A Study of Effectiveness of Accounting Systems in Mitigating Risk for A Company

Abstract

Accounting Information Systems and their results are important in managing a company efficiently. The information gathered from these tools is used in day to day decision making. This study is committed to determine how effective is the AIS in reducing or eradicating risks facing JayMel Inc. To get the intended results, a questionnaire was formulated and distributed to a sample of employees who held different positions in the company including manager, auditors and others. Then the questionnaire was retrieved, analyzed and a conclusion drawn. The study determined that the AIS had a huge effect in mitigating the financial risks that faces JayMel Inc. The study recommends that the AIS be fully utilized in the company.

Executive summary

The need for Accounting Management System in any organization cannot be overemphasized, this paper endeavors to determine how effective these systems can be. The paper does so by analyzing a particular section of an organization, the risk mitigation section. It is done by analyzing the results of a questionnaire filled by JayMel company and thoroughly analyzed to determine the effectiveness of these systems. The questionnaire was handed out to different employees serving at different levels in the company, right from top management to the juniors. The paper determines to a large degree that these systems are of huge importance and highly effective in an organization. There was transparency and aided decision-making when the Accounting Management Systems were used as compared to when they are not used. It is the recommendation of this paper that the management of any company should ensure all transactions in a company should be captured in the Accounting Management System with continuous staff training and system upgrade.

Introduction

Accounting is described as an oversight that serves to monitor financial and accounting rules and directives aimed at safeguarding the quality of an institution’s finances and ensuring the integrity of accounting error financial statements. In other words, the management of accounting ensures general control and application control. This oversight is to ensure that the directives of management are lawfully executed, the financial transactions traditionally and the proper use of the establishment’s funds are reported according to accounting standards. Therefore, Accounting Systems are effective in mitigating risks for a company.

The aim of this paper is to look at how risk management is aided by and interacts with process or transaction “technologies” in order to educate and influence organizational behavior as it shifts in response to risk in particular at the JayMel. Accounting systems are a set of procedures that are organized to facilitate the operations of a larger company or corporation. As a result, they are knowledge processes. The paper synthesizes analysis of transaction cost economics, which explains the structure of the enterprise, and shows how this view can be expanded to include the complex factors that alter an organization’s risk strategy. Accounting information’s importance, significance, and limits can be more clearly determined from a realistic standpoint. Accounting’s knowledge viewpoint aids professionals in understanding and deciding how operations within their organization interact and affect one another. Accounting is not just a bookkeeping procedure, a billing mechanism, or a narrow functional device that aims to reduce costs in this sense.

Appropriate mechanism for the judgment of financial reporting of companies that are not deficient inconsistency of developed economy management is what accounting information system is. Society is safer if science can enhance decision-making by improving knowledge and as a result of fast technical and socio-political developments, the planet has become a global village. The growth and in some instances viability of each market and sector depends on the capacity of companies to compete internationally. Processes and management approaches have recently improved in all categories of organizations, including companies, government, education, healthcare, the military, and research & innovation.

Many of these organizations, due to conditions such as budget cuts, increasing expense, competition for scarce capital, and a need for better quality results, have been pressured to perform more efficiently. Competitive challenges from both local sources and federal, national, and foreign sources must be addressed by business leaders in the 21st century. They need to look at any opportunity in the immediate, national and global contexts because deregulation increases competitive pressure on companies to succeed, grow and thrive.

In order to achieve the company goals and targets in a dynamic world, management must use many tools at their disposal as effectively as possible. Management Information System (MIS) makes information available in the form of reports prepared by managers and many business professionals. Information System is a structured method for providing accurate information to management on all levels and tasks such that successful decisions can be taken at the right time to plan, administer, evaluate and monitor the operations for which they are involved.

In terms of sales, revenue production, sales achieved, recruiting of top-skilled applicants, goodwill of the company, and the perceptive view of the JayMel and its performance, the management Information System (MIS) has a significant impact. It provides information, encourages and strengthens the overall judgment process for decision-makers. The management information system supports the efficient distribution of the goods and services of a company. Information management systems at the required level should be robust, open, scalable, and usable.

Financial and managerial controls or the MIS are effectively subject to the following (Moskov, 2007, p. 3012)

- Track financial transactions and accounting activities from the original record to the conclusion of the financial reporting process to ensure the proper implementation of commonly agreed accounting standards

- The productivity of employees who work in finance and accounting is essential to every system because the system of control, in general, relies on the design, delivery, and control efficiency of employees.

Problem statement

Accounting System plays a major part in organizational decision making and determination of other factors that are crucial to companies. Accounting Systems are also used to generate statements that are used by the public to evaluate the value of a company and its worth in public trading, therefore addressing the question of how effective the accounting systems can be, is important in helping organizations rely on it. The aim of this paper is to determine the effectiveness of Accounting Management Systems to a unique factor, mitigating risk in an organization, particularly at JayMel.

Objectives

- The objective of this report was to determine the importance of accounting information systems (A.I.S.) in enhancing financial management effectiveness at JayMel

- To determine analysts’ views on the financial value of using accounting systems, thus improving financial management efficiency at JayMel.

Literature review

The Management Information System (MIS) is the implementation and application of the information system to help companies accomplish their objectives and goals. The information management accounts structure provides the necessary contact to perform the administrative roles and to connect companies to their external world. Management Information System, along with increased processing also contributed to a reduction in management bottlenecks. A machine is a collection of components interacting to accomplish a certain goal. Kang’ethe (2002) defines Information System (IS) is a collection of components that interact to generate information (computer hardware, software, records, procedures, and people). For e.g., in the machine used to write the paper, while you are using hardware, software (word or other text processing program), to read the paper. The kind of details that are present on any system of information. These five components in a computer machine include: (random accessible memory, disk storage, keyboard, mouse and monitor). In order to improve public trust, it is essential to maintain authenticity to the management’s accounting records and to ensure an efficient management accounting information system use of machines. Accountable information uses accounting procedures and controls within the system to monitor all financial operations of a company in order to provide internal and external reports on the company’s operations.

A quality performance is calculated as the statistic link between financial statements and performance exists. For instance, in stock market or corporate returns, while effective accounting data offers quality information appropriate, timely, up-to-date, it is also available to all consumers to demonstrate performance. According to research into value significance, the relationship between a security price metric and a number of separate accounting variables is investigated and determined to highly rely on the accounting management systems. Data perspectives assess the impact the study has on individual consumers without emphasizing the exact nature of the relationship between accounting knowledge and the valuation of the company. In order to achieve the requirements mentioned above, prompt transaction registration and proper classification where required information is provided on a timely basis. It must be noted that proper and functioning controls must be implemented to ensure that the information thus provided is accessible to the right people.

In order to achieve efficient records about the success of the JayMel, accounting information as part of the information system for management comprising an effective mix of tools within the company is used throughout. The fact that the lack of attention to this critical management strategy has brought so much havoc to so many organizations and in return has made quality accounting knowledge to be directly related to an organization’s success and in turn, the implementation of the strategy, has been a major cause for concern. Inadequate accounting evidence has dramatically taken away the public’s interest in many organizations’ financial statements.

There are several research studies conducted in various countries, including Spain (e.g. Grande and Estébanez, 2011), Yemen ( e.g. al-Bawab, 2011; Al-Bawab and Alulymi, 2010; Touman, 2008), Libya (e.g. Abu Fares, 2006), Iran, which are concerned with financial reporting (e.g. Sajady, Dastgir and Nejad, 2008). In analyzing past research papers, it is found that seven research studies on the subject of accounting information systems and verdict have been carried out. They have greatly given an insight into the effect of the Accounting system on an organization.

Financial reporting Accounting System processes are seen as vital operational structures essential to the success of organizational decision-making and regulation. The American Institute of Certified Public Accounts (AICPA) declared for the first time in 1966 that, “Accountability is, in fact, an information system, and, if we are more specific, accounting is the practice of additional information-theoretical frameworks of efficient economic activity and leads to a high number of quantitative information.

Kim (1989) states that consumer perceptions of the accuracy of information are dependent on the use of accounting information systems (A.I.S.). The accuracy of the information varies based on authenticity, reporting style, timeliness, and decision-making significance. The efficiency of the Accounting Information System often relies on decision-makers’ understanding of the value of the system’s information to meet operational information demands, management reports, budgets, and controls.

Al-Rawi (1999) describes financial management practices as systems that run data collection, processing, categorization, and reporting functions for financial events to provide relevant information for scorekeeping, careful management, and decision-making purposes.

Doll and Torkzadeh (1992) use such concepts to assess the efficiency of the accounting information in order to examine customer satisfaction. These definitions include the content, authenticity, structure, convenience, and timeliness of the material. Sajady and Dastgir and Nejad (2008) reported that their effect on decision-making progress, on accounting information accuracy, performance assessment, internal controls, and enabling business transactions can be assessed for the benefit of the accounting information system. The efficacy of AIS is extremely critical for all companies with respect to the above characteristics. In addition, details on consistency should always be observed.

Theoretical Framework

The system theory provides solutions for handling dynamic input and output flow conditions. It uses communication theory that helps develop a device architecture capable of processing and distributing information from the source to the destination with the least notice or distortion possible. Method philosophy considers an organization a system and a system may be closed or open, but most investigations are treating an organization as an open system.

A company receives input-related services, including tools, natural resources, and staff jobs. The inputs are converted, called needs, and then return goods or services called performance. Feedback loops warn the company by adding the outputs to the inputs. A negative feedback loop shows a correction of a query. For instance, the product design failure indicates that the product has to be retracted. A positive feedback loop can recognize well-functioning outputs. An effective marketing campaign, for example, generates high sales. Feedback loops are a way to validate or signal that the device needs to be corrected.

Internal management became more obsessed than ever about risk evaluation. The key explanation is the likelihood of modifying the company’s circumstances and the technical changes that threaten the industry and its existence. Risk is described from an internal control perspective as “conditions of uncertainty regarding the occurrence of things which significantly impact the company’s goals”, and the repeat of risks or high likelihood of occurrence assess these risks. The risk is sure to exist in the accounting systems: the competence of the company does not influence them and, based on a vast range of observations, calculates the likelihood of occurrence. And the system of regulations is weak. The hazards in information technology, whether for information or the networks, are assessed by organizations on the basis of these risks and their interaction with the enterprise, such as efficiency implementation, information management distribution, safety, and the likelihood of regression or degradation.

Conceptual Frameworks.

An accounting information system is a computer-controlled framework that improves control and strengthens corporate management in an enterprise is the accounting information system. Needles (1981) believes that the method of decision-making requires accounting information and it gives qualitative information for three functions: planning, monitoring, and assessment. In the analysis by Simon (1987) the first section of the argument used management as a controlling factor and the second part was used by constant monitoring to evaluate the efficacy of the accounting material. In order to operate any company, businesses must correctly store their financial details. In recent years there have been small regulation values for traditional accounting knowledge aimed at calculating benefit. Managers need all sorts of non-binding information about the external world, such as social, economic, political, and technological growth in this age of the global economy.

AIS is meant to be accurate because the information it provides largely responds to device users’ requirements. Accounting information is normally divided into two categories: knowledge affecting decision-making and, in particular, to manage the organization, information facilitating decision making and used primarily for collaboration in an organization (Kren 1992). By research, its impact on the facilitation of business purchases, internal checks, AI performance assessment efficiency, and improving decision-making is unmatched, Sayady (2008) argued about the benefits of AIS. In view of these dimensions, AIS is becoming increasingly important to improve operational efficiency. The findings of a study by Anderson (2008) on the other hand demonstrate that the economic analysis of financial AI is an important instrument for supporting decisions. Regardless of how high a business judgment is, a detailed review of manufacturing process inputs is needed for the planning of tasks.

The efficiency of AIS depends on the consistency of the performance of the information system which can meet the needs of the users. In most management and financial decisions, AI is a very critical component. In developing countries, these judgments value billions of dollars annually. Often, the consistency of these decisions is deficient; thus, studies are needed to encourage managers to consider the value of quality of knowledge access in the organization.

Characteristics of AIS

AI should be the same, uniform and checkable, helpful and timely at the same time as Oprean, 2001 mentions. On the other hand (Needles, 2001), says that the main qualitative characteristics of the AI produced by the FASB are clarity and utility, which must have the two fundamental technological characteristics to satisfy this utility requirement: relevance and reliability.

The majority of choices must be based on insufficient details (Dumitru, 2009), citing Drucker (2007), either as information is not accessible, or as it takes too much time and resources to be obtained. However, managers must have appropriate details at their service in order to make the correct decision, which results in awareness development, reduces ambiguity, and is beneficial for the intended use. (Achim, 2009) indicates that specificity can be integrated with comprehension and that contextual features (importance and reliability) are associated with secondary consistency, which is comparability.

Putting the foregoing into perspective, I would imagine it is of great importance to present more detailed and wide qualitative phenomena of the AI as presented by the IASB, and just to note, there exist huge differences in the qualitative characteristics of AI as defined by the IASB and the FASB. Below is what I would consider the characteristics.

- Relevance: The basic formula for the planning and implementation of established accounts sets out that the information supplied by the commercial institutions to the judgment needs of the consumers must be applied in order to be useful. The knowledge is pertinent as the economic judgment of consumers is affected by the evaluation, validation, or correction of historical, current, and future events. AI pertinence is doubtful by some Writers (Needles, 2001 Oprean, 2001 & Achim, 2009) because what is essential to the vendor or for certain consumers, is not disclosed.

- Comparison: general structure of the preparation and presentation by IASB of financial statements which must allow consumers, in order to recognize financial situation and performance trends, to compare the financial statements of their entities. Comparability involves the continuous use of field and accounting evaluation techniques, enabling consumers to distinguish correlations, variations and characterize the different time frames or organizations within the same sector. The comparability often requires constant implementation.

- Integrity: This means a user will rely upon knowledge or trust it. Accounting material is deemed to be trustworthy if it does reflect what it is meant to represent (a consistency that is called representational faithfulness).

Data collection & Feasibility

The research plan is described by Burns and Grove (2003) as a model for performing an analysis that maximizes influence over variables that may impair the validity of conclusions. Survey and post-facto analysis architecture is used by scholars. The survey analysis architecture allows research, while the Ex-post de facto design has been used to collect input from the company’s employees so researchers manipulate this data instead of primarily studying the variables that provide answers to the research questions that have been put out. 1405 employees of JayMel from five (5) departments were given the primary data in form of questionnaire with a return of 364.

Hofstede (1967) is a classical model for this study based on a contingency theory advanced by Fred Riedler (1958), which focused on the adequacy of accounting information for the making of indecisiveness in the management of aid and one of the earliest works on management accounting research with an immediate perspective. The principle of contingency also was generalized to the level of the subunits of companies, since the factors derived from accounting details such as dividend, earnings per share, stock return, return on asset were all used by management to assess performance. The model of regression below was used:

AIA = f (ROA, ROE, EP) …. (1)

Where;

AIAM = Accounting Information Availability to Management

ROA = Return on asset

ROE = Return on equity

EPS = Earnings Per Share

The ordinary least square of the equation is stated thus:

AIAM = bo+ b1ROA + b2ROE + Beps3 + e…. (2)

Where;

AIAM = Dependent variable

ROA, ROE, and EPS = Independent variables

bo = unknown constant to be estimated b1, b2, and b3 = unknown coefficient to be estimated

e = stochastic error term

Analysis

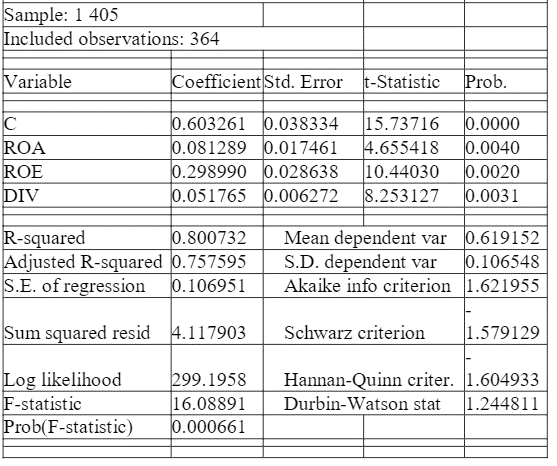

Table 1.1

Considering: R2, Adjusted R2; t-statistics; and F-statistics, Durbin-Watson statistics. These statistics have been used in measuring the effects of accounting knowledge on management decisions. In the analysis, the R2 was used to calculate the extent of the correlation from the dependent variable to the independent variables or the extent of the variability from the dependent variable which was measured in the independent variables used in the study. The Adjusted R2 illustrated the fitness of the regression model used for this analysis and also demonstrated how the dependent variable was actually different. The modified R2 is very significant in this analysis since it is multiple regression and is the standard for this type of research. The t-statistics were used to study the impact of the independent variables on the dependent variables. The F-statistics were applied to measure the significance and auto-correlation of first-order random variable explainable variables as a whole, and the Durbin Watson statistics were used. Table 1.1 presents the analytical consequence of the Ordinary Lower Place (OLS). The results showed in Table 1.1 that a 0.80 R2 and 0.76 R2 have been adjusted, this means that 0.80 of the dependent (ROA, ROE, and EPS) variables (remaining 20 percent) were defined by the standalone knowledge management variable, while stochastic mistake or other variables not included in that model were captured by the remaining 20 percent. The modified R2 further confirms that the parameters of approximation are correct. The exact variance described by the independent variable is clearly seen (accounting information available to management).

In order to calculate the impact on management judgment of the Accounting Facts, the following statistical parameters were considered: R2, Adjusted R2, t-statistics, F-statistics, and Durbin-Watson statistics. The research was conducted using the R2 to calculate the correlation degree of the dependent variable to the independent variables or the variance level of the dependent variable which was captured in the study by the independent variables. The Adjusted R2 explained the goodness of the fitness of the regression model used in this analysis and also the individual variance of the dependent variable that the independent variables explained. In this work, the modified R2 is very significant as it is a repeated regression and that is the norm for this nature analysis. In t-statistics, the importance of the independent variables on the dependent variables was examined. For a first-order auto-relationship evaluation of the random variables, F-statistics is used to test the significance of explicatory variables as a whole on the dependent variable and Durbin-Watson statistics. Table 1.1 shows the empiric outcome of the Ordinary Last Square (OLS). Table 1.1 reveals that R2 is 0.80 and R2 is 0.76 changed. Obviously, this means that the real change (accounting knowledge available for management) explained in the independent variable is 0.76 percent of the contingent (ROA, ROE), while the rest is 24 percent of the stochastic error. With a positive sign of 15.73716, the constant word entered in the model and is relevant with a meaning level of 5 percent. The constant word entered the model with a positive sign and individual t-statistics in order to test the statistical importance of the econometric variables used in the analysis using the t-statistics or the individual parameters of the model.

The outcome of an F-statistic is the table value 16.08891>2.93, which reflects the general importance of the econometric model as per ANOVA on the F-statistic. The model used in the analysis suits the data well and is consistent with the principle of econometrics. The statistics for Durbin Watson vary from 0 to 4 and the law of choice is that a value of around 2 is not automatic; a value to 0 is positive self-relationship and a value to 4 shows a negative self-relation. DW=1,244811, d1=0,525 and DV-2,016 were computed because K= 4 factors, n=10 years at 5% significance levels. The model, according to the laws is within the acceptable range and therefore free from auto-correlation.

Conclusion

During this report, several works were examined, within different departments, showing that there is a connection between the availability of accounting information and corporate success. The findings of the analysis found that the provision of accounting knowledge for management has an adequate effect on the success of JayMel. The success of accounting factors like ROA, ROE, and EPS is a feature of the management’s strategic judgment.

The report’s stance is consistent with many of the analyses undertaken by academics and analysts on the basis of accounting indexes, which often comply with the conclusion of the analysis, in and outside a company. It is also critical, in short, that any organization is well-structured and accountable since any prediction that is considered in the future depends on the knowledge the management may have.

Proposed solution

With regard to the analysis and given that every company irrespective of the type of sector is dependent on the accounting information system, the following recommendations were made:

- Based on the strong degree of association between the predictive and the dependent variable used in the analysis, the administration must always ensure that all activities are captured with a very well accounting scheme.

- Equity investors should still aim to reinvest their assets and this would facilitate the financing of ventures by management in their businesses, thereby increasing profitability.

- JayMel must always seek to maintain an increase in the EPS since it speaks a lot about how all the management will use both personnel resources and financial resources for profits.

- Management must ensure that costs are always kept under control because the lack of control affects the return on the asset since the rate was high.