BMW Company Analysis

Industry overview

In the contemporary world of business and globalization, there is great competition, while companies have to thrive and make the most out of the competitive world. This paper focuses on the automotive industry and some of its activities including the differentiation strategies for companies to thrive in the industry. Also, this paper provides an overview of the operational activities in the automotive industry in which BMW, which is a giant automotive company having globalized its operations. The automotive industry is basically an internationally operated industry in which the involved companies have gone global in terms of their operations. For them to survive, they have to adopt the concept of differentiation. The concept of differentiation is key to the development and thriving of businesses in any sector, including the automotive industry. Under the concept of differentiation, companies try to make their products and services unique from those of their competitors. The point here is coming up with improved products on a regular basis (Nieuwenhuis & Wells, 2003). That said, the element of innovation and creativity poses as inherent in the entire process of displaying the products of a particular company as unique. For instance, BMW has its own differentiation strategies while other companies like Toyota, operating in the same industry have their own differentiation strategies. Some of the possible differentiation strategies as applied in the automotive industry include, but are not limited to;

Creation of Auto Products That Affect the Emotions of the Clients

Vehicles are good and people have the tendency of getting attached to their vehicles. However, to get more and more attached to someone’s vehicle, they have to be luxurious and prestigious. Therefore, in trying to make the products more attractive, companies can come up with a strategy of how to make their vehicles more prestigious and luxurious (Sturgeon et al., 2009). This would create a situation whereby everyone would want to solely own the vehicles for the sake of prestige and not any other reason. The attachment involved in fancy vehicles is far much than people could expect. People are sometimes attached to their vehicles than they are attached to people. To attain such a state and thus attract more customers, automotive should focus on improving the outlook and the inner of their products to specifically make them look prestigious and provide the feeling of comfort whenever someone gets inside. To a large extend, this could be viewed in the light of a marketing strategy for the automotive industry. The role of marketing strategy in business is undisputed and thus considering it as indispensable is an undeniable fact. A perfect implementation of this differentiation concept in business leads to the situation whereby the products of a company are not only bought for their functionality, but for status too. A close look at the BMW vehicles reveals some element of differentiation in making the vehicles prestigious and attractive for increasing attachment between them and their owners. Furthermore, this concept drives the concept of brand love. For instance, when a person buys a BMW, they don’t just do this for the sake of functionality but for their attachment to the brand.

Another possible element of differentiation in the automotive industry is the proactive deployment of the technology and innovation. The previous point follows from this one where, before a company makes its products fancy and prestigious, they must make use of the technology. This is a fast moving world in terms of technology and thus for the automotive industry to remain alive, there must be a high level of deployment of the technology which is in line with the general technological advancement of the world. A fact is that a company which maximizes on the use of technology places itself at a greater competitive advantage as compared to the other companies which could be lagging in terms of technological advancement. BMW has performed well in this sectors as they record some exceptional parameters of innovation in the production of their products. For instance, BMW displayed a great concern for technological advancement by the introduction of the hydrogen cars back in the year 2000. By creating a whole lot of vehicles in this category, the company poses as an environmentally friendly company thus generating an incredibly good name in the international world which is overly sensitive of the safety of the environment. This, therefore, presents another strategy of differentiation in the automotive industry- showing care for the environment or rather displaying environmentally friendly operations.

Differentiation strategies simply aim at giving a business organization a competitive advantage over competitors. The automotive industry provides several opportunities for differentiation strategies and in all, there must be the deployment of the technology. Enticing clients is the greatest goal of all businesses and it is for this reason that businesses have to make their products unique from those of their competitors. Improving the connection between the customers and the companies should not be neglected since it is a differentiation strategy which has been neglected by many automobile companies. Whenever a customer walks out of the motor shop with a car and already paid the full amount, many companies tend to forget about them thinking that they could be a one-time client. However, a company that makes a follow up on those clients and caring to help with any complications that they encounter portrays itself as a customer centered company, thus creating an attachment with the emotions of the clients. This tends to lead to the element of brand love which whenever attained, tends to be long living and beneficial to the company while attracting referral client at the same time. The best chance of differentiation in the world automotive industry was grabbed by the Tesla group. Tesla identified the need for maximizing in the use of renewable sources of energy and thus came up with the Tesla electric cars. With the global warming effect and bursting out of unique diseases which trace their origin from air pollution from the increased number of vehicles, the world is not hesitant at embracing any environmentally friendly option. This means that BMW is facing real competition and to survive, they have to generate more advanced environmentally friendly options for the world to embrace.

Overview of the Automobile Industry

Dating back from the late 19th century, the automotive industry has seen great changes from the time when the legendary Henry Ford in the year 1909 jokingly suggested that people will never see cars of any other color apart from color black. This was a thought that development in the automotive industry would be somewhat slow, but the rate of change in the automotive industry is quite alarming as well as impressing. Though the automotive industry is enjoying great changes in the line of technology, the Boston Consulting Group Publication suggests that changes in the automotive industry are basically due to the changes in the BRIC nations that is- Brazil, Russia, India and China. According to them, these nations contribute over 30% of the total sales of the vehicles worldwide. One major character to note about the automotive industry is the competition tracing back from the onset of the 21st century and which threatens to tighten even more in the coming decades.

Analysis of BMW

The Bavarian Motor Vehicle group consists of three brands that is BMW, MINI and Rolls Royce with all of the brands positioned in the premium segment. The group has embraced the element of diversification since, besides the production vehicles, the company is also a world number production of motor cycles. They also produce aircraft engines and marine engines. As mentioned in the above, the automotive industry is a highly competitive sector which calls for strategies to increase the company’s competitiveness. Also, the company has really invested in innovation and technological advancements as a road towards diversification. One of the reasons why the company is a market leader in the premium sales of vehicles is its continuous process and technological improvement in its R&D (Wänke et al., 1997). Due to its concern about the technology, the products of the company are best known for quality and reliability. Praise for the company does not end there, but it boasts itself of incredible customer care support services even after sale of vehicles whenever the clients want help concerning their bought vehicles. The company also embraces the idea of product differentiation from their lovely design of vehicles that they have always been producing. To succeed in the differentiation strategy, the company has a workforce of over 100000 workers all over the world in all the nations that the company has set foot. This high number of the workers is only composed of the highly qualified workers who have been working to see the company’s products are differentiated from the other products of competitors. Remember, the primary rationale for companies embracing the idea of product differentiation is for taking into account the needs and preferences of the clients and also presenting to them new designs that they will obviously love. Apart from venturing in the already developed markets, the company has also been greatly investing in the developing markets of India and China. China and India are seeing a great economic development recently and by investing in their markets, the company lands on the rare opportunities availed by the markets (Hoberg & Moon, 2017). To cater for all people in the market and also to be pose as an environmentally friendly company, the BMW group is working on launching models of the vehicles which run on alternative fuels to petroleum such as electricity. However, besides the developmental milestones of the company in the automotive industry, they also face weaknesses such as the recent recalling of cars. The most recent non-abidance case that faced the company is the BMW recalling about 1.6 million cars concerning the issue of airbags. BMW is a reputable company and when such issues like this come up, they threaten to spoil the established brand of the company.

Operational Activities in BMW

The operational activities in BMW of interest to this paper are the company’s manufacturing, distribution and manufacturing. The manufacturing procedures of the company follow a market segment. For instance, the company’s manufacturing follows the premium markets which show potential of growth. By growth the company means, growing in line with the current model portfolio in all the markets where the company has already set foot. Their production strategy is clear and straightforward. They are constantly opening and developing new markets. The company uses local production markets in facilitating access to new markets with a potential of long-term growth. Above all of the company’s (Fuchs et al., 2014). The company takes advantage of the completely knocked down (CKD) assembly companies. Due to the high importation duties imposed on companies with completely built-up cars, BMW assembles cars from imported products into the foreign markets and not importing fully-built up cars. This strategy enables the company to offer competitive prices to their clients on the products. Also, in order for the company to balance off the flow of goods as well as the fluctuations in the currency together with risks, the company uses the natural hedging strategy. They achieve this by ensuring large purchasing volumes in the key sales regions with different currencies. Another breakthrough of the company that made a great milestone in their history is the decision of setting their production facilities in the USA. Businesses that establish their production processes in the USA especially in machinery are opened up to a worldwide market access (Nobanee et al., 2021). For instance, since the establishment of the company’s operations in the USA in the year 1992, their sales rocketed tremendously from 50, 0000 to over 250, 000 units of only the BMW brand by the year 2004. The burgeoning sales since 1992 were attributed to the local production of the vehicles in the USA making the USA the largest producer of the BMW brand. While the company is focusing on globalization, it has made the Great Britain the MINI heritage. The company is focusing on making the Great Britain the home for the MINI brand.

Financial standing of BMW

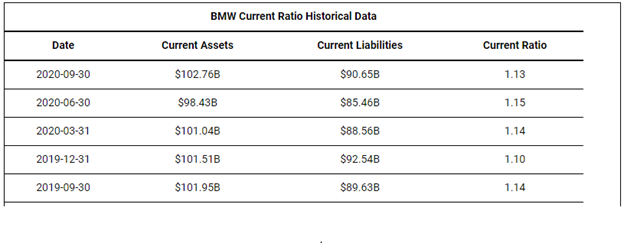

A calculation of the annual reports of the company was necessary to find the financial ratios of the company. The two financial ratios of BMW that this paper focuses on are current ratio and equity ratio. The two ratios were done for the years, 2020 and 2019 at specific dates.

Calculating Current Ratio

Current ratio is calculated by dividing the current assets by the current liabilities.

Taking two values of 2019-12-31 and 2020-09-30, the calculations of the current ratios are as follows;

2019-12-31

$ 101.51B=current assets $92.54B

2020-09-30

$ 102.76B=current assets $90.65B

Current Ratio for 2019-12-31

= $ 101.51B/$92.54B=1.10

Current Ratio for 2020-09-30

= $ 102.76B/$90.65B=1.13

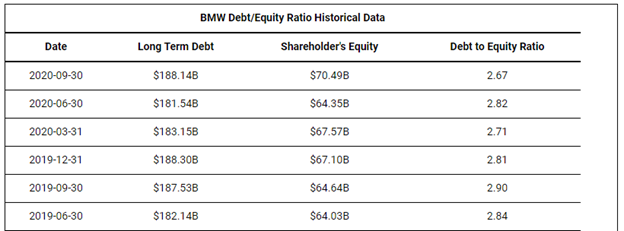

Calculating Equity Ratio

Results

The equity ratio of the company for this report was done at dates; 2019-06-30 and 2020-09-30, by taking the company’s total liabilities and dividing it by shareholder’s equity. i.e.

$188.14B/$70.49B for the period 2020-09-30 = 2.67 and;

$$182.14B/$64.03B for the period 2019-06-30=2.84.

BMW’s Financial Performance

Ratio Analysis

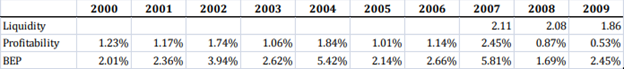

This is one of the most common technique for determining the financial status and thus health or rather stability of the company. The efficiency of utilization of the company’s resources can be determined through the calculations of these ratios. For this analysis, the ratios used are; liquidity ratio, profitability ratio and basic earning power ratio.

Liquidity Ratio

The computation of the company’s liquidity ratio goes by taking current assets and dividing them by the current liabilities. In order to come out with reasonable and convincing data for the liquidity ratio, values for three years had to be taken into account. The importance of this kind of ratio for any business institution is for determining whether the assets of the business organization are enough to pay off all the debts of the organization without the business running bankrupt. From the above data of the ratios, it can be concluded that the liquid assets of BMW are well enough to pay for the debts of the company without the company running into the state of bankruptcy (Ahmed, 2010). This could be attributed to factors such as the company enjoying large economies of scale. In the explanation of the company’s operations, it was seen that BMW has several advantages over other companies in the automotive industry such as setting its operations in the USA. If the company decides to pay off all its debts, some of its money remains idle, which is a sign of a company which is fairing on well even in the incredibly competitive environment.

Profitability Ratio

Profitability ratio of a company is always computed by taking into account two parameters; net income and the total sales. It, therefore, goes by taking the value of the net income and dividing the same by the total sales (Cardenal et al., 2013). The company depicts a ten years profitability ratio meaning that it has always been maintaining a certain profitability over time. Despite the fact that the percentage of the profitability is not big, this is not a problem. BMW is a large automotive producing company meaning that a profitability ratio of 1-2% for the company means a lot of income. Here, the company is still benefiting from the element of large economies of scale. Due to the company’s large economies of scale, they have the courage to take big risks like diversifying in its investments. As mentioned earlier in the operational analysis of the company, they are not only a car production company but they also produce aircraft machinery and the company is also a leader producer of motor cycles. This gives the company a significant competitive advantage in the competitive market of the automotive industry.

Basic Earning Power (BEP) Ratio

The computation of this financial ratio follows by taking earning before tax values and dividing this by the total assets of the company. The BEP ratio of the company resembles the return on capital values of the company and any implication made by the return on capital ratio applies to the BEP ratio too.

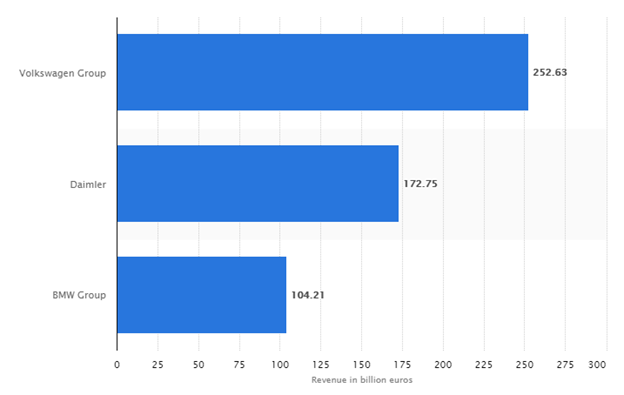

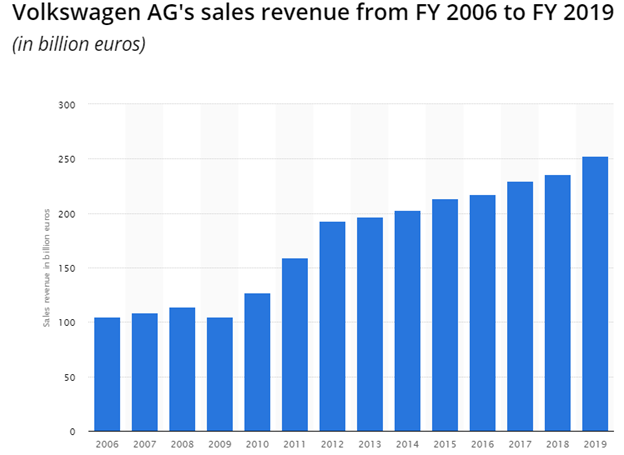

Revenue Performance Comparison with Volkswagen Group

The above figure is for the FY 2019 for the three automotive companies, BMW, Volkswagen and Daimler. However, the focus of this report is basically on BMW and Volkswagen. From the figure, it is obvious that Volkswagen made a reasonably higher value of the sales compared to what BMW recorded during that year. This is a trend that Volkswagen had set since the onset of the year 2018 due to their strategies of competitiveness. The values are in terms of billion euros, meaning that in the FY 2019, Volkswagen recorded a total sales value of over 252 billion euros while BMW recorded a sales value of 104.21 billion euros. The end of the year 2019 was the marked the commencement of the covid19 pandemic, which has created a situation of recession in many companies with BMW appearing on the chats as one of the most affected companies with the prevailing pandemic. Supposedly, the sales for BMW recorded a greater decline due to the hit of the pandemic. Volkswagen on the other hand has had its share of the pandemic hit, but not to the level of companies like BMW.

Both companies have been seeing an unstable trend in sales during the corona virus pandemic with the sales of their products rising and falling in some of the times of the 2020 or rather the covid19 pandemic period. In the onset of the pandemic which attracted the lockdown policies in almost all countries of the world, the BMW group reported a 15% drop in terms of sales of its products bringing the total number of sales of vehicles to about 5 million. In the same FY, but in December, VW group that had been experiencing the same hardship since the inset of the pandemic, reported a positive behavior of their sales. For instance, they saw a 19% increase in sales in Western Europe, and a 14% sales increment in the parts of North America. According to inquiry, the main reason why the VW group has been seeing a greater sales volume compared to BMW us due to their commitment to their electric vehicles investment. They are taking the risk of venturing in the production of the costly vehicles, but they seem to be gaining a competitive advantage over their competitors like BMW. According to the statement of Ralf Brandstaetter, the VW group CEO, their target is to become the market leader of the electric vehicles, even to outwit Tesla, the greatest electric vehicles producer.

Since the VW began venturing into the electric vehicles strategy, they have seen a growing graph since 2006 to 2019, according to the graph above.

Conclusion

BMW is doing well in the automotive industry and has to maintain their status quo through their operational management strategies. Unique features of differentiation give the company an upper advantage in the competitive automotive environment. However, VW have come up with their own competitive strategies