The Washington Consensus concerns the adoption and expansion of neoliberal policies and practices. For the past thirty to forty years, this agenda has dominated market economies. In the past few years, emerging research is demonstrating the challenge of this agenda(Picketty 2014). The following will argue that the limitations of neoliberalism, is the challenge or ‘underperforming’ strategy of Financialization. Financialization is a policy agenda and political process of increasing the financial sector instruments and institutions that are involved with areas like banking, insurance, investments and capital management. This paper will outline the key arguments that criticize the agenda of financialization. Three developing countries that have adopted this(Mexico, Bulgaria and Romania), will serve as case studies to demonstrate the underperformance of Neoliberalism or the Washington consensus. The Washington Consensus maintained that wealth would trickle down if private corporations rather than government managed finance and development. Rather, neoliberal policies have resulted in stagnation or negative growth, and further, it has resulted in a greater disparity between the rich and the poor. Therefore, the limitations of neoliberalism, presents a challenge for financialization.

Financialization Defined

In the simplest of terms, financialization means the increase of the financial sector of the economy over and against the real sector(Palley 2013). The real sector is defined in terms of the production of goods and services, while financialization is generally viewed as ‘capital’ increasing ‘capital’. For instance, the mere accumulation of interest on a loan or investment is capital creating capital rather than real people achieving the general of capital.

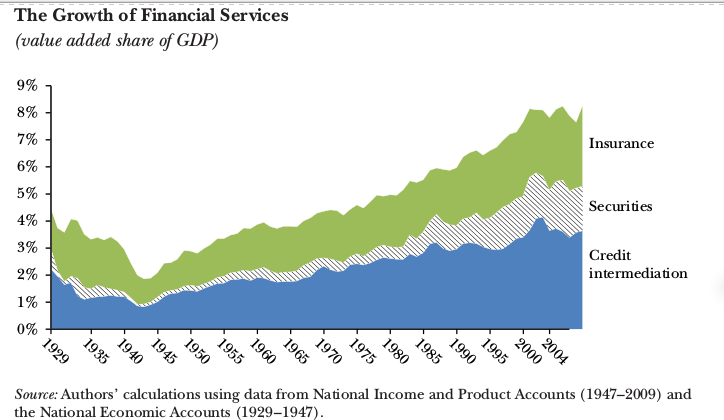

‘Real’ in this sense, means actual material or output, while financialization essentially means an increase of paper money(Palley 2013). To contrast the finance sector with the ‘real’ economy, supposes that there is something non-real about financialization. However, the non-reality really just means that finance is an abstraction when compared with other sectors. At the same time, financialization over and against other sectors of the economy, has increased significantly since the post-war period or from 1945, to the present(Godechot 2015), and has gone through several phases of growth that has been particularly significant since 1980 (see: APPENDIX ONE).

Financialization and Neoliberalism

Financialization is as much about political-economy as it is strictly a micro or macro-economic term. It is political to the extent, that some maintain that it is little more than an ideology(Tomaskovic-Devey 2015). Indeed, the support for this position, is defended by the emergence and growth of financialization alongside the emergence and growth of neoliberalism as the main ideology that has driven the policy objectives of international development and also domestic economic policy (Gospel 2014). Financialization is also inseparable from the decline of manufacturing and the rise of the ‘service sector economy'(Hirst 2015). Both the outsourcing of manufacturing to the developing world, and the increase in automated technologies have significantly influenced financialization. Beyond the economics of declining manufacturing and its impact, the rise of financialization is political or ideological(Palley 2016). Neoliberalism is inseparable from the Chicago School of Economics. At the centre of this school, was Milton Friedman and Frederick Hayek(Gospel 2014). Both maintained that economic growth will occur at greater rates when the government does not interfere with the private sector. The private sector was viewed both as more efficient, but also the instruments of the overall market. When supply and demand are solely the outcome of market forces, growth occurs at grater rates.

The ‘laffer’ curve is one of the primary economic theories that underpins this theory(Gospel 2014). Friedman’s curve is an attempt to demonstrate how ‘capital’ if it is taken away from the public sector, and then allowed to continue to circulate in the private sector, results in accelerated growth rates and higher degrees overall of employment and GDP(Palley 2013). The reason why this is viewed as ‘ideology’ less so than policy, is because this strategy serves the interests of business over and against the general population. It is a form of ‘legitimation’ that allows for the cutbacks of government that impact the poorest the most, and impacts the wealthy the least(Van der Zwan 2014). With fewer government services, the affluent can pay less tax’s therefore increasing their share of ‘capital’. However, these very services like education, social supports and health-care, impact those who cannot afford to buy these services from the private sector. While critics call this an ideology that serves the interests of business against the interests of the public, figures like Friedman and Hayak maintain that wealth ‘trickles’ down(Hirst 2015; Rajsingh 2016).

In the 1970’s the rise of the Chicago School of economics had a significant impact on both foreign and domestic economic policy and that influence continues. In terms of the concrete application of this model, the political election of Prime Minister Margaret Thatcher in the UK (1979) and then, the election of President Ronald Reagan (1980) is a watershed period for financialization(Gospel 2014; Harvey 2007). The reason why this new approach of cutting back government and improving the private sector, was driven also by labour problems and also, the perception that government was getting too large and this resulted in the increase of both debt and deficit financing. One of the outcomes was globalization(Gospel 2014). Governments started de-regulating, and one of the consequences of fewer government restrictions in trade and tariffs, was the rise of the finance and service sectors(Picketty 2014). Globalization has been the outcome of neoliberalism, and in turn, the quest for cheaper labour and fewer regulations that protect the health and safety of workers and the regulations that also protect the environment(Harvey 2007). The rise of financialization is therefore inseparable from the neoliberal platform. Where believers think that the outcome is growth, it has been outlined that critics maintain that it is an ideology because the growth occurs among the owners of ‘capital’ and excludes those who have to sell their labour in order to subsist (Hirst 2015; Picketty 2014; Gospel 2014).

One of the most significant validations of the private sector and the significance of financialization emerged with the Bretton-Woods Agreement. This was an international agreement ratified by 44 nation-states that abandoned the gold standard(Picketty 2014). Gold was viewed as the means by which international trade could occur becasue it was a medium for diverging currencies. However, the eradication of this form of standard, and the switch to national currencies for the determination of the value of exchange rate, was a reaction to the Stock Market Crash in 1929, and the Great Depression that followed(Harvey 2007). By using currency standards, national banks could regulate more efficiently. Runaway inflation was one of the most significant forces creating poverty in the Great Depression. To control inflation, the banks generally use the instrument of interest rates(Harvey 2007). When inflation is high, banks will increase interest rates and the opposite is likewise the case. Interest rates will determine how much corporations and individuals will seek financing. The importance of this change from the Gold Standard, harmonizes also with the idea that the private sector is more efficient than government at controlling growth in the economy. Business and financial institutions like Banks have become important drivers of growth since the eradication of the gold standard, and this is an important dimension that helps explain the rise of financialization(Palley 2013; 2016).

Finacialization and International Development

The background to financialization as a policy for development, has much to do with post-colonial geopolitics and globalization. Since 1945, de-colonization has been a significant International trend. Colonization means, the European control of nations world-wide(Epstein 2005). The largest of these imperial powers was England. Most of what we call the developing world became colonized in(Peck 2002). In the post-war period, a number of factors contributed to the liberation of many of these colonies. First, they were starting to be viewed as unprofitable. Symbolically, the independence of India from Britain in 1948 is viewed as a significant transition. Other colonies took longer. For example, Jamaica and Rhodesia (now, Zimbabwe) were not given independence until the 1960’s. What is important about de-colonization, is a particular vacuum that this created. The vacuum in the same period was beginning to get filled by the expansion of Soviet communism(León 2015; Palley 2016). In this period, most of Eastern Europe became an extension of the Soviet Union, and to many of the newly independent countries, communism was perceived as a possible means of growth through independence.

One of the important aspects of this vacuum, was that it created the challenge for development and growth. Where the colonial model was quite a simple form of economic planning and infrastructure, after this structure was gone, the integration with the International economy was viewed as both essential to their development and growth, but also, essential to combat the spread of communism(Harvey 2007; Hirst 2015). In this period, the ideological conflict and consequent ‘arms race’ was defined as the Cold War period. It is important to understand that the emergence and expansion of financialization, is inseparable from the emergence of policies and strategies to help aid the development of former colonies. At the same time, because the gold standard was being eliminated, the rise of the World Bank(WB) and World Trade Organization(WTO) began along with the International Monetary Fund(IMF), and the United Nations(UN). These institutions became the most significant institutions for international development(Hirst 2015) and financialization.

There is no separating the aims of financialization, and most of its implementation without a consideration of the policies and practices of both the IMF and the WB. Just as the emerging neoliberal’s in the 1970’s and 1980’s viewed government as inefficient domestically, so too with foreign policy(Harvey 2007; Hirst 2015). There was a shift with both the IMF and the WB during this period. Their approach to providing aid for development, and mostly loans/capital to these developing countries, has always to find ways to minimize the risk of losing it. By introducing and expanding on financialization, a two-fold impact is being made by the IMF and the WB(Hirst 2015).

First, by integrating private lending institutions and guaranteeing some of the loans provided by these institutions, the push toward this approach legitimated this through the neoliberal axiom that the private sector could manage better than public institutions, and this was believed to be especially true when it came to the introduction and implementation of financialization (Tomaskovic-Devey 2015). When it comes to loaning money and creating the infrastructures in order to expand financialization, the WB also imposed privatization beyond the finance and banking sector. In some well documented and widely circulated cases, the IMF and WB facilitated infrastructure development in a way that imposed the privatization of natural resources including water(Bakker 2015). In Africa, the IMF and WB supplied the capital to build water wells and filtration systems, but the private corporations who did this tried to sell water to impoverished families and individuals(Hirst 2015). There were new water pumps to provide water to aid agriculture, and just survival or sustenance, however, no one could afford to purchase the water.

Financialization and 3 Case-Studies: Bulgaria, Romania and Mexico

In terms of the imposition of privately run and held organizations that are connected to financialization, consider the case of Bulgaria. Following the end of Soviet communism in 1989, Bulgaria became an independent and a developing country . In Bulgaria, the initial years were difficult in terms of stability and this is true whenever there is this much of an economic infrastructure change. By 1997, Bulgaria sought the support and aid of more developed countries and the result was an increase of private banks, and in turn, their control of currency(Pavlova 2015). Much like the management of interest rates elsewhere, the banks did in the short term stabilize the economy. This reigned inflation, but further made this an attractive economy for foreign investment. At the same time that the financial infrastructure or the financialization of the country was occurring, so too was the concentration of wealth. As Pavlova and Sariiski (2014) demonstrate with extensive analysis of economic data, profit that was obtained from the development of financialization, left the country. When the IMF guaranteed investment opportunities for outside corporations, capital left the country and organizations that expanded the infrastructure for financialization in Bulgaria(Pavlova 2015). Further, one of the problems about financialization in general, is that it benefits from loaning. The more institutions loan, the greater the profit. While a government who guarantees a loan in the form of aid (via the WB or IMF) is doing so without the incentive to make profit, it is the case that with private lending institutions, it is actually in their best interest to loan as much as they can(Harvey 2007).

Some economists have argued that this results in greater ‘debt’ and not the opposite which neoliberalism promises. In Bulgaria, the debt increased with the introduction and expansion of financialization. Palley (2013) demonstrates that in the US, and world-wide this is actually the outcome of financialization. Where financialization as a sector grows, is through the very institutions that benefit from debt. What financialization left in Bulgaria, was a situation where the polarization between the rich and poor became worse, and debt financing became the norm (Pavlova and Sariiski 2014). Debt financing earns private banks money, and this is one of the main criticisms of neoliberalism. Wealth in the case of Bulgaria did not trickle down, but became more concentrated in the foreign corporations who both loaned money but also, developed the financialization of the economy. The result was that the challenge of growing the economy was not realized.

In Romania, the same basic problems occurred. Like Bulgaria, they were a developing country in the post communist era. They took loans from the WB, and then, adapted the IMF dictated policy changes that accompanied these loans. In terms of financialization, what the case of Romania demonstrated was that the stabilization of the economy was continually compromised by the currency markets(Gabor 2011). In developing countries, one of the important obstacles, are exchange rates. While a developing economy is going to have a comparatively lower currency exchange rate that a developed economy, the financialization of the economy aims to achieve a greater balance.

One of the instruments that was introduced specific to the financialization was the expansion of currency exchange markets. With the greater flow of foreign capital, it was thought that there would be reinvestment. However, like Bulgaria, capital just wound up leaving the country. Where currency exchange is an important factor in economic growth, the growth really only occurred among the institutions of financialization that were participating in it(Gabor 2011; 2013). This meant that the profits from these markets were leaving to benefit the very institutions or foreign lenders who introduced these practices of financialization. However, what occurred was a growing inflation of imports, and then, an increase in taxation that further imposed hardship and burden on the average citizen. Even with the attempt to control inflation, capital flowed out of the country and imports decreased because the demand fell significantly.

A third case study worth noting that had the same outcome as Romania and Bulgaria, is the country of Mexico. However, an important difference is that it is not a developing economy that just emerged out of a vacuum left by political upheaval, and therefore, it was not in need of the same aid that was introduced by the IMF, the World Trade Organization and the WB in both Eastern European countries so far analyzed. Rather, Mexico largely moved toward financialization as a way of improving economic growth, and the attempt to expand this sector coincided with policy decisions that were likewise, defined within a neoliberal paradigm that favoured less government controls, and greater privatization(Doyran 2015). Like the other countries discussed, one of the key problems of financialization is relative currency value. How is banking in a developing country going to compete with the developed world when the exchange rate is so different. Where purchasing power for the more valuable currency is greater, exchange is one-way. In Mexico, many goods and some services were exported and were attractive investments, however, parity was not achieved so little imports were made through the same period(Correa 2012). Further, the proximity and integration with the US economy, stimulated job-growth because of increased ‘outsourcing’. However, the real wages created by more employment, did not rise in a way that would have had impact. That is, the challenge of creating growth and economic stimulation was barely noticed. As a consequence, there was wage stagnation in Mexico and no stable growth that developed internally. In cases where exports are high, and imports are low — because of exchange, no stability is created overall. In Mexico and elsewhere, growth and the flow of capital was entirely dependent on foreign investment. Moreover, foreign investment or the flow of capital is not going to be consistently distributed or consistently reinvested.

Any economic downturn that occurs in the higher currency economy, will automatically impact the economy with the lower currency value and this is exactly what happened in Mexico(Levy-Orlik 2012; Correa 2012). Through the 1990’s, the expanded financialization increased the amount of exchange and investment from foreign private lending and service institutions. However, growth never occurred in the way that was expected by neoliberal policy makers and the politicians. Further, like what happened in both Romania and Bulgaria, capital wound up leaving the country. Why would profit necessarily be re-invested where it is made. One of the cornerstones of the financialization of an economy, is the integration and diversification of different institutions world-wide. If a foreign bank is abstracting profit from a loan, it may not want to re-invest that profit where it was created. In order to minimize risk, any bank or institution connected with financialization, will seek to invest profit or capital in a diverse way such that risk is minimized. Literally, it is an investment strategy that is akin to not putting all of ones eggs in one basket. Again, when it comes to a private corporation who is lending the money, even when it is managed or guaranteed by the WB, WTO and IMF, is ultimately accountable to their shareholders(Tomaskovic-Devey 2015). In Mexico, the flow of capital left the country which created instability, and in turn, this instability created the type of risk that made Mexico an unattractive investment(Levy-Orlik 2012). To minimize risk, the capital, profit or surplus that was created in the Mexican economy, was not re-invested in it.

Stagnation and Neoliberal Financialization

Having looked at some of the general strategies, and three case studies where it has been implemented, the following will articulate the main challenges. First, the challenge of levelling inequality and the to to stimulate domestic economic growth through increased capital that was supposed to result from financialization(Tomaskovic-Devey 2015). The challenge in both terms, is a of neoliberalism and the ideology that maintains that the private sector should be stimulated as a means for greater growth.

In a work titled Capital in the 21st Century, Thomas Picketty (2014) gathers together a comprehensive set of data to demonstrate the of the neoliberal agenda. He argues that since 1980, and the growth of neoliberalism in mainstream domestic politics and foreign policy, both ‘stagnation’ and ‘greater inequality’ has resulted. Where neoliberalism maintained that inequality would create growth and improve economic disparity, that growth never occurred. Using the data collected from tax returns in both France, and the US, Picketty shows that real wages have not increased at all since this period started. In other words, wages have not kept up with the standard rate of inflation, and they, have not increased proportionate to the growth in the upper strata of society(Picketty 2014). The rich are getting richer, and poor, poorer according to Picketty.

In terms of the stagnation, he maintains that ‘capital’ has not ‘trickled down’. Further, because of this, no economic growth has occurred. For growth, capital has to be re-circulated and re-distributed throughout the economy. For instance, when an individual earns more, they will spend more. That spending is the engine of growth as it is capital that was accumulated by one individual, and then, re-distributed to those who sell this individual ‘goods’ and ‘services'(Harvey 2007). However, stagnation and the declining value of real wages, has meant that little distribution or re-distribution has happened. In short, it has not trickled down. When individuals have less to spend, growth cannot be achieved. If one translates this same problem with capital, and then look at how financialization has resulted in wealth leaving the developing countries. Profit obtained from the mainly G7 institutions that aided or supplied the WB and the IMF with loans and financialization infrastructure, largely left these countries(Tomaskovic-Devey 2015; Hirst 2015). Further automation has worsened the problem in regard to creating employment. Consider, for example, the work that was essentially clerical and involved people, and how these forms of work in a digital environment are easily automated(Hirst 2015). Again, the results has been fewer available jobs because of the digitization of automated tasks, and fewer jobs, means less capital in circulation and either, negative growth or zero growth. Further, the inequality promised was never achieved. The flow of capital was concentrated in the institutions that supplied it, and the institutions who supplied the varieties of financialization functions — insurance, investment and broker industries and financial institutions such as banks. In terms of profit motive, these corporations have arguably only been working to serve their own interests. Where the UN, WTO, WB and the IMF all supported the neoliberal agenda of greater control by private corporations, this strategy failed because of the very profit motive that was supposed to help. Profit from institutions, was not re-invested enough in developing economies(Palley 2016; Tomaskovic-Devey 2015). Rather, profit/capital flowed toward less riskier investments. And, it flowed into the pockets of the shareholders of these very institutions. One of the key critical factors regarding financialization, is that growth never occurred and this presents the core ‘challenge’. For example, where financialization increased its share of the economy, it did not increase the amount of wealth. Especially for the more impoverished and vulnerable individuals in the varieties of developing nation-states that used financialization as a strategy.

Conclusion

The Washington Concensus and the implementation of neoliberal economic policies, never realized the main challenge of improving growth and prosperity with privitization and neoliberal policies. The theoretical foundation of neoliberalism, is the economic theory that less government and less tax’s, means that money in the hands of private corporations would generate wealth. Profits would be re-invested rather than given to the government in the form of taxation. However, this re-investment never occurred. This paper has shown how the introduction of financialization, failed because of this lack of re-investment. Profit and the flow of capital, left these developing countries. What resulted, was not growth but stagnation. Further, there was not a greater distribution or the ‘trickle down’ of capital that improved equality. Rather, profits left these countries and in turn, inequality became worse. Privitization and financialization, created more inequality than existed prior to its implementation. Financialization has failed in developing economies because neoliberalism has failed to deliver what it promised. When profits are made by corporations, they are taken to serve the interest of those corporations and not the countries where it is supposed help in terms of creating growth. The Washington Concensus was adopted by institutions like the WTO, WB and the IMF, and these became the way in which developing countries had to accept the terms and policies of neoliberalism. Where it would appear that these institutions were acting in the best interests of developing countries, instead, they functioned mostly to improve the private corporations who provided the capital for the growth of financialization. This paper has argued that the challenge of financialization, was undermined by the of neoliberal economic policies that were theorized to create growth.

APPENDIX ONE. The Growth of Finance and Financialization.

From: Greenwood, R., & Scharfstein, D. (2013). The growth of finance. The Journal of Economic Perspectives, 27(2), p. 4.

Here you can check some of our dissertation services:

– Dissertation Writing Services

– Write My Dissertation

– Buy Dissertation Online

– Dissertation Editing Services

– Custom Dissertation Writing Help Service

– Dissertation Proposal Services

– Dissertation Literature Review Writing

– Dissertation Consultation Services

– Dissertation Survey Help