Introduction

Taxes and transfer system affects the redistribution of income depending on the level of income, wealth and family age and type (Commission 2015). The tax incidence also affects the behavior of tax payers which can either be motivating the individuals to save, work and invest depending on the level of ratio of tax to that of income. Besides, taxes rise as income rises while transfers fall with rise in income and also depend on the family composition. This paper examines why taxes and transfer system affects the income redistribution in Australia to show that the high level of income, wealth and the aged working class contributes more in this redistribution. This has been done by considering the rise of income and wealth with rise of taxes and the influence of family age and type with respect to transfers and taxes.

Tax and transfer as measured by income and wealth

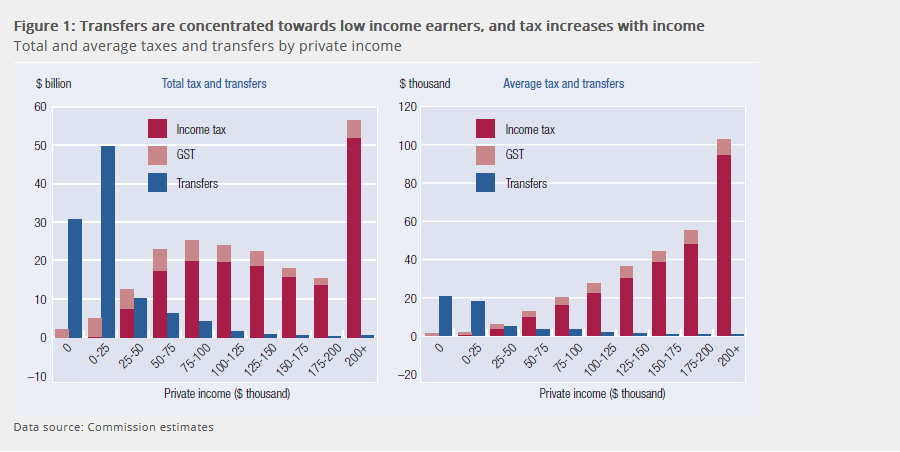

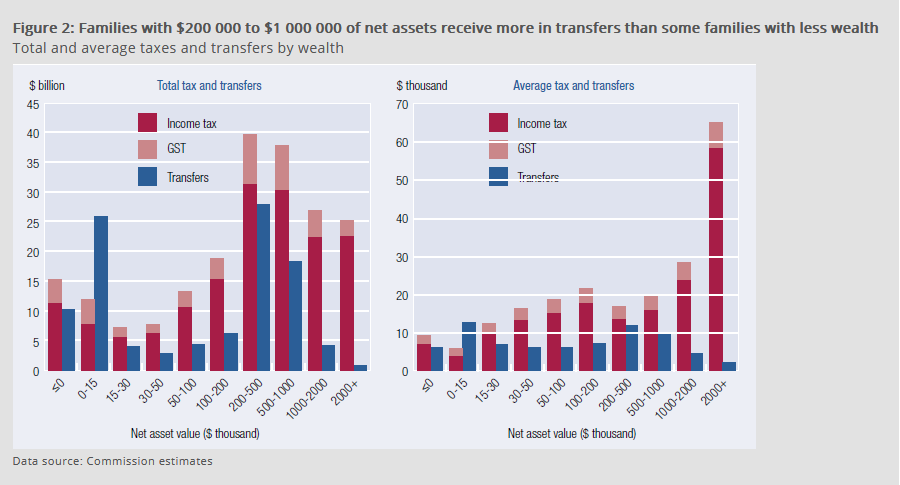

The net tax amount paid rises proportionately with the rise in income, while the amount of transfer received decline with the rise in income. Moreover, low wealthy families pay less tax but receive more transfer, whereas high wealthy families pay more taxes but receive fewer transfers. On taxes, According to annual statutory deduction rates, a category of families earning above $25,000 pay more in taxes than transfers received as compared to families earning less of the same amount. An amount ranging between $100,000 and $125,000 of private income pays averagely $25,700 net of tax annually while transfer of $16,400 averagely is received by families earning between $0 and $25,000. Considering the GST, as the income from private individuals’ rise, the GST tax falls proportionately, however, taxes paid by families of low income constitutes the largest GST taxes (Commission 2015). On transfers, pension group, disability, children, students and windows of veterans with low income receives the largest percentage of transfers as compared 16% received by those with no income. On the other hand, a family of $200,000 to $1,000,000 net of assets considering taxes and transfers will pay less tax but receive averagely more transfers as compared to those who have lower wealth since most of them are retirees who receive pensions and are also low income earners.

Figure 1:

Figure 2:

Figure 3:

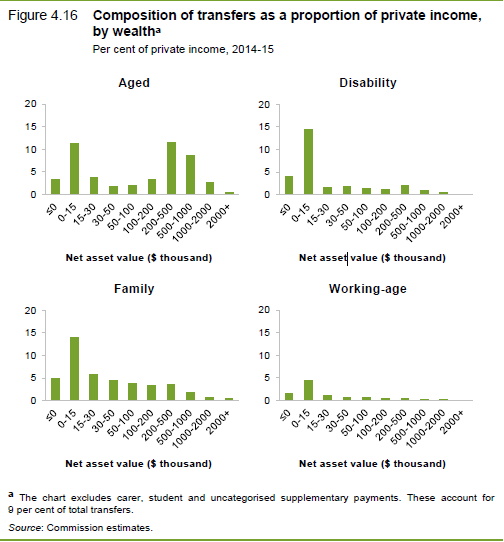

The inequality of income is influenced by statutory deductions and taxes. Further, when tax systems are progressive, the tax paid increases proportionately to the income earned while more tax burden is placed on low income in case of regressive tax system (Gale and Samwick 2014). On the other hand, due to unequal distribution of wealth, tax charged on wealth separately and income derived from wealth decreases inequality. The concentration of transfers on low private income as displayed above is because disability, family payments, aged persons and home owners are in the class which pay less income tax but receives comparatively more transfer than those of higher income earners (Joumard, Pisu, and Bloch 2012). Moreover, the families with high level of wealth and those with high number of children also receive more pension benefits and cash transfers respectively. Furthermore, those families who earn income from private sources do own few assets with personal liabilities such as loans and therefore pays more taxes comparatively due to low wealth as with those of high wealth.

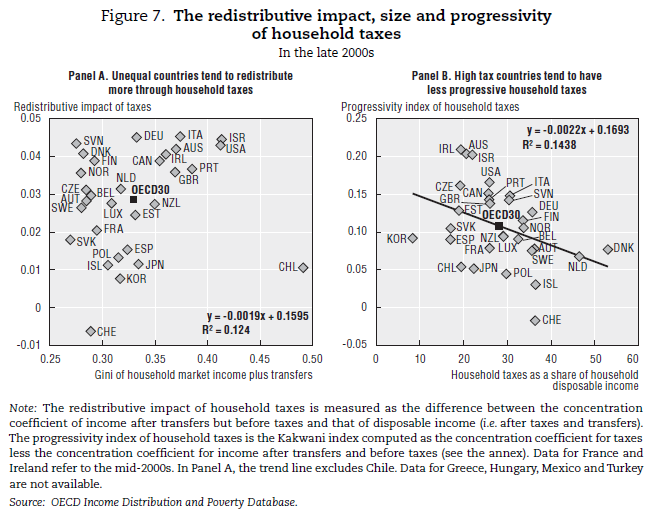

Figure 4:

The dispersion and impact of taxes and deductions with respect to income before or after which depend on composition, size and progressivity can be explained by concentration coefficient, where countries with high market inequalities of income like Australia redistribute more of private income as compared to those of low income (Joumard, Pisu, and Bloch 2012). The redistribution is lower in Australia due to low ratio of tax charged to level of income earned, unlike countries such as Belgium with high tax ratios.

The low wealth owners and aged pay more taxes on assets owned but receive higher number of transfers as compared to low wealth owners. The family, disability and aged also get more transfers than the working group through child allowances, student’s payments and pensions. Thus redistribute income from high private income to low private income families and from low asset owners to high asset owners. This redistributive nature of income is done as an incentive to work, savings and investments due to effects of substitution (Gale and Samwick 2014). And therefore explains why low income earners pay less tax but receives more transfers as compared to high income earners and why high net of assets attracts less tax in comparison to higher ones.

Tax incidence as measured by Family age and Type

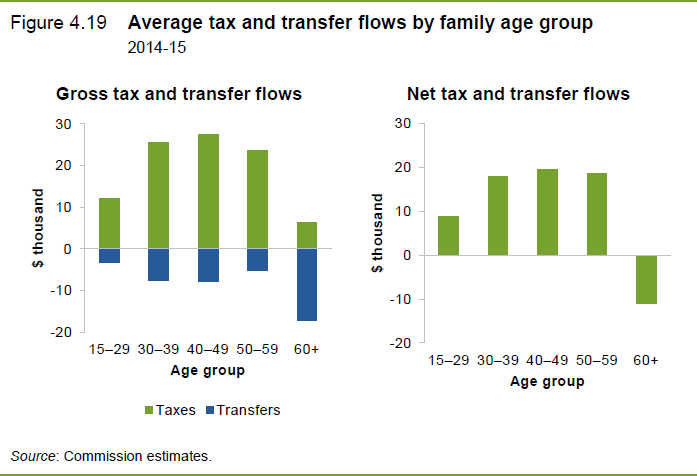

The effective tax and transfer system is the redistribution of income from the working age group families to those of retirement. The net tax difference between the amount paid and transfer benefits should be positive for all age groups excluding those of 60 years old (Aziz, Germmell, and Laws 2008) Additionally, those aged below 60 receives less transfers as compared to $15,300 paid as taxes, conversely, those above 60 years receives more by %10,900 of transfers than their paid taxes. Also over 60 years receives more transfer of gross amount as compared to the gross tax paid since the majority of this class is hardly working, comprising more than half of expenditures on transfers.

Figure 5:

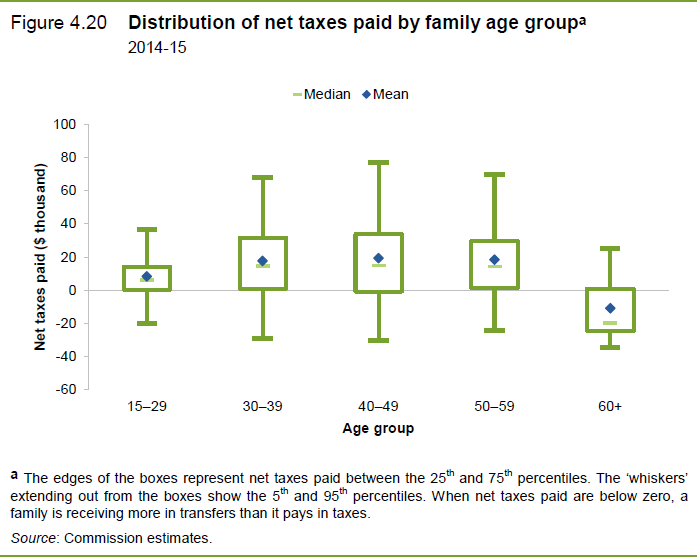

From the patterns as observed, net of taxes increase as age increases with a peak during the middle age and then begin to decrease towards the retirement age majorly because of the changes in gross tax amount paid which is inclined to different age groups. Besides, transfers behaves in the same manner, but the middle age considerably contributes more of net tax while at the same time receives more of transfer benefits which is as a result of income tax and the amount of GST tax. The income tax and GST tax paid ratio is constant among the working class age unlike persons above the age of 60.

Figure 6:

There are different categories of age cohorts which receives different transfer payments where over 60 age group attracts an averagely $14,600 annually higher than other age groups while under 60 transfers are majorly family based payments which is followed by payments for disability which constitutes $2,600 and pension payments for over 60 aged individuals. In terms of type of family, both the couples and singles receive a proportional amount of transfer based on age and number of children while the high amount received by single individuals is based on disability. In short, couples receive fewer transfers but pay more of their income tax compared to singles families having children or without because the private income for single families is low therefore attract fewer taxes. Likewise, families without children attract less tax because their income is low but receives more transfer as compared to those with children who pay more tax but receives less transfer. Therefore more children attracts more transfers and high income attracts high tax and vice versa. On the other hand, different age bracket with different income is as a result of either differences in the ability to work overtime as in the case of youth, years of work experience as in the case of older persons and opportunities to secure a job as in the case of older persons ((Aziz, Germmell, and Laws 2008) ). The tax incidence is therefore high to the working class aged men since they contribute a significant amount of tax to the government as compared to children and the elder persons.

From the evidence outlined the redistribution of income shift from the working class but receives less government’s transfers as compared to non-working class due to differences in private income. Additionally, families without Children also receive fewer transfers and also pay fewer taxes considering the family composition as compared to families with Children. Retired aged group receives more transfers but pay more taxes therefore shifting the tax burden to the working class. Thus the fiscal policy considering taxes and transfers redistribute government income from aged working class, singles and families with few Children but the extent of redistribution will depend on the ratio of tax charged with a given level of income and amount of transfers per a given number of Children per household.

Conclusion

Taxes and Transfers operate together in the redistribution of income consequently impact saving, investment and work (Commission 2015). Taxes for both income and wealth rise proportionally while the reverse is true in the case of transfers. Moreover, the extent of redistribution depends on the level of income, wealth and family age and type. Thus, the redistribution of income in Australia is affected by taxes and transfer system and demonstrates that high level of income, wealth and the aged working class contributes significantly in the redistribution. Therefore, considering the income, wealth and family age and type, the conclusion is that different income and wealth level attract different levels of tax and transfers together with the age bracket and family type consequently affecting the incentive to investment, savings, work and the distributive nature.