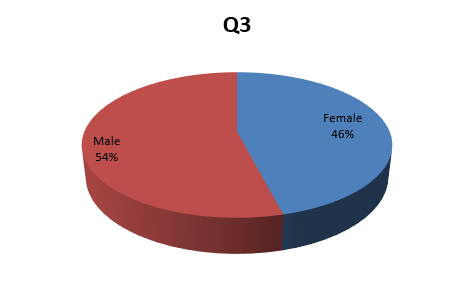

TABLE 1. Gender and Marital status

| Row Labels | Count of Q3 |

| Female | 23 |

| Male | 27 |

| Grand Total | 50 |

Interpretation: The majority of participants are male which is 27 and female are 23.

| Row Labels | Count of M |

| Married | 34 |

| Single | 15 |

| Grand Total | 49 |

TABLE 2.Work experience: number of years

| Bin | Frequency |

| 0 | 22 |

| 3 | 10 |

| 6 | 4 |

| 9 | 5 |

| 12 | 3 |

| 15 | 4 |

| 18 | 0 |

| 21 | 0 |

| 24 | 2 |

Private sector

| Bin | Frequency |

| 0 | 21 |

| 3 | 6 |

| 6 | 7 |

| 9 | 12 |

| 12 | 4 |

TABLE 3.Age Distribution of respondents

| Row Labels | Count of Q6 |

| 25-34 yrs | 15 |

| 45-54 yrs | 22 |

| 55-64 yrs | 11 |

| 65 and above | 2 |

| Grand Total | 50 |

TABLE 4.Educational Qualification of the Respondents

| Row Labels | Count of Q7 |

| MSc/MBA | 27 |

| BSc/HND | 11 |

| ND/NCE | 5 |

| Others | 7 |

| Grand Total | 50 |

TABLE 5.After the merger; was the objective of profitability enhancement achieved?

| Row Labels | Count of Q8 |

| Yes | 29 |

| No | 21 |

| Grand Total | 50 |

TABLE 6.After merging, does the company`s market power increase?

| Row Labels | Count of Q9 |

| Yes | 29 |

| No | 21 |

| Grand Total | 50 |

TABLE 7.In your own opinion, can you say that the merger process has enhanced the survival of your company?

| Row Labels | Count of Q10 |

| Yes | 29 |

| No | 21 |

| Grand Total | 50 |

TABLE 8.After merging, was growth through diversification achieved?

| Row Labels | Count of Q11 |

| Yes | 29 |

| No | 21 |

| Grand Total | 50 |

TABLE 9.After the merger process, was the cost saving achieved?

| Row Labels | Count of Q12 |

| Yes | 22 |

| No | 28 |

| Grand Total | 50 |

TABLE 10.Your organization make mergers and acquisitions part of your corporate plan?

| Row Labels | Count of Q13 |

| Yes | 28 |

| No | 22 |

| Grand Total | 50 |

TABLE 11.In your own opinion, were the terms of agreement a fair one?

| Row Labels | Count of Q14 |

| Yes | 31 |

| No | 19 |

| Grand Total | 50 |

TABLE 12.After the merger process; was there any problem of integration?

| Row Labels | Count of Q16 |

| Yes | 33 |

| No | 17 |

| Grand Total | 50 |

TABLE 13. If yes, would you have preferred not to merge?

| Row Labels | Count of Q17 |

| Yes | 16 |

| No | 17 |

| Grand Total | 33 |

TABLE 14.Classification of population based on departments

| Row Labels | Count of Department |

| Admin | 4 |

| Finance | 10 |

| HR | 24 |

| Personal | 12 |

| Grand Total | 50 |

Testing of Hypothesis

The use of chi-square (X2) will help to accept or reject hypothesis and giving a statement based on the result obtained from the hypothesis testing. The level of significance considered for this test is 95%; this will accept the null hypothesis if the variance is upto 5% of error within population set.

Analysis of Hypothesis 1

H1 = Mergers and acquisitions process enhances the survival of company

H0 = Mergers and acquisitions process do not enhances the survival of company

Response to question 10 on the questionnaire

| Column and Row Totals | |||||

| Admin | Finance | HR | Personal | Row Totals | |

| Yes | 2 | 6 | 16 | 5 | 29 |

| No | 2 | 4 | 8 | 7 | 21 |

| Column Totals | 4 | 10 | 24 | 12 | 50 (Grand Total) |

Application of chi-square in the above table:

The contingency table below provides the following information: the observed cell totals, (the expected cell totals) and [the chi-square statistic for each cell].

| Results | |||||

| Admin | Finance | HR | Personal | Row Totals | |

| Yes | 2 (2.32) [0.04] | 6 (5.80) [0.01] | 16 (13.92) [0.31] | 5 (6.96) [0.55] | 29 |

| No | 2 (1.68) [0.06] | 4 (4.20) [0.01] | 8 (10.08) [0.43] | 7 (5.04) [0.76] | 21 |

| Column Totals | 4 | 10 | 24 | 12 | 50 (Grand Total) |

The chi-square statistic is 2.1757. The p-value is .536751. The result is not significant at p < .05.

Interpretation: The value of p is greater than 0.05 (0.536751 > P > 0.05); thus null hypothesis will be rejected and alternative hypothesis will be accepted. Based on this it can be concluded that mergers and acquisitions process does not enhance the survival of company.

Analyses of Hypothesis 2

H0 = Merger and acquisition process does not results into profitability due to reduction in the cost.

H1 = Merger and acquisition process results into profitability due to reduction in the cost.

Response to the question 12 in questionnaire

| Column and Row Totals | |||||

| Admin | Finance | HR | Personal | Row Totals | |

| Yes | 1 | 4 | 13 | 4 | 22 |

| No | 3 | 6 | 11 | 8 | 28 |

| Column Totals | 4 | 10 | 24 | 12 | 50 (Grand Total) |

Result

| Results | |||||

| Admin | Finance | HR | Personal | Row Totals | |

| Yes | 1 (1.76) [0.33] | 4 (4.40) [0.04] | 13 (10.56) [0.56] | 4 (5.28) [0.31] | 22 |

| No | 3 (2.24) [0.26] | 6 (5.60) [0.03] | 11 (13.44) [0.44] | 8 (6.72) [0.24] | 28 |

| Column Totals | 4 | 10 | 24 | 12 | 50 (Grand Total) |

The chi-square statistic is 2.2119. The p-value is .529618. The result is not significant at p < .05.

Interpretation: The value of P is greater than 0.05 (0.529618 > P > 0.05). Thus null hypothesis will be rejected and alternative hypothesis will be accepted and it can be conclude that, merger and acquisition process results into profitability due to reduction in the cost.

Analyses of Hypothesis 3

H0 = Merger and Acquisitions doesn’t result into integration problem

H1 = Merger and Acquisitions results into integration problem

Response to the question 16 in questionnaire

| Column and Row Totals | |||||

| Admin | Finance | HR | Personal | Row Totals | |

| Yes | 3 | 6 | 16 | 7 | 32 |

| No | 1 | 4 | 8 | 5 | 18 |

| Column Totals | 4 | 10 | 24 | 12 | 50 (Grand Total) |

Result

| Results | |||||

| Admin | Finance | HR | Personal | Row Totals | |

| Yes | 3 (2.56) [0.08] | 6 (6.40) [0.03] | 16 (15.36) [0.03] | 7 (7.68) [0.06] | 32 |

| No | 1 (1.44) [0.13] | 4 (3.60) [0.04] | 8 (8.64) [0.05] | 5 (4.32) [0.11] | 18 |

| Column Totals | 4 | 10 | 24 | 12 | 50 (Grand Total) |

The chi-square statistic is 0.5208. The p-value is .914291. The result is not significant at p < .05.

Interpretation: The value of P is much higher than 0.05 (0.914291 > P > 0.05); thus, alternate hypothesis will be accepted. It can be concluded that merger and Acquisitions results into integration problem.

Analyses of Hypothesis 4

H0 = Mergers and Acquisition does not increase the company’s power in the market

H1 = Mergers and Acquisition has increase the company’s power in the market

Response to the question 9 in questionnaire

| Column and Row Totals | |||||

| Admin | Finance | HR | Personal | Row Totals | |

| Yes | 2 | 6 | 15 | 5 | 28 |

| No | 2 | 4 | 8 | 7 | 21 |

| Column Totals | 4 | 10 | 23 | 12 | 49 (Grand Total) |

Result

| Results | |||||

| Admin | Finance | HR | Personal | Row Totals | |

| Yes | 2 (2.29) [0.04] | 6 (5.71) [0.01] | 15 (13.14) [0.26] | 5 (6.86) [0.50] | 28 |

| No | 2 (1.71) [0.05] | 4 (4.29) [0.02] | 8 (9.86) [0.35] | 7 (5.14) [0.67] | 21 |

| Column Totals | 4 | 10 | 23 | 12 | 49 (Grand Tot |

The chi-square statistic is 1.9026. The p-value is .592867. The result is not significant at p < .05.

Interpretation: The result shows higher P value (0.59287 > P > 0.05); this indicates that null hypothesis rejected and the statement that, mergers and Acquisition has increase the company’s power in the market is accepted.

Secondary Research

Thematic 1:

According to Ferreira and et al (2014), Mergers and acquisitions (M & As) are important processes where companies complete their r domestic and international strategies and have been named the system of choice by CEOs. As an important research area, M&A research has gathered a lot of information. This bibliometric study analyzes advanced approach and global business writing on M&A. Ferreira et al analyzed a sample of 334 articles distributed in sixteen administrative / business diaries, over a long period of time, from 1980 to 2010. The results provide a worldwide perspective on the field, differentiating the works that have been particularly influential, the academic connections between creators and works, primary study conferences or subjects studied related to M&A Basic and longitudinal studies reveal changes in the academic structure of the field over a long period of time. A discussion of the information gathered and future research paths will conclude this article.

The findings of the research of Ferreira and et al shown that both merger and acquisition have negative impact on the existing employees due to change in culture, responsibilities, and increase in competition.

Thematic 2:

According to Goyal and Joshi (2011), who researched on mergers in banking industry of India; mentions in his research paper that; there was evidence that major efforts themselves have strengthened smaller competitors. This audit article on mergers in banking industry was clarified by the position of Bank of Rajasthan Ltd. also ICICI Bank Ltd. The purpose of this paper was to test banks’ thought processes for mergers and acquisition with remarkable reference. to the banking sector of India. For this reason, a test of 17 confirmations (after progression) of Banks was performed. This study was conducted based on the number of branches, observed geological infiltration and the benefits of consolidation. In addition to their financial ideas, this article also raises specific issues from the perspective of human resource management and organizational behavior for researchers and scientists.

The findings show the result that; M&A have proven to be a useful tool for the stability of fragile banks entering a larger bank. Our study shows that small banks and neighbors are having difficulty coping with the impact of the global economy, which is why they need support and this is one of the reasons for consolidation. Some private banks have used consolidation as an essential tool to elicit their views. There is great potential in India’s rural economic sectors that has not yet been explored by major banks. In this sense, ICICI Bank Ltd. has used collections as their expansion system in the segment market. They are effective in making their quality in rural India. It strengthens their organizations beyond the topographical frontier, develops the customer base and part of the industry as a whole.

Thematic 3:

The purpose of the research conducted by Rottig (2007) was to explore how global initiatives can effectively integrate with various companies in global construction. Before making such an assessment, Rottig found it essential to understand the goals necessary for societies in socially excluded situations. The newspaper was the subject of another suspect. The structure created in this study suggests that social distance may not be an obstacle to global ownership if a buyer actually joins various associations. Social differences can also include an open door for a multinational to get a high hand in the world. By buying property in socially inaccessible business sectors, multinationals may have access to critical resources and capabilities that are not available in relatively social business sectors.

The findings of the paper have led to fundamental construction challenges around the world and built some sort of systems that can alleviate these problems. It has been said that a worldwide shopping show is part of a fertile social mix during the mail order confusion phase. The system devised in this document suggests that productive social cohesion is ensured by adequate cultural persistence, diversified communication, connection and discipline. Because of the basic initials of these five precursors to global mortality, the high-level model can be referred to as the “Five C Framework” of effective worldwide delivery to officers.

Thematic 4:

The result from the interview conducted by Macdonald and Hellgren (2004) focus his report on problems which company usually not talk about. Macdonald and Hellgren found that most mergers and acquisition fail due to unaided handling of the progress of the action. Change is the lonely thing that will never change, so we should understand how to find leaders through change. This paper has analyzed all the variables that cause the change. Important reasons for structural change are structure-based change, individual-based change and productivity issues. Protection from change can be due to lack of letters, lack of reasonable vision, lack of a legitimate reward structure, disorder and dissatisfaction, power of prejudice, fear of darkness, fear of fragility, lack of capacity and helplessness.

The research finding of the report shows that; it is important to the company as it seeks consolidation and provision to understand the importance of monitoring change and planning appropriately to achieve consistent management change. There are a number of cases where, if not properly managed, change leads to a situation where the situation has changed. The report also recognized that organizations needed to make appropriate changes to the regulatory framework established during consolidation and protection. Introduced groups should see themselves in the culture and understand the significance of progress. At the same time, the pioneers of both sides should understand the intricacies and retain the workers of both sides that are needed during the union. They should be clear and legitimate in what they offer to employees, otherwise risk of resistance and sabotage might occur.

Thematic 5:

The journal article written by Mukele (2006) has a principle objective of his study to identify choices of mergers and acquisitions partners in Kenya. The survey sought to cover all organizations that have been involved in consolidation and construction in the past. The study was therefore placed in any case a referral review plan. The target audience was all those groups that had gone into collections and construction somewhere between 2001 and 2004 and issued warnings about that time. The information was gathered through a systematic survey in which respondents were required to obtain a score on a 5-point scale which showed how important they considered the variables included to be in determining ‘the decision of the confirmation and safety of the supporters. The information obtained was disseminated using frequencies, rates, average scores and factor analysis and was incorporated into the tables. The side effects of the information collected show that the number of companies deciding to confirm is slightly higher than 53.1% compared to a guarantee. The results also show that organizations exhibit a combination of legitimate ownership and structures. The accompanying elements were identified as important decisions in selecting collections and achievements in consolidating: removal of information and advice; social distance; hierarchical distance; asset redistribution and income related considerations; most likely cross-effects after consolidation and in addition to performance; inequalities between groups in terms of the expected dynamic cycle associated with post-consolidation and procurement and policy cycles; area-specific variables; the similarity of managers’ styles, performance of contracts; and the similarities between the scoreboards and the award, among other things. From the results of the test, it was generally accepted that groups in Kenya were considering different variables before entering into consolidation and construction contracts. This has been demonstrated by the way in which most of the different perspectives on each of the above components are assessed in a unique and tolerable way. There was not a single sight that was of humble value. In addition, the components considered in making a decision about a particular M&A assessment instrument are in a more informed way the method of mixing, the type of consolidation or supply, the range of activity and the opportunities for improvement.

Thematic 6:

According to the journal report of Majidi (2007), cultural factors play an important role in International Mergers and Acquisitions. He shows in his report that; the past studies on IM&As were based on finance and economic perspective, these researches have weak point that it only focused on short-term objectives rather than long-term returns and non-financial factors. The current study is designed to address this gap by examining the cultural impact on IM&A production and a combination of these effects during different periods of IM&A. The study is based on the part of social disparities around the world: the distinguishing feature between consolidation and housing construction (M&A) and IM&A. Estimates performance from an internal perspective, related to IM&A addiction, and its long-term performance. This approach is not the same as the standard one for market response-based performance measurement to IM&A – external measurement. This thematic study is based on an explanatory approach, which cuts financial, global and behavioral profits. The critical importance of the study lies in public culture as a development separate from hierarchical culture, in estimating IM&A’s performance or disappointment with its goals and in estimating it supports the idea of resilience in financial aspects.

The main argument of this study is that there is no one-size-fits-all approach. People’s perceptions and understandings influence their current situation and, consequently, their end point, with social components. Different interpretations and translations lead to different choices and practices. Social differences affect our view of the business and board of directors and, therefore, the outcome of IM & As. At a time when it is similar to IM&A destinations, social disparities can be an asset. When they fight, they are both a duty and a risk factor. In any case, public social disparities should be represented and prepared to reduce the risk of disappointment and increase what is wrong with performance.

Thematic 7:

According to Stahl and et al (2013) the essential components for performing mergers and acquisitions (M&A) and the reasons why M&A remain poorly understood. While efforts to clarify the outcomes and frustrations of unions and benefits have generally focused on key components and money, an area of study has been devoted to socio-cultural issues and human resources involved in inclusion of acquired or consolidated companies. This review sought to clarify M&A performance and underperformance in terms of the influence of factors, for example, social suitability, appearance of style of action, example of strength among merging firms, the degree of social aggression of the buyer and the social situation under construction involve the post-confirmation settlement step. In this article, we will attempt to consider and incorporate research findings on socio-cultural and human resource integration in unions and benefits, to identify controversial ideas and uncertain research just as few undeveloped areas, and subsequently used our experiments to design it for the next research phase in this area.

Stahl and et al further added mergers and acquisitions (M&As) are important for organizational change phenomena that have drawn critical analysis by focusing on a number of angles, but recently consideration has begun to focus on its complex nature and rooted in various contexts. To date, the impact of the large-scale approach to the M&A industry has been underestimated and its communication with the heterogeneous nature of M&A has gone unnoticed. This article tends to add to this barrier by examining whether the various macroeconomic and non-wavelengths of M&A movement affect the M&A times in terms of secrets, pre- and post-construction tours and get a showcase. Drawing on a Greek M&A dataset, a poorly studied M&A context, the findings suggest that construction in wave less times is driven by different thought processes of those times on the air. . Suddenly, however, we did not find much-needed changes in pre- and post-construction cycles and in union performance and construction between on-air and off-air phases. We suggest that the result of this authoritative change may be the result of the early Greek M&A idea and may also relate to the experience of different countries. Further hypothetical and concrete effects of these findings are also discussed.

Chapter Five: Discussion

Introduction

This chapter is discussed about findings obtained in previous chapter by providing justifications and conclusive statement about the results. All the hypothetical tests and pie charts shown for each questions separately have been discussed in this chapter.

Discussion

Result from Primary research

The result from primary research shows that; mergers and acquisitions do not have any survival impact of a company. M&A not guarantees for long-term survival of a company. Hence, any company chooses M&A to survive, might face failure and bear losses from merger and acquisition process. Another hypothesis test result shows that merger and acquisition results into successfully reduction of business cost and thus enhances profitability of the company during the year. The result obtained from hypothesis test also reveals that M&A has increase the company’s power in the market through adding extra capital, stakeholders, employees, merging of technologies, innovation and leadership styles. M&A sometimes result into synergy impact; as it may be chance that, the two different companies which they lack in each other found after merging. This synergy only works when strength of one company is weakness of others and vice a versa. Majority of participants chooses No in their survey; but result shown by Chi-square is opposite of descriptive analyses. This indicates that result changes when observation done by categorizing the variables.

Result from secondary research

The result from secondary data reveals that major authors accepts that M&A has an impact on companies performance and is essential for international companies to enter into foreign market from higher risk perspective. Authors also conclude that the impact of M&A might be in both negative, as well as positive way depends on economic condition, political disparity, cultural differences, and employee’s attitude. The writes mentions in their research that the concept of M&A is not new and practiced by companies to gain competitive advantage in the market. This concept is used not only at organizational level but also at political level. For instance, making alliance has similar feature as like merger have.

Chapter Six: Conclusion / Recommendations

Conclusion

The result from the study clearly shows that merger and acquisitions has an important role in conducting international business. As some of the Asian countries like China and India; no foreign company is authorized to have 100% stake or own fully owned company. For this, it is mandatory for them to join some small or already established company to enter into the foreign market.

At the same time, there is a absence of aggressive acquisition in China. This is due to the problem caused by market inadequacies and administrative precautions. Most of the confirmations and purchases have been made; they also include non-affiliated organizations. That said, it can be said to have contributed a little to their effectiveness. It has also been found that fortification and construction therefore exchange and involve a number of large amounts of money.

Recommendation

An organization considering mergers and acquisitions as an alternative to its financial affairs should consider the support:

- Creation costs should be lower than normal benefits with the aim of improving the financial performance of most memberships. Although at present it is unlikely that so much trade will take place in consolidation and construction in China.

- A reflective examination of the competitor’s organization should be completed to determine whether the legitimacy to be given after the broad merger is in line with their stated objectives of consolidation. of the group. For easier implementation, organizations should be grouped with similarly large organizations that should not be allowed to join the Securities and Exchange Commission as this could lead to limited business infrastructure along with the country’s economy. At the same time, the Security and Exchange Commission should allow the consolidation and acquisition of entities for the purpose of advancement.

It has not yet been determined whether the performance of the group’s over-the-counter money has improved. However, there is no guarantee that the productive use of the contracted organization will determine the degree of mix of development that will be achieved. However, given the bank’s consolidations, it can be said that the consolidation of 2020 is the impetus for the expansion of trade value and pre-tax and also the resulting consolidation. Like these lines, as long as the requirements for business development exist, business inclusion will remain a vicious circle for the created and created economies. So, going by its various advantages, it is recommended to review suitable options with respect to the adjustment with corporations and organizations.

Appendices

| Questionnaire

This questionnaire is to know the role of mergers and acquisitions in corporate growth and development within the context of international business. Your opinion will be very useful to my research work. Kindly read the following question careful and tick the appropriate answer to each box. 1. Personal data 2. Position occupied 3. Gender 4. Marital status Single [ ] Married [ ] 5. Work experience: number of years in Public [ ] Private [ ] 6. Age: 25-34 years [ ] 45-54 years [ ] 55-64 years [ ] 65 and above [ ] 7. Qualifications: MSc/MBA [ ] BSc/HND [ ] ND/NCE [ ] Others [ ] 8. After the merger, was the objective of profitability enhancement achieved? Yes [ ] No [ ]

9. After merging, does the company`s market power increase? Yes [ ] No [ ] 10. In your own opinion, can you say that the merger process has enhanced the survival of your company? Yes [ ] No [ ] 11. After merging, was growth through diversification achieved? Yes [ ] No [ ] 12.After the merger process, was the cost saving achieved? Yes [ ] No [ ] 13. Does your organization make mergers and acquisitions part of your corporate plan? Yes [ ] No [ ] 14. In your own opinion, were the terms of agreement a fair one? Yes [ ] No [ ] 15. If not, Why? 16. After the merger process, was there any problem of integration? Yes [ ] No [ ] 17. If yes, would you have preferred not to merge? Yes [ ] No [ ] 18. If yes, Why? 19. If no, Why?

|