To evaluate the impact of online banking on the financial performance of the banks: A case study of Barclays Bank

Abstract

Increasing globalization and advancement in technology has completely changed the outlook of the world and the way organizations are handling their operations. This change caused by globalization and technology has also influenced the banking sector immensely. The way banks used to operate has changed radically from being traditional to modernized services. Today banks are utilizing the benefits of technology to its full extent by going viral and electronically available for its customers. E-banking is one of the best strategy that has been implemented by this sectors as it has not only provided benefits to them but has also benefited the customers as they can now easily access and do transactions from anywhere in the world easily. Apart from that there are also numbers of other strategies that are now being practiced by this sector and out of all these strategies majority has proven their successful outcome as well. Maintaining financial performance and stability is one of those successful strategies. The impact that online banking has on the banks practicing and providing financial performance and stability to its company is to be studied through this research study. This is the primary aim of this research. For this purpose a leading bank of United Kingdom known as The Barclays Bank has been selected and this research would analyze the operations of this bank in order to justify this research. The result obtained highlighted that online banking can significantly improve profits of the bank due to low maintenance cost as customers mainly use online banking for checking balances, gaining information about products and services and funds transfers.

The first chapter of the research that is known as the introduction provides an overview of the entire research thoroughly. This chapter highlights all the major concepts that has been a part of this research study. A detailed introduction of the research topic, background of the research along with an overview of the company on which the research is based will be explained in this chapter of the research briefly. Furthermore, this section of the report would also highlight the aim of the research, its objectives along with explaining the research questions that have been specifically developed for this research would be highlighted as well. It is because of all these significant concepts that this chapter is considered as one of the most important and integral part of the research study. In the end this first chapter would also highlight the scope of the research along with providing a brief synopsis of all the chapters that has been a part of this dissertation.

Financial performance and stability is considered as one of most discussed concepts of the present era. According to Sharma (2013) in the past few years this concept has managed to create a strong presence of itself in the corporate market. The reason behind this sudden popularity of this concept is the rapid progression in technology as well as competition that has been taking place and increasing the exposure level of consumers. Today consumers all around the world are well aware about almost every other thing because of the strong media and technological presence in the country. It is because of this reason that companies that were habitual of facing struggle and striving hard to attract customers, can easily access their target audiences on a larger scale. Consumers are now at an easy approach for organizations even those dealing in services. The progression and advancement in technology has shrink and turned the world into a global village where everyone is interconnected with one another along with being easily accessible. Communication has become immensely easy and people can easily communicate with one another no matter where the other person is located. Services based companies has also facilitated with this progression and technology and it is because of this globalization that companies are able to target their customers sitting anywhere in the world. For this purpose banks are their middle agent and all the transaction and communication between customers and company takes place through them. The progression in technology has influenced the financial institutions as well and today almost every bank has provided its customers with facilities like electronic banking. Customers can easily access and transact their account online.

In order to evaluate the impact of online banking in India particularly that on the financial performance and stability this research has been conducted. This research would also analyze the impact that online banking has on the companies operating in Western countries has, as all this progression in technology initiates from West only. However, it is a known and undeniable fact that with the progression in technology organizations must strive hard to sustain their position in the market and for this particular reason conducting online operations is one of the suitable and productive strategies.

Money and the importance it has in today’s world is undeniable and one can simply not ignore its significance. Hammonds (2006) has also stated in this regard that those individuals that deny the importance of money are ignorant and often end up without any assets in hand. When one talks about money, banks that are also known as the financial institutions also arises with it. People either save their money by placing it in anywhere safe or utilizing the services of these financial institutions that are considered even safer than the former one. It is because of this reason that banks holds such a significant place in establishing world’s economy.

Increasing globalization and advancement in technology has completely changed the outlook of the world and the way organizations are handling their operations. According to Dzaja (2007) that this change caused by globalization and technology has also influenced the banking sector immensely. The way banks used to operate has changed radically from being traditional to modernized services. Today banks are utilizing the benefits of technology to its full extent by going viral and electronically available for its customers. E-banking is one of the best strategy that has been implemented by this sectors as it has not only provided benefits to them but has also benefited the customers as they can now easily access and do transactions from anywhere in the world easily. Apart from that there are also numbers of other strategies that are now being practiced by this sector and out of all these strategies majority has proven their successful outcome as well. Financial performance and stability is one of those successful strategies.

When banks start providing special services to their customers along with their usual banking services, then that service is collectively termed as Financial services or bank services (Jaffer, 2007). He further stated that both the internet providing company and banks merge their services in such a situation when both share the same vision and objectives and that has become easier because of the emerging modernization and advancement in technological exposure such as online services etc. Here the benefit that company has the exposure and easy access they would be getting by making banks their partner while banks agrees for such a partnership because of the huge profit they could generate through this merger and new offer for their customers. The former having less access to their target market has managed to influence larger section of their target audience through this. America being one of the leading technological savvy countries has been the pioneer of this concept by introducing and launching this concept while with the passage of time financial performance and stability managed to mark its position in other countries as well particularly United Kingdom. Today even Asian countries have also welcomed this concept with open hand because of the successful outcome it has been providing to other countries.

According to Sharma (2013) financial performance and stability and online banking are two of those concepts that are interlinked with one another hence, this research would be focusing on both of these concepts respectively. This research would determine the impact that online banking has on financial performance and stability along with evaluating the difference in the impact that one country has with another would also be determined through this research.

Founded by British founders this bank was launched back in 1865 and was named as Barclay Banks. Today this bank has its branch all over the world including Asian countries like India. It is considered as one of those banks that has faced past three centuries and has managed to sustain its position in the market despite the emergence of new banks. The present era is a modern era and has bought many technological changes that has turned the outlook of banks completely. All the three centuries has bought numerous changes that has actually changed the entire bank from the time of its establishment. At the time of its establishment back in 18th century this bank was established in other city however, with the passage of time it has established its headquarter in another city after its collaboration of United Industrial Bank Limited (Barclay, 2013).

Because of the number of changes that this bank has went through particularly the because of the technological advancement that has been the part of this bank’s history it was considered as one of the most suitable bank for this research. Moreover, as this bank has been in the existence since a longer period of time hence, it is considered more suitable for analyzing this technological transition. Moreover, Barclay also has a running website that further make it more eligible for this research as this factor was necessary considering the topic under investigation. Considering this bank as the prime investigating target all the important research topics such as the research issue, objective and aim of this research, the research questions etc. would be developed that would be further analyzed in the later chapters of the research thoroughly.

The impact that online banking has on the banks practicing and providing financial performance and stability to its company is to be studied through this research study. This is the primary aim of this research. For this purpose a leading bank of United Kingdom known as The Barclays Bank has been selected and this research would analyze the operations of this bank in order to justify this research. For this purpose the findings would also be compared with that of other banks operating in other part of the world particularly in countries in west. Through this the researcher would be able to judge the difference that remains in the operations and outcomes of banks operating in UK with that of banks operating in other western countries that has been practicing financial performance and stability as their star strategy. Following are the objectives that have been developed for this research:

- To evaluate the impact of the online banking on the financial performance of the chosen bank

- To evaluate how the managers of the bank perceive the significance of the online banking in terms of improving the overall bank performance

- To evaluate whether there is an increase in the customer base by the adoption of the online banking

- To provide recommendations in order to enhance the overall financial performance of the bank

A justification to these particular research objectives would be provided with the assistance of the chose research methodology for this particular research project.

All these research objectives would be supported by a theoretical stand that would be provided in the further parts of this research study.

Following are the research questions that have been developed for this research study:

- What is the impact that online banking has on banks’ financial performance and stability and its services rendered to its customers particularly The Barclays Banks?

Similar to the objectives the research question developed above would also be justified and supported by theory that would be presented in the later chapters of the research study. This would be done by analyzing the data that would be collected following the research methodology that has been determined for this research

The impact that online banking has on the banks practicing financial performance and stability is the prime reason behind conducting this research. For this purpose on specific bank has been selected that has been in the history since the 18th century and hence, is the perfect example of an entity that has undergone numerous technological transitions in all these years. This bank has implemented almost every other emerging strategy in its operation to remain successful and therefore, has also been offering financial performance and stability to its customers. Through investigating this bank it would become easier to analyze the role of online banking and its impact on the banks performing this concept particularly. The impact that it has on the overall productivity of the bank could also be analyzed through this way. Hence, one can state that the purpose behind conducting this research is analyzing the impact that online banking has on different strategies that has taken place due to modernization and globalization in the banking sector.

As this research is primarily focusing on the concept of online banking and its impact in detail hence, one can stated that the scope for this research is broad and extensive. Online banking is a vast concept impacting almost every other field. Moreover, the other variable under investigation that is financial performance and stability is also one of those concepts that are widely discussed in the present era making it a concept that requires a thorough discussion and in depth analysis as well. There are numerous researches that has been conducted on this similar topic in the past in order to determine the impact that this concept has been having on the overall performance of the bank. Hence, this research could be said to have an extremely wide scope as it would help the future researchers in analyzing the role of financial performance and stability in the prosperity and growth of different banks. Through this research different banks around the world could also facilitate as they could easily determine the impact that all these latest and emerging technologies has on the performance level and can later implement them in their operations to achieve beneficial and productive outcomes. The importance of internet banking and information technology in banks is determined through this research.

Following is a brief synopsis of all the chapters including in this research:

Chapter one: This chapter being the introductory chapter of the research would provide a detail overview of all the important concepts that would be explained in the research study. As this chapter would highlight all the fundamental concepts that would further become the basis of the entire research hence, it is considered as one of the integral part of the entire research and is therefore, the most important chapter of the research as well. Concepts like research aim, objectives and research questions would be determined in this introductory chapter only and would be later supported through evidences that would be collected in the subsequent chapters.

Chapter two: This chapter known as the literature review of the research highlights all the work that has been conducted by the previous researchers on the similar topic. It is because of this chapter that the researcher understands his own topic in detail by going through the research and theoretical work of previous researchers. Moreover, by analyzing the work of previous researchers, one can get motivation and a guiding path following which one can lead his research further. The data for this chapter is collected through different secondary sources such as journals, books, websites, articles etc.

Chapter three: All the research methods that has been determined for collecting the data of this research and later analyzing it is explained in this chapter of the research study known as research methodology. This chapter would highlight concepts like research philosophy, research approach, research strategy, time horizon etc along with highlighting the limitations that the researcher has to go through while conducting the research. All the ethical consideration that must be followed is also explained in this chapter of the research study.

Chapter four: The findings of the research that has been conducting following the research methodology highlighted in the previous chapter of the research would be analyzed in this chapter thoroughly. This chapter would become the basis and provide support to concepts like research aims, objectives through these findings that would be generated by analyzing the data collected.

Chapter five: An overall conclusion of the entire research would be presented in this chapter of the research that would be based upon the current findings as well as the previous findings that has been gathered in this research as its secondary data. Moreover, this chapter would also provide recommendation for future researches along with highlighting the knowledge that the researcher has gained while conducting the research.

The unavailability of data along with the issue associated with the access of data has been the biggest limitation while conducting this research. Banks being highly confidential with the data related to banking made the analysis process of this research extremely difficult.

With the evolution of information technology, banks gained the potential to change their operations and infrastructure. Many viewed the contemporary system of banking as the way to destroy old model of banking where more face-to-face interaction with customers was embraced between the banks and its customers. However, the contemporary arena in banking is placing bank on the edge of technology where transactions have become computer mediated and everything appears to be a robotic engine. Thus, this literature review will focus on analysing the impact of online banking on the overall performance of the bank. For this purpose, a comprehensive discussion and analysis of the literature would be made by gathering various views and opinions of different authors. Besides, the contemporary online banking would be evaluated against the traditional banking system to identify the potential and challenges exist in the online banking. The perception of management for online banking would also be evaluated along with the impact of online banking on the customer base. Thus, this literature review would provide a comprehensive analysis of online banking as the contributor in overall financial system and performance of the banks.

The term online banking is a complex term that is interpreted and defined in different ways. This complexity is further intricate by the integration of multichannel delivery into the online banking system. Nevertheless, different authors have tried to provide a comprehensive and inclusive definition of online banking (Auta, 2010; Furst, Lang and Nolle, 2000; Krik, 2009). Furst et al (2000) defined online banking as the process of using various delivery channels for performing banking activities. Krik (2009) defined online banking or e-banking as the automated delivery of the traditional banking services to the customers through interactive and electronic medium. The view of Krik (2009) supports the existence of conventional banking system rather than completely replacing it. However, the conventional banking system has improved its services such as service deliver, reduced operational cost and enhanced quality, provided real time access and increased the efficiency of the overall banking system by integrating the contemporary online banking (Gonzalez, 2008; Ovia, 2001).

Simpson (2002) further elaborated online banking as the process of carrying out bank’s transactions electronically without using the brick and mortar model. In this context, the online banking is viewed under the sphere of virtual or branchless banking where the geographical location of bank becomes less important and the banks prone more towards the adoption of online banking. Thus, online or e-banking can commonly be defined as the use of interactive and intelligent devices for conducting various banking transactions in order to bring efficiency in the overall banking system (Auta, 2010; Gonzalez, 2008; Krik, 2009).

The discussion on the use of online banking as the innovative platform for offering banking services provides a more fruitful insight about the relationship between online banking and the traditional banking. At one end, the online banking is considered as the substitute of the traditional banking system in terms of financial transactions. However, an alternative view of the online banking supports the conviction that the online banking rather complements the conventional banking system in providing the services to the customers (Ciciretti, Hasan and Zazzara, 2009). The prior view placed greater importance on the contemporary banking system by stating online banking as the second-best system introduced in the world as compare to the conventional banking. Under this view, the personal contacts of banks with the customers have seemed to be eliminated and the reproduction of non-verbal communication on the web has become difficult (Ezeoha, 2005).

However, an important point negating the above replacement of conventional banking system with the contemporary one is that the human resources necessary for banking activities could not be substituted by any technological system (Gonzalez, 2008). The deployment of new technology or online banking requires the development of both competencies and knowledge for supporting the value and improved functionality of online system. Therefore the reinforcement of existing system and routines is necessary to adapt to the new system (Ciciretti et al., 2009). This view as mentioned by Malhotra and Singh (2009) certainly places greater importance on both the contemporary and conventional banking system and postulates that the conventional system in the prerequisite for contemporary banking. Therefore the online banking seems to complement the traditional face to face banking rather than substituting it.

The initial phase in the construction of new banking system was conceived as the replacement of the traditional activities by integrating new systems, technologies and models of banks into the banks. Therefore the online banking primarily appeared as the replacement of the traditional banking system and the need of banks to remain competitive was provoking almost every bank to replace their existing practices with the online banking (Ciciretti et al., 2009; Gonzalez, 2008). However, it soon became apparent that the two systems of banks could coexist and are not incompatible with each other (Malhotra and Singh, 2009). Furthermore, Ezeoha (2005) cited that banks had also realised that using the two systems together produce synergies in the banking system and improve the overall banking services. This indicates that the benefits and potentials of online banking could not be exploited properly without combining them together. This is because the online banking could not facilitate the face to face interaction between the banks and the clients that the conventional banking facilitated. Malhotra and Singh (2009) signified that for achieving the same degree of interaction, the new banks model are based on the integration of online banking system into the conventional banking that provide ease and convenience to the customers.

Berger (2003) articulated that the online banking provides various functions that the traditional banking system did not provide to its customers. The convenience is one of the most appealing functionality of the online banking through which customers could perform bank transactions at any time. The fund access and transfer without the time barrier has made the payment of bills and other transactions much easier (Auta, 2010).

The Basel committee on Banking Supervision (2003) defined online banking as the process of providing small value and retail banking services to the customers through electronic medium. Those services that are facilitated through online banking include lending, accounts management, deposit taking, bill payment and provision of financial advices. Hernando and Nieto (2007) believed that the online banking system enables the financial institutions and businesses to interchange essential business data pertaining to customers, acquire information about different financial products and services and develop an internal network for facilitating improved banking services.

Wu, Hsia and Heng (2006) cited that the functionality and services of online banking that is complete customer oriented include the use intelligent electronic devise such as automated teller machine (ATM), personal computer (PC) and personal digital assistant (PDA). The membership agreement is also provided in the online banking services where customers are assured of their personal accounts and services by ensuring the privacy maintenance. The unique characteristics of online banking also enable such banking system to function much faster than the traditional banking system. However, due to the allocation of large data on websites and internet there is also a high risk and threat of security and may led to legal, strategic and operational risk (Hernando and Nieto, 2007).

Berger (2003) uttered that the integration of technology has made the functionality and services of banking quite intricate. The banking has now become a complex arena of different networks connecting several banks which demands a distributed environment. Therefore the customer demands have also changed considerably during the past few years with a high focus on computer mediated operations and integrated applications into the banking system (Hernando and Nieto, 2007). Thus, with the increasing complexity of the banking system, the reliance of bankers on technology has also increased due to the improved functions and services of the overall banking system (Wu et al., 2006).

The integration of technology has made it possible for the traditional banking system to break the old value chain and develop the new value chain with the greater emphasis on the distribution of banking services across different and separated businesses. Primarily, banks were operating as a separate entity with restricted distribution of securities and while the online banking has allowed the banks to produce synergies by forming technological alliance with other banks (Delgado, Hernando and Nieto, 2007).

Nevertheless, while highlighting the importance of online banking, the banks’ first aim to reduce the overhead expenses by removing the extra staff and branches required for performing the manual banking activities (Wu et al., 2006). Across the Europe, the Spanish banking system is regarded as the “over-branched” banking system as claimed by DeYoung (2005) and Delgado et al. (2007) where the economies of scale could be achieved by removing the traditional distribution channels of banks. Highlighting this perspective, DeYoung, Lang and Nolle (2007) further enunciated that the online banking offers the innovative process for substituting the physical branch based banking that was both costly and time consuming. Therefore in the case of Spanish banks, the overhead and unit transaction costs have considerably reduced due to the integration of internet enabled channels.

Despite of the empirical evidences provided by DeYoung (2005) and Delgado et al. (2007) for reducing the unit cost of banks by engaging them in the online banking system, no academic work has so far supporting the reduction of fixed cost by using the online banking system. Therefore, Malhotra and Singh (2009) produced the complementary model for integrating both conventional and online banking services into the overall banking system. DeYoung et al. (2007) defined the online banking as the product innovation in the banking system because it enables the bank to add value in its traditional services by using new technologies.

The online brokerage has evolved as the mainstream activity in the retail banking system across Europe through which different online customers are acquired and the existing offline customers are transferred to the online channels. To the large extent, this activity could be viewed as the bank’s need to achieve cost effectiveness (McKinsey, 2001). The customers directly conduct the online brokerage activities which considerably lower bank’s cost and eventually lead to its profitability. During the past few years, the importance of online banks has grown tremendously within Europe due to the transformation of previous brokerage model into the online brokerage units. As a result, the customers have now got the cheap access to information and the banks’ ability to respond to customers has also increased. The online banking system has also enabled some of the European banks to offer trading services through web in 2000 (Hernando and Nieto, 2007).

However, as far as the US banks are concerned, the online brokerage activities were conducted by the nonbank security dealers due to which the dealing powers and securities underwriting was extended by the Gramm-Leach-Bliley Act of 1999. Under this act, the dealers were required to conduct the online brokerage activities through separate securities entities (Hernando and Nieto, 2006). Consequently, those customers that were getting the online brokerage services from the banks were enrooted to legally separate entities of such banks. However, the payoff generated as a result of such activities did not actually impact banks (Hernando and Nieto, 2007).

DeYoung et al. (2007) illustrated that the depositors’ behaviours have also considerably changed with the advent of new technologies into the existing banking system. The rising competition among banks across the UK has caused many bankers to offer high interest rates in order to remain competitive on the online banking platform (Hernando and Nieto, 2007). Simultaneously the contemporary banking system is showing high volatility in the activities that include the ease of fund transfer between core deposits and accounts. Therefore such high volatility might become the reason for the development of a highly expensive financing system stemming from the needs to transfer mutual funds at the interbank level (Delgado et al., 2007).

The adoption of online banking has provided numerous benefits to the conventional banking system but the risks that managers perceived in such system also leaves a negative impact on the overall attitude of banks towards online banking. The perceived risk theory has been used widely in the researches to evaluate the perceived risks of the managers in the online banking system (Sajjad, Humayoun and Khan, 2010). Perceived risk is defined by Featherman and Pavlou (2003) as the potential loss that could incur during the pursuit of the desired services. Such perceived risks could occur in five different forms namely psychological risk, performance risk, opportunity or time risk, financial risk and safety risk.

Featherman and Pavlou (2003) featured safety risk as the possible harm that could be caused physically to the person involved in the services. At the physical levels, it is the bank and the managers that are usually threatened by the safety risk. The psychosocial risk is different from the safety risk as it indicates the risk for the individual manager. Therefore are two types of psychological risks namely the psychological risk which is the perceived threat to the manager’s peace of mind. The engagement of manager in the online services might reduce the peace of mind due to the complexity of the services and the queries that customers generate regarding the use of such services. The second type is the social risk that could incur in terms of loss of social group or status due to the adoption of new system (Featherman and Pavlou 2003).

While introducing different risks, authors came up with the strategic risk dimensions that identify the potential damage to manager status and peace of mind in response to the development of activities that could jeopardize existing bank’s privilege. Such strategic dimensions are mainly based on the safety and opportunity risks (Sajjad et al., 2010). However, the managers tried to reduce such risks by adopting the positive view of online banking as the more convenient and automated banking system that does not considerably reduced the manual banking activities but also provided the opportunity for much faster banking system (Go, Chua, Chai, Lee and Chua, 2011).

Thus, the relationship that the manager holds pertaining to the performance of online banking system and attitude towards online banking is considerably shaped by the extent to which online banking reduces the perceived risk of managers. Therefore the more positive performance of the online banking system, the greater will be the tendency of managers to reduce their perceived risk and use online banking system (Manoranjan, Bhusan, Kanta and Suryakanta, 2012; Wixom and Todd 2005).

The online banking has emerged as the conventional banking system that offers significant benefits and advantages to the customers and bankers. However, a wide of literature also intends to identify different factors underlying the online banking system that could lead to raise the performance of the banks. These factors are assessed below:

Accessibility is defined by Godwin (2001) in terms of the ability of user to access the information and services available online. However, such accessibly is also influenced by various other factors such as internet connections, hardware, content format and environmental conditions (Hackett and Parmanto, 2009). Among them, the most promising factor is the web content that enables the user to understand the information available on the website (Hackett and Parmanto, 2009).

Convenience refers to the extent to which customer perceived online banking as the timed and location friendly service. Online banks get the relative advantage when they are able to provide improved services to online users performing transactions at distant places from banks (Godwin, 2001). Hackett and Parmanto (2009) identified those determinants of online services that further add to the convenience of online banking system. These include the care, attentiveness, friendliness and responsiveness of online banking services. However, Godwin (2001) identified certain factors that lead to greater dissatisfaction among online users. These include responsiveness, integrity, functionality, reliability and availability.

This is one of the most influential factors in influencing online banking services. Customers usually are doubtful about the trustworthiness of online banking system (Godwin, 2001). Lallmahamood (2007) believed that the customer sensitivity to personal information makes the privacy an important determinant of engagement in online banking activities such as internet or mobile banking. Cheung and Liao (2003) articulated that for engaging more customers in online banking, it is important to develop secure and private online banking system that could facilitate two-way communication between the parties without the exploitation of consumer trust on banks.

The security refers to the extent to which the safety of customer’s personal information is insured during the web transactions (Lallmahamood, 2007). Hackett and Parmanto (2009) explained that many banks develop privacy statements to ensure that the information of their customers remain secure. In these statements, the logos of trusted third parties are also shown to warn the customers about deceitful acts and frauds. Such types of actions by banks ensure that the banks certainly make customer protection their first priority and guarantee them all types of security while displaying any content or their personal information on their respective accounts (Ciciretti et al., 2009).

The download speed of the web content and the user satisfaction has found to be strongly associated with each other. The nature of the web content, the type of internet connection and the hardware used in performing transaction determine the speed of the download (Ciciretti et al., 2009). Thus, the speed of the download also plays a major role in influencing customer’s perception about online banking. Most people often associate downloading with the import of different unwanted viruses that could adversely impact the online banking system (Lallmahamood, 2007).

Malhotra and Singh (2009) associated online banking with the customer loyalty and found out that the online banking considerably influence customer loyalty among the online users while those that were non-users contained negative impact of online banking. Therefore customer care and customer retention are the two most important aspects that have been stressed in the literature for increasing the customer base through online banking. These two aspects are linked with online banking because the convenience, ease and speed that online banking facilitates depends on the integration of both human and technology into the banking system (Delgado et al., 2007).

The customer retention is defined by Ismail and Panni (2009) as the extent to which customer engages in price tolerance and repeat purchase behaviour and contains the positive attitude towards the service provider. Nitzan and Libai (2011) also defined customer retention as the major determinant of increasing customer base. Therefore if customer shows his or her stated continuation with the business that he or she is likely to be retained by the organisation in the long-term. Malhotra and Singh (2009) also associated customer retention with online banking activities by stating that the online banking service provides a contemporary way for increasing existing customer base through customer retention.

Nitzan and Libai (2011) contended that some influential factors shaping customer attitude towards online banking include the customer satisfaction and the capabilities of the bank to meet customer demands. Consequently banks fulfilling these two criteria are able to increase their customer base over the period of time. Cooil, KeininghamAksoy and Hsu (2007) narrated that service is an intangible aspect that contains different meanings for different people. Therefore the service should be designed in such a way that could provide maximum satisfaction and appeal to the customer that uses it. The resulting indicators of such satisfaction are the increased customer loyalty, customer base and customer commitment.

Mende, Bolton and Bitner (2013) postulated that customer commitment is the major determinant of customer retention and customer switching behaviour. According to them, the highly committed customers are likely to refer the bank’s services to more people and are less likely to switch bank’s services with another bank as compared to the customers with low commitment level. Cooil et al. (2007) contended that the higher level of affective commitment is found in those customers that perceive website usability of bank as high than that of other banks. Such commitment leads to establish a significant, direct and relationship between online banking and customer retention.

Ismail and Panni (2009) also found the positive impact of online banking usage on customer loyalty. Thus, for increasing the customer base, three important factors have found to play a major role namely customer loyalty, customer retention and customer commitment. Therefore the online banking system should focus on both the human beings and technology to increase the customer retention and customer loyalty (Mende et al., 2013).

The empirical studies on online banking provide chucks of evidences that determine the relationship between online banking and financial performance of the banks. This is because of the revenue and cost implications on online banking that eventually affect the overall profitability of the banks (Guru and Staunton, 2002). Hernado et al. (2006) conducted a study on the impact of online banking on the financial performance of the banks by using the sample of 72 Spanish banks during the period of 1994-2002. After analysing their performance, a positive association was found between the profitability and online adoption within those banks. Similarly, DeYoung et al. (2007) further found out that the online banks are much more profitable as compared to the conventional banks. However, their study did not indicate any time period during which such findings were generated.

Onay, Ozsoz and Helvacıoğlu (2008) also found analysed the impact of online banking on bank’s profitability among Turkish banks during the period of 1995 and 2005. They found out that after two years of implementation of online banking, the online banking started to contribute to the ROE of banks. These results also confirmed the finding of Hernando et al. (2007) that during the first years after implementation, the online banking was found to be negatively related to bank’s financial performance.

On the contrary, Malhotra and Singh (2009) also conducted the study over banks during June 2007 for analysing the impact of online banking on risk tracking and financial performance of banks. It was found out that the bank’s profitability and online banking does not contain any significant relationship. These findings also confirmed the results of DeYoung (2005) and Arnaboldi and Claeys (2010). Mohammad and Saad (2011) further analysed the relationship between online banking and bank’s performance among Jordanian banks during the period of 2000 and 2010. It was found out that the financial performance of banks are negatively associated with the online banking which corresponds to the analyses of Delgado et al. (2007) and Siam (2006) as well.

There are various studies that have also conducted to investigate the relationship between online banking and bank’s performance in the US, Australia and European (Furst, Lang and Nolle, 2002). Furst et al. (2002) conducted the study over those banks that adopting online banking in the third quarter of 1999 in the US. These banks showed no significant impact of online banking on the bank’s overall profitability because the online banking was considered to be a very small factor to have such a huge impact. Nevertheless, Onay et al. (2008) argued that these results were not held for all the banks and the growing inclination of banks towards online banking have significantly impacted the financial performance of banks during the past few years.

Sullivan (2000) also found out that having multichannel banking system did not have any harm or benefit for the existing banks. Sathye (2005) also conducted the study over some Australia banks during the period of 1997 and 2001 and found out that the online banking is not the performance enhancement tool for banks and unions. In the same year, DeYoung (2005) also conducted a study over a dozen of online banks within the US in which it was found out that the performance on the bank was significantly affected by the technology base economies of scale. He further demonstrated that impact of online banking on the age and size of the bank. It was found out that as the online banking grows larger the size and age of the traditional banks become smaller and their profitability becomes mainly dependent on the online banking.

In Europe, the performance of the banks is majorly dependent on the online banking because they heavily rely on internal channels for delivering the services. In this context, Delgado and Nieto (2004) also conducted the study over banks in Spain and found out that the negative profitability of banks till 2002 was attributed to their high financial costs and low income followed by the fiercely competitive environment of the traditional and online banks. Delgado, et al. (2007) also analysed the magnitude of online banking across fifteen European primarily Internet banks. They found out from the analysis that banks heavily relying on online banking showed high technology based economies of scales. Therefore, their primary source of controlling their expense was the inefficient banking enabled by the online banking system and technological development in traditional banking.

Simply put, the overall analyse showed the mixed results of the financial performance based on the online banking. Nevertheless, the contemporary studies have found a positive association between the online banking and the financial performance of the banks because of the increase in the magnitude of online banking and intensity of competition. Therefore with the greater integration of online banking the bank’s performance is likely to be improved. This study therefore bases its finding on the contemporary studies that widely support the association between online banking and financial performance especially in the European context where Barclays is located.

While a vast majority of researchers point out the benefits of online banking, a very few studies have focused on identifying its challenges and issues that should be overcome before capitalising on the benefits of online banking (Hackett and Parmanto, 2009). Ciciretti et al. (2009) conducted the study over challenges in banking among African banks through which it was found out that the level ratio of economic development, low per-capita income, limited number of online users, limited skills to develop online banking and the lack of familiarity with online banking were the major challenges in online (Hackett and Parmanto, 2009).

The cultural reluctance as claimed by Tan and Teo (2000) has found to be one of the greatest challenges in adoption online banking. The cultural reluctance becomes the major hurdle between technology oriented-interface of the banking system. Other challenges include the cost associated with online banking, security reason, high investment on ICT, lack of skills and knowledge, lack of managerial and technical skills and lack of past experience of banks in the online banking. Thus, although the online banking has considerably benefited many banks, it has also brought certain difficulties and challenges for banks and users that should be avoided to reap its full potential.

Ciciretti et al. (2009) conducted a preliminary investigation on the potentials and prospects of e-banking. They concluded that internet banking has spread across different countries of the world including Spain, Europe, Austria, Switzerland, the Scandinavian countries, Korea and Singapore. In these countries more than 75% of all the banks are engaged in the online banking activities. However, the largest number of online users in online banking has been attributed to the Scandinavian countries with about one-third of customers in Sweden and Finland is fascinating with the advents of online banking (Delgado et al., 2004). The US is among those states where online banking is still concentrated into the largest bank and even if banks offer the online services to customers in the US, about 6% only utilise such services. Therefore, the Scandinavian and European countries have the potential for online banking and the performance on banks in these countries is largely depends on the online banking (Mende et al., 2013).

However, most banks have not replaced their traditional banking system. Rather they have combined their brick and mortar system with the contemporary online banking, but some banks solely depend on the online means for offering their services. Therefore the online banking contains a lot of potential to replace the traditional banking system in the coming era (Ciciretti et al., 2009). Although such banks operate virtually or through internet only but the physical presence of an administration office or headquarter is also important for these banks. Moreover, they also provide some non-branching activities such as ATM for their customers (Delgado et al., 2004).

In developing economies, online banking is still limited to larger banks. Despite of growing use of internet among users, the online banking has not gained much popularity due to the threat of security and privacy in developing countries. However, having huge customer base and potential, these economies could become the major source of revenue for banks if they start using online banking system. This is because there are some emerging economies such as Korea where the internet usage is very high and a high prospect for online banking is also present. Therefore the online banking has become the most potential arena in the contemporary business environment that could easily dictate the profitability of banks in the fierce environment (Auta, 2010).

Technological innovations have contributed significantly towards the global transformation of traditional banking operations to the contemporary online banking. Consequently, online banking has become an important source of revenue for most of the banks operating in the Europe and Scandinavian countries. These banks embrace the technology but also place emphasis on the human competencies and skills. Therefore the online banking has found to be support better financial performance of banks in European countries where the online banking is growing larger. The online banking contains a lot of potential even for emerging countries because of huge population and percentage of online users in these countries.

Chapter 3: Research Methodology

This chapter explains the research methodology used and selected by the researcher for this specific research. The selected research model, research philosophy, research approach, research strategy, research choice, time horizon, data collection techniques, research limitations and ethical considerations are discussed in this chapter of the study. This chapter of the research holds great significance as the data is obtained based on the selected research tools and techniques presented in this chapter.

Research methodology is explained as the process which the researcher adopts in order to conduct research and this process takes into account selection of research methods and means (Kumar, 2010). It is actually related to data collection and using the acquired data to extract the required information to provide desirable results. The researcher in the process of research methodology tends to plan, collect, analyze and interpret the data to deliver results and research conclusion.

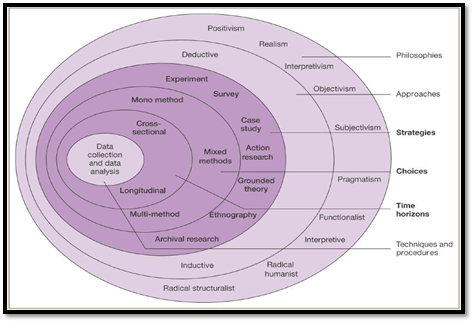

The researcher has this option to select the desired research model among the wide ranging research models. However, the research model that has been selected for the completion of this research is known as a research onion model by Saunders, Lewis and Thornhill (2009). The reason for selecting the research onion model is based on its characteristics as it assists the researcher to conduct research in a systematic way. Saunders et al., (2009) research onion model is presented in figure 1.

Figure 1: The research onion

Source: Saunders, Lewis and Thornhill (2009)

As figure 1 shows that there are six main layers of the research onion model. These layers are presented in detail as follows.

Saunders et al., (2009) stated that research philosophy is basically about the systematic search for knowledge along with values, language and the reasons. For this research study, it is important to have an open mind so to establish facts related to new as well as existing theories. There are various research philosophies catered in the first layers of the research onion model, namely positivism, realism, interpretivism, pragmatism, objectivism, subjectivism, radical humanist, radical structuralist and functionalist. Saunders et al., (2009) stated that positivism research philosophy tends to work with quantitative nature of data and tests the hypothesis of the study to provide statistical justification. Interpretivism on the contrary is entirely different from positivism research philosophy and tends to work with qualitative data. Realism research philosophy is the combination of positivism research philosophy and interpretivism research philosophy that the researcher mostly adopt when a scientific research is to be conducted keeping in view the social actors playing a major role. These are the three research philosophies that are most widely used for the completion of the research studies.

The research philosophy selected to carry out this research study is a realism research philosophy which is a mixture of positivism research philosophy and interpretivism research philosophy. The reason for selecting this research philosophy has been the nature of this research being qualitative as well as quantitative which works on evaluating the impact of online banking on the financial performance of Barclays Bank.

According to Badke (2011), there are two main research approaches, namely deductive research approach and inductive research approach. In deductive research approach, the research by using the existing theories comes up with the research hypothesis. The inductive research approach, on the other hand creates theories by taking into account observations and by evaluating the information. Easterby, Thorpe and Jackson (2008) explained that the deductive research approach works from the common view points before it proceeds towards particular scenarios. In addition, Philip and Thornhill (2006) stated that the deductive research approach works well with the positivism research philosophy which takes into account the hypothesis that tends to prove certain assumptions based on the research situation or problem. This requires the researcher while following deductive research approach to be general. The inductive approach, on the other hand does not require any preexisting theory in order to support the data that is already collected as well as evaluated.

The research approach chosen for this research study and that completely justified the aim and objectives of this research are mixed method approach. Mixed method approach is a combination of inductive research approach and deductive research approach. The research approach is suitable with the selected realism research philosophy and this approach is appropriate to evaluate the impact of the online banking on the financial performance of the Barclays bank and how the managers of the bank perceive the significance of the online banking in terms of improving the overall bank performance.

Saunders et al., (2009) explained that the research strategy helps the researcher by providing a plan which would answer all their research questions in a systematic manner. A researcher could select different research strategies for the completion of the research. However, an effective research strategy is in line with the research aim, objectives, resources, data collection and takes into account the limitations of the study which includes time constraints, monetary resources and ethical consideration. The different research strategies that can be utilized by the research includes surveys, case study, archival research, experiments, grounded theory, action research and ethnography (Saunders et al., 2009).

In order to conduct this research, the research strategy that has been chosen taking into accounts the research resources and limitations is survey method. Barclays bank is selected for justification of this research study and mainly to evaluate the impact that online banking has over the bank’s financial performance.

The fourth layer of the research onion model is research choices (Saunders et al., 2009). There are three main types of research choices: mono method, mixed method and multi method. Mono method research choice uses one data collection technique for a data analysis technique. The mixed method research choice uses a combination of data collection technique for qualitative as well as quantitative data analysis techniques. The multi method research choice takes into account the different data collection technique for one data analysis technique (either qualitative or quantitative) (Kumar, 2010).

In this research study, mixed method research choice has been used. The data collection techniques used in this research are questionnaire surveys and interview for both data analysis techniques as in, for qualitative as well as quantitative data analysis. The research choice selected for this research study is appropriate to fulfil the aim of the study, which is to evaluate the impact of online banking on the financial performance of the banks which in this research is Barclays.

A research either follows a cross sectional time horizon or a longitudinal time horizon. Saunders et al., (2009) stated that the cross sectional research needs to be completed within a specified time interval. On the contrary, the longitudinal research requires a longer duration as in a year or more for completion and data collection. The entire research is of cross sectional nature as it is likely to be completed within the time duration specified.

The researcher in order to conduct this research required using primary data along with secondary data. In this research study, both primary and secondary data are used. Creswell (2013) stated that primary data is collected by the research on a first hand basis as this is data is specifically for a research and is collected by the researcher for the very first time with the help of different methods and from various data sources. On the other hand, the secondary data is the data that is already available for the researcher to conduct research. Secondary data were already available as someone else has collected this data and it can be used for completion of the research study.

In this research study, primary data are obtained through questionnaire surveys and interviews. This primary data caters to the quantitative as well as quantitative data requirements of the study. A questionnaire has been developed and the employees of the selected bank were approached to analyze the impact of online banking on the financial performance of Barclays bank. The designed questionnaire comprises of both the open ended questions and the close ended questions. The open ended questions were designed for the managers of the bank. These managers were interviewed to obtain primary data.

Secondary data have been used in the literature review of the research study. The work of past researchers plays a major role in getting an understanding of the research problem and for this reason, in order to conduct a critical literature review, relevant data has been obtained from various secondary data sources. The secondary data in this research has been obtained from various journals, different published articles, books and websites.

3.9 SAMPLE SIZE AND SAMPLING TECHNIQUE

The population of the research study includes the stakeholders that are directly as well as indirectly involved with the research area. It makes it difficult for the researcher to gather information from the entire research population (Creswell, 2013). For this reason, the subset of the population known as sample is used for data collection purpose. In this research, the focus is on the employees and managerial staff of Barclays bank. The sample size of this research is 57 (50 employees of Barclays for questionnaire surveys and 7 managers interviewed at Barclays).

A convenience sampling technique that is a type of non-probability sampling is selected for this research study. The selected sampling technique equipped the researcher to obtain data with ease, keeping in view the time and resource limitation.

3.10 Techniques Of Data Analysis

In this research study, the data analysis technique used for analyzing quantitative analysis is with the assistance of statistical software, namely SPSS and through the use of relevant statistical tools and techniques from the SPSS software. The data analyzed through SPSS is presented in the form of tables and graphs. On the other hand, the qualitative data obtained from interviews of the managers at Barclays are analyzed using content analysis technique.

Ethics hold a critical position in the research study. For this reason, certain ethical considerations are taken into account while working on this research. For example, the research required data that were to be collected by the research on a first hand basis and this made the research ensure respondents that their privacy was maintained and the information shared with them will only be used for academic purpose. The researcher ensured that the respondent’s personal information was kept safe and not shared with third parties. In addition, the secondary data used in this research for ethical reason is properly cited and referenced.

There are certain limitations that are faced by the researcher while conducting this research. Firstly, time constraint was a major hurdle as it restricted the researcher to conduct research on an extensive level as the requirement was to complete the research within the defined time period. The requirement of this research was to collect the required data, analyze it and compile the report within the specified time interval and this made the research follow the time related limitations. Similarly, the limitations associated with budget and resources played a major role during this study. The constrained budget made the researcher adopt the most suitable research tools and methods as compared to the ones that would provide the most desirable results. Limitation pertaining to knowledge was another concern as the researcher required extensive knowledge to complete the research. These limitations took away the flexibility from the research study.

For the completion of this research study, the research model that has been adopted is Saunders et al., (2009) research onion model. This research is carried out with the assistance provided by the selected research model. The research philosophy adopted for this research is the realism research philosophy and therefore, mixed method approach has been used as the research approach. Survey method has been selected as the research strategy and cross sectional time horizon has been adopted to evaluate the impact of online banking on the financial performance of Barclays Bank. The data has been obtained from employees and managers of Barclays through surveys and interviews respectively, and the technique adopted for data analysis is through SPSS.

Chapter 4: Presentation, Analysis and Interpretation of the Results

4.1. Introduction

As set out in the structure of the research study provided in the first chapter, this chapter of the research study outlines the results and outcome by presenting, analyzing and interpreting the results obtained in a synchronized and organized manner. As mentioned by Creswell (2013), the result section of the study provides the findings which can be used to answer the research question and therefore indicates the extent to which this research justifies the research objectives. The findings of the research study which are set out in this section can be used to disapprove, confirm or reject the research objectives. In contrast to other chapters, this chapter provides the outcome of the study using as much quantitative figures and fine points as possible.

4.2. The Purpose of the Result Section

The result section of any study provides basis for the discussion where the researcher looks at the previous results provided in the existing literature and compare it with the current result to look for gaps and discrepancies in the outcome. The result section of the dissertation highlights the significance of the study and provides results which can be further used by the researcher to identify unexpected outcomes, deal with research problems, relate it with the research question and hypotheses or make recommendations. In this regard, the purpose of the result section in this particular research is that it will set out the result and outcome of the study which is presented by carefully analyzing the information provided in the questionnaires which is analyzed using IBM SPSS statistical software through descriptive statistics and through content analysis of the interviews.

Kumar (2010) quoted the words of Stephen Hinshaw, Chairman of the Psychology Department, University of California, Berkeley who stated that the main overall aim behind drafting the result and findings section of the dissertation is that it sets out the outcome of the study which is then reviewed by the researcher as he links the findings of this study with that of the existing literature to identify the gaps.

4.3. The Pre-writing Phase

Creswell (2013) explained that result and outcome chapter of this research study which is also referred to as the ‘brainstorming phase’ or ‘the Pre-writing Phase’ where the researcher examines the problem under study by carefully analyzing the data gathered from the respondents through different tools and techniques which provides outcome and findings that can be used for providing justification for the research question and objectives. Keeping in view, it can be said that this section is the most important phase as it allows the researcher to ponder over the research title using the available literature and then to draft the details.

4.4. The Profile of the data

Based on the nature of the study, the data for this research study is extracted from the representative sample which comprises of 50 managers and employees that are currently working in Barclays Bank using self-developed questionnaire as well as using the data extracted from the annual reports of the banks. The results of this study are provided shown below;

4.5. Findings from Primary Research

As mentioned above, the result and findings of this study is obtained using both survey and interview approach where five managers were selected for the interview using unstructured questionnaire while 50 managers and employees were selected for the survey using self-developed questionnaire. The data obtained through questionnaire is analyzed using descriptive statistics while data obtained from interview is analyzed using content analysis. The section below provides the results of this study;

4.5.1. Findings of the Interview

The section below provides the results which are obtained after carefully analyzing the responses obtained from the managers using content analysis;

- When Barclays bank launched its online banking services?

In response to this question, managers of Barclays bank mentioned that in the era of intense competition and availability of cutting edge technology, the bank with the aim to increase customer base and income, the bank launched online banking in 1999. In addition to this, manager 1 and manager 3 shed light on the overall aim behind offering online banking services which was to provide customers with innovative online banking services enabling customers to freely manage their day-to-day accounts, payment of credit cards and mortgage, take account of their daily balances, and to keep a tap of their detailed transactions.

- What are the benefits of online banking? Compare it with the traditional banking system?

Majority of the managers affirmed that online banking has changed the shape of the business environment. Manager 1 of Barclays Bank mentioned that online banking has changed the way people carry out their banking transaction as it has reduced traditional banking, in addition, it has reduced the culture of recording transaction and keeping books of accounts manually.

In contrast to manager 1, manager 2 stated some of the benefits of online banking over traditional banking where the manager mentioned that after the advent of online banking, banking has become real fast. Through online banking customers get banking services on a single click, further, both local and international transaction including remittances and money transfers can be done within less time and efforts.

The response from manager 3 was quite different as he compared the time taken by online banking and traditional banking. The manager mentioned that in traditional banking, customers were forced to follow a long procedure for any banking activity such as it used to take agonizing procedure for account opening but now with the advent of online banking the processes have become “one window operation” making it convenient for the customers.

Manager 4 and manager 5 pointed out the convenience and accessibility achieved through online banking which was absent in traditional banking. Managers asserted that in traditional banking, customers have to travel to the nearest branch of their respective bank which may be located in far distant areas or can be one in one country but in case of online banking, customers can carry out their banking transactions 24/7 and from any part of the world

- What are the impacts of online banking on traditional banking?

Majority of the managers have provided that generally it has been observed that after the advent of online banking, the traditional banking have decreased but in contrast to this few managers mentioned that the banking activities carried out through traditional banking remained the same and no substantial affects were observed on the amount of banking transaction. One of the manager even quoted that after the launch of online banking, Barclays continued to expand its traditional banking services which include opening branches in Pakistan, Russia, UK and other parts of the world thus highlighting no impact of online banking on traditional banking.

- What are the challenges faced by customers in case of online banking?

In response to this question, most of the managers provided same issues that their customers confront with when using internet banking which may include the effect of customers’ literacy on the usage of online banking. Managers asserted that in urban cities it is easy to promote online banking and it has been observed that customers are willing to use online banking due to the available literacy but in rural areas literacy is one of the most important issues. In addition, managers mentioned that they also experienced challenges from customers that lack the basic knowledge to use online banking due to their lack of knowledge regarding websites and their usage.

- How do you address the challenges faced by the customers in the context of online banking?

Managers mentioned that most of the challenges faced by the customers are dealt by customer representatives as they educate the customers that show willingness to use online banking by providing them information regarding how to open online account, how to look for their daily transaction, how to send remittances and transfer funds. Thus, it can be said that most of the problems can be dealt but problems related to lack of trust, literacy and confidence can pose serious threat on the online banking which became evident during the global financial crisis, as stated by manager 3.

- Why Barclays launched online banking?

In response to this question, manager 1 and manager 3 mentioned that the overall aim behind offering online banking services to customers was to provide customers with innovative online banking services enabling customers to freely manage their day-to-day accounts, payment of credit cards and mortgage, take account of their daily balances, and to keep a tap of their detailed transactions.

- What is the impact of Barclay’s online banking on the financial performance?

Manager 1 mentioned that the services and facilities provided by the banks to their customers along with the environment and ambiance serve as the major factors in increasing customer base, loyalty as well as banks profit. Online banking significantly integrated customers with the banks as funds can be transferred from ne account to another as well as from one bank to the other through online banking window within less time and efforts. As the banks are now more closely linked with each other as well as with banks across national borders thus this has increased accessibility and customer base of banks offering online banking over time.

Manager 2 shed more light on the benefits achieved by Barclays due to online banking which includes providing new opportunities, increasing service quality and increasing customer base. Through online banking, customers are more able to get all the banking services under one roof which enable banks to provide more unique banking techniques to cater the demand and needs of their customer to retain their customers.

Manager 3 mentioned that increased long-term relationship between the banks and the customers and highlighted that relationships with customers have enhanced due to online banking services offered by banks for better customer services.

Manager 4 and 5 discussed the basic motive behind launching online banking and how it affected the financial performance. The main motive behind online banking was to increase customer base, increase customer satisfaction, retain customers and expand business and eventually to increase profits. E-banking has successful reduced waste as now much of the transaction and records are maintained electronically on computers which reduce chances of human error, save time and increases accuracy; further, it reduces labor cost which eventually reduces operating expenses. Managers confirmed that online banking significantly add to the profits of their bank.

Manager 5 mentioned that although Barclay experiences significant costs in implementing online banking as it required infrastructure for e-banking, training of their employees and creating the environment which can increase service quality, image, brand equity and goodwill of the bank. In turn, the costs are well-covered by the banks in a few months.

- What are the future prospects of Barclay’s online banking?

Looking at the growth of technology and use of online banking, managers have shown a positive attitude towards online banking as they mentioned that online banking is increasing profitability of the banks and financial performance thus Barclays is looking forward to come up with more innovative and unique features for their online banking and to completely adopt modern e-banking services.

4.5.2. Findings of the Survey

The section below provides the results which are obtained after carefully analyzing the responses obtained from the managers and employees using statistical analysis;

Response Rate

The survey questionnaires were given out to 50 managers and employees of Barclays bank who were contacted through email and tracked down on the social media websites such as LinkedIn and Twitter where, upon agreement, the questionnaire were sent through email or embedded in the social media messenger. All the questionnaires that were sent out to the managers were received. Filled and complete which indicates that the response rate for this study is;

Table 1

| Questionnaire mailed | 50 |

| Questionnaires received | 50 |

| Questionnaires rejected | 0 |

| Response Rate | 100% |

Reliability of the results

In order to test the reliability of the result, Cronbach alpha was estimated using all the variables under study. The table 2 below highlights that the alpha was greater than 0.70 which implies that the data is reliable and can be used for making judgments and recommendations for the future studies.

Table 2

| Reliability Statistics | |

| Cronbach’s Alpha | N of Items |

| .939 | 22 |

Demographic analysis

This section of the study carefully analyzes the demographic profile of the respondents to gain insights about the extent to which the problem statement is understood by the participants. It has been observed that factors such as age and gender mainly influence the employee’s ability to use advance and modern technology. Thus, this section provides an analysis of the demographic profile which is as follows;

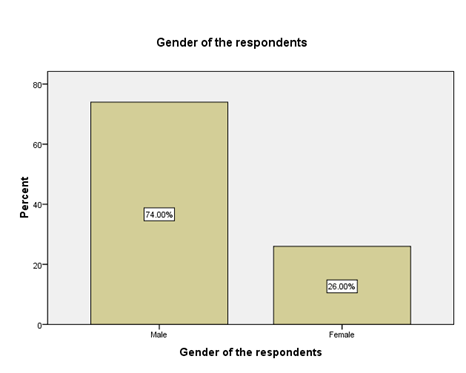

Figure 1

As shown in the figure 1 above, most of the respondents (74%) that took in the survey are male whereas the remaining 26% of the sample size represent female managers at Barclays Bank. This highlights that the results of the study may be influenced by gender biasness as males are more likely to use innovative services and products due to their low uncertainty avoidance nature compare to females.

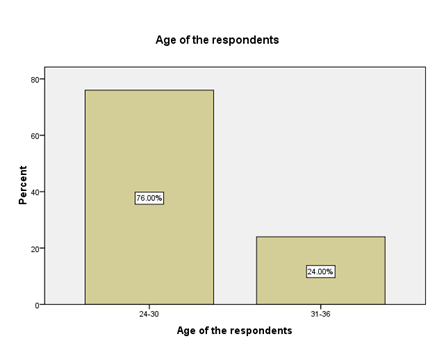

Figure 2

As shown in the figure 2 above, most of the respondents (76%) that took in the survey fall in the age bracket of 24 and 30 years whereas the remaining 24% of the sample size represent employees that have ages between 31 and 36 years. This highlights that most of the participants that took part in the survey have the required skills, knowledge and expertise regarding the topic under study which may assist in obtaining accurate responses.

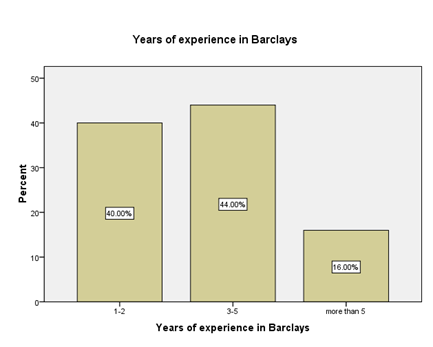

Figure 3

As shown in the figure 3 above, most of the respondents (44%) that took in the survey have 3 to 5 years of experience, 40% of the sample size have 1 to 2 years of experience while 16% of the respondents have been working in the bank for more than 5 years. This highlights that most of the employees of Barclays have been with the bank for more than 1 year and have observed the impact of online banking on the financial performance and therefore are able to provide better insights to the problem statement.

Research Related Analysis

This section provides the analysis for the research related questions which is as follows;

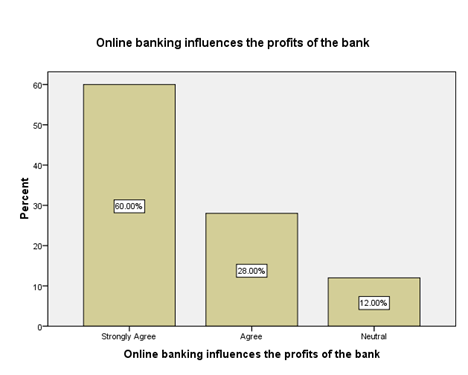

Figure 4

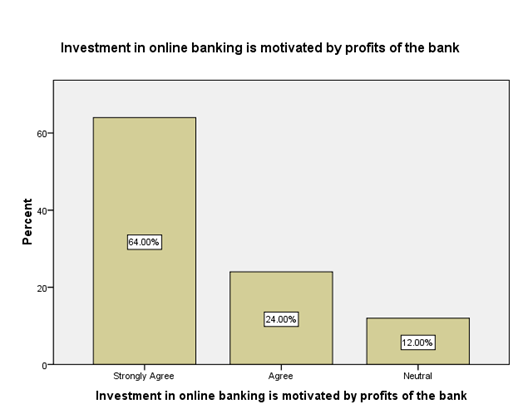

As shown in the figure 4 above, most of the respondents (60%) strongly agree with the perspective that online banking influences the profits of the bank, which can be in either direction. 28% of the sample size agreed to the statement while 12% of the respondents remained neutral. This highlights that most of the employees believe that Barclay’s online banking significantly affected the profits of the bank. This can be in either direction as noted by one manager that during the financial crisis, consumer lost confidence over online banking and thus e-banking transactions declined resulting in significant drop in profit margins.

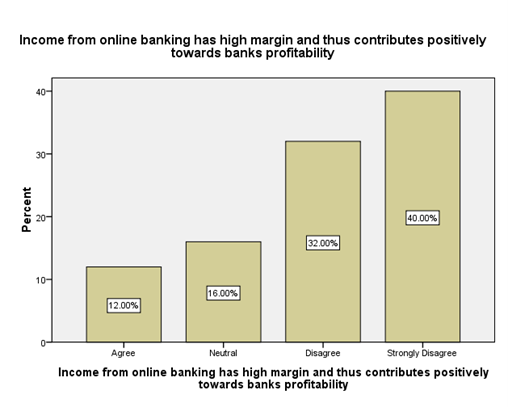

Figure 5