AMAZON ACQUISITION OF WHOLE FOODS: MARKETING STRATEGIES

Introduction

The US retail business is a multi-billion industry. This characterization is, at face value, true. At a deeper analysis level, however, US retail industry has witnessed waves of radical changes in recent years. These waves have not only changed how US retail industry is characterized beyond conventional quantitative methods (e.g. sales volumes) but, most importantly, by qualitative methods. More specifically, in contrast to a revenue-based business model by which successful retailers are defined based on broad physical store presence, market share, distribution channels, extensive supplier networks and diverse product offerings, successful US retailers are increasingly defined based on data-analytics methods by which not only customer shopping habits and experience are accurately identified but equally accurately anticipated. These methods include, but are not limited to, sensor-enabled shopping carts; robots-in-lieu-of-human-sales assistants; and, more generally, automated, application-based shopping methods. The shift in business model from brick-and-mortar sales volume into a customer-oriented shopping experience enhanced by numerous automation methods model can, accordingly, be said to be a major defining shift in US retail industry business practice. For current purposes, one strategic move made recently by a major online retailer to acquire a private label organic food company is of primary interest. The acquisition of Whole Foods by Amazon is, more specifically, central focus of current research project.

The announcement of Amazon’s acquisition of Whole Foods has received much media attention. The underlying rationale for why Amazon, an online retailer, has chosen to reverse a general shift from conventional, brick-and-mortar shopping habits into online ones has, moreover, received most attention in media’s coverage and industry’s analysis of Amazon’s (most recent) acquisition. There are, in fact, much room for interest in why Amazon has acquired Whole Foods. The specific research focus in current project centers, however, on marketing strategies adopted by Amazon to acquire Whole Foods. The strategic marketing strategies, informed by overall corporate strategies adopted by Amazon particularly M&A strategies, are, more specifically, primary and specific focus of current research project. To better understand Amazon’s strategic decision, a closer examination is required of industry’s overall operating environment and marketing strategies of Amazon prior to and post Whole Foods acquisition. This paper aims, hence, to explore marketing strategies adopted by Amazon to acquire Whole Foods in order to assess Amazon’s decision in relation to company’s overall business and impact on US retail industry at large.

This paper is made up of five sections in addition to Introduction: (1) Initial Market Response, (2) US Retail Industry: Overview, (3) Whole Foods Acquisition: Marketing Strategies by Amazon, (4) Implications for Amazon & US Retail Industry and (5) Conclusions & Future Trends. The “Initial Market Response” section offers an initial insight into how US retail industry in particular and investment landscape in general has received Amazon’s decision to acquire Whole Foods. This initial response offers, moreover, a broad overview of main issues raised from different perspectives on Amazon’s decision. The “Initial Market Response” section is not an in-depth exploration of US retail industry per se but is, instead, a brief coverage of recent developments in US retail industry pertinent to current research focus. The “Whole Foods Acquisition: Marketing Strategies by Amazon” section is main part in current paper. This section explores major marketing strategies made by Amazon before and after acquisition of Whole Foods. The exploration of Amazon’s marketing strategies before and after acquisition is meant to highlight marketing build-up efforts leading up to final acquisition which is followed by even more aggressive marketing moves. The “Implications for Amazon & US Retail Industry” section assesses impact of Amazon’s acquisition of Whole Foods on Amazon’s strategy and overall business. The “Conclusions & Future Trends” section wraps up main arguments and offers further insights into possible future directions for Amazon and US retail industry at large.

- Initial Market Response

The announcement of Amazon to acquire Whole Foods has come as a major surprise for investors in general and retail industry in particular. The initial market analysis offered, for example, by The Wall Street Journal qualifies Amazon’s acquisition of Whole Foods on June 16, 2017 for $13.7 billion, including debt, as a transformative step. 1 More specifically, Amazon, an online giant, has become a major player in conventional brick-and-mortar retail industry, an industry which has been hit hard by Amazon’s very business model and aggressive expansion.

This surprise is reflected, moreover, by stock performance for major retailers as well as by Amazon. While shares of Kroger, Wal-Mart, Costco and Target have plunged 9.2%, 4.7%, 7.2% and 5.1%, respectively, Amazon’s shares rose by 2.4%.

This stock performance across all US retail spectra is seconded by an increasing inclination of industry analysts of Amazons’ ability to further penetrate retail industry particularly in what appears to be Amazon’s mastery of omni-channel retailing. 3 This overall upbeat, or bullish, outlook of Amazon’s acquisition decision is countered, however, by a few voices skeptical of Amazon’s ever-expanding growth strategy, pointing out to company’s increasing distancing from core competencies. 4

Later in 2107, Amazon’s share price has shown strong performance and bullish outlook. According to estimations by Credit Suisse, Amazon’s share price is projected at $1350 up from $1,100. 5 The upward projection by Credit Suisse is justified not only based on short-range projections for price cuts to enhance market share but by long-range expectations of value-added services offered by Amazon including, in particular, Prime Now 2-hour delivery service in several US zip codes. 6 The projections made by industry experts, seconded by actual market moves made by Amazon (discussed in further detail under “Whole Foods Acquisition: Marketing Strategies by Amazon” section), have broad implications on short and long ranges for Amazon’s business.

Over short range, Amazon is projected to enhance market share aggressively by a zero-profit strategy. Indeed, Amazon has a long track record of losses, particularly in earlier operation years, only to reverse direction by achieving unprecedented profits as well as surges in share price. This financial pattern is, one believes, more likely to be sustained for Amazon’s food sector. Over long range, Amazon’s leadership in data-analytics innovations and constant investment in numerous online and offline innovations (e.g. more automated services and energy recycling solutions for company’s iconic Seattle’s headquarters) are apt to sustain Amazon’s cost leadership in retail industry by a parallel value differentiation leadership. (Both strategies, i.e. cost and value differentiation, are discussed in further detail under “Whole Foods Acquisition: Marketing Strategies by Amazon” section.)

To better understand how Amazon’s acquisition of Whole Foods might be a game changer, made possible by company’s early adoption leadership of “avant-garde” retail innovations, and to identify where different industry players stand and are more likely to stand in upcoming years, a quick overview is required of US retail industry

The US retail industry is in a state of decline. This sweeping statement is justified by actual developments in US retail industry, not based on industry projections or, for that matter, rumors. According to recent, official reviews by US Bureau of Labor Statistics, decline of US retail industry is evident in increasing decline of payrolls in major retailers, more store closers and, not least, more aggressive deals made by major online retailers. 7 This decline spans full spectrum of US major retailers including, most notably, Sears, Michael Kors. 8 Wal-Mart and Amazon remain, however, winners.

For Wal-Mart, although company’s historical emphasis on cost leadership and customer-orientation has maintained (at least so far) company’s profitability, Wal-Mart has made several investments in retail innovations including, most notably, in virtual reality headsets and home delivery offerings. 9 These moves by Wal-Mart appear to be in heels of Amazon’s leadership in automated and data-analytics innovations. Needless to say, Amazon’s leadership, consistent to projections made by Credit Suisse above, has resulted in surges in share price to $1000 as at June 2017. 10

The state of decline of food retail industry is further highlighted by broader developments undergoing US retail industry in general. Macy’s is, if anything, an iconic US household name. This over century-old status is under mounting pressure from e-commerce giants, including Amazon. More specifically, in order to stay afloat, Macy’s appears to be in a steady march of selling company’s prime real estate in several US locations. 11 Interestingly enough, Amazon plans to lease office space in Seattle’s Macy’s.

This decline in brick-and-mortar retail industry, combined by Amazon’s aggressive expansion strategy into several business lines, can be best captured by offering an in-depth analysis of marketing strategies adopted by Amazon. This is discussed in extensive detail in next section.

Fig 1. Benjamin Benschneider, “Amazon plans to lease office space in the Seattle Macy’s,” The New York Times, n.d.,

- Whole Foods Acquisition: Marketing Strategies by Amazon

This section is made up of two main sections: (1) Pre-Acquisition Marketing Strategies and (2) Post-Acquisition Marketing Strategies. The “Pre-Acquisition Marketing Strategies” section explores marketing strategies developed and adopted by Amazon prior to acquiring Whole Foods. The pre-acquisition component as opposed to post-acquisition one is particularly important. If anything, Amazon has a long history of acquisition and expansion across product lines and markets. Thus, by identifying strategic moves made by Amazon prior to actual acquisition would amount to an analysis of Amazon’s marketing – and, for that matter, overall strategic – buildup to close Whole Foods’ acquisition deal. The “Post-Acquisition Marketing Strategies” section explores in-depth marketing strategies developed and adopted by Amazon in order to assert her recent acquisition. The extensive analysis of Amazon’s post-acquisition moves should, moreover, shed more light in emerging industry practices and, more broadly, future implications for Amazon and retail industry at large.

Before moving on to discussions of Amazon’s pre- and post-acquisition strategies, a brief overview of Whole Foods’s profile is performed. This should help explain underlying motives of Amazon to acquire Whole Foods, a company which, at face value, is at odds at numerous levels of Amazon’s business model, if not raison d’être.

Whole Foods is an established, nation-wide, premium organic food retailer. The company’s history dates back to 1980 when company’s first store was opened in Austin, Texas. 13 In subsequent years, Whole Foods has continued to expand both in product offerings and markets, propelled by an increasing awareness of environment challenges and wellness issues, to be world’s leader in natural and organic foods at 474 stores standing (and counting, when considering more recent openings after Amazon’s acquisition) in North America and the United Kingdom. 14

Whole Foods is, moreover, a mission-oriented company. This orientation is reflected in company’s very organization and social responsibility. More specifically, Whole Foods operates (one would say much like Starbucks) on a community-basis. According to company’s corporate website:

As a company, we are set up very uniquely for a large business. Our stores are not cookie cutter big box-type stores with directives from “corporate” about how to run the business. Each of our stores has a lot of latitude in deciding the best way to operate that individual store to meet the needs of the local community. That makes community giving really special and fun. Overall, our community giving well exceeds 5% of our total net profits each year.15

This community-orientation is further reflected in a broad range of foundations, programs and initiatives which Whole Foods supports including Whole Plant Foundation, Whole Kids Foundation, Whole Cities Foundation, Whole Trade Guarantee and Local Producer Loan program. 16

The long-standing history in organic food retailing and a parallel community-oriented stewardship are strategic assets which, in light of Amazon’s business model, do not only help boost company’s image but, more importantly, add value to Amazon’s product and service offerings clouded by company’s aggressive expansion and commerce-oriented appeal. This is not to mention ,of course, a market visibility which Whole Foods offers to Amazon, a presence, which as shown in next sections, is an asset Amazon has long lacked.

4.1. Pre-Acquisition Marketing Strategies

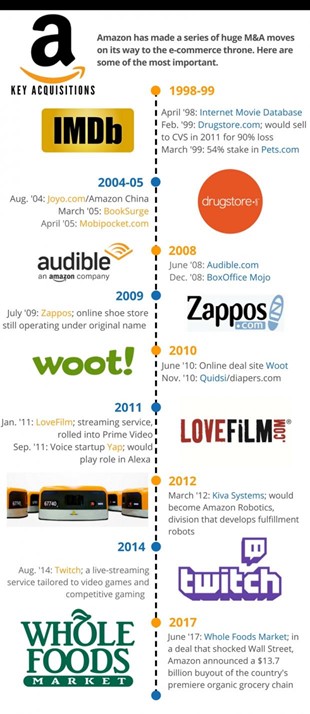

There has been a strategic buildup to current acquisition of Whole Foods by Amazon. This buildup includes a combination of aggressive M&As and specific marketing strategies. Needless to say, Amazon has a long history of acquisition and expansion across product lines and markets. The earlier expansion and M&A efforts can be justified, from a strategic perspective, by company’s need for growth which could not be achieved organically alone. Indeed, Amazon’s early operation years in 1990s were marked by loss, not profit. The business model which Amazon has been based, and still largely is, was not enough alone to sustain company’s growth across product and market portfolios. This fact is underscored by company’s intermediary status, particularly in earlier operation years. To achieve growth has required, accordingly, an aggressive expansion across product portfolios and markets. Today, although Amazon still adopts a comparatively aggressive M&A strategy, company’s more recent M&As show more inclination for vertical integration, if not full independence from established business partners. The exponential growth in Amazon’s brand equity, combined by company’s maturity, explains more recent strategic moves.

Fig 2. Zacks, “Timeline of Amazon’s biggest mergers and acquisitions,”

In recent years, however, Amazon has embraced a more sophisticated approach to her historical expansion strategy. This approach, informed by company’s growing market power and coming of age, represents what author qualifies as a buildup to next strategic moves and to later marketing strategies after acquisition. If anything, one most visible move is Amazon’s decision to launch Amazon Fresh. 18 In so doing, Amazon can be said to have adopted a vertical integration approach. To add value to her ever expanding fresh food product portfolio, Amazon has chosen to launch a separate service which is offered to Amazon Prime customers, which is another added-value service. Indeed, having outgrown her supplier and business partner networks, Amazon has moved a step forward away from an intermediary and into an independent brand. (This move has another parallel which, albeit not particularly relevant to current analysis, is insightful of how Amazon has crafted a gradual independent brand status. If anything, Amazon Web Services (AWS) represent one notable example of own brand, in-house service offering which is at odds with company’s earlier product and service offerings as an intermediary retailer.)

The buildup to acquisition is to be found in a second value-added service Amazon has rolled out recently, a service which is pat to cut across different product offerings provided by retail. Amazon Go is, indeed, a service which is more likely to upend decades of shopping habits within store space. Combining computer vision, sensor fusion, and deep learning, Amazon Go enhances in-store shopping experience by slashing out waiting lines and, more importantly, making billing process more convenient across different platforms and mobility devices. 19, 20

The strategic moves by Amazon, reflected in a series of value-added services, have not gone unnoticed by retail industry analysts. As matter stand, Wal-Mart remains (brick-and-mortar) dominant retail player, particularly in groceries which account for 50% of giant retailer’s revenues. 21 By launching Amazon Go, industry analysts argue, Amazon has concluded that a physical presence is required in food and beverage sectors, particularly when online sales represent only 1-2% of overall $US 1 trillion grocery market. 22

Thus, Amazon’s pre-acquisition strategic moves can be said to fall into four main categories: (1) conventional M&As, (2) expansion in value-added services, (3) brand differentiation and (4) full-fledged retail services. The conventional M&As are a continuation of Amazon’s historical expansion strategy in order to enhance product and service offerings. This step represents, particularly in more recent years, a founding block upon which more sophisticated steps have been made. The expansion in value- added services, including Amazon Fresh and Amazon Go, highlight company’s accelerating vertical integration strategy in order to achieve further brand independence. Having grown in market power and brand equity, Amazon has outgrown her intermediary status into an independent brand, a development which is not, in fact, uncommon in business. (The auto industry, for example, offers numerous examples of intermediaries or dealerships who have grown from local or regional players into nationwide independent service companies.) The brand differentiation is a second step forward by which Amazon is no longer dependent on, say, logistical support (e.g. shipment services) from business partners but has developed her own shipment service, Amazon Prime, a service which is projected to disrupt how orders are delivered, nationally and internationally. The full-fledged retail services have, in fact, been partially implemented by introducing robots instead of sales agents and, after acquiring Whole Foods, are apt to expand aggressively, particularly in newly opened stores in several US cities.

4.2. Post-Acquisition Marketing Strategies

The post-acquisition marketing strategies are a continuation of Amazon’s moves to “secure” her pre-acquisition marketing strategies. More specifically, having reached a conclusion that, in order to be able to compete more aggressively (and more profitably) in fresh food market, a physical presence is required, Amazon has continued to invest in marketing strategies to, first, establish her market position and, predictably, to dominate fresh food market – a typical move Amazon has made in different sectors. In current section, four main marketing strategies are examined: (1) Cost Leadership, (2) Market Expansion, (3) Value Differentiation and (4) Vertical Integration. The “Cost Leadership”, a blueprint in Amazon’s strategic repertoire, is a zero-profit (or close) strategy Amazon adopts to establish an initial market presence and, later, to reverse strategy to a profit-based one. The “Market Expansion” strategy is one Amazon has adopted to expand aggressively on current physical presence of Whole Foods stores nation-wide. This strategy aims, more specifically, to offer Amazon a major competitive advantage which, so far, Amazon does not have: extensive distribution system. The “Value Differentiation” strategy is not new to Amazon’s strategic repertoire but is adopted in numerous, innovative ways in case of Whole Foods, ways which are apt, author believes, to upend current fresh food market landscape, if not retail experience at large. The “Vertical Integration” strategy is, similarly, an extension of Amazon’s strategy of rolling out new product and/or service lines which enhance value delivered on existing ones. The following sub-sections discuss in further detail each marketing strategy.

4.2.1. Cost Leadership

As noted above, cost leadership is not new to Amazon’s strategic repertoire. Indeed, cost leadership can be said to be Amazon’s “wild card”, if not company’s most fundamental strategy upon which company’s very business model is based. To do so, Amazon implements her overall cost leadership strategy based on a double-pronged sub-strategy: (1) cost cuts and (2) innovation. The cost cuts component in Amazon’s cost leadership strategy is one which is, conventionally enough, about slashing out profit margins in order to outperform competitors along cost dimension. This is, of course, not an innovation and is a historical strategy adopted by different enterprises across industries for decades. The innovation in Amazon’s approach to cost cuts is in a zero-profit formula. More specifically, while one fundamental raison d’etre of a for-profit enterprise is profit, Amazon’s zero-profit approach upends profitability as a critical goal for business growth, if not survival.

The acquisition of Whole Foods offers valuable insights into Amazon’s zero-profit marketing strategy. Indeed, Amazon’s acquisition of Whole Foods has raised a flurry of analysis, particularly in retail industry. Notably, Amazon’s acquisition is interpreted based on how Amazon operates. More specifically, Yglesias explains that, in acquiring Whole Foods, Amazon does not, in fact, aim to generate profits (or, at least as a primary business goal). 23 More specifically, Amazon operates as a startup and startups, argues Yglesias, do not aim, primarily, to generate profit but to expand on business and hence becoming more valuable. 24 Interestingly, Amazon’s acquisition of Whole Foods is meant to fuel existing business by channeling current and potential customers of Whole Foods to Amazon’s extensive web platform and, more importantly, to add value to Prime Members and expand on company’s distribution system and network. Put differently, while acquiring Whole Foods might not generate profits to Amazon, at least initially, Whole Foods offer Amazon multiple benefits in so far as cost cuts strategy is concerned.

First, Whole Foods enables Amazon to establish a physical presence to reach out for Whole Foods high-income customers. This offline visibility is, indeed, a pre-requisite in retail industry, grocery retail industry in particular. 25 Thus, in addition to a web presence, Amazon would be able, having acquired Whole Foods, to lure customers in before rolling out more “pricy” products and services. Put differently, while Amazon has an established web presence already in different global markets, conventional brick and mortar stores offer Amazon more control of grocery supply chain across different distribution channels.

Second, Whole Foods, in a brick-and-mortar style, offers Amazon a valuable distribution channel not for current food offerings of Whole Foods per se but for a broad range of product and service offerings on Amazon’s web platform. More specifically, Amazon could “link” discounts made on Whole Foods offerings to Amazon Prime membership and hence driving up sales for “loyal” and “valuable” customers elsewhere. 26 This re-configuration of existing distribution channels – at least in so far as distribution channels are understood in grocery retail business at large – offers Amazon a substantial market competitiveness against competitors not only in retail but also across almost about every business line Amazon is engaged in.

Third, Whole Foods is another valuable source for customer data. If anything, Amazon’s very success in online retail is based, primarily, on company’s innovation in data analytics, particularly in understanding consumer behavior and habits before actual purchase actions. Indeed, by acquiring Whole Foods, Amazon is, in fact, expanding company’s already vast database of consumer data into a new pool of new users who offer additional insights, if not value by acquiring Whole Foods high-income customers. 27

Needless to say, Amazon has already made practical steps to attain her cost leadership, zero-profit strategy. The announcement by Amazon to cut out prices right after close of acquisition deal 28 has been followed by actual price cuts for specific products including Kale and Avocado 29 as well as special discounts for holiday offerings including organic and no antibiotic turkeys over Thanksgiving 30. These offerings are clearly in customer advantage. 31

On another hand, Amazon’s strategic moves are apt to wreck havoc in retail industry in general and grocery market in particular. As just noted, Amazon’s very business model is based not on profits but on expansion. In an industry defined primarily by profit margins, however slim, a race to bottom – in fact, to zero profits –does not only undermine current market balance in favor of Amazon but, more importantly, industry’s very business model. In marketing and promotion activities, for example, while industry’s standard has been one based on discounts and deals, a zero-profit strategy only makes industry’s very raison d’etre meaningless. Then again, a closer look at Amazon’s market moves, particularly earlier ones reveal similar broader patterns.

The upending of one industry by another is, notably, a common practice in recent years in US business practice. ICT companies – including, most notably, Google, Apple, Microsoft – are, indeed, clear indicators of how ICT industry has not only upended business models across industries (e.g. auto, retail, academia and, of course, financial sector) but, more importantly, shifted business models from conventional, hierarchical, highly specialized ones into innovative, horizontal and diverse ones. The retail industry – again – offers invaluable earlier insights. Notably, while established conventions in retail industry included closer personal relations with well known customers at a local level in order to better understand and predict customer purchasing habits, points of sales (POS) were a first innovation which standardized shopping experience at an initial level by offering an accurate metric by which sales volumes could be better analyzed and predicted. Fasting forward to early 21st century, data analytics methods have been increasingly adopted by big and small retailers across different retail sectors including Wal-Mart. The introduction of data analytics has, indeed, offered invaluable insights to retailers in order to launch aggressive marketing and promotion campaigns informed by extensive data analyses, prior to actual purchase actions. This development has been, paradoxically, adopted by Amazon since early inception years and refined into even more sophisticated methods later on. (Needless to say, Amazon is, arguably, a pioneer in offering product suggestions and customer reviews, a method which has helped leverage company’s insights of customer behavior, prior to, during and after actual purchase actions.)

The zero-profit, a cost leadership strategy par excellence, adopted by Amazon is projected to disrupt retail industry and grocery market in particular in even deeper ways. Through company’s multiple cost-cutting initiatives, Amazon is positioned to expand market share at considerable expense of major and small retail players alike. Then again, Amazon’s cost leadership strategy is supported by another, no less aggressive strategy, a strategy involving a component Amazon has always excelled at: data analytics. This brings up Amazon’s second component of cost leadership to penetrate retail industry: innovation.

The announcement of Amazon of cutting costs has been enacted into actual practical steps. In addition to cost cuts, Amazon has also announced company’s plans to introduce robots in Whole Foods stores, a move which, in addition to slashing out human labor costs, is meant, industry analysts argue, to expand Whole Foods brand beyond premium offerings into a more mass appeal. 32 The introduction of robots is not new in Amazon’s innovation repertoire. Indeed, robots are already working at company’s warehouses side by side to human workers. The more interesting motive in introducing robots in Whole Foods stores is, similar to company’s zero-profit strategy, meant not to accelerate check-out process (predicable for an ICT company) but to cut prices, albeit in a different way. Paradoxically enough for an ICT company, Amazon’s move outmaneuvers established industry players whose primary, if not sole, focus is price cuts and, ultimately, profits. This is, of course, another unfolding example of how an outsider – an ICT enterprise again – reshapes whole industries by undermining basic foundations upon which such industries are based.

Thus, Amazon’s cost-leadership marketing strategy can be said, in sum, to be based on company’s dual sub-strategies of cost cuts and innovation. Moreover, while cost cuts are a standard business practice and innovation particularly in data analytics methods are ones which are adopted by online retail players, Amazon has managed nevertheless to achieve success in both. The next marketing strategy, market expansion, is even more paradoxical and far more conventional for Amazon.

4.2.2. Market Expansion

The marketing expansion strategy is, as just noted, a territory which, above anything else, remains alien to Amazon. In a way much similar to price cuts, establishing and even expanding in physical presence runs counter to company’s very business model. From a resource management perspective, Amazon’s ever-expanding strategy, horizontally and vertically, stretches corporate resources. Needless to say, companies losing strategic focus might end up going completely out of business. This remains, however, outside current scope of discussion. For current purposes, Amazon’s aggressive market expansion in physical form is of primary interest.

Amazon has made a series of announcements upon closing Whole Foods acquisition deal. In addition to price cuts and automation solutions, Amazon has not only announced new Whole Foods store openings but has in fact launched several new stores in several US cities. 33, 34, 35, 36 Thus, consistent to company’s strategy to expand physical presence, Amazon has accelerated pace of new store openings, a pace which is unprecedented in Whole Foods history. Interestingly, Amazon’s market expansion strategy is foreign to Whole Foods, a premium brand. More specifically, while Amazon is a giant online retailer selling both own and different business brands, Whole Foods has developed a reputation for premium quality both in product offerings and prices. This gap in cost structure and brand positioning, although is understated in current expansion rush, is more likely to cloud how Whole Foods is perceived by long-standing customers, an effect of broad implications for Whole Foods, Amazon and retail industry at large. (This is discussed in further detail under “Implications for Amazon & US Retail Industry” section.)

The opening of new Whole Foods stores as part of Amazon’s market expansion strategy is also meant for broader distribution channel. As noted above, one underlying motive of Amazon’s physical retail presence is not to compete against established retailers, particularly Wal-Mart, over prices but, more importantly, to provide an integrated, hopefully, nation-wide distribution system, particularly in grocery business, one most lucrative sector in retail industry. 37 Needless to re-emphasize, Amazon’s market expansion strategy, besides offering Amazon a nation-wide distribution network (and, possibly, international network upon further expansion), is also an investment in value, real estate value in particular. As shown in Figure 1 above, Amazon’s plans to lease office space from Seattle Macy’s is, for Macy’s, a Holy Grail to make up for losses in sales. True, although Amazon is not hard on cash as Macy’s is, company’s acquisition of Whole Foods might, ironically, offer another understated benefit for Amazon namely, prime real estate spots in which Whole Foods stores are located nation-wide.

The next strategy, value differentiation, combines both Amazon-style and conventional actions.

4.2.3. Value Differentiation

The value differentiation and cost leadership strategies are standard business

strategies adopted by companies in all industries to enhance competitiveness and expand on market share. Amazon is not an anomaly. Notably, in an interesting post-acquisition move, Whole Foods under Amazon has recently announced a partnership with celebrated chef Joan Nathan in order to feature High Holiday dishes. 38 This is a conventional product development strategy which for Amazon, an ICT company, is outside company’s conventional definition of product development plans. Tapping into now a business subsidiary, Amazon does not need to develop F&B offerings in-house in conventional product development style but by an affiliate who has a long standing expertise in premium organic F&B. This crates value in an optimum resource management method. Typical of Amazon’s M&A history, acquiring Whole Foods is apt to create added-value for Amazon by not only enhancing company’s own product portfolio but by more vertical integration.

This conventional value differentiation approach by food product development is, of course, seconded by Amazon-style value differentiation offerings. The range of value-added offerings in Amazon’s repertoire is, indeed, vast and cuts across different business activities. In logistics, for example, Amazon Prime is clearly Amazon’s answer to current shipment methods. More specifically, while Amazon has historically relined on shipment business partners, Amazon Prime, a drone-based service, is apt to make Amazon more vertically integrated but, more importantly, to save, over long run,

shipment costs which might deter consumers of specific products from making a final purchase. This is not to mention, of course, developing new niche markets altogether by delivering to destinations formerly unreachable by conventional shipment methods. The list of value-added services is indeed extension including, most notably, Amazon Go and Amazon Fresh. Still, Amazon Prime Account remains most interesting. Based on a subscription to company’s drone-based Amazon Prime service, Amazon Prime Account expands value-added services well beyond delivery options and into almost about every product and service line. Indeed, since one underlying motive of Amazon to acquire Whole Foods is not profit but to cater to company’s existing customers, Amazon Prime Account could be considered a global access platform via which customers are, author strongly predicts, are channeled gradually to company’s subscription and profitable service. Thus, by expanding into another business, Amazon is adopting her long-standing dual strategy of business expansion (at no profit) and value enhancement (at incremental increase in profits).

The next marketing strategy, vertical integration, highlights Amazon’s specific market moves to consolidate her acquisition of Whole Foods.

4.2.4. Vertical Integration

The vertical integration strategy is not a novelty to Amazon. If one variable is consistent in Amazon’s strategy, vertical integration clearly is. As noted in Figure 2 above, Amazon has a long history of M&A, a history which underscores, if anything, company’s constant vertical integration to enhance product and service offerings but also, more importantly, to expand in business which, in a loop-style, enhances company’s product and service offerings.

Two basic rationales underlie Amazon’s acquisition of Whole Foods: (1) Data and (2) Product. 39 The data component is, as noted above, one which Amazon drives form Whole Foods premium customers. The data Amazon is for sure to “comb into” for further insights would, indeed, enhance company’s accuracy of understanding customers even more in another sector, i.e. grocery, which would, author believes, drive more value for Amazon and customers alike. The product component resides, of course, in Whole Foods premium, organic F&B offerings. The product development instances in post-acquisition period h, including above mentioned Whole Foods- Joan Nathan partnership, add more value to Amazon.

In balance, Amazon can be said to adopt four main marketing strategies in Whole Foods acquisition deal. These fall into pre- and post-acquisition phases. The highlights of each strategy in each phase are shown below in Figure 3 and Figure 4, respectively.

| Pre-Acquisition Marketing Strategies

|

|||

| Conventional M&As

→ Continuation of Amazon’s historical expansion strategy |

Expansion in Value-Added Services

→ Accelerating vertical integration strategy → Achieve further brand independence → Examples: Amazon Fresh and Amazon Go |

Brand Differentiation

→ More brand independence → Examples: Amazon Prime |

Full-Fledged Retail Services

→ Automation

|

Fig 3. Amazon’s pre-acquisition marketing strategies.

| Post-Acquisition Marketing Strategies

|

|||

| Cost Leadership

→ Zero-profit strategy → Automation (robots to replace agents to slash out costs) |

Market Expansion

→ Aggressive new store opening strategy → Extensive distribution network |

Value Differentiation

→ Technical innovation (more accurate data analytics methods) → Product Development (new premium F&B) → Strategic Innovation (Amazon Prime Account) |

Vertical Integration

→ Conventional M&As → Investment in new product and service development

|

Fig 4. Amazon’s post-acquisition marketing strategies.

5. Implications for Amazon & US Retail Industry

The acquisition of Whole Foods by Amazon has broad implications for Whole Foods, Amazon and retail industry at large. Generally, implications, actual and projected, cut across different organizational, business, market and industry lines. Organizationally, Whole Foods and Amazon are most likely to be impacted by recent acquisition. As noted above, Whole Foods and Amazon do not fit together. More specifically, while Whole Foods has a premium brand status in a more conventional manner, Amazon does not only appeal to a mass market but, more importantly, aims to transform Whole Foods into a platform for mass market. Needless to say, Amazon’s marketing strategies highlight, above anything, Amazon’s radical approach to business compared to more established business in Corporate America. By adopting, for example, a zero-profit strategy Amazon runs, in fact, against established business practice, at least in the United States, by bypassing profit into business expansion even after maturity. Indeed, Amazon appears to be operating as a startup although company’s growth and profits reflect another phase of growth. This has, accordingly, broad implications, for retail industry at large. Notably, current market setup and business landscape in retail are not, in fact, sustainable. The increasingly slim profit margins represent, for one, major evidence of how a race to bottom does not only make business under increasing question but, more importantly, current business model under which US retailers operate. Thus, in order to retail industry to reverse current race to abyss, current profit-based pricing strategies should be subject to extensive review. Indeed, retail industry, grocery sector in particular, might not need to play a catch up game in order to restore reputation, let alone profitability. Instead, US retail industry might develop innovative marketing strategies to counter Amazon’s unstoppable march across all business activities. This is highlighted in further detail in next section.

-

Conclusions & Future Trends

To wrap up, Amazon has made a surprising strategic move by acquiring Whole Foods. This move is understood, in one analysis, by examining Amazon’s marketing strategies prior to and after acquiring Whole Foods. This paper examines marketing strategies adopted by Amazon in pre- and post-acquisition phases. The pre-acquisition strategies include: (1) Conventional M&As, (2) Expansion in Value-Added Services, (3) Brand Differentiation and (4) Full-Fledged Retail Services. The post-acquisition marketing strategies include: (1) Cost Leadership, (2) Market Expansion, (3) Value Differentiation and (4) Vertical Integration.

In sum, all marketing strategies in pre- and post-acquisition phases highlight, if anything, Amazon’s business growth strategy. The zero-profit strategy has, indeed, a most powerful impact on retail industry, an industry defined primarily by profit margins. The impact on retail industry is already felt, if only by Amazon’s rising stocks and failing stocks for major retailers. In response, retailer industry is recommended to:

- Create an industry-wide alliance in order to mitigate effects of falling sales to Amazon;

- Engage customers in more innovative ways beyond digital corporate platforms and seasonal discounts including, most notably, home visits for most loyal customers and engaging active users by appointing Brand Ambassadors; and

- Developing value-added digital platforms offering, in addition to standard discounts and offers, experience-enhancing offerings including, for example, digital credits for loyal customers based not on loyalty cards but on peer engagement and referrals.