UK Airline Sector Market Structure Analysis

Introduction

Every market, whether local or global, has a set of characteristics that define and make it unique from the other markets. The varied characteristics that define each market have led to the development of different market structures that pool similar markets together. According to Aguiló, Alegre, and Sard, (2003, p. 270), a market structure refers to the collective characteristics of an organization or a market that make it unique when compared to the other markets. It focuses on the characteristics that have an impact on the market’s prices and competition while at the same time affecting the prices of the market share. Importantly, market structures are defined by multiple firms (both local and global), firms with the largest share, and the type of costs in the market (Ignatius, Tan, Dhamotharan, and Goh, 2018). The types of costs that are commonly looked at in a market structure include the potential that an organization has to exploit the available economies of scale and the sunk costs availability that affect market contestability. The other notable features of a market structure are the extent to which an industry is vertically integrated, the degree of product differentiation, customer turnover and buyer’s structure in the market. Based on these characteristics, market structures affect the pricing strategies adopted by organizations operating in the same market. In line with this, this paper seeks to give an analysis of the market structures and pricing mechanisms that characterize air travel in the United Kingdom.

Market structure that characterize the air industry

The operations of the air industry are controlled by very few players due to the nature of the business and the capital needed to run the business. As such, the characteristic features of the air travel industry make it fit the oligopoly market structure well due to its imperfect competition characteristic that limits the number of players in the market. The imperfect competition characteristic of the airline market in the United Kingdom has seen very few companies operate in the sector, with the likes of the British Airways, Virgin Atlantic, Easy Jet, Emirates, Qantas, and Etihad Airways being some of the key market players (Aguiló, Alegre, and Sard, 2003, p. 275). The presence of this small number of operators gives them power to dominate the pricing strategy in the market. The reason for their price dominance is linked to how oligopolistic companies are empowered to set or alter their product or service prices by developing multiple levels of output.

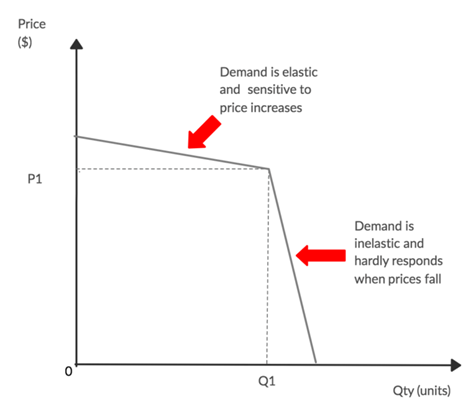

Figure 1: The behavior of the oligopoly market structure

Source: Gregory (2002)

Again, all firms in the air travel industry in the United States offer the same services, meaning that any slight adjustments made by one of the players is equally felt by the other players. For example, a change in the price of tickets by Virgin Atlantic will directly be felt by the British Airways because it will lead to a shift in customer preference from one airline to the other. Reducing the price of the air ticket by one of the companies will make customers to develop a bias towards any of the other airlines that fails to adjust its prices downwards (Ignatius, Tan, Dhamotharan, and Goh, 2018. p, 2280). As such, oligopolistic companies have the power to adjust their prices anytime they feel like changing without making any consultations with the other stakeholders.

However, while one company may decide to act smart and change its prices slightly, its competing rivals can decide to cut its prices a little further as part of their strategy to enhance their market share. The price cutting strategy works perfectly in gaining a fair share of the market they serve because customers are always attracted by any of the providers who offer best services at low prices (Evans, 2001, p. 495). The ability to make decisions based on the adjustments made by other companies mean that organizations in the oligopoly are interdependent, meaning that their specific market power is dependent on the decisions made by the other players in the market (Cominetti, Correa, and Stier-Moses, 2009). Importantly, the interdependency of oligopolistic firms can also be easily eroded by the decisions made by all the other companies operating in the same market.

The effectiveness of this market structure is also easily affected by the introduction of new companies in the sector because they may introduce prices that change how the other organizations carry out their pricing. For example, having a new airline get into the market means that the company can come up with its own pricing strategy within the first few months of operations, and this will destabilize the operations made by other companies in the same market (Evans, 2001, p. 480). The struggle by a company to make it in the oligopolistic market is influenced by the fact that the common measure of an organization’s market power in this structure is determined by its concentration ratio. The ratio is directly related to the market share of the biggest companies in the industry over the size of the whole market.

Pricing Mechanisms

One of the important elements in any business is how product or service prices are determined. Adopting the right pricing mechanism will lead to an improvement in the profits made by an organization from its sales or operations while relying on a poor pricing strategy will lead to a series of losses being experienced in the operations of an organization (Cominetti, Correa, and Stier-Moses, 2009, p. 1425). In the air travel business, the pricing techniques adopted by an airline determine whether customers will be attracted to its services or not. The common pricing strategies that have been evident in the UK air travel industry include total customization, competitive pricing, customer profiling, and brand image.

Total customization

Customers in the aviation industry pay their tickets based on the class that they want to travel in. To separate different classes of customers during the booking process, airlines have different prices for the business, economic, and first-class passengers (Saharan, Bawa, and Kumar, 2020). The variation in the pricing is linked to the varied services that are offered in each of the classes, with first-class passengers being privileged to get better service compared to passengers in other classes (Wang, 2009).

Competitive pricing

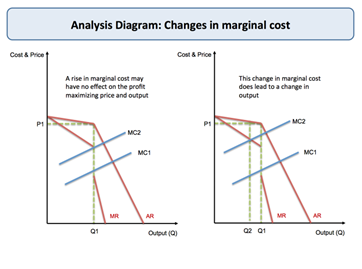

The airline sector has become one of the highly competitive sectors in the world because new entrants have been finding their way into the market more than they did in the past. The tremendous growth in air travel has led to a decline in the money paid by different passengers from one point to the other (Feng, Li, and Li, 2013, p. 63). However, the high competition levels have led to the adoption of competitive pricing techniques like the Expected Marginal Seat Revenue (EMSR) due to its ability to help companies optimize on what they charge in real-time (Delahaye, et al., 2017, p. 625). Competitive pricing has led to better decisions being attained by companies in their bid to take advantage of the highly competitive market environment.

Figure 2: Changes in organizational marginal costs

Source: Gregory (2002)

Brand image

The high level of competition in the airline travel industry makes companies offering varied services an opportunity to overcharge their customers or charge based on the existing market prices. Companies that have made a name for themselves in the aviation industry are free to charge their customers any price they feel is good for their brand (Saharan, Bawa, and Kumar, 2020). However, despite using their brand as part of their pricing strategy, different seasons call for different pricing strategies, with low season when the seats are empty calling for lower prices as opposed to when the season is high and demand for air travel is high too.

Customer profiling

The reason why customers travel from one part of the world to the other is used to determine the prices they are to pay to various airlines (Zhan, Ma, Li, and Zhu, 2019). For example, people travelling for holidays tend to have a different package compared to people going for important missions or those travelling for business reasons (Delahaye, et al., 2017). Holiday destinations are charged high while business destinations are lowly charged because the number of people going for business trips is low compared to those going for leisure trips.

Conclusion

The airline industry in the United Kingdom fits in the oligopolistic market structure because it is characterized by fewer companies who control plane ticket prices in the industry. Having these companies in the market means that a slight change in the pricing of one airline leads to changes in the price charged by other airlines. To determine the prices charged by different airline companies, pricing strategies like customer profiling, brand image, competitive pricing, and total customization have been adopted.