1 Introduction

With the ever-evolving nature of the business environment, it has been acknowledged that the strongest factors for keeping businesses alive are the implemented growth strategies along with their outcomes (Durmaz & İlhan, 2015). Accordingly, the question of how firms enter and operate in foreign markets has been a consistent and persistent topic in business research generally and strategic marketing literature specifically for decades (Schellenberg et al., 2017).

In fact, the growth strategies are of particular significance for the technology and entertainment industry (Singh, 2018) due to the rapid evolution of technologies and the fierce competition levels that exist in such industries (Yoon et al., 2021). In line with this, and aiming for the next 100 million subscribers, Netflix has decided to expand into the Indian market in 2016 as part of its global growth and expansion strategy; this has further been driven by the fact that India is the second-largest streaming videos on demand (SVoD) market in the Asia Pacific Region (Kumar et al., 2020).

However, despite the huge efforts that have been exerted since then, Netflix India did not attain the expected success. As stated by Kumar et al., (2020), “Netflix, has a lower market share, even though market expenditure has been increased. Their market share has not increased as expected, and their rate of net income growth has fallen“ (p.10). Thus, this report aims to examine the entry modes, strategic positioning, and other external and internal influencers in Netflix’s expansion into the Indian market in an attempt to provide recommendations that would inform future decisions.

2 Background & Overview

Being founded in 1997, by Reed Hastings and Marc Randolph, as a U.S.-based postal DVD rental service, Netflix has become a leading SVoD provider with over 167m subscribers and an enterprise value of $157bn in 2019 (Merskin & Schmidt, 2020). Besides the streaming of licensed videos, Netflix also finances award-winning original and exclusive content in several languages (Singh, 2018); thereby, creating an extensive library of online content that could readily be accessed and viewed by subscribers (Kumar et al., 2020). To date, Netflix’s growth and expansion into new markets is reaching tremendous success levels; as of 2019, 60% of its paid subscribers were from 190 countries other than the US and Canada (Merskin & Schmidt, 2020). This success is considered to be an unprecedented one since its expansion and growth efforts started in 2010 (Merskin & Schmidt, 2020).

As part of this expansion strategy, Netflix ventured into the Indian market in 2016 due to its huge potential in driving the company’s growth with a target of having their next 100 million subscribers (Kumar et al., 2020). India has over 300 million online video views as of 2019 with recent statistics showing that over 80% of those viewers have up to three video applications on their smartphones (Sull & Turconi, 2021). This is further supported by the fact that, in 2019, the internet users base in India reached 627 million; this expansion has been driven by low internet costs, and the expansion of 4G in the country (Kumar et al., 2020). The following paragraphs provide a detailed analysis of Netflix’s entry and expansion into the Indian market.

3 Analysis of Netflix’s Market Entry Strategy

As stated by Yoon et al., (2021), three main aspects should be properly planned for in a company’s expansion strategy namely, its market entry model, product/market expansion grid, and strategic positioning. The following paragraphs analyse Netflix India’s expansion strategy in terms of the aforementioned factors.

3.1 Market Entry Model

As defined by Sharma and Erramilli, (2004), the Market Entry model is “a structural agreement that allows a firm to implement its product market strategy in a host country either by carrying out only marketing operations (i.e. via export modes) or both production and marketing operations there by itself or in a partnership with others (contractual modes, joint venture, wholly-owned operations).” (p.2). From reviewing the literature, it was evident that several market entry modes exist such as exporting, licensing, joint venture, franchising, partnering (Schellenberg et al., 2017).

To start with, direct exporting entails directly selling the company’s products/services into the entered market through the company’s own resources and competencies (Horská, 2014). Licensing, on the other hand, entails the transfer of a company’s right to sell a service/product to another firm (Horská, 2014). Similarly, franchising also entails the transfer of rights to another firm; however, it works best for businesses with repeatable business processes and that have a very strong brand recognition that could be utilised internationally (Horská, 2014).

Moving on, partnering entails forming strategic alliances and is of significant importance in those markets where the culture, both business and social, is substantively different from the company’s own; thus, local partners bring local market knowledge and contacts, if chosen wisely (Horská, 2014). Finally, joint ventures are forms of partnering where two companies agree to work together in a particular market by creating a third company to undertake this. Risks and profits are normally shared equally (Horská, 2014).

Netflix India faces a huge competition level from multiple mega-companies, such as Amazon Prime, Voot, and HotStar, who are currently leading the market with their original content and growing regional focus (Kumar et al., 2020). Despite this fact, Netflix has decided to choose the direct exporting entry model to enter the Indian market (Sridharan, 2022). This is primarily attributed to its adherence to its global strategy where it continues to operate alone without any local or international partners. This pattern is consistent in terms of several aspects including its licensing agreements, development of original content, and committing to a no-ads service (Sull & Turconi, 2021).

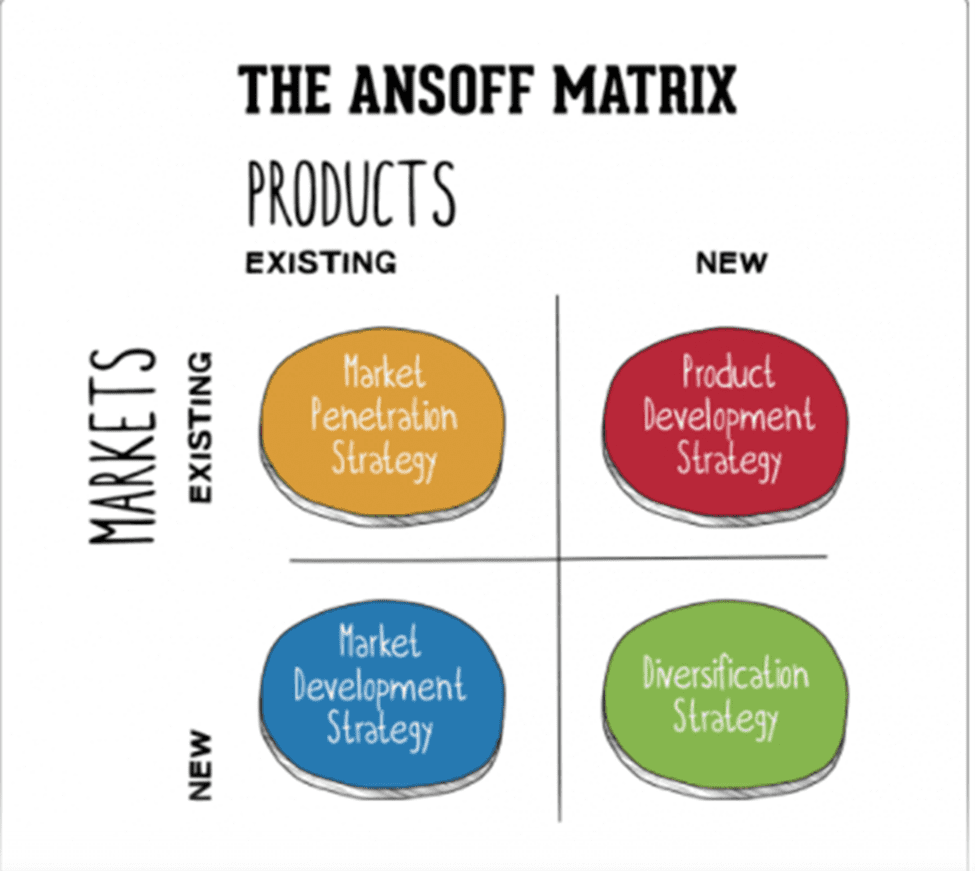

3.2 Product/Market Expansion Grid- Ansoff Matrix

The Ansoff matrix, also known as the product/market expansion grid, was developed to aid companies in planning for their growth strategies with four main expansion possibilities namely, market penetration, product development, market development, and diversification strategies (Ansoff, 1957). The Ansoff matrix allows business executives to better understand the inherent risks of growing and expanding their businesses based on new and existing markets and products (Dawes, 2018).

Starting with marketing penetration, it is considered the least risky penetration strategy; this is since a company increases sales and achieves growth within an existing market using the same existing products (Hanlon, 2021). Moving on, the product development strategy is also considered to be a safe growth strategy; yet, riskier than the marketing penetration strategy. In product development, a company seeks growth through the introduction of novel products that are tailored to meet existing unmet needs and demands in the current market (Dawes, 2018).

The third growth strategy is the market development strategy which entails higher risks as compared to market penetration and product development. This is since it involves catering to a different customer base or expanding into new geographies either nationally or internationally (Dawes, 2018). Finally, the diversification strategy is the riskiest as it includes both the development of new products and the expansion into new markets (Hanlon, 2021).

Figure 1: The Ansoff Matrix. Source: (Hanlon, 2021).

According to the Ansoff matrix, it could be concluded that Netflix’s strategy is a market development strategy since it entered a new market with its existing services of providing SVoD services that are primarily in the English language. This entry strategy is considered to be inappropriate given the fierce level of competition in the Indian market. Netflix’s competitors include but are not limited to large broadcasters, international streaming video players, Indian streaming video players, and traditional TV distributors (Sull & Turconi, 2021). Thus, the following paragraphs analyse why the market penetration strategy is inappropriate amidst such levels of competition.

To start with, unlike its mega competitors, Netflix India, similar to its global strategy, has maintained an exclusive focus on its video-streaming services most of which was from its original English Library (Sull & Turconi, 2021). This is since Netflix India is primarily targeting affluent consumers who are well-educated and with a good appetite for International content in English (Sull & Turconi, 2021). However, with a 13% English speaking population, only 6% have expressed interest in watching online video content in English (Sull & Turconi, 2021).

Accordingly, Netflix’s catering to only one segment namely, the elitist, has been criticised and was largely attributed to the lack of success of the company in the Indian market (Sridharan, 2022). From such segmentation and targeting, it is apparent that Netflix India is missing out on the growth and expansion opportunities that could be gained by targeting a wider audience. As stated by Sridharan, (2022), “Netflix chose a maximum of top 10% Indians as its potential market.”. This clearly shows that Netflix India could have had wide expansion opportunities had it targeted a wider consumer base.

However, in recent years, Netflix had been slowly expanding its consumer base by introducing specific changes to better tailor its existing service to meet the demands of the Indian market and to sustain itself against the fierce levels of competition in India (Kumar et al., 2020). Accordingly, Netflix has increased its investments in original content in India more than any other market (Sull & Turconi, 2021) and increased investments in original content in local and regional languages along with enhanced dubbing of existing English content (Kumar et al., 2020).

Nevertheless, such efforts are considered weak as compared to its competitors’ efforts who are known to have a better understanding of Indian culture along with the needs of Indian consumers. As stated by Kumar et al., (2020), “The local players have a deeper understanding of the ethos, culture and taste of Indian consumers. They have accession to TV serials, an extensive catalogue of Bollywood movies, reality shows and live sports events (especially cricket, which was extremely popular in the country).” (p.8).

3.3 Strategic Positioning Model

Knowing that Netflix India has chosen a direct exporting entry model that is primarily based on market development, having a critical analysis of the strategic positioning of such services becomes crucial. This is further supported by the fact that the leading SVoD providers are struggling to maintain their customer base in India. As stated by Kumar et al., (2020), “Consumers are switching platforms quickly. As per one estimate, around 50% of OTT apps were uninstalled within seven days of installation.” (p. 8). Thus, the following paragraphs provide a detailed analysis of Netflix India’s strategic positioning.

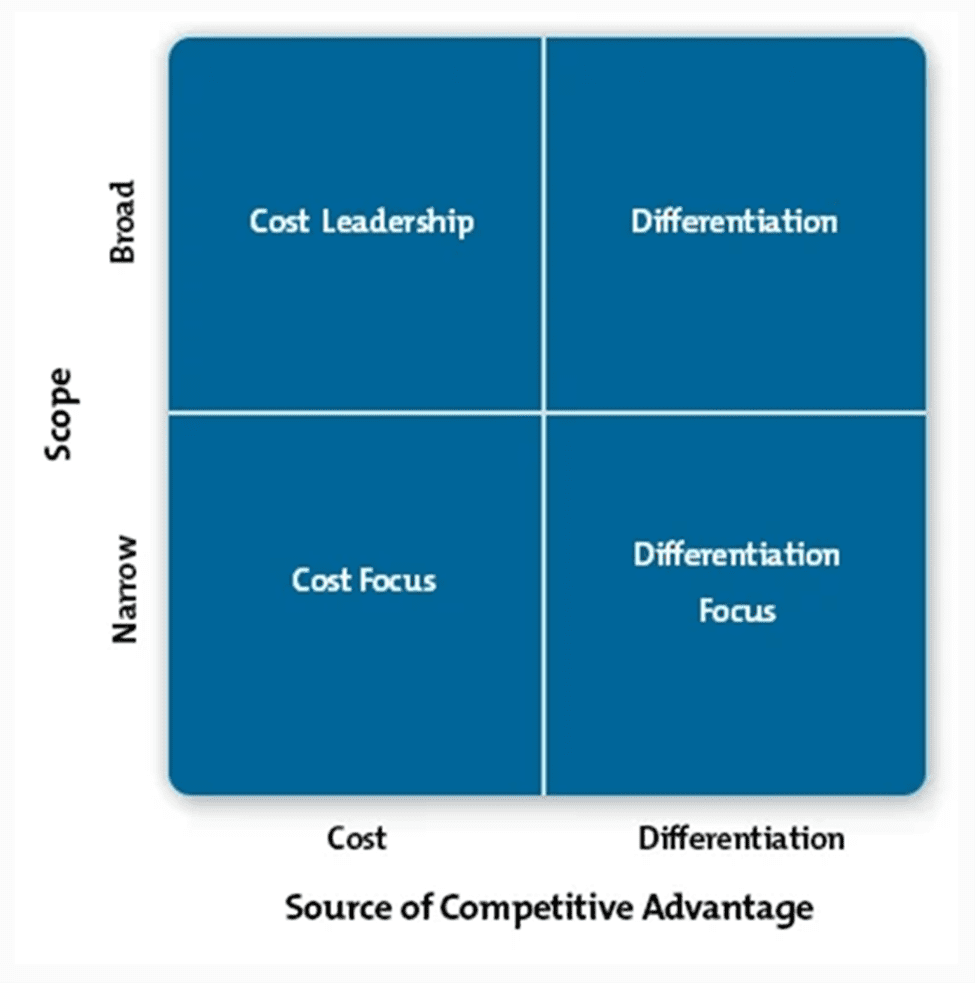

3.3.1 Porter Generic Strategy

To start with, Porter’s generic strategy model determines the company’s relative competitive position against its rivals. Accordingly, the model has three generic strategies namely, differentiation, cost leadership and focus (Porter, 1985). The differentiation strategy aims to differentiate the company against rivals through uniqueness and singularity; this is primarily achieved by considering aspects such as high quality, novel technology, innovation, and exceptional customer relationship management among others (Ali and Anwar, 2021).

On the other hand, cost leadership entails providing customers with the lowest possible prices by lowering costs to gain a competitive advantage over competitors; this could be done through means such as attaining efficiency, large scale production and economies of scale, preferential access to resources including raw materials and talent pools, and the use of novel technologies to cut down production costs among others (Akan, Allen, Helms and Spralls, 2006).

Finally, the focus strategy is a type of competitive strategy where the company’s focus is shifted towards a narrow competitive scope. Accordingly, a company either uses the cost leadership or the differentiation strategy on a narrow target market/ niche group (Tanwar, 2013).

Figure 2: Porter’s generic strategy. Source: (Tanwar, 2013).

While analysing Netflix India’s strategy, it was evident that it is similar to Netflix’s global strategy and is primarily based on a differentiation strategy in terms of quality, content, and no-advertisement agreement.

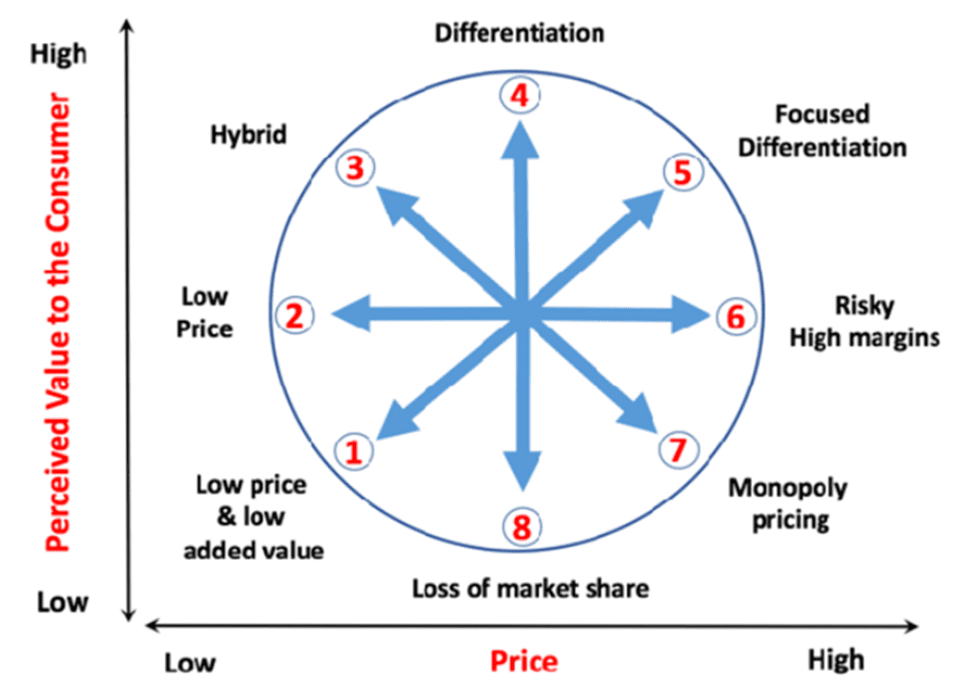

3.3.2 Bowman’s strategy clock

Similar to Porter’s generic strategy model, Bowman’s strategy clock model provides insights into the different strategic positioning of a product/service albeit with a widened expansion to eight identifiable positions and with a greater emphasis on the value proposition to customers (Bowman and Ambrosini, 1997). Starting with position 1, companies are usually forced to set low prices due to the lack of differentiation in their products; thus, by selling inferior products at a very attractive price, companies could sustain themselves with this strategy (Bowman and Ambrosini, 1997).

In position 2, companies aim to become the low price leaders in an attempt to generate a large enough volume of sales. However, such a strategy often triggers price wars that only benefit the consumers (Bowman and Ambrosini, 1997). In the hybrid strategy, position 3, a company seeks to have a moderate price and differentiation levels; thus, building a reputation for offering fair prices for reasonable goods (Bowman and Ambrosini, 1997).

Moving on to position 4, the differentiation strategy tends to offer customers exceptionally high perceived value. An extremely important factor to be considered in this strategy is branding to determine the attributes that the company would become synonymous with (Sridharan, 2021). Position 5, focused differentiation, is based on targeting the perceived value of the products as a means that justify the charge of significantly large premiums; this strategy is often deployed by designer brands such as Gucci, Channel, and Armani (Sridharan, 2021).

While the choice of the applicable strategy depends on several factors, Sridharan, (2021) asserted that strategies 6, 7, and 8 are unsustainable in the long run since the offered price is greater than the perceived value by customers. This is further exacerbated by the high competition levels where competitors either provide a higher value for the same price or the same value for a lower price (Sridharan, 2021).

Figure 3: Bowman’s strategy clock. Source: (Sridharan, 2021).

From Bowman’s clock, it could be stated that Netflix’s India strategy is a hybrid strategy that combines reasonable prices and differentiation to enhance customers’ perceived value of their service; and thus, elevate their competitive edge. This is further evidenced by Netflix’s commitment to its unlimited viewing of commercial-free content for an affordable, flexible, and non-binding monthly subscription (Kumar et al., 2020).

To further enhance its prices, Netflix India has introduced new packages, including the mobile-only packages (priced at $2.85 per month); however, with a restricted number of users, reduced quality to a standard definition, and restrictions from accessing the service via TVs and PCs (Sull & Turconi, 2021).

While the aforementioned patterns indicate that Netflix is trying hard to enhance its adaptability to the needs of its new market, which is a crucial factor in ensuring the sustainability of a business, it is apparent that they are yet insufficient. This could be attributed to the great differences in its new target customers including but not limited to their language, price sensitivity, and priorities when it comes to watching advertisements or not. The case is further worsened by the existence of multiple mega competitors in the Indian market, each with a unique strategy and content edges (Sull & Turconi, 2021).

4 Analysis of External Influencing Factors

As emphasised by Schellenberg et al., (2017), external antecedents and determinants play a crucial role in the modal outcomes of a business; these include but are not limited to (national) culture, cultural difference, and market attractiveness, environmental uncertainty, and legal environment. The following paragraphs provide an analysis of the external factors that influence Netflix India’s chosen market entry strategy.

4.1 Economic & Financial Factors

4.1.1 Pricing Strategy

To start with, subscriptions act as the main source of revenue for Netflix; thereby, causing its pricing strategy to be one of the crucial factors that determine its success. As stated by Sammut-Bonnici & Channon, (2015), the choice of a pricing strategy depends on several factors including market conditions, underlying competitive advantage, consumer demands, price of competitors, consumers’ price sensitivity, corporate image, and regulatory constraints. There are five main primary pricing strategies namely, mark-up pricing, target return on investment, perceived value pricing, competition-based pricing, and penetration pricing (Sammut-Bonnici & Channon, 2015).

Nevertheless, it could be concluded that Netflix did not change its pricing strategy in India where it sticks to the perceived value pricing strategy. This is based on both tangible factors such as the usefulness of Netflix’s services, and intangible factors such as quality and brand attributes of no-advertisement (Sammut-Bonnici & Channon, 2015). Based on this strategy, Netflix India is targeting affluent consumers who would pay extra for such a level of service. As stated by Kumar et al., (2020), “the primary market of Netflix India remains the high-income consumers from Urban Areas,” (p.6).

However, this pricing strategy caused Netflix to lose its ground (Kumar et al., 2020). In fact, comparing Netflix’s pricing strategies with other competitors, it was evident that Netflix charges three times higher than HotStar and eight times higher than Amazon Prime (Kumar et al., 2020). Moreover, Netflix India has refused to depend on advertising revenue and stood its ground for prioritising viewer satisfaction; which might be problematic since it is clear that Indian consumers place more emphasis on financial aspects (Kumar et al., 2020).

Thus, it is evident that Netflix’s main mantra remains “Product over Price” despite the high price sensitivity of the Indian market (Kumar et al., 2020). Whereas, Netflix could have resorted to competitive pricing or market penetration strategies to attain its 100 million subscribers goal.

4.2 Cultural Issues

4.2.1 Indian Culture and Taste

The understanding of the culture of the newly entered market is of utmost importance since it determines the level of acceptance/rejection of the provided services by prospective customers (Kivenzor, 2015); thus, it has been acknowledged that marketers should understand the cultural nuances of the target market to effectively design and communicate their marketing strategies. This is particularly true in India as it is a country that is characterised by several cultural differences. As stated by Kumar et al., (2020), “Indian users are difficult to understand and Netflix had to adapt entirely different strategies.” (p.5).

In comparing Netflix’s performance to other mega competitors in India, the lack of a comprehensive understanding of Indian culture is apparent. It has been acknowledged that the lack of experience in the Indian market had caused Netflix to lack superiority in scripts and production quality (Thakur, 2022); thereby, hindering the growth and expansion of its subscriber base. The case is further worsened by Netflix’s refusal to enter into partnerships or any forms of strategic alliances to have a better understanding of the Indian market (Kumar et al., 2020).

Furthermore, Netflix’s sticking to SVoDs only is another hindering factor; this emerges from the fact that Indians develop a wider taste for a broad range of entertainment content. This is further supported by Sull & Turconi, (2021) who state that Netflix India should diversify its content in India to include sports, specifically cricket, and user-generated content. In fact, Netflix India has ignored the greatest obsession of the Indian audience which is cricket; thereby causing it to miss significant growth opportunities (Thakur, 2022). By capitalising on the fact that Cricket is played for 8-9 months in a year, Netflix could ensure a significant increase in its subscriber base (Thakur, 2022).

4.2.2 Changing Consumer Behaviour

As stated by Singh, (2018), “while traditional media continues to be the media of choice for consumers with an overall share of 84 per cent, India is seeing an increase in the share of digital in media consumption.”. This indicates that populations in rural areas are increasingly adopting digital media for entertainment; thereby, raising concerns about Netflix’s target audience, which are the elitist only.

Besides, such a trend is expected to radically change with the change in multiple factors including but not limited to rising affluence, penetration of data into rural areas (Singh, 2018), increased access to technological devices, and the introduction of high-speed internet services (Kumar et al., 2020). Thus, causing Indian audiences to consume more digital content, an estimated five hours per day on average (Sull & Turconi, 2021). Accordingly, Netflix India should have capitalised on this fact through the targeting of a wider audience in their marketing strategy to be able to gain the desired market share amidst fierce competition levels.

5 Analysis of Internal Influencing Factors

5.1 Institutional Factors

5.1.1 Main Library

It has been evident that Netflix’s Indian library is not enough for Indian Audiences (Kumar et al., 2020). Thus, Netflix India was obliged to increase its expenditure on original content from $70 million in 2017 to $420 million in 2019. In fact, it has been acknowledged that investments play a crucial role in the process of establishing the firm’s relative position in new markets (Spence, 1979). However, Netflix’s refusal to capitalise on the core competencies and capabilities that could be gained through mergers and acquisitions is another limiting factor in terms of the capital available to generate a decent amount of content to convince customers in India to subscribe to Netflix (Sull & Turconi, 2021). Another main hindering factor is that Netflix needs to develop regional content to be able to establish a solid base in rural areas (Kumar et al., 2020), an aspect that requires tremendous amounts of capital investments. However, with the lack of the needed level of experience in the Indian market, Netflix India seems to lack the needed competencies and financial resources to effectively compete with its mega competitors and secure more subscribers.

5.1.2 Economic Integration

Economic/financial integrations are crucial for securing enough capital to enter a new market (Frederiksen, 2022). As stated by Martinez-Piva & Zúñiga-Arias, (2018), “ firms vertically and horizontally integrate separate economic activities located in different countries in order to capture a set of transactional benefits derived from placing these activities under common ownership” (p.2). It has been evident that mergers, acquisitions, partnering, and joint ventures are the main types of economic integrations that are sought by businesses when entering a new market (Frederiksen, 2022).

Such integrations are done with the aim of enhancing its value-adding activities through an improved pattern of investment, production, and trade (Martinez-Piva & Zúñiga-Arias, 2018). However, as mentioned earlier, Netflix seems to follow its global strategy by avoiding mergers, acquisitions and alliances (Sull & Turconi, 2021). This is similar to its overall strategy across the globe where it continues to operate alone without any local or international partners. This weakens its position relative to its competitors who have highly sought such forms of integrations to better diversify its content and attract a wider base of customers in India.

5.1.3 Human Resources Factors

Netflix has shown great success in managing human resources. Sull & Turconi, (2021) state that Netflix’s main success could be attributed to its corporate culture that promotes agility and innovation. To motivate its workforce, Netflix has adopted an employee empowerment approach where they are allowed to make their own decisions (Sull & Turconi, 2021); thereby, leading to the establishment of an environment where employees could thrive. Such a decentralised management form is of significant importance in new markets since it eliminates bureaucracy in the decision-making process; it further allows employees to make better-informed decisions based on their knowledge of the Indian market which is another important factor that determines the success level of the company.

In addition, Netflix does not depend on bonuses as rewards; rather, employees choose to get their compensation through stock options each year (Sull & Turconi, 2021). This further drives them to set higher performance standards and bars; thereby, leading to the success of the company.

6 Recommendations

Based on the aforementioned discussion, it is evident that Netflix India needs to revisit its marketing strategy in several main areas. These include its premium pricing strategy, commitment to no advertising, and refusal to capitalise on mergers and acquisitions. Accordingly, the following recommendations are provided.

First and foremost, Netflix India needs to seek new forms of partnerships to be capable of having wider access to resources, specifically, financial resources that would make it better compete with its mega-competitors. Secondly, Netflix India needs to shift from its market development strategy to a diversification strategy where it continues to develop new products and services in the new market.

Thirdly, Netflix India needs to change its strategic positioning to a cost-leadership strategy. This is based on the price sensitivity of the Indian market and the priorities of Indian customers in terms of the level of quality provided and the number of advertisements they view. Accordingly, Netflix India needs to change its pricing strategy to a competition-based pricing or penetration pricing to be able to attract subscribers.

Fourthly, Netflix India should have a better understanding of the Indian culture and unique taste of the Indian market in entertainment; thus, it should consider diversifying its content beyond SVoDs to include sports for example. This should be accompanied by targeting a wider audience from rural areas. This is further supported by Kumar et al., (2020) who state that “there is a need to search for a new market in India like the rural market, Bottom of the Pyramid market or the market in Tier II, III and IV cities” (p.1). Finally, Netflix India should consider forms of vertical and horizontal integration through partnerships, mergers, or acquisitions to capitalise on the needed resources and competencies to be able to further expand its customer base and increase the number of subscribers.