Introduction

Facebook may be considered a monopoly under monopoly criteria due to the number of producers, the barriers to entry, the interdependence, and the concentration ratio according to the article “It’s Time to Break Up Facebook by Chris Hughes” published in 2019. Facebook has a monopoly in the social media market since it was the first to enter and fulfil stringent regulations. In democracies, citizens are expected to recognize when a company plan is detrimental to the public good (defined as civil, human, consumer, and economic equality) and to take corrective action (Hughes, 2019). What Facebook says is irrelevant; harmful content is still accessible. Strong competition legislation is necessary in response to Facebook’s anticompetitive behavior, which stymies market innovation and has a negative impact on all other businesses. Facebook’s data monopoly binds everything together, since Facebook owns and controls the vast majority of personal information belonging to both Facebook users and non-users.

Due to its tremendous reach, the social media behemoth has the ability to influence our opinions, votes, and purchases. Facebook is primarily motivated by two social needs: the desire to join and the need to publicly show oneself. Individuals who have a large number of Facebook friends are assumed to converse often, since they are active Facebook users. Facebook has 2.80 billion active users as of January 2021, making it the world’s most popular social network. According to a recent research, Facebook accounts for more than two-thirds of the world’s 4.2 billion active social media users.

Antitrust laws are notoriously difficult to enforce, despite the fact that Facebook is a for-profit business and is accessible to the general public. Concentration has been associated with investment and productivity increase. The government should monitor corporate paradigm violations and act against Facebook for eroding public rights as a result of capitalism. In 2021, a six-hour Facebook outburst highlighted the growing concentration ratio of the social network.

Relevance of the economic issue

Chris Hughes says that a monopoly in the social networking business should be broken up because it is being used by cartels in emerging countries to influence voters and promote price discrimination. Apart from providing businesses, financial institutions, government, and other groups with the ability to monitor individual users, these platforms may also be used to discriminate against and abuse consumers collectively. Behavioral profiling, which economists classify as price discrimination, enables marketers to offer products at varying prices in order to maximize revenue from each particular customer(Hughes, 2019). As a consequence, online pricing discrimination increases total consumer prices while disproportionately affecting families with lower incomes and less technical capability. The majority of dishonest organizations use behavioral profiling to target weak groups with a range of financial and economic schemes. Subprime mortgages, for example, employ ethnic and economic profiling to make lower offers to vulnerable individuals. Following the financial crisis, advertising and payday loan advertisements targeted struggling families.

According to David Weinberger, authorities and other business leaders should support Facebook. Not a few more limits, but a lawsuit claiming antitrust breaches has Facebook on edge. Facebook must be split up and controlled in two ways by the US government. It is critical to divide up Facebook into many distinct firms. According to others, if Facebook is dropped as a partner, competition in the social media industry would be boosted.

Even if Facebook were to dissolve, Julian Zelizer believes it would remain a highly successful firm. He asserts that the government might devise a deft trade policy that would deter China while also helping a large number of people economically. According to Tim Stanley, Americans would profit the most from the breakup of Facebook. According to Stanley, a new organization with legislative power is required to supervise digital companies: Americans should have the option of how much control they want over their digital data if a privacy law is implemented.

As a consequence, the agency should also be accountable for guaranteeing platform compatibility. According to David Rothkopf, the government should fight for Facebook’s demise and the formation of a regulatory body for social media. While it may seem un-American, he thinks the agency should develop criteria for appropriate social media expression.

Academic explanation of the economic concepts

Due to entry barriers, Facebook’s competitors are kept out of the market or discouraged from entering. Economic size, physical resource ownership, legislative restraints on competition, patent, trademark, and copyright rights, and intimidation tactics such as predatory pricing are all barriers to competition (Hutchinson et al., 2017). Intellectual property refers to legally protected ownership of an idea, as opposed to material property. Intellectual property laws include patents, copyright, trademarks, and trade secrets. A natural monopoly exists when economies of scale exist over a sufficiently wide spectrum of output that no other company may enter without suffering a cost disadvantage if one firm supplies the whole market.

According to Facebook’s Federal Trade Commission filing, an investigation into potential anti-competitive behavior has been begun (FTC). The major focus of this investigation is on Mark Zuckerberg’s acquisition strategy. Even Facebook may pursue acquisitions of potential competitors before they pose a substantial danger to the FTC. Facebook has become into a critical component of the internet. It has evolved into more than a necessary component of the media ecosystem; it has become an integral aspect of society and the social experience. As technology evolves at a breakneck pace, social media has surpassed traditional news, entertainment, and communication as the key source of information for residents and consumers. The progressive expansion of the internet has created new opportunities for individuals and companies alike to succeed and develop. In this setting, Facebook has emerged as the preferred social networking site. However, Facebook’s predominance is the consequence of a mix of the company’s first mover advantage in developing a product and user experience that resonated with consumers and the consumer internet industry’s inherent proclivity for natural monopolies.

If a single business makes all of the goods/services in a market, it has a monopoly. Because there are no significant rivals, a monopoly may determine its own pricing. As a consequence, a monopoly may set its own market price (Hutchinson et al., 2017). There are other additional products from Facebook, like Giphy and Instagram. Facebook’s headquarters are situated in Menlo Park, California. Facebook acquired Instagram, WhatsApp, and Giphy in 2012. Additionally, Facebook advertising is a popular way to promote businesses and services. In March 2016, the site had over 3 million followers, with 70% of them located outside the United States. Advertising accounts up the majority of Facebook’s $70.7 billion in income.

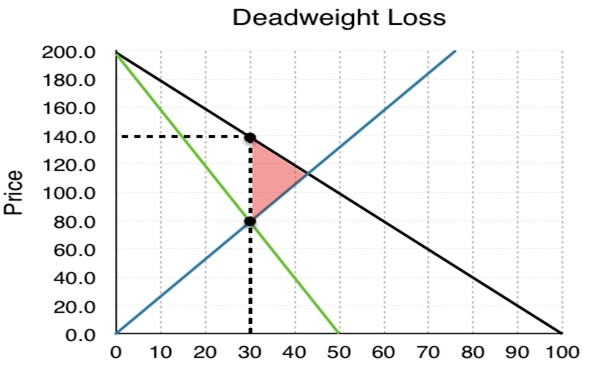

Consider the financial ramifications. The law of supply and demand dictates that when the price declines, the quantity required increases. Price reductions may imply a loss of revenue from previously sold items. Each of Facebook’s already sold 60 million adverts will cost the firm $40 less if the ad price is reduced to $40. As a consequence, Facebook loses $2.4 billion. This graph demonstrates that price = MC no longer plays a significant role in selecting where to manufacture. Price changes have a revenue impact to consider. Will the MR/MC intersection at P = $80 represent the market price? Consumers are prepared to spend $140 each pair of ads in order to sell 30 million pairs. Facebook is aware of this and intends to get the most advantage from this method. This is standard operating procedure for monopolists. Monopolistic companies are equivalent to monopolies in terms of value. It has a PE of $116 and a QE of 42 million. Despite the loss of 12 million advertising dollars, the price increase more than compensates. The Graph shows depicts a PE of $140 for the monopolistic market, while the company’s QE is $30 million.

The sole source of deadweight loss is a decrease in the equilibrium quantity. Consumers are willing to pay more than the firm’s marginal cost for 30 to 42 million advertisements, implying that MB > MC. As long as the monopolist maintains its current pricing, deadweight loss will persist and lose money from pre-existing sales. To emphasize the social cost of monopoly rather than competition, the graph above has a red colored region.

In this competitive environment, it’s tough to assert that Facebook is a monopoly. Although Facebook earns the majority of its revenue from digital advertising, the business controls just 20% of US online ad sales, which implies that 80% of all digital ads are presented outside of the Facebook network.

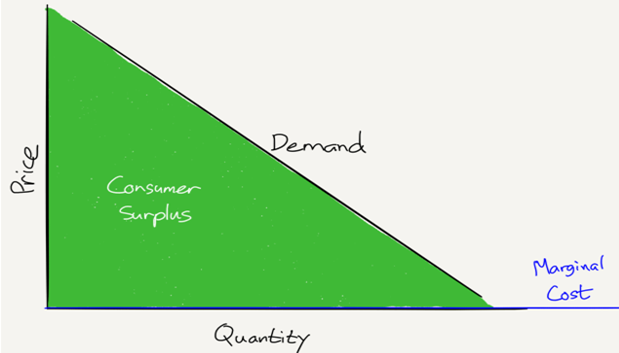

The second misunderstanding is on antitrust law. Due to these principles, which extend all the way back to the 1800s, a business will (Hughes, 2019)not be penalized for inefficiency. They offer low-cost, high-quality products and services to protect their clients. Continuous and quick invention is required for technological development. Facebook is concentrating its efforts right now on developing products that are both free and monetizable via advertising. There is a significant challenge in applying this kind of study on Facebook. The cost of acquiring an additional consumer for Facebook is nothing. As a consequence, the following graph is obtained:

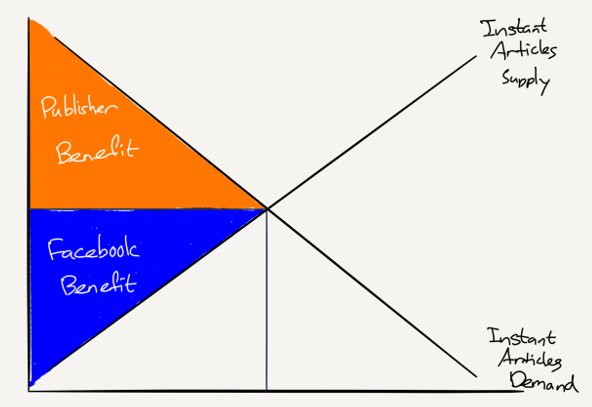

However, Facebook profits from such material pieces in part because the more time users spend on Facebook as a consequence of like it, the more advertising they will see.

As a result, Facebook Instant Articles seemed to be a wonderful idea: readers would have a superior reading experience, which would drive them to spend more time on Facebook. For content providers on Facebook’s three-sided market, Facebook’s plan to assist publishers with monetization—publishers could sell their own advertisements or sell them for a 30% commission—would not only benefit content providers, but would also lock them in with cash they couldn’t obtain elsewhere. This is how it can be envisioned the market in the graph shown below.

It’s barely more than a way for Facebook to collect rent in a down economy. To retain clients, companies that advertise on Facebook may raise the price of their items, compelling others to purchase from them. In our fast-paced culture, new and improved products are always being developed. When monopolists bring new categories of abundance into the market, customers get extra options. Creative monopolies are necessary for the greater welfare of mankind and the growth of civilization.

Conclusion and reflection

Without Facebook and other digital behemoths, the world would be a worse place for everyone. According to these ideas, antitrust enforcement may be classified into two separate groups. It is vital to do a comprehensive study of the market’s structure and the possible advantages of key players’ holdings. In the future, competition between the two clusters will be fueled by data reservoirs, which will feed the next wave of war. Almost definitely, these businesses would purposefully reduce their costs in order to lure customers into systems from which they would be impossible to exit.

Regulators look at more than just a person’s spending patterns. Individuals’ personal information should be reviewed to see whether it is being gathered. The discussion will continue eternally, at least as long as one of the industry’s founding fathers is still alive. The result of a lawsuit against a business has no influence on your decision to file one or not.

Facebook’s services come with a slew of issues, including an inability to secure our personal information and the spread of hate speech. These worries may have the effect of destabilizing developing economies, boosting autocrats, and intensifying our displeasure and dread. Price adjustments may be made to avoid the appearance of a Facebook monopoly. In today’s society, technology has developed into a serious political concern. “Antitrust litigation is a natural result of technological advancement,” a European Commission official said. That is, if they fail to accomplish their loftiest goals, such as bringing down large enterprises, their influence will be small.

Hughes thinks Facebook is a “natural monopoly” due to its high entrance barrier and declining acquisition costs over time. Natural monopolies are created by a company’s working environment, not by criminal behavior.

Hughes asserts that each of Facebook’s several places competes for users’ attention in its own unique manner. Hughes believes that the loss of Facebook would have a significant impact on the US and global information technology economies. This article debunks many claims that Facebook is involved in antitrust enforcement. According to the CEO of Facebook, antitrust legislation is about more than scale. Legislation governing privacy, harassment, and misinformation may be enacted if Facebook ceases operations and the social media industry becomes more competitive.