Abstract

The business world has rapidly evolved necessitating the need for a project manager in the management team who will look at the issues affecting the business from a project management perspective. This article demonstrates the importance of project management in managing business risks. A project manager is an asset to any business. Therefore, it is imperative to discuss the forms of risks businesses are faced with and how project management skills can be employed to address the risks. This involves risk management by effectively employing risk management plans and risk control skills. The focus of risk management analysis is on tracking risks, identifying new risks, and executing response plans. The article also shows the importance of project management in managing risks, which in turn results in profitability to a business.

Introduction

Most businesses will start as sole proprietorship or partnership where the identity of the owner and that of the business entity coincide making the owner or owners fully liable for all the liabilities the business may incur. With time the business may be transformed into another, more complex business structure, such as a corporation, a multinational corporation with multiple departments and employing huge numbers of employees.

A business enterprise is a project in itself where the owners are keen to see its success. The complexity of the business makes it hard to make simple decisions and the management will need to rely on project management professionals who have skills on how well to run the said business project (Lavingia, 2003). Any business is here to make profits and this can only be achieved when the business relies on a project manager who will advise on effective methods to complete a project while staying within a predefined budget and timeframe with a keenness to ensure that the enterprise produced goods and services that meet acceptable market quality (Enderle, 1999). A project manager is well equipped in handling modern business challenges since they have skills in areas ranging from identifying and focussing on the priorities, addressing unforeseen business risks, tracking, and measurement of performance, among others.

Risk Management in Business

One of the areas that plague business is risk management. Businesses are always venturing into new territories, changing their business and embracing the many changes happening in the business world. All these can be opportunities or can turn out to be the business downfall if the necessary risks are not well measured and the best management practices are adopted by the corporate.

Form of Risks in Business

One of the commonest risks that businesses will encounter is a strategic risk. The business world is changing every day and business enterprises will need to make strategic changes in their way of business to remain relevant, meet the changing need of the clients, and need to be competitive against their rivals (Stoneburner et al., 2002). Business change is a risk that if not well mitigated could land the enterprise into big debts or even cause it to close shop. As the business organization expands, there are major decisions that will need to be made at each stage in the business cycle. Technological advancement is also causing a major shift in how an enterprise has always done business. All these strategic changes will require good research and planning before the business can adapt to the new strategies.

Financial risk is another major challenge to many businesses. As the business expands and sometimes venture into new productions, they find themselves at the risk of running bankrupt. Cash flow is therefore a big concern to businesses and how it is managed may be a matter of life and death for the business (Thomas and Sheth, 2013). While it is prudent to invest in huge capital investments, the managers need to remember that there are operations costs like salaries, utility bills, rents, etc that will need to be met regularly (Kliem, and Ludin, 2019) The source of business funding should also be a concern to the business management so that they are wary of the interests that accrue from such funding which may eat up on the business profits.

Closely related to the financial risk is the economical risk. Businesses do not operate in a vacuum; they are affected by the prevailing economic conditions. they are affected by serious recessions where there is little money circulating in the economy. Recessions can damage even the wealthiest of organizations and can put organizations out of business if good mitigation steps are not taken (Matveev, 2016). Businesses’ strategic plans should revolve around futuristic issues that could affect the economic aspect of the organization. Trends and changes that have a significant impact on the business should be of concern to the management. They can mitigate this by saving excess cash and negotiating favourable purchasing terms during prosperous times. This will help the business to remain afloat during hard times until when the tides will turn.

Business organizations are also prone to liability risk. This may be brought about by a failure to meet contractual obligations, property damage, employee or customer injuries, among others (Nocco and Stulz, 2006). Lawsuits can be financially and time-draining. This explains why a business will be cautious in their decisions and actions lest they fall prey to the liability risk. Businesses will also invest in good insurance policies to protect themselves against some of these liabilities.

In recent days, businesses are also experiencing security and fraud risk. This is brought about by technological advancement and the use of the internet. Cyber and online and mobile channels risk have made businesses vulnerable to data and information leakage. Hacking has led to financial loss, data leakage, business disruption, and business reputational damage. Often businesses are now held liable for any data breaches or fraud. This shows the great need to build a strong and tamper-proof security system while at the same time thinking and strategic planning on ways to mitigate such risks (Aven and Renn, 2010). Businesses should invest in advanced ways of detecting fraud and securing their data. Their stakeholders such as employees and customers should be well educated on ways of detecting such security concerns.

There is the compliance risk that businesses face especially multinational businesses. This is because governments keep on imposing new laws and regulations to abide by. Non-compliance often attracts huge fines and penalties. Business enterprises have to remain vigilant and get themselves acquainted with new laws and regulations that are likely to affect them (D’arcy and Brogan, 2001). They do this by regularly reviewing government agency information, joining an industry organization, and seeking assistance from consultants who specialize in compliance.

In this day and age where organizations are facing huge competition in the industry, reputation risk is very rife and could be very costly to a business. Hiccups such as a negative press headline, a lawsuit, a product failure, or a customer complaint can impact the reputation of the organization to the public. Mushrooming of social media has made it easier to spread such negative information faster and to a wider population. This is because it only takes an individual to make a negative tweet or bad review for the business to feel the repercussions. Businesses are actually on their toes and have to put their ears on the ground so that they can mitigate such a risk promptly and effectively. They should monitor online and offline complaints and feedback from the public regularly (Kumova and Toropova, 2016). Business owners should encourage feedback from their clients, be it positive or negative, and should go ahead and respond to the feedback promptly and appropriately where positive feedback is met with appreciation and gratitude and negative feedback is met with a promise to rectify the problem (Kasap and Kaymak, 2007. In addition, a media policy that determines how stakeholders such as employees, relate online should be put in place. The policy should touch on organizational and personal pages.

Businesses are also likely to experience a business interruption or operational risk. This could be caused by internal and external factors (Nocco and Stulz, 2006). A business could experience natural disasters such as floods, wind, or fires that destroy the buildings and halt the operations of the company for some time. Other internal disruptions brought about by server outages, power cuts, and workers on a go-slow can cost the business a lot of money in terms of lost production time. A supply chain where a business relies heavily on others for raw materials, service parts, and products can result in delays caused by the waiting time. To mitigate this, businesses should devise ways of minimizing the impact of such interruptions and bringing the business back on track.

Risk Management Plan

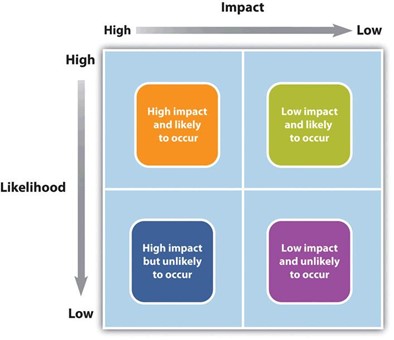

An effective project manager will always have a risk management plan in place. This is a document that gives details of anticipated risks, the estimated impact the risks will have on the project (high and low impact), and the likely responses the project teams will take against the risk, as shown in figure i. A risk management plan is not a static document since it is regularly reviewed by the project team. This is because there are new risks that emerge as well as the new ones changing thus making parts of the risk register obsolete. Therefore, the risk management plan should be reflective of actual potential project risks in a given time.

Project risk identification can be done using a simple but effective strategy of identifying the causes of risk and its effects on the business (Kopp, 2016). The project manager and his team can also identify business risks through brainstorming, interviews, going through the possible risks’ checklist, use of assumption analysis, among other techniques.

The next step will require organizing the risks in the order of probability and their impact on the business (Wilson and Crouch, 1987). Risks with high probability and a severe/ high impact should be given the first attention by the project team. This is the risk prioritization stage.

Figure i: Risk and Impact (Source: Watt 2014: E-textbook: Project Management. Accessed from: https://opentextbc.ca/projectmanagement/chapter/chapter-16-risk-management-planning-project-management/ )

The next step involves assigning ownership for each potential risk. According to Rausand (2013), the designated members should be equipped with the right resources so they are able to immediately work on reverting or managing the risk should it happen. This gives the project management team assurance since there is always someone on standby to ensure that the risk is dealt with quickly and efficiently.

Project Risk Control

The project manager must regularly monitor the project and work towards controlling existing and perceived risks. This will ensure that the risks are accounted for and are adequately addressed. Proper risk monitoring and control will ensure:

- Risks are well tracked

- Novel and residual risks are identified

- There is the implementation of response plans

Tracking Risks

The risk register is not static and will experience changes from time to time. The project manager keeps on consulting with the risk register so that if an anticipated risk did not happen, it can be labelled as “did not occur.” On the other hand, when risks happen, the project team should initiate mitigation plans as set out in the response plans. Again, the team should take note of risks that changed in the project lifecycle and modify the changes. As a way of tracking, the project manager should indicate the risk triggers in the risk register (Cervone, 2006). This is an excellent way of simplifying the monitoring process since they will be indicators of an occurrence of a risk and will help in making fast and effective decisions and actions.

Identification of Novel Risks

There is a possibility of experiencing new risks mid-way through the project cycle. This is because many of the risks in the register are often dependent on each other, thus an occurrence of one may change the nature and the impact of others (Uher and Toakley, 1999). In addition, new risks that were not anticipated during planning may mushroom in the course of project implementation. The project team should meet regularly so that they can identify the emerging new risks and chart the way forward.

Executing Response Plans

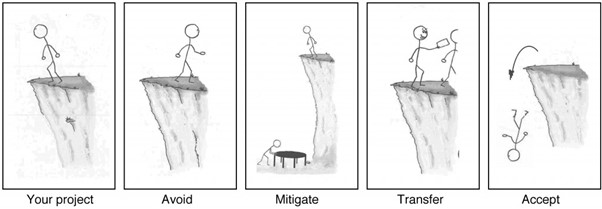

Among the different strategies that a response plan could take include avoidance, risks acceptance, risk transfer, and risk mitigation. These different strategies are demonstrated in figure ii. Avoidance involves evading from participating in mitigating risk by not participating in events or actions likely to make the project vulnerable. This can be done by modifying the project so that it is not affected by the impact (Chapman and Stephen, 2003). This is possible in instances where the project has some flexibility in terms of timelines and the budget. It is, therefore, possible to modify either of them so that the project is not adversely affected.

In risk acceptance, the stakeholders can agree to cost-share the damages should the risk happen. This lessens the burden on one person so that they only incur the damages in proportion to their involvement/share in the project. Risk transfer involves transferring the risk to a third party. This takes off the burden of risk ownership and responsibility from the project. This is often done by taking insurance covers against some anticipated risks in the project life.

Risk mitigation strategies and investments a project team will employ, in order to reduce the risk likely to face the project. Risk mitigation has a cost factor to the project. Examples include avoiding fluctuations of the exchange rate by buying at a guaranteed rate of foreign exchange, getting highly qualified individuals to handle activities that are prone to high risk, among others. The four types of response can be represented as in the figure below:

Figure ii: Risk Response plans (Source: Watt 2014: E-textbook: Project Management. Accessed from: https://opentextbc.ca/projectmanagement/chapter/chapter-16-risk-management-planning-project-management/ )

The rule of thumb is that the project manager should regularly and continuously monitor risks. This is because besides the risks listed in the risk register there is a possibility of mushrooming of new risks (Meng and Boyd, 2017). The manager should be proactive in monitoring, reporting on trigger events, and starting the response plan. Project managers know that risk planning is a continuous process since risks are part and parcel of any project. Since one cannot predict with certainty what will go wrong, project managers are always on the lookout. A risk management system will help in detecting and responding to risks effectively.

Conclusion

The risk management strategy is very critical in any business if the business is to make any profits. The role and the place of the project manager in any business cannot be overemphasized since he helps the business to make those critical decisions that may mean life and death to a business enterprise. The project manager acts as the eyes and the ears of the business and helps in identifying the viable projects through risk assessments, market surveys, and strategic management so that businesses venture into only those projects that are viable and profitable.