Asset light model of a business has gained popularity over the recent years around the globe and in different industry. The model takes an approach of increasing operations in a business while reducing the cost of hard assets’ acquisition. By this way, companies tend to increase their scalability and while reducing the risks involved with having a significant amount of collateral.

The traditional approach taken by most of the world largest companies was vertically integrated. The focus here is to ensure that the company has a significant share in the process of production and distribution. This leads to the acquisition of the tangible assets required for the process. They may include: properties, infrastructure, business division and machinery. This approach gives the company using it the superior control over the operations however, it requires a significantly larger capital to initiate and manage. It poses also a challenge to the company by limiting it to change quickly when market conditions shifts.

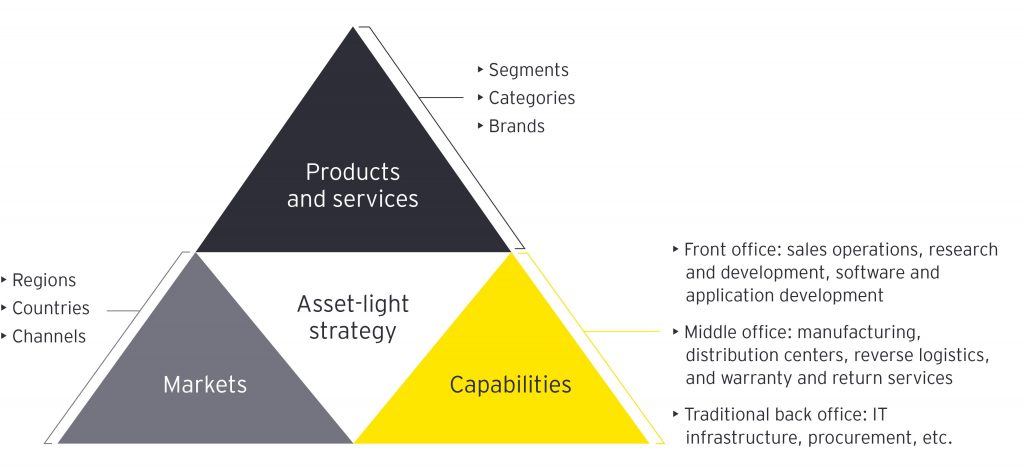

On the other hand, asset light approach takes a significant turn to flexibility. The companies that use this approach incur lesser front capital when compared those who use the traditional way. The investment of intellectualism is high as compared to the physical assets. The businesses using this approach outsource operations sales, distribution and manufacturing. The lean costs of operations helps a company to respond to conditions in the market rapidly.

The hospitality industry has not been left behind when it comes to the ever changing market conditions. Many companies in this industry have been using this method to increase their service delivery as well as increase the scale of their operation. This literature review focuses on three key areas: the capital structure for asset light strategy, the possibility of growth through merger and how acquisition is handled in the hospitality industry when using the asset light strategy.

ALFO (Asset-light and fee-oriented strategy) is the model that has been used in the hospitality industry. It facilitates a firm growth with little capital investment while reducing the risks of loss of collateral. This structure of capital change has led to the increase in the degree of franchising and fee-income ratio (Li & Singal, 2019). Interestingly enough, this study shows that ALFO has different results on the subsections of the hospitality industry. In the restaurant section long-term debt ratio is directly proportional while indirect in the hotel sector.

The capital structure in asset light business model in the hospitality industry affects the dividends given to the shareholders. However, this is not true for all the firms, it is only applicable in those that are associated with a high growth (Poretti & Blal, 2020). When institutional ownership is low, the capital structure approach employed by asset light strategy positively affects it. In such an occurrence, dividends is used as a monitoring tool because of the potential conflicts lying in such an agency.

In the hospitality industry, the sub section of lodging brings a different light to the asset light strategy. There is minimal risks involved as modeled in the capital structure although there may be real estate risks when there is high liquidity constraints (Kim et al., 2019). At the onset of the COVID-19 pandemic, a research by Poretti & Heo (2021) validated that the hospitality industry was divided in terms of the capital structure effects on the business. Those in the industry that ad earlier adopted the asset light strategy were shielded more for the first 4 days than those that had the traditional way of asset acquisition. However, after the fifth day, stock brokers changed their expectations on the stocks of the later, shielding it more from being hard hit.

When a company in the hospitality industry chooses to go the asset light strategy way, the results are that moderation is negative on the investment’s sensitivity to cash flow. Through research by Seo & Soh (2019), the model positively affects the return gains.