EXECUTIVE SUMMARY

The construction sector is estimated at $106.3 billion, representing more than 7 per cent of Canada’s GDP. Approximately 1.4 million Canadians are working in this sector in 2018, and this sector buys goods and services in every area of the world and all sectors of the economy, making it a barometer of overall economic growth. Multi-family construction continues to dominate investment for the residential sector with a rise of 7.6 percent to $5.5 billion in May. The single-family sector dropped 2.2 percent to $4.9bn. Around three-quarters of the multi-family investment went down to British Columbia where major ventures in Burnaby and elsewhere pushed the total higher overall. The Construction Association / Bodies of have special focus on economic and political structure and ensuring individual rights and private enterprise, in the best interest of our society. The Prime Minister should take certain initiatives to promote the sector. The Informing owners, in writing, of the proposed development project in their area where land use differs from neighboring areas and the density of the area increases significantly. Evaluate the city and country planning act in response to the requests of neighboring stakeholders for the purposes of third party Appeals-Preparing Civic Participation Protocols to discuss the effects of local policies before all substantive initiatives are approved. Ensures proper involvement in project approval of the neighborhood. Devise a system to provide ample space for separation and processing of waste and recycling for project supporters.

SCOPE OF PROBLEM

This report is addressed to the Office of the Honorable Prime Minister of Canada containing the analysis of various prospects and role of Business Investment and Residential Construction in Canada such as financial performance, share in GDP, market worth then recommendations are made regarding share investment. The period under review is 2010-2020. Financial Information and construction sector stats have been obtained from reputable sources and URLs.

Construction is a major economic (Statisics Canada, 2020)contributor. Canada’s building sectors— residential, repair, engineering, , and other building facilities — accounted for 6.0 percent of Canada’s GDP, contributing $73.8 billion in 2010. Construction GDP increased by 42.7 percent from 2000 to 2010, while GDP decreased by 20.2 percent for all sectors. Construction is a significant Canadian industry, providing employment opportunities to over 1.2 million people. In 2010, 7.1 percent of employed Canadians worked in the construction sector, a 50.8 percent rise since 2000, when 806,900 people were working in construction. Historically, construction employment was more prone to economic ups and downs, and that was so in 2009 and 2010. In 2009, total jobs decreased by 1.6 percent during the 2008–2009 recession, while jobs in construction decreased by 5.7 percent. As the economy showed signs of change in 2010, employment in all sectors rose by 1.4%, while jobs in construction increased by 4.9%. The said sector contribute the largest share of construction GDP among the three component industries. It accounted for 54.0 per cent of building GDP, or $39.9 billion, in 2010. The development of residential buildings contributed $23.4 billion while development of non-residential buildings

contributed $10.8 billion.

Canadian construction (Randall, 2019) spending hit $15.2 billion in May 2019, [ up 2.2 per cent from the month before]. According to Stats Canada there is a significant increase due to impetus in investment in residential development [up 2.8 per cent to $10.4 billion]. While non-residential sector increased 0.8 per cent to $4.8 billion. Investment in building rose 1.8 per cent to $12.7 billion on a constant price basis.

Multi-family construction continues to dominate investment for the residential sector with an rise of 7.6 percent to $5.5 billion in May. The single-family sector dropped 2.2 percent to $4.9bn. Around three-quarters of the multi-family investment went down to British Columbia where major ventures in Burnaby and elsewhere pushed the total higher overall. The housing industry would have projected higher payment requirements, higher credit rates and higher mortgage insurance premiums in the next decade as a consequence of strenuous public regulations for surcharge red housing markets, especially in Vancouver and Toronto, with housing starts decreasing more than 13% in the first quarter. In 2017, Ontario is also a leader in the fields of industrial, trade and institutional construction (ICI).

The construction sector is estimated at $106.3 billion, representing more than 7 per cent of Canada’s GDP. Approximately 1.4 million Canadians are working in this sector in 2018, and this sector buys goods and services in every area of the world and all sectors of the economy, making it a barometer of overall economic growth. There are four major building categories: building a new house and renovating (for one or more families); heavy industry; industrial and institutional; and civil construction. The Canadian housing market is generally recognized as the principal indicator of the Canadian economy’s overall state. Canada’s six main metropolitan areas–Toronto, Vancouver, Montreal, Calgary, Edmonton and Ottawa–also have the highest home rates, partially due to over 320,000 immigrants from the world in 2018. In 2018 212,843 homes were built in Canada. One of the largest building markets in Ontario (starts 78,742), followed by Quebec (46,874), and British Columbia (40,857). Building costs have been increasing. New housing buildings are 5.1% higher as opposed to existing non-residential buildings 4.5% higher, as compared to July 2018 through July 2017.

POLICY ALTERNATIVES

The Construction Association / Bodies of (Alberta Construction, 2020) have special focus on economic and political structure and ensuring individual rights and private enterprise. Individual freedom to compete must be secured at all times, and promoted by government whenever possible. Many associations oppose regulations that deter free competition and is actively campaigning to avoid or eliminate all such restrictive provisions. Like minimum wage rates or compulsory hiring standards or quotas. At all rates states and government departments will refrain from competing with the private sector. Considers the collection of project knowledge to be a key task of local building organizations. Dissemination and dissemination of project and tender incentive information and documentation to help the construction procurement procedure must be provided by organizations that have a clear knowledge of the bidding process and construction markets.

Research is essential (Govt. of Canada, 2019) for the continued improvement and development of buildings in the country. Therefore, advocates continued backing of well-known Centers of Building Research expertise across Canada and other institutions engaged in works to improve building practices. Members are encouraged to contribute to this important task, as realistic as possible. The sector endorses the principle of sustainable growth, acknowledging the importance of alignment in decision-making processes with environmental and economic considerations. The feedback of the construction industry should be sought in order to achieve sustainable development goals. The industry promotes green building and green construction efficiencies and suggests that the parties directly involved in the project follow and validate those targets through the usual commissioning process for building design and certification. Waste management and recycling strategies are better than legislation. Where laws apply, they should rely on performance rather than technological recommendations. Industry should be able to agree on the best means of fulfillment. Innovative approaches must be pursued instead of punitive (e.g. drywall recycling testing before considering site bans on drywall).

Industry leadership (BRITISH COLUMBIA CONSTRUCTION ASSOCIATION, 2019) is essential to maximizing program success in the design and administration of a management program. The geographical position, financial, social or membership of any association should under no circumstances be regarded as a justification for awarding a contract to a contractor or supplier, or any price advantage or preferential treatment should be granted due to location or affiliation.

The rights of association (Alter, et al., 2018) of workers and employers for collective bargaining and industrial relations are strongly recognized. Improving wages and working conditions addressing economic and functional needs of business and the society. Collective negotiating groups interact frequently and efficiently between them. Daily and efficient contact with, and representing the contractor, construction staff and construction purchasers and their respective organisations. Protection of workers ‘ rights to determine whether to join the unions. Employees and employers ‘ association rights are well accepted for collective bargaining and working relations. Improving wages and working conditions addressing economic and functional needs of business and the society. Collective negotiating groups interact frequently and efficiently between them. The safeguarding of employers ‘ right to contract and work regardless of their workers ‘ decision to express themselves or not by syndicates or trade unions. Important legislation for industrial relations, labor rights, compensation for employees, apprenticeships and business education, occupational health and safety in the workplace and unemployment insurance for construction workers and employers. Public infrastructure investments are effective and safe to improve Albertans ‘ quality of life and are an integrated strategy in order to attract new investment and create a stable, productive economy. New, high-quality infrastructure provides efficient production and transportation of goods and produces investment through jobs, income and taxes in the province.

POLICY RECOMMENDATIONS

Considering the above mentioned facts of the investment in housing and construction sector activity there are certain recommendation for the policy makers and regulators of the country.

- Notifying owners, in writing, of the proposed development project in their area if land use differs from neighboring areas and the area’s density increases significantly.

- Prepare Community Engagement Guidelines to tackle local government social impacts before all construction proposals are approved

- Evaluate the City and Country Planning Act, in response to demands by neighboring landowners to take account of appeals by third parties.

- Ensure appropriate neighborhood participation in project approval.

- Call on local government authorities, before consideration of project approval in areas, to obtain geotechnical and geological reports

- Increase understanding of the need for the environmental impacts to be taken into account for land use purposes amongst local authorities.

- Calling on technical staff from land transfer to the post-construction stage to present coordinated and detailed plans.

- Formulate a framework for assigning sufficient space for waste and recycling separation and collection for project proponents.

APPENDIX

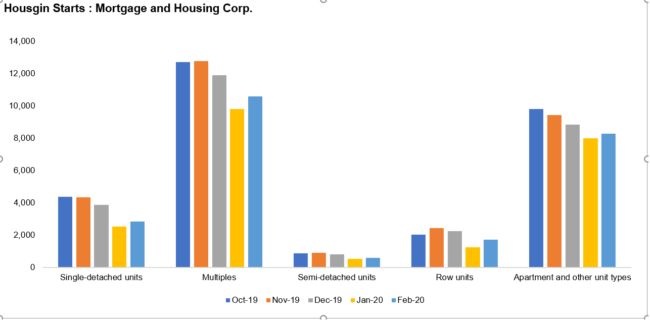

| Type of unit | Oct-19 | Nov-19 | Dec-19 | Jan-20 | Feb-20 | |

| Housing starts | Total units | 17,060 | 17,108 | 15,772 | 12,318 | 13,423 |

| Single-detached units | 4,359 | 4,323 | 3,874 | 2,522 | 2,837 | |

| Multiples | 12,701 | 12,785 | 11,898 | 9,796 | 10,586 | |

| Semi-detached units | 868 | 911 | 820 | 539 | 594 | |

| Row units | 2,013 | 2,434 | 2,234 | 1,250 | 1,721 | |

| Apartment and other unit types | 9,820 | 9,440 | 8,844 | 8,007 | 8,271 | |

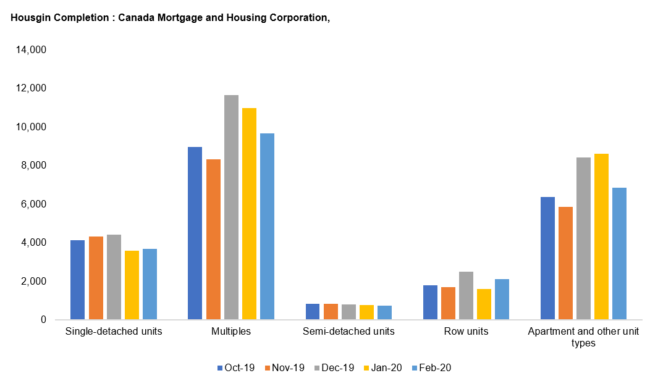

| Housing completions | Total units | 13,066 | 12,634 | 16,061 | 14,531 | 13,349 |

| Single-detached units | 4,108 | 4,307 | 4,414 | 3,570 | 3,685 | |

| Multiples | 8,958 | 8,327 | 11,647 | 10,961 | 9,664 | |

| Semi-detached units | 813 | 819 | 776 | 756 | 721 | |

| Row units | 1,790 | 1,670 | 2,471 | 1,593 | 2,106 | |

| Apartment and other unit types | 6,355 | 5,838 | 8,400 | 8,612 | 6,837 |

(Statisics Canada, 2020)

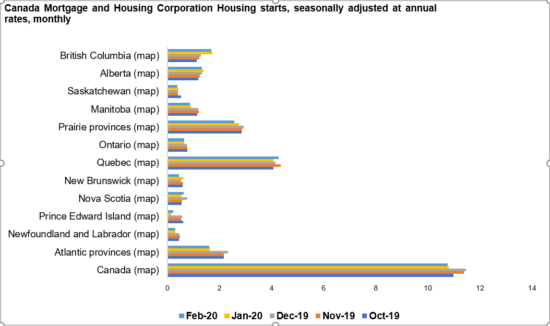

| Geography | Oct-19 | Nov-19 | Dec-19 | Jan-20 | Feb-20 |

| Units | |||||

| Canada (map) | 10.989 | 11.382 | 11.455 | 10.811 | 10.765 |

| Atlantic provinces (map) | 2.169 | 2.177 | 2.327 | 1.626 | 1.601 |

| Newfoundland and Labrador (map) | 0.44 | 0.489 | 0.463 | 0.309 | 0.299 |

| Prince Edward Island (map) | 0.601 | 0.52 | 0.573 | 0.151 | 0.215 |

| Nova Scotia (map) | 0.546 | 0.559 | 0.766 | 0.555 | 0.635 |

| New Brunswick (map) | 0.582 | 0.609 | 0.525 | 0.611 | 0.452 |

| Quebec (map) | 4.072 | 4.352 | 4.154 | 4.076 | 4.264 |

| Ontario (map) | 0.768 | 0.759 | 0.753 | 0.651 | 0.653 |

| Prairie provinces (map) | 2.854 | 2.86 | 2.928 | 2.74 | 2.565 |

| Manitoba (map) | 1.144 | 1.214 | 1.193 | 0.914 | 0.857 |

| Saskatchewan (map) | 0.521 | 0.396 | 0.409 | 0.433 | 0.377 |

| Alberta (map) | 1.189 | 1.25 | 1.326 | 1.393 | 1.331 |

| British Columbia (map) | 1.126 | 1.234 | 1.293 | 1.718 | 1.682 |

(Statisics Canada, 2020)

Students working on case studies or might need academic help, might find our custom Case Studies Writing Services helpful.

Also look at some of our business services

– Business Essay Writing Service

– Business Dissertation Writing Services

– Business Report Writing

– Business Assignment Help

– Business Planning Writing Service

– Business Assignment Writing Service

Here you can check some of our dissertation services:

– Dissertation Writing Services

– Write My Dissertation

– Buy Dissertation Online

– Dissertation Editing Services

– Custom Dissertation Writing Help Service

– Dissertation Proposal Services

– Dissertation Literature Review Writing

– Dissertation Consultation Services

– Dissertation Survey Help