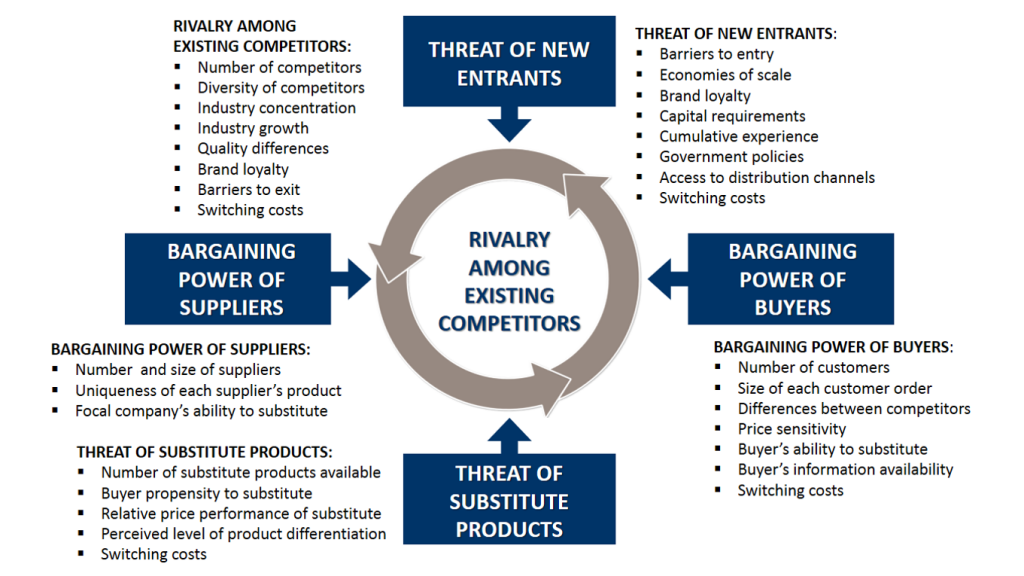

Porter’s five forces (P5F) is an evaluation framework for a business’ competitive strength and position in a market economy. The framework was developed by Michael Porter in 1979 to simplify experts’ work in identifying where the power of an organization lies. According to Porter, the state of competition in any particular industry relies on five primary forces, which include the power and number of rivals, availability of substitute products, power of suppliers, the potential of fresh market entrants, and the bargaining power of consumers. A combination of these factors affects a company’s profitability within the industry that it operates. Understanding Porter’s competitive forces are useful to organizations to help them adjust their business strategy to fit the current competitive environment and enhance its profitability potential.

Critical Evaluation

Porter defines an industry as a collection of productive organizations that manufacture and supply products and services that are close substitutes (Porter, 1985). Porter’s model is divided into five fundamental components, which are subject to change by the behavior of individual factors within an industry. Consumers, suppliers, substitutes, and potential entrants are all competing forces that influence the trajectory of business depending on their prominence in a specific sector (Grundy, 2006). The collective strength of these forces determines the ultimate profitability potential of a company at any given time.

Figure 1 showing the Porters Five Forces

- Availability of Substitutes

Substitute goods refer to products that are eligible to replace or serve as alternatives to other entities. Companies provide a range of alternatives for consumers to choose from while creating competition in the marketplace through product quality and price differentiation. Firms remain in business while others are thrown out of the market due to a high substitution rate by other products, which significantly outperform their offerings. Also, price differentiation stimulates preference for alternative goods that can serve the same purpose but are sold at favorable prices. However, the current industry dynamics have broadened the meaning of substitutes because certain products from different industries are also regarded as substitutes or competitors, for instance, eBay is considered a substitute or competitor of Amazon. The responsiveness of demand is subject to price changes of one substitute relative to the other.

- Competition Intensity among Current Industry Rivals

Porter (1985) defines competition as minimizing the return on investment to boost profitability, which is the fundamental measure of business success. Competition is anchored in the underlying market economics that surpasses the strength of established players. Industries like telecommunications, steel, tires, and metal can experience intense competition levels, hence companies earn subdued returns on investment. Meanwhile, the degree of competition is mild among companies operating in oilfield services, toiletries, and soft drinks industries in which case there is room for higher returns. Competitive rivalry is the main driver of sales in the market since most industry players sell undifferentiated products.

- The threat of New Entrants

Markets are usually affected by many factors that either facilitate or bar entry of external players. Strong and durable barriers such as product differentiation, patents, economies of scale, government regulations, inaccessibility of distribution channels, and large capital requirements reduce market attractiveness to external investors (Dalken, 2014). On the other hand, minimal government interference, favorable trade policies, low taxation, and minimum capital requirements make the industry vulnerable to entry. New entrants bring new capacities with the desire to amass substantial resources and gain market share from entrenched competitors. Newcomers leverage their resources to shake up industries with limited entry barriers.

- Supplier Bargaining Power

Vendors exert pressure on industry participants by influencing the quality and prices of goods and services. They can either raise or reduce prices or increase or decrease the quality of purchased products. Powerful suppliers erode company profitability by increasing the cost of goods (Bruiji, 2018). On the other hand, low-priced vendors enhance profitability by decreasing the cost of production.

- Consumer Purchasing Power

Consumers are important stakeholders that influence the trajectory of business using their buying behavior. Changes in customer tastes and preferences determine the demand pattern, which eventually forces down or inflate prices. Their demand for better quality or more services instantly changes the supply pattern of competitors at the expense of profitability. The power of consumers is substantial when they purchase goods in large volumes, create great incentives, their demand is selective to standard, differentiated, or undifferentiated goods. Backward changes in customer purchase patterns pose a significant threat to the industry.

Relevance to Organizations

The significance of Porter’s model on organizations is apparent across industries. The framework helps companies to understand the factors that affect their profitability and competitive strength (Lee, Kim, & Park, 2012). For instance, foreign investors with huge capital to invest in telecommunications can easily enter unregulated industries that require massive investments. Their entry influences the itinerary of competition, which reduces profit margins for existing enterprises. Also, P5F highlights the weaknesses of the organization, which clarifies the areas of changes that will yield a huge payoff. The model focuses on areas in which the most essential purchases are done as well as changing consumer purchase trends. Organizations can leverage this information to identify the opportunities and threats to their business. For example, improving the quality of products without adjusting the prices can attract more clients to purchase the goods. Also, having multiple raw material vendors enables competitive input costs hence low production costs. Porter’s framework helps organizations to recognize threats and handle competition using innovative ways that create long-term value.

P5F informs organization decisions to venture into a specific market. Market entry decisions are a result of in-depth scrutiny of the factors listed by Porter including competition, suppliers, customers, substitutes, and strength of incumbents (Porter, 2008). Profitable markets attract many external players hence erodes profitability. Incumbents of highly regulated companies wield durable barriers to market entry, which makes it difficult for new entrants to penetrate (Porter, 2011). Besides, P5F influences firm decision to increase or decrease capacity. Where close substitutes exist in the market, companies opt to differentiate their products, or cut down prices, or improve its features to suit the current market needs. In addition, the model helps organizations to develop competitive strategies by considering the dynamic characteristics of the industry. Porter’s model is a powerful tool that can be used in conjunction with other strategic planning techniques to understand a firm’s current business environment.

In the contemporary business environment, P5F is appropriate to organizations during the implementation of change and innovation. It provides a broader perspective on technological advancements and how they can be deployed by organizations to help them step out of their current competitive market (Semuel et al., 2017). Besides, the model offers multiple ways of strategic thinking to seek new opportunities in emerging markets. Porter’s analysis is useful to analyze the potency of international markets before embarking on globalization (Bruiji, 2018). It impacts organizations by portraying a snapshot of the rapidly changing business environments, trends, innovation, and technological advancements to facilitate adjustment of competitive behavior of small, medium, and large enterprises. Porter’s model helps to understand industry structures and how they influence change.

Relevance to Business Strategy

P5F is a new model of strategic positioning designed to help companies boost profitability by exploiting competitive gaps in the market. A corporate strategist’s goal is to put the company in a position that it can better defend itself against market forces or consolidate individual factors to work in its favor. The collective strength of P5F can be understood by conducting a grassroots analysis of the sources of each. For instance, assessing customer behaviors helps to understand the factors that influence consumer bargaining power. Also, the availability of many close substitutes enhances the likelihood of fluctuating demand patterns because customers can easily switch between products in response to price increases. Organizations implement cost-leadership or differentiation by offering greater value to consumers using lower pricing or by providing greater benefits that justify higher prices (Tanwar, 2013). Its relevance to the business strategy can be examined using Porter’s (2007) generic strategies.

Cost Leadership and Cost Focus Strategies

Cost leadership is a strategic model deployed by businesses to achieve sustainable competitive advantage. With this strategy, companies target a broad market by offering goods at the lowest cost possible to increase demand. They utilize lean production methods, high productivity, effective technologies, and their strong bargaining power to produce standard goods with little differentiation from other substitutes (Akan et al., 2006). Low-cost producers occasionally give discounts to maximize sales (Tanwar, 2013). Global retail giant Wal-Mart employs a cost-leadership strategy. The strategy confers significant cost-advantage to the business, which can further expand its market share. The cost-focus strategy is deployed in a situation in which a company seeks lower-cost advantage for basic products in a small number of market segments.

Differentiation and Differentiation Focus Strategies

Differentiation is a leadership strategy that targets larger market segments by developing distinct commodities across the entire industry. Companies that deploy this strategy charge premium prices to cover the extra production cost for value-added features (Akan et al., 2006). The method requires substantial and sustained marketing investment to facilitate superior product quality, branding, multi-channel distribution, and consistent promotional support. Differentiation entails investing in rare and unique products that are costly to imitate (Semuel, Siagian, & Octavia, 2017). Global brands like Apple Inc. and Nike use aggressive differentiation to foster brand loyalty (Magretta, 2011). Meanwhile, differentiation focus is deployed for only a limited number of target market segments as opposed to the whole industry.

Overall, a company’s relative position in the market determines whether its profitability matches the industry average to promote a sustainable competitive advantage for the business. The essence of formulating a business strategy is to keep up with competition and consolidate market share (Dalken, 2014). Porter’s competitive strategy promotes a broad focus on the industry-level rivalry. Porter’s generic strategies, including cost-leadership and differentiation, underpin strategic decisions. Knowledge about sources of competitive pressure provides the groundwork for an organization to develop a strategic agenda.

Conclusion

Porter’s forces are not constant; rather, the behavior of individual entities can be changed by the actions of single factors within the business environment. A critical analysis of Porter’s model demonstrates that companies can adopt either a defensive positioning strategy or aggressive marketing tactics to shape market forces through research and development. Porter’s five forces are relevant from a strategic and business strategy standpoint.

Here you can check some of our dissertation services:

– Dissertation Writing Services

– Write My Dissertation

– Buy Dissertation Online

– Dissertation Editing Services

– Custom Dissertation Writing Help Service

– Dissertation Proposal Services

– Dissertation Literature Review Writing

– Dissertation Consultation Services

– Dissertation Survey Help