Introduction

Based on their core assumptions and ideologies, the Neo-classical economists have come under different critiques and their theories have been questioned. Notable works of the neoclassical such as the theories of asset specificity (Williamson, 1985); information incompleteness and asymmetry (Stiglitz, 2000); and contested exchange (Bowles, 1988) have face challenges from empirical test and critics. The theory of firm acts like a set that house several subsets of other economic theories that shed more light into the nature of the firm and also predict its structure and behaviour in relation to the market as it seeks to find answers to its existence, boundaries, organization, heterogeneity of actions, and evidence. Transaction cost economics and property rights theory, as well as team and agency theory, have surfaced in the modern theory of the firm. Coase in 1937 was one of the first attempts by the neo-classical to define the relation for the firm to market theoretically. However, in his work as regarding transaction cost, he maintained that when asset specificity and asymmetric information is in view, the cost of negotiating about the division of surplus might be considerable.

Asset Specificity

As put forward by the neoclassical, asset specificity has developed to become an essential concept of transaction cost economics and it refers to the degree to which a person possessing value or thing possessing value can be readily adapted for other purposes. The usefulness of thing with high specificity is restricted to a certain task. An asset characterized by low specificity can be adapted for many purposes and are perceived to be more valuable due to the flexible resource and higher sales value. Various researchers at different times have given various definition to asset specificity. Vita, Tekaya and Wang (2011) categorize all the definitions into six themes which are interrelated: (i) the level of customization that is required to aid the transactional relationship; (ii) the importance attached with the identity of the two parties involved in the transaction; (iii) uniqueness of the investment utilized for the task; (iv) transferability of investments or assets needed for aiding the transaction; (v) value of investment or assets in its alternative use outside the transaction; and (vi) the value embedded in the extension of the relationship.

The depth of customization involves assets or resources that are devoted, first from the angle of the supplier in doing the service or activity being transacted and secondly, it can be seen also from the buyer in carrying out deals with a specific provider. The degree of uniqueness of the investment or assets deployed to the function or activity being transacted then determine the degree of customization (Erramilli and Rao 1993; Widener and Selto 1999), and subsequently, the extent of the alternative use or transferability of assets in question to other activities outside that relationship (Brown and Potoski 2005; Espino-Rodríguez and Gil-Padilla 2005). As opined by Barney and Hesterly (1996), the former refers to ‘the difference in value between an investment’s first best use (in the current transaction) and its second-best use (in some other transaction)’. Klein et al (1978) referred to the discrepancy in value as ‘appropriable quasi-rents’ – ‘the excess of its value over its salvage value, that is, its value in its next best use to another renter’. For every transactional relationship, higher quasi rent flow occurs the greater the level of specificity while on the other hand, the quasi rent reflects the importance of the identities of the parties in a transaction.

Asset specificity is also seen as the degree to which the use of an asset can be redeployed to alternatives without given up productive value and six kinds of distinctions have been identified:

(a) The first is site-specificity which is related to localization. In order to economize transportation expenses and all other processing cost, stations are located in what is referred to as check-by-jowl relation.

(b) The specificity of a physical asset such as specialized diets that are required to have a component produced.

(c) Brand name capital specificity addresses the reputation of the investment. A high brand name capital results from a transactional relationship that involves activities which have a high and direct impact on the overall firm performance.

(d) Human asset specificity that accrues from learning by doing. The degree to which knowledge, experience and skills of the firm’s workers are specific to the necessities of transacting with another firm.

(e) Dedicated assets. The specificity is based on the discrete investments in multipurpose plants that are made at the request of a particular customer. The transactional agreement has the tendency of a long-term relationship.

(f) Temporal specificity which is seen as a kind of site-specificity and it is similar to technological non-separability. It gives credence to the importance of coordination and timing required by a transactional relationship.

Transaction cost economics has been advanced by asset specificity. The first five forms of asset specificity mentioned above generate bilateral dependency and result in more contracting hazards. Production cost-saving and revenue implication as affected by the transaction cost result from asset specification and this undoubtedly at all forms of governance increases transaction cost. However, it must be noted that asset specificity is only worth it if the governance cost that resulted from are offset by the increases in revenue or production cost savings. Asset specificity takes different forms but one commonality is that the asset specificity deepens as the bilateral dependency start. When asset specificity is zero the identities of the sellers and buyers are irrelevant. However, as the transaction specific assets increases as a result of the investment, identity becomes crucial as the specialized assets experience a drop in its productive value when redeployed by the best alternative users for other purposes (Vita, Tekaya and Wang, 2011).

Asset specificity stresses capabilities and resources as the start point competitive advantage in which resources are distributed heterogeneously across competing firms. The heterogeneity witnesses a long stay as a result of the imperfect mobility of the firms. More so, the level of profit expectation as the choice of the market by the firm is limited by the resource. Firms capabilities to better deploy their resources is the only advantage they have as there is no resource advantage. Different scholars have noted that the essential competence of a firm has to be distinctive, controllable, stand the test of time and ability to produce success. Unlike in the transaction cost economics that addresses governance via properties of transactions, asset specificity in relational exchange theory explains the properties of relationships with much justification from the marketing field. It maintains that by regulating and guiding the standards of trade and conduct, relational standards limit opportunism and result in a rise to bonding effect. The background idea of relational exchange is that over time, a relationship develops with each transaction having the history and long-term relationship between the two parties investing.

Information incompleteness and asymmetry

Emerging from the works on the economics of information (Stiglitz, 2000), the findings obtained by the author open up the gaps that reveal that information is imperfect and the cost of obtaining information is exorbitant. The interplay between firms and individuals reflect how much information asymmetries affect either of the parties or both. The breakthrough shows that information has a sharp difference from other commodities but close to public goods as it possesses some of its properties such as the consumption of information to be non-rivalrous. It is always difficult to exclude individuals from benefiting from the available information and where the exclusion is possible, doing so will result in a socially inefficient result. The subject matter of appropriating the proceeds to investments in knowledge and information is thus central.

In order for markets to attain an equilibrium, sellers and buyers must have complete information about the price and quality of the products as lack of this will make the parties not to be able to transact and end up with poor decisions. Imperfect information implies that buyer and sellers do not have all information to arrive at an informed decision as they transact. In the case of asymmetry information, either the buyer or the seller has more information than the other, both the seller and buyers involved in the transaction have an unequal amount of information. Many of the transaction occur under imperfect information in which parties have less than one hundred per cent qualities of what is being sold and bought. This can cause a reduction in the quantities or prices of products sold. It is however noted that sellers and buyers amidst of imperfection information have motivations to create mechanisms that will permit them to make a mutually beneficial transaction.

The problems that result due to information incompleteness and asymmetry are adverse selection and moral hazard. The “lemon” is what is used to refer to a product that turns out, after the buyer’s purchase, to result in low quality. In the other way round, when the seller has access to accurate information relating to the quality of the product more than the buyer, the buyer will be cautious to buy, due to the fear of purchasing a “lemon.”

Contested Exchange

In the category of goods, the finance capital and labour are highly relevant as they are both subject to what is referred to as the contested exchange. According to Bowles and Gintis (1988), “contested exchange occurs the good exchange has some of its aspect possessing an attribute that the buyer finds valuable, is costly to provide and is at the same time difficult to measure or otherwise not subject to determinate contractual specification”. The basis of contested exchange is centred around the conflict theory of firm and it is a microeconomic model. When exchange regarding property rights is about taking place between agreed parties, the neoclassical commitment follows when the agreement is enforced without cost. But such agreement is not obtainable and two exchanges that are fundamental to the capitalist economy exhibit character of unsolved problems. The exchange is those that have to do with labour and financial capital. During the employment of labour, an employer gives a wage in exchange for what the employee has to offer based on the unforeseeable promise to optimally perform. The employer will have to put a structure in place to monitor the adherence of employee to what is expected and also checkmate performances that are not satisfactory. In the finance capital perspectives, financial investors provide funds to the enterprise without have a probability distribution or determinate returns. The investor’s interest in making funds available is only safeguarded by instituting a costly array of constraints and rewards. To induce borrowers and monitor the use of funds factors such as regulations of securities markets and the creditworthiness and the financial intermediation structure.

Term of exchange is strictly guided by the monitoring and sanctions put in place by the buyer to induce proper behaviour from the seller. Contested exchange are recognizable as elements of pollical structure in the economy. Valid exercise of physical coercion in a liberal state is monopolized by the state, private economic agents do not have many instruments as the contracts are severely restricted. Of the available instruments is contingent renewal plays a major role in which the buyer induces compliance of seller by the promise to renew the contract based on the satisfaction of the seller’s performance. When the buyer offers terms that are more favourable than the best alternative available to the seller’s, nonrenewal of exchange becomes a viable threat. Enforcement rate must be made available by the buyer to the seller in other to make the contingent renewal effective. Due to the fact of competitive optimizing behaviour of the parties of the market, the rent provided by the buyer remains in competitive equilibrium. There is no incentive for those who have the capacity to change the rent or compete it away as they are constrained by market agents on the long side.

Based on the above reasons, the contested exchange market does not always clear in competitive equilibrium. This led to some agents cannot exercise power over the price or quantity while others have power over both. In regards to this analysis, three types of agents can be identified: (i) those on the short-sider of the market who use enforcement rents to as an instrument to exercise control; those on the long side who succeed in making a transaction and thus receive the rents; and those on the long side who fail to make a transaction. Firms and markets turn into the ground of exercising substantial economic power as long siders are constraints to obey the commands given by those who are on the short side of the market coupled with the fact that the former cannot make the transaction as they are quantity constrained.

Under the property and power, the general competitive equilibrium would be unaltered by having agricultural workers reward themselves with the residual and only rent lands and also pay landlords marginal product of land under the assumption of constant returns to scale operations. A contested exchange is predominant on the landlord worker relationship and the location of the residual claimant status makes a very substantive difference. As the agent deciding the contested variable is not the residual claimant, he bears the full cost of his actions and he does not the complete returns. However, when a contested exchange is in operation, reallocation of property rights usually includes residual claimant status. Competitive equilibrium will be altered by the reallocation of competitive rights and also further lead about changing prices, output levels and enforcement costs in contested exchange markets.

Challenges of the neoclassical theories

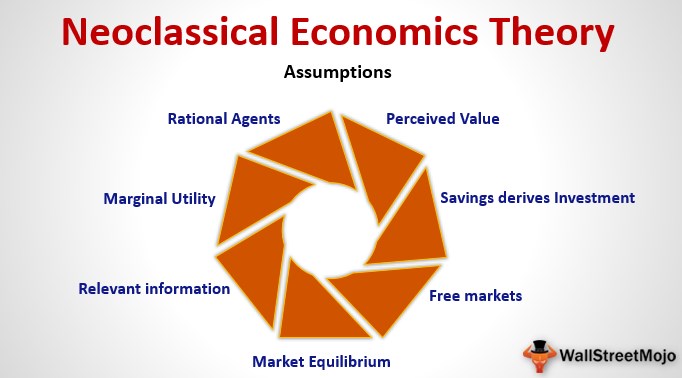

There are various contradictions and ambiguity which were highlighted in the neoclassical work. Their theories are criticized on the ground of normative bias in which does not emphasize more on explaining real economies but instead on describing “utopia”. School of thoughts that have a contrary view to the neoclassical maintains that the theories do not explain the real economy based on empirical observation and will, therefore, do well if the real world were to be confined to their model. For instance, many of the neoclassical models fail to achieve Pareto-optimality where the market is allowed to move freely and unregulated. The theories have the assumptions that competitive markets create an environment embedded with incentives for economic agents to learn optimal behaviour (Foss and Klein, 2005).

Asset specificity does not have a consistent definition across theoretical perspectives. There is need for disaggregated operationalization of the construct of asset specificity and it must allow for separate estimation of the all distinct dimension of asset specificity. De Vita (2011) further shows that longitudinal analyses be conducted to control for the possibility of existing non-linearities in estimation in the asset specificity model. It was also noted that the theoretical perspective covered by the asset specificity was not highly significant which result in a high transaction cost. More so, there is a need to rework the theory to better explain the complex relationship between inter-firm relationship performance and asset specificity. Under the contested exchange, all the basic proposition of the neoclassical are regarded as false in the context of the contested exchange. The measurement of the concept presented in the topic is still in a high ad hoc state.

In the works of Estola (2014), the author argued that these theories of neoclassical do not accommodate the dynamics obtainable in the real economy. This was reechoed by MasColell (1982) that summarize the challenges of the framework of neo-classical as follows: “A characteristic feature that distinguishes economics from other scientific fields is that, for us, the equations of equilibrium constitute the centre of our discipline. Other sciences, such as physics or even ecology, put comparatively more emphasis on the determination of dynamic laws of change. … The reason, informally speaking, is that economists are good (or so we hope) at recognizing a state of equilibrium but are poor at predicting precisely how an economy in disequilibrium will evolve. Certainly, there are intuitive dynamic principles: if demand is larger than supply then the price will increase, if the price is larger than marginal cost then production will expand. … The difficulty is in transforming these informal principles into precise dynamic laws”. So, to better understand the erratic nature of economic agents and the economic dynamics there is a need to assume that agents are not in their optimal.

Some other disciplines that deals with human behaviour have also questioned the theories of the neoclassical. The critics pointed out that theory that is too grounded in instrument rationality do misrepresent people’s true basic nature. They also pointed out that transaction cost economies overlooked the role of structuring any economic organization in different capabilities. More so power relation was ignored and the evolutionary process was not factored in. More so, the relationship between motivation and the environment has been misconstrued in the theory of firms. There is a claim that within an organization, individuals act on their perception for the entity and does not necessarily perform based on the opportunities or incentives offered. Organization loyalty drops based on hierarchical controls which tends to increase shirking and this complicates the problem it is designed to solve in relationship-specific investments. Theory of firm seeks to explain the governance of individual transactions (Hegji, 2001), or clusters of attributes (Rauh, 2017), without identifying how the governance of a particular transaction may depend on how previous transactions were governed.

Another lapse of the theory of the neoclassical is that equilibrium is not attained as argued by them. Contested exchange labour markets in equilibrium do no clear and it may not the only drive responsible for the unemployment witness because the system may be out of equilibrium perpetually. In this case, average productivity and the level of aggregate demand might play a better role. It was also highlighted that contract does not automatically enforce themselves nor can they be costless when implemented by the state in as much as labour market that does clear and agents are generally quantity constrained. Based on this enforcement rents preached by the contested exchange are ubiquitous and the subject of political conflict both within the capitalist economy and the state. The capitalist economy offer by the neoclassical does give an imbalanced economy in which the system only has the boss and subordinates with social divisions base on the property. All these attributes embedded in the workings of the capitalist economies are imprecise and rough which results can be quested.

For more academic help please check a wide range of services our Economics Writing Help team offers:

– Economics Assignment Writing Services

– Economics Essay Writing Services

– Economics Dissertation Writing Services

– Buy An Economics Research Paper