Qantas.com Corporate Accounting Figures, Intangible Assets Sustainability and CSR

Introduction

The assessment of this assignment is based on has been over the overview of an Australian based Airlines company that has been on rise more than a decade in Australia (“Qantas.com”, 2019). The key factors, the accounting figures, the intangible assets sustainability and the social responsibility of the firm has been show cased in this assessment (Watson, 2015).

Description and details of the selected company

The Qantas Airways was founded in the region of Queensland back in 1920’s; they have been known to be growing Australia’s largest international and domestic airline company (“Qantas.com”, 2019). The firm has been registered in the northern territory Aerial services and Queensland, Qantas has been regarded widely as the globally recognized distance airways and one of the prominent brands in Australia (“Qantas.com”, 2019). Their reputation has been concentrating on the safety, reliability in operations, maintenance and engineering, and the efficient customer services. The airways company has been operating in the domestic as well as the international segments (“Qantas.com”, 2019). They have also been operating o the subsidiary businesses which includes other airlines. The main group of the Qatar airways’ main business is the transporting of customers which uses two complimentary brands like the Jet star and Qantas. Apart from the airline sector they promote sponsorships in sports and arts and do welfare for the community (Schneider, 2015).

Industry segment

The mentioned company works in the field of Airlines and is associated with domestic and international flights all across the world (“Qantas.com”, 2019). The industry has been growing as it is an airline industry and their main motive is to focus on the flights and regulations. The main competitor of the Qantas airlines are the famous Air India, Singapore airlines, Etihad airways, Malaysia airlines, Qatar airways, the famous emirates, Lufthansa and the British Airways. The firm is an airline company which is totally public and the organization is ranked 17th out of all the 2000 companies in Australia (“Qantas.com”, 2019). The innovation in the digital data segment and the customer data segment are the major competitive advantage for the brand Qantas and it has been continuing to be pivotal in meeting the modern customer experiences. In the coming year 2020, Qantas will be retiring six of their 747-400 and increase the production of 787 to 14 in the present year (“Qantas.com”, 2019). Their target has been a premium international airline and has a strong domestic and international prominence (Paterson et al., 2018). Their implication has been an implication for providing abundant services like the lounges, fryer programs etc.

Funding sources and financial structure

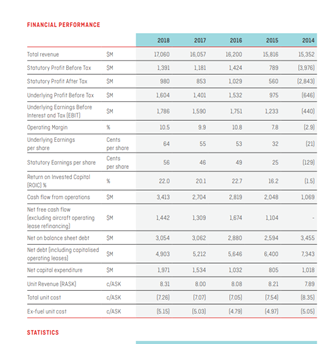

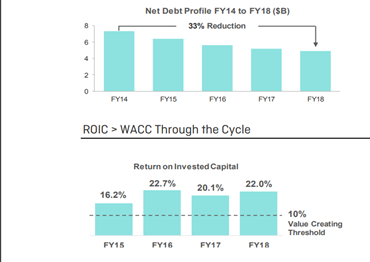

The renowned airlines brand has been making record breaking profits through their statistical measures and they have an underlying $1.7 billion dollars underlying profit before taxation which is the highest in the history of Qantas, their shares are numbered 56 cents and have a 23% returning investment capital, and their operating cash flow is around $3,414 million dollars, also their returning shareholders has around $1 billion in their pockets (Speed 2017). Qantas domestic has around $768 million underlying EBIT which is up by 195, and in the international segment they have around $400 million EBIT up by 19% underlying. In the collaboration with the jet star group their underlying EBIT is around $462 million which is up by 11% and their loyalty amount is $372 million which is up by 1% (“Qantas.com”, 2019).

Financial Framework

Financial performance and Annual report

The items that have been under the management segment which is identified and conveyed to the CO making of choice bodies not presenting the presentation that has been underlying for the business that are not involved in the primary PBT, the concentration of these prospects is ready made after the reconsideration of their materialism and nature which has been applied continuously over the period (Agrawal & Cooper, 2017). The commodities that are not involved in the underlying PBT majorly provides an outcome from the revenues or the expenditures relating the activities in the business activities or the reporting spans, the prime transformation stages, the transaction including giving of money, and the assets and other money dealings outside the course of trade (Maas, Schaltegger & Crutzen, 2016). The EBA acts employees open for registration and had succeeded to an 18 month pay freezing which has been announced on the 20th of August, 2015.

Change in the accounting policies

The recent amendments made by the government to the act of corporations have completely changed the barriers of the firm in coordination to the reports made annually (Crotty 2018). As an outcome, the shareholders of Qantas have been no longer receiving a printed copy of the annual report unless advising the Qantas share registry (“Qantas.com”, 2019). The shareholders of Qantas have the option to elect to get notified via emails upon the availability of the annual reports online. In order to get this inform the communication, options are available online through the Qantas share archive facilities. And if an individual choses to get the hard copy of the previous reports it would be sent via an email (Kothari, 2019). The service would notify up on the availability of the reports asked.

Intangible assets and company relevance

The meaning of an intangible assets is defined as the identified non-monetary possessions that cannot be seen, touched or can’t be physically measured (“Qantas.com”, 2019). Qantas airways’ intangible assets for the ending quarter on 2018 were around $833 Million dollars. The intangible assets would categorize the copyrights, patents, secrets of trade and trademarks (Crotty 2018). If the goodwill is remaining the same, the firm while acquiring other organizations is perhaps paying less than the value on the book or not acquiring at all. Businesses with a moat are never sold lesser than the value on the book. In this case, the brand name being the Qantas Airways Ltd is a key example (“Qantas.com”, 2019).

Accounting policies of the intangible assets

The initial Final Report has been made accordingly that properly complies with “Australian Accounting Standards” that is being adopted by the “Australian Accounting Standards Board” and the “Corporations Act” (“Qantas.com”, 2019). To add further, the Report mainly states that the “International Financial Reporting Standards (IFRSs)” as well as the interpretations that is being undertaken by the “International Accounting Standards Board”. Furthermore, the Report is represented in AU dollars, which is the working currency of Qantas Airways and their controlled entities and has been made basing on the historical cost except in agreement with applicable accounting policies where assets and liabilities are specified at their fair values (Crotty 2018). In accordance with the usage of the implemented instrument the kinds of reference of the Australian securities, all information relating the financials represented has been rounded to the nearest million dollars (Atanasov & Black, 2016).

Impaired items

The target of Qantas Airways is to be the airline for the consumers with particular needs, by giving the experience of travel which is comfortable and issue free, along with the endurance of safety feature of the passengers and the staff of Qantas (“Qantas.com”, 2019). They offer various types of assistance for the travelers with low rate of mobility and other particular needs. The information regarding this help would be found in their own website represented. Any sort of assistance from the Qantas is accessible by dialing 13 13 13 with the Australian region or in the local offices (Balakrishnan, Watts & Zuo, 2016).

Research component

Social responsibility and sustainability report

In the year 2016, the historic agreement was destined by the Qantas ltd for meeting the commitment level that is predominated within sectors as there is scope in future years also (White 2018). The offset carbon and the scheme of reduction for CORSIA, would be commencing on 2021 would be needed where airline industry will be purchasing the nearby offsets for meeting the own share and attainment of future growth and lead to smooth functioning of business enterprise (Jefrey, 2018). Qantas has been strongly advocating the Australian government choosing in the phase one of the pattern oriented just to ignore the substitutional makeshift to carbon pricing (Crotty 2018). Qantas will be commencing the report on various other components and some of these are the international emissions for CORSIA agreement that took place from 1st of January 2019, venturing the report of the local emissions which they have been leading under the government of Australia national greenhouse and energy reporting scheme whilst 2009 (“Qantas.com”, 2019). In the year 2017, Qantas supported the IATA resolution which called for the governments to pace the development of aviation biofuels, and they have continued to work with the Australian federal as well as state governments for policy designing which would provision commercialization of the flight biofuels in Australia that is currently the sub-scaling (Ijiri, 2018).

Media broadcasts by the Qantas airways

On 14th January 2011, The Qantas group announced that they will be launching direct services from Sydney to Dallas IA, on the press coverage. In 2019, they have also announced that a series of frequent flyer redemption would take place across its entire network with the seats which is only available to the members Qantas points the inaugural points plane will be the Airbus A380 which would be operating from Melbourne to Tokyo on the 21st of October (White 2018). The concept is the one of the various Qantas Loyalty which is exploring to reward Qantas frequent flyer members and feature them with even more redeeming opportunities. In order to maximize flexibility on the level of returning the members have the option for the booking an A330 return points plane on the October 26th or to depart on a substitute date of their option by booking a classical rewarding seat with the Qantas partner airline (“Qantas.com”, 2019).

Importance of corporate social responsibility and sustainability

It is very much important that any firm operating in a way that would be demonstrating social responsibility (“Qantas.com”, 2019). Even though this is not a legal requirement, it is seen as a good social value and a practice for the firm to take into consideration involving social and environmental issues (Honggowati et al., 2017). The social responsibility and the mythical practices are vital to the success for the firm. The 2015 cone global CSR study suggests that the rising 91% of the global buyers expects the businesses to operate with a responsible sense of address to the social and environmental problems (“Qantas.com”, 2019). Nevertheless, 85% has been saying that they have been seeking out the responsible products anywhere possible. As the analytics recommend the buyers are hiking aware of the role of the social responsibility and demandingly seeks products from the business they have been operating (Caskey & Laux, 2016). CSR has been demonstrating that the firms business that takes a wide range of interest in the broader social matters, rather than who can actually impact the firm profit margins levels, which would be attracting customers who has been sharing the similar values (Epstein, 2018). Thus, it would be making a good sense of all-round business and operate sustainably. Also, there are a lot of benefits from the CSR volumes about how much important it is and why the firm should try to make an effort to adapt in the firms business (White 2018). Improving the public image is a crucial aspect as the buyers would be seeing your public image in order to design whether they want to buy from the subjected firm. The form of cost savings in the favor of sustainability which would be less amount of packaging and increasing brand awareness which will help the firm to establish itself well in front of the consumers (Duff, 2016).

Conclusion

The final part of this assignment refers to the social aspects of the firm that has been on the scale of their market presence and the form of activities they have been doing for the society. This assignment also refers to the basics of a company mentioned Qantas Airways starting from the accounting aspect to the sustainability.