Term Structure of Interest Rate and Theories

Term structure concerning interest rate implies the relationship between the yields obtained from bonds concerning maturities. This term is often used to refer to the expectations that investors or buyers of government bonds have when purchasing them concerning future changes in interest rates. In particular, the changes that occur happen to interest rates based on the monetary policy are focused on as it is the biggest influence on interest rates. The term structure of short-term bonds is often different from long-term bonds. The latter have longer maturities and hence more yields. This expectation is what the term structure of interest rates refers to when discussing bonds (Filipović & Willems, 2020). In this context, three main theories will be analyzed about their relevance in explaining the term structure of interest rate. These theories are the segmented markets theory, the liquidity premium theory, and the expectations theory. These theories will be used to explain three main premises. The first is that interest rates on various maturity bonds move together over time. The second is that yield curves are steep when short rates are low and are downward sloping when short rates are high. The third premise is that yield curves are often upward sloping.

Segmented markets theory

This theory holds that both short- and long-term interest rates are not related. This means that the interest rates for intermediate-, short- and long-term bonds should be viewed separately meaning that forces acting upon them cause differing outcomes. This theory explains that most people prefer to invest in short-term bonds due to low default risk. However, short-term bonds have less yields. Despite that, the expectation that short-term bonds have low yields but less risk explains why the yield curve is upward sloping (Greenwood et al., 2019). While this theory explains the first premise, it does not explain the second and third premises. This is because it is based on the underlying principle that short and long rates are to be determined separately.

Expectations theory

This theory, contrary to the one above, can explain all three premises. On the first premise regarding interest rates moving together over time for different bonds with differing maturities, this theory focuses on the averages. The short rates’ average today is expected to be similar to those in the future (Angeletos et al., 2020). The reason for this is that the conditions leading to the rise in interest rates are often similar in the past and the future. For instance, if interest rises today at an average of 5%, in the future, it will rise by the same 5%. This is because economic conditions often remain the same at different times.

On the second premise regarding the steepness of the yield curves when the short rates are low, this theory explains that it is because the expectation in most people is that these rates will rise to a normal level in the future. At the same time, it is expected that the long rates will be above the current short rate in that same period in the future. As well, when short rates are high, the expectation is that they will in the future. This expectation leads to a steep upward slope (Wachter, 2020). Thus, this theory implies that expectations of adjustments to the short rates based on their current state are what makes the slope steep downwards or upwards.

In the third premise, yields curves are upward sloping because of the expectation that short rates will force the monetary policy to act in the opposite way (Akçelik & Talaslı, 2020). For instance, when short rates are low, it is expected that demand for money is high. To prevent this from becoming a problem, leading to issues such as inflation, the Fed is expected to increase these rates in the future. This expectation is what leads to these curves being positively sloped.

Liquidity premium theory

This theory can explain the first premise on why interest rates for different bonds move together over time. this theory holds that investors prefer to hold highly liquid securities over that can be sold quickly. This assumption is constant in the present and future. As such, the interest rate ramifications of this tendency to hold short-term securities remain the same. On the second premise, this theory holds that the preference for short-term securities can at times exceed the normal levels. It can happen when the low default risk associated with short-term securities shifts. If investors perceive the default risk in the short term to be high, then an inverted yield curve emerges (Berentsen & Waller, 2018). It is the opposite of a normal yield curve. this theory helps to differentiate between the two which explains the features that make a normal curve appear as it does. Lastly, the third premise can be explained by focusing on the liquidity premium. The yield curve will assume its typical shape because large liquidity premiums tend to induce lengthy bond terms.

Purchasing Power Parity

Mehmood and Younas (2019) define purchasing power parity as the capacity to purchase a standard basket of goods with different currencies. In that case, the two currencies can be concluded to be equal in terms of value. If there is a disjoint where one currency buys more goods in the basket than the other, that currency is assumed to have more value or to have appreciated. This is to say that if $10 US can buy two items in the standardized basket of goods, €8.43 will buy the same products. If this parity is lost, then one of the two currencies will have depreciated and the other appreciated at the expense of the other.

The PPP theory is used to understand the long-term movements in exchange rates. It is more accurate in the long term than in the short term. It holds that parity “P” is achieved through the division of the two currencies (Kai-Hua et al., 2019). For instance, P = C1/C2, where C1 is currency from one country and C2 is currency from another country. This parity can also be used as an alternative to market exchange rates. By determining the PPP of a country, companies and governments can determine the relative cost of living as well as inflation rates compared between nations.

The relationship between a currency exchange rate and short turn: Return on the foreign asset, RETF schedule

Changes in foreign interest rates have repercussions on the RETF schedule. An increment in the foreign interest rate will lead to a shift in the RETF schedule to the right. In such a case, the domestic currency will appreciate. The vice versa is true as shown in Graphs 1 and 2.

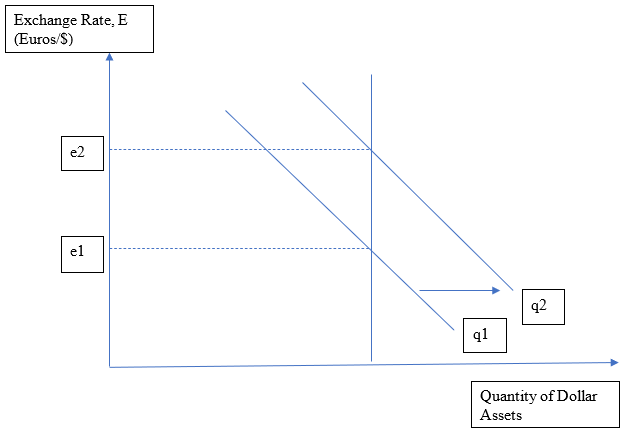

Graph 1: Domestic; Increase in foreign interest rate

As shown in graph 1, the curve will shift to the right whenever the exchange rate, E, is increased from e1 to e2. This means that the number of dollar assets will increase with an increase in the exchange rate (Nusair, 2021). In this context, the domestic currency will appreciate.

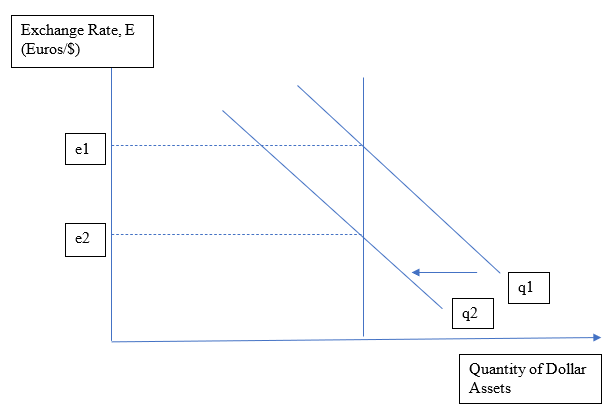

In graph 2, a reduction in the exchange rate from e1 to e2 means that there will be a decline in the number of dollar assets. In other words, the dollar will depreciate. This depreciation is likely to force investors to relinquish some of their properties to avoid losses, especially investors from the US (Nusair, 2021).

Liquidity preference for return on asset-based on demand and supply

A liquidity preference framework is a tool used to assess money demand and supply about bond prices and their respective yields. It is used in determining loanable funds in the bond market (Culham, 2020). To do this, there is one underlying assumption—it is that the market has only two assets namely money and bonds. In this market, total demand for wealth cannot exceed the supply. As such, holds. This means that the bond market is in equilibrium. Simplifying the equation leads to the following equation: , this means Bd = Bs. At this juncture, the bond market is said to be at equilibrium.

Additionally, demand for real cash in such a market can be obtained using the following formula: . The main strength of this formulae is that it disregards real assets such as housing (Culham, 2020). This makes it easy to assess changes in the supply of money, income, and price levels.

The function of Financial Intermediaries: Asymmetric Information, Transaction Costs, and Moral Hazard

The function of financial intermediaries can be summarized in three main ways, they act as agents of information lowering information asymmetry, lowering transaction costs, and moral hazard (Sunaga, 2017). These are critical roles for investors to ensure that their experience in the investment market is profitable.

On transaction costs, the intermediaries are expected to use their experience and vast knowledge to determine investment opportunities that have low costs of transactions. They are also expected to trace sources of costs in normal transactions to mitigate them or avoid them altogether. In most cases, this process is complex and involves complex computations. As such, the financial intermediaries play the role of determining these costs and avoid or mitigating their impact on profits (Manasseh et al., 2021). One of the main ways that intermediaries use is relying on the benefits of economies of scale.

On asymmetric information, two issues are involved. This moral hazard and adverse selection. Information symmetry occurs when both the borrower and the lender in the investment market have the same amount of knowledge. In reality, one party often has more knowledge than the other regarding pertinent issues. This puts the other party at a disadvantage. This is the reason why lenders sometimes utilize intermediaries to help them cover the risk that comes with lending money. The lenders may decide not to repay the loan. This decision could have been made even before being granted the loan (Manasseh et al., 2021). This is the moral hazard that the investment market carries. Consequently, financial intermediaries are employed to help lower this risk.

Adverse selection occurs when lenders choose to offer funds to individuals with a high moral hazard. They need to avoid such individuals to keep them in business (Manasseh et al., 2021). Again, the financial intermediaries come into play in this regard helping them to solve the issues that emanate from adverse selection.