Executive Summary

Operational issues are the problems which make a business less profitable and contribute to its ruin by draining all its resources and energy. They tend to affect the operational performance, impact strategy and serve as an anti-growth agent. The following report has reflected upon the major operational problem which is being faced by Tesco Fresh and Easy in its daily operations in the host country USA. The major operational problem which has been identified within Tesco in USA is the problem of inappropriate pricing which is caused due to fraudulent activities. The problem has diversely affected the business prosperity of the company. The report has provided an analysis of the causes of the particular operational problem and the major cause which has been identified is the issue of fraud. The report has suggested some of the strategies and has also given their justification, which is likely to be implemented by the company in order to tackle the problem efficiently.

Furthermore, the report will also provide some solutions which are convincing and will be helpful in the mitigation of the potential problem. It will also provide an internal as well as external analysis so that the mitigation of the problem becomes easier for the company. Lastly, some recommendations will be given along with some evidences supporting the solutions. All the provided recommendations and strategies are likely to help Tesco to overcome the operational issue which has been hampering its growth and expansion.

Introduction and Company Background

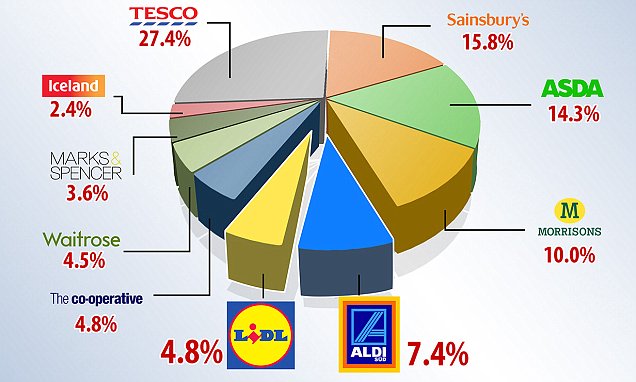

TESCO is a British multinational grocery chain and merchandise retailer which is headquartered in Hertfordshire. It is considered to be the third largest retailer in terms of the gross revenue and the ninth largest retailer in the world when measured by revenues. It is the market grocery leader in UK having a market share of 28.4 per cent (Tesco plc. 2018).

Figure 1: Fresh & Easy Logo

(Source: Tesco plc. 2018)

It is a retail market based in UK but it has its chains spread across eleven countries. It is known for retailing books, clothes, electronics and many more products. TESCO has been actively involved in international business operations in USA and it is facing a major operational issue in the process. The following research paper will introduce some strategies which might help the company to overcome the operational issue and will also present evidence supporting the solution. The external and the internal analysis will help the company to analyse the prevailing market conditions both in the home country and in the host country. In the end, recommendations will be provided can be of great help to the company while it is trying to overcome the problem.

SWOT

| Strengths | Weaknesses | Opportunities | Threats |

| 1.Long standing history in Europe | 1. Competitive pressure leading to price wars. | 1.Strategic alliances | 1. Reducing number of market shares. |

| 2.Improved technology use | 2. High dependency on UK and Europe for sales. | 2. Joint ventures. | 2. Competitive threats. |

Table 1: Tesco SWOT Analysis

(Source: Created by the Author)

Strengths: The retail company has a long standing past in UK which provides it with reliability and assertion that it will continue to operate as one of the leading markets in the economy of Europe (Stanton. 2018) .The Company also has an enhanced use of technology throughout its business operations. It leads to a greater cost efficiency and provides an improved service experience.

Weaknesses: The competitive pressures from the potential competitors have led to a price war which have led to a reduction in some of the profit margin of the company.The retail company is heavily reliant on UK and Europe for its sales and has not invested much resource in its development in the new markets in which it operates (Ramanathan et al. 2017). It is trying to cater to too many markets and many of these markets are not financially feasible.

Figure 2: SWOT

(Source: Kim, Hallsworth and Kim. 2018)

Opportunities: The Company has many opportunities to form strategic alliances with the other popular brands which can help it to offer more products and attract new customers within certain target markets. The company can also form joint ventures with the local companies which can help it to improve performance in those areas (Kim, Hallsworthand Kim. 2018).

Threats: The credit crunches and the economic recession shall continue to threaten the company’s number of market shares which is likely to affect its profitability. Some of the big competitors of TESCO are ASDA, Sainsbury and Morrison’s. Competitive threats are being put up by these big companies who are able to offer products at lower prices and also provide a wide variety of materials thereby having a strong supply chain (Cuthbertson, Furseth, and Ezell. 2015).

PESTLE Analysis

The PESTLE Analysis provides a framework that will analyse and monitoring the External Marketing Environment in the host country of USA and is explained as follows:

| Factors | Description |

| Political | USA enjoys a stable political climate and has rarely influences the business operations as both the leading political parties are focussed on promotion of the businesses in the country largely benefitting Tesco’s Fresh & Easy in its operations in the country (Gupta. 2013).The country with its advanced political environment in the form of advanced technology and infrastructure promotes democracy and has positioned itself as a great destination for Foreign Direct Investment (FDI).As a result of the friendly political conditions in the country, USA has been the first choice for a large number of Multinational Company contenders for Foreign Direct Investment. |

| Economical | USA is the world’s largest economy having a nominal GDP ultimately providing numerous opportunities for the products of Tesco’ Fresh & Easy (Aithal, Shailashree and Kumar. 2015).In the recent years, the unemployment levels in the country have come down and the income levels have also increased resulting in enhanced purchasing power for the customers ultimately contributing to enhanced sales opportunities for the organization.The labour rates are high in the country and the net profits of the Fresh & Care will be affected by the high labour rates of the country. |

| Social | The major part of the population is health conscious and will provide an opportunity to Fresh & Care by focussing on the health factor of their products (Sadgrove. 2016).The country features people from different origins and genre ultimately contributing to a diverse population of customers. |

| Technological | The USA is a technologically advanced country and will provide the organization with innovative technologies for its operations.The recent rate of technological advancement for the country has largely enhanced creating numerous opportunities. |

| Environmental | The USA faced some of the toughest weather condition in the world which may largely impact the business of the Fresh & Care (Brulle. 2018).The Environmental protocols of the organization are also strict and any activity in relation to it may result in large penalties. |

| Legal | All businesses in the domestic boundary of the US come under the regulatory structure and the rights uphold equal treatments for both the foreign and national businesses (Brians. 2016).The labour laws and working hours are strictly fixed in the country. The involvement of child labour and the other associated rules of the country are mandatory to be followed by the organization. |

Table 2: PESTEL Analysis

(Source: Created by the Author)

Identification and Analysis of the operational problem

The identification of the operational problem for Tesco’s Fresh & Care is the issue of inappropriate pricing with an intention of the fraudulent activities which ultimately affected the sales of the organization resulting in the closure of more than 150 stores in the year 2013. The outcome of the operational issue of inappropriate pricing largely affected the funds of the organization where in the year 2007, it was launched with an initial investment of £250 million while at the time of its closing; it closed with a loss of £1.2 billion (Tesco plc. 2018). The root of the problem lied in the poor management decisions wherein the management with an aim to enhance the profits for the organization had manipulated the price of various products. The pricing decisions were intentionally manipulated for the performing of the fraudulent activities by the internal management of the organization.

Figure 3: Failure of Fresh & Care in the USA

(Source: Kim, Hallsworth and Kim. 2018)

The process of pricing generally requires the application of strategies of premium pricing, economy pricing, penetration pricing and price skimming. The determination of the price for a product generally requires the management to make a detailed analysis of market prices. The general practice for a pricing strategy is to analyse the prices of the competitors and quotes prices comparatively lower to them (Nayyar, and Singh. 2018). The pricing strategy followed by the Tesco’s Fresh & Care was based on creating a provision for the fraudulent activities where the prices were raised for a few products and were brought down to surprising levels for a few products. The customers were attracted to the prices of the products listed by the organization as they were low as compared to the other organization. The fraudulent activity was in terms of where the prices were made so low with an aim to attract the customers that it resulted in the ultimate loss for the organization while the reporting showed that they earned profit which was not actually the case.

Critical Analysis for the occurrence of the problem

The analysis of the occurrence of the problem can be considered as an inappropriate strategy from the management of the organization. The primary aim of the management was to reduce the prices of the products with an aim to attract a large number of customers. There was also involvement of fraudulent activity where the prices were reduced to such low magnitude that it did not fetch profits of the organization (Nezamoddini and Wang. 2017). These policies generally come up as a pressure to the management for increasing the sales of the organization. In case of Tesco’s Fresh & Care, the reducing sales of the organization had created pressure for the organization to reduce the prices with an aim to attract more customers and attain a greater base which will help the organization to enhance its profits. This led to the managers in reducing the prices so low that it impacted the profitability of the organization while the records exhibited them as profits. This fraudulent activity in the form of inappropriate pricing strategy largely impacted the reputation of the organization which ultimately resulted in the closing of 150 stores for the organization ultimately resulting to a loss of £1.2 billion.

Recommended Strategies

The recommended strategy for Tesco’s Fresh & Care will be to ensure at every point of business that the management is not involved in the committing of the fraudulent activities. The recommended strategies for the Tesco’s Fresh & Care pricing strategies will require arriving at a value-based price (Arasti, Zandi and Bahmani. 2014). It is recommended to pick the product which is comparable to the product and finding out what the customers are paying for the product. It will require finding out the new ways by which Tesco’s Fresh & Care can differentiate their products with the compared product. It will be required by the Fresh & Care management to place a financial value on the basis of these differences along with adding of all the positives and subtracting of all the negatives by coming up at a potential price. In the process of coming up to the potential prices, it is required to make sure that the value to the customer is higher as compared to the costs. Fresh & Care will require demonstrating to the customers with the acceptability of the prices in terms of trained marketing staff.

The strategy made for the prices to be based on economy pricing. The application of this strategy is aimed at attracting the most price conscious segment of the consumers which are generally very large in number. The application of this strategy will minimize the costs associated with the marketing and productions with an aim to keep the prices down. As a result of this it will provide the customers of both the UK and the USA with a greater purchasing power (De and Nag. 2016). The organization is also recommended to use price skimming process for its products as the process is designed to help the business to maximize the sales of the newly introduced products in the market. The process of product skimming requires setting up the rates higher at the introductory phase of the product. The next step of the process is where the organization will reduce the prices of the products gradually with an aim to lower the demand of the product sold by the competitor and attain a competitive edge against them.

Justification and Evidences supporting the solution

The value-based pricing will prove to be the best Tesco’s Fresh & Care as it will provide the product with a competitive price in the market and the advanced features that it possess will attract more of customer (Liu, Zhai and Chen. 2018). The process is highly beneficial for Tesco’s Fresh & Care as it is based on providing the customers with perceived values. The price will better fit the perspective of the customers. Value-based pricing will allow the organization to be more profitable allowing the organization to be able to acquire more resources ultimately contributing to the growth of the business. The value-based pricing explains that when a pricing strategy is not working for a product, it does not always mean that reducing the prices will prove to be beneficial for the company but providing the customers with the services that match the prices proves to be more fruitful for the organization (Alderighi, Nicolini and Piga. 2016).

There have been evidences of a large number of companies who have attained success by the implementation of quality pricing strategies. Walmart is an organization which is a renowned name in the world retail market. The success of the organization is largely owned by the pricing strategy that is implements. The organization features daily discounted prices for its customers. This daily discounted price strategy of the organization converted a large number of the feasible customers into actual customers and benefitted the organization not only with higher sales but enhanced goodwill. In the same way Starbucks uses its pricing strategy for the purpose of profit maximization. The organization in an opposite approach uses the policy of enhanced prices for the quality products it serves which has created a reputation of the organization as a premium coffee brand. The stagnant price levels of the organization in relation to the decreasing prices of coffee have also provided the organization with good amounts of profits (Arasti, Zandi and Bahmani. 2014).

Figure 4: Value-based Pricing

(Source: Iyer et al. 2015)

The evidences explain that value-based pricing can boost margins. Both the companies have shown great examples of the application of pricing policies through research and customers analysis for the formulation of the target prices with an aim to capturing the maximum number of customers. Similarly, Xiaomi also follows a low pricing strategy in India and the outcome is in terms of it becoming the highest selling phone in the country. The organization has simply removed the major intermediaries in their distribution channel with an aim to reduce its operational costs. The lower costs and the best competitive features provided the organization with a large number of customers where the company earned great revenues and also resulting in the enhancing of the goodwill (Iyer et al. 2015). As these organizations with its pricing strategies have made the organization leaders in their industries and the following of the same strategies will also benefit Tesco’s Fresh & Care in attaining a competitive edge both in the UK and the US operations.

Conclusion

From the above report it can be concluded by saying that the operational issue of inappropriate pricing is hampering the daily business operations of the company to a great extent. It has been identified that fraudulent activities were taking place within the company which was ultimately leading to high level of poor sales performance. Due to poor sales performance the company was incurring heavy losseswhich was also reducing its market shares. The above report has successfully identified and analysed the problem and has also identified the root cause of it. It has also recommended some strategies which must be implemented by TESCO in order to revive its business operations.

Students working on case studies or might need academic help, might find our custom Case Studies Writing Services helpful.

Also look at some of our business services

– Business Essay Writing Service

– Business Dissertation Writing Services

– Business Report Writing

– Business Assignment Help

– Business Planning Writing Service

– Business Assignment Writing Service