1. Introduction

1.1 Purpose of the Report

This report is compiled as an evaluation of the strategic merger of Tesla and SolarCity in 2016, where Tesla invested $2.6 billion in the acquisition of SolarCity. The article has two main parts; the first entails the analysis of the external business environment in the car manufacture industry through PESTESL and Porter’s five tools to achieve the evaluation. The second section analyses the internal environment of Tesla through VRIO and Value chain analysis, which leads to the strategy analysis of the merger through the SAF Framework.

1.2 Company’s Background

Tesla is an American based automotive and energy company, located in Palo Alto, California. Tesla is an outstanding company in the car manufacturing industry, by engaging in the manufacture of electric car models. The company, as Stringham, Miller and Clark (2015, p. 86) asserts, has worn environmental awards as a pioneer in the protection of the environment, since the electric car models are more environmental friendly.

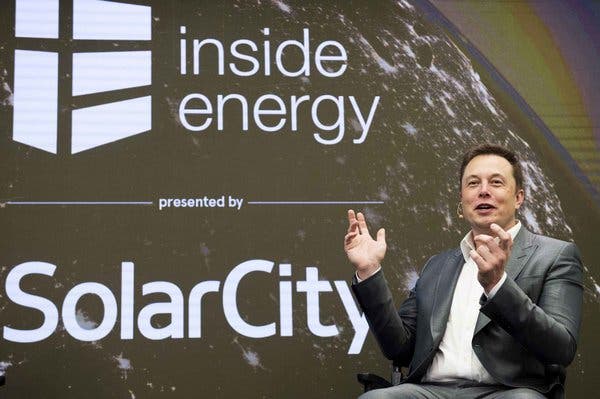

As reported by The Wall Street Journal, in 2016, Tesla, through its chairman and CEO Elon Musk, who doubled up as the chairman of SolarCity, stroke a $2.6 billion deal, where Tesla purchased SolarCity, a solar energy company. The main reason of purchase as claimed by Musk was to enhance Tesla’s production of more energy effective vehicles, including a solar powered car (Chris, 2016). Musk further confirmed that the solar energy products sale were also to get a boost through direct marketing to the over 3 million customers who visited Tesla’s stores all over the world.

2. External Analysis of the Industry

The car manufacture industry is a highly diverse industry with different companies focusing on creating of cars that meet the dynamic customer requirements. There is daily improvement in the production of the vehicles from speed, efficiency, and performance.

2.1 PESTEL Analysis

The industry forces can be identified through pinpointing of the opportunities and threats in the wider environment or society which affects the production and distribution of the vehicles. The strategic positioning of the company can easily be identified after such review.

Political

The political environment in the world has always been geared through supporting innovations and business. For instance, the UK and the United States are in an economic block which enhances movement of goods from one country to the other; however, the Brexit exit might affect the effective business environment. With such actions, industries such as the car manufacture might be negatively affected. For instance, the article by Anuradha Garg in the Market Realist reports that Tesla had a record sale in UK in the month of August despite being an American based company. Such are attributed to the supportive political environment which allows the company to effectively market their vehicle in the country.

Economic

The automotive production industry as Holmes, Rutherford and Carey (2017, p. S77) argues is one of the most important industries in the world’s economy. There are high chances of success and profits in the industry with production of reliable vehicles, thus, acts as an opportunity. However, with the availability of many manufacturers and companies in the industry, there is high competition, which might impact the chances of a particular single entity success, thus, a threat. There is also an increase in the interest of the world in engaging in clean energy usage, thus, acting as an opportunity for Tesla and SolarCity merger.

Social

The whole society has an interest in the automotive industry. Therefore, a company can decide to target a particular social group to enhance their chances for success. In consideration of sleek vehicles and high performance, most of the youths are the most probable customers. Therefore, there is an opportunity in the industry, for a company which ensures they endure in production of more sleek cars with better performance, than those produced by the competitors.

Technological

The technological environment in the automotive industry is highly competitive. As detailed by Holmes et al. (2017, p. S81), the automotive industry has underwent high transformation due to the technological capabilities encompassed in the industry. Companies with higher innovation capabilities have an opportunity for success in the industry. For example, the automotive manufacturers have implemented aspects such as auto drives in their vehicles, which enhances performance, thus entices more buyers. However, a company with less innovative capacity might face a challenge in the automotive industry due to competition from technological enhancement by others.

Legal

The vehicle manufacture industry has always got a support from the legal environment in the whole world. The interest of the legal environment is always to ensure that the business environment works well for the benefit of the countries’ economy as well as the profits of the entrepreneurs. For instance, in the UK, the automotive industry can consider the legal environment as an opportunity. Despite the country manufacturing its own vehicles, there is a support for the sale of vehicles manufactured from outside countries. Therefore, Tesla can take that as an advantage and venture into such markets.

Environmental

Environmental concerns in the world are always strict on ensuring that the world is protected from pollution from fossil fuels and the use of ‘dirty’ energy. There are always enhancements of any positive step to production of clean energy by organizations such as the United Nations Environmental Program, which also help in coming up with effective legislations for protection of environment. Vogel (2018, p. 156) considers the automotive industry as one which has a major impact on environmental pollution for a long period in time. Therefore, Tesla has an opportunity in the industry with their production of vehicles which utilizes electricity, with zero chances of pollution

2.2 Porter’s Five Forces

The porters five forces according to Argyres and McGahan (2002, p. 41), is the strategy used in the analyzing of a business competitive environment. Analysis of the business environment of Tesla through the Porter’s five forces will help in identifying of the company, and the merger with the SolarCity power, can produce positive results in the market, through effective competition.

Competitive Rivalry

There is a high competitive rivalry in both the production of automotive and solar energy in the world. Therefore, Tesla should ensure that they remain a top notch company in producing better vehicle qualities with great performance. The merger of Tesla and SolarCity will ensure that both companies get a wider range of customers, as well as improve the companies’ services, for instance, better battery energy, as well as increase chances for innovation, such as the solar powered vehicles, which enhances the ability of Tesla to produce better cars. Therefore, there is a high competitive rivalry of the company; however, the company still has ability of better handling the competition.

Supplier Power

The supplier power refers to how easy it is for the suppliers to increase the prices of goods. Tesla only depends on a single supplier for batteries the use of the powerpacks. Therefore, Tesla runs a risk of getting higher prices for the raw materials of the manufacturing of the Powerpacks, due to the fact that there is only a single supplier for the goods. Additionally, Tesla gets most of their raw materials for the production of the body of the cars from China. Since many companies are running to China for the goods, there is a high possibility for China producers to increase the prices of the goods required by the companies. Therefore, the supplier power is high.

Buyer Power

The buyer power relates to the ability of the buyer to influence the prices of a commodity by a particular business entity (Argyres and McGahan 2002, p. 42). However, Tesla is compared to the Apple Company, which has a designated sect of buyers, who might be considered as high end buyers. Therefore, Tesla makes products focusing on the high-end buyers who normally have a lower bargaining power. Additionally, Tesla aims at improving their market, thus, the merger with SolarCity, will help the Company’s subsidiary, Gigafactory, be able to produce considerably cheap batteries with longer lasting power capabilities. Through such innovations, Tesla is capable of creating much cheaper vehicles, which are also durable, to enhance increase in their buyers size. Therefore, the buyer power on Tesla is low.

Threat of Substitution

The threat of substitution as detailed by Argyres and McGahan (2002, p. 42), highly bases on the ability of the customers to fins new methods of acquiring the business entity service. There are very low chances of substitution in Tesla’s production and distribution of electric powered vehicles. However, the solar energy power has various substitutions in the market as consumers not only depend on solar power for energy. Due to the era of high embracing of clean energy however, Tesla has a higher chance of ensuring that the consumers of the solar energy remain in utilizing it through extensive innovations in the company that offers the client a more durable solar power. The merger of Tesla and SolarCity will also ensure that Tesla is capable of producing vehicles with long durability of batteries for effective performance, thus, neutralizing the threat of substitution.

Threat of New Entry

As detailed by Mcdonald (2019), Tesla has no problem with any other individual producing an electric powered car. Therefore, one can easily engage in the production and distribution of electric powered automotive, provided it is done in good faith, without getting into trouble with Tesla. There is therefore, a high threat of new entry to the manufacture of the electric cars, what earns Tesla a competitive edge in the industry. However, through the innovativeness in the company, Tesla works hard to ensure that such entry will not jeopardize their operations. The merger also helps to ensure that Tesla manages to produce stringer batteries for their car models, which any new entrant in the sector might face as a challenge judging from the growth of Tesla to reach such height. Therefore, the threat of new entry is medium.

3. Internal Analysis

The main strength of a company is derived from the people working in the company through their skill and capabilities, as well as other physical resources owned by a particular company such as financial and assets.

3.1 Resources of Tesla

The competitive advantage of Tesla can easily be identified through knowledge of the resources that the company owns. Barber (2015, p. 106) claims that resources can be in terms of assets or financial. The main resources that Tesla has are the workers who double up as an asset to the company. The employees of Tesla ensure that the company is always operational and it continues to achieve the goals set by the management. Tesla is among the companies in the world that offers good compensation to their employees, as well as has the most demanding working environment. Through offering high compensation, Tesla acknowledges the fact that the need the employees for their success. In return, employees are offered a chance and environment to work even harder and deliver more to the demanding company.

Mcdonald (2019) confirms the stock standings of the company at $200 mark. As much as the stock reduced from the high shares it had in the market previously, Tesla still has a good share in the market considering the market it is a player on and the competition from earlier engages in the automotive industry.

Tesla is a reputable brand in the vehicle industry due to their production of electric cars, which are not common in the automotive industry. The company is worldly known, with a brand preferred and has got positive reviews in the market. Brand reputation and awareness are essential for manufacturers in the automotive industry, as such helps them in even gaining more clients in the industry.

3.2 Capabilities of Tesla

The capabilities of Tesla Company are the strengths it has for a competitive advantage in the industry.

Tesla has the highest innovative capabilities in the industry. The main reason behind the argument is the ability of the company to produce electric cars, which according to Brough (2013, p. 16), was even hard for the largest industry players before the emergence of Tesla. Therefore, the company has a major player in innovativeness in the automotive industry, judging from the ability of ensuring that the electric cars are in operation at the moment.

Tesla has a capability in the growth of their brand portfolio due to the merger. Through the merger with the SolarCity, Tesla has the capability to be even known wide and large in the world as a pioneer of clean energy production.

3.3 VRIO Analysis

The table below is a VRIO analysis table detailing the core strengths of Tesla. The strengths enhance a sustained competitive advantage of the company in the market, as detailed by Business-to-you.com (2016), (see Appendix 1 on VRIO Framework).

| Resource or Capability | Valuable | Rare | Imitable | Organized | Sustained Competitive Advantage |

| Reputation and Brand Awareness | Yes | Yes | Yes | Yes | Yes |

| Innovative Capabilities | Yes | Yes | Yes | Yes | Yes |

| Growth in brand portfolio due to merger | Yes | Yes | Yes | Yes | Yes |

Table 1: VRIO Analysis of Tesla

3.4 Value Chain

The company value chain according to Mindtools.com (2019) (see Appendix 2) details a set of activities performed by the company in their field of operation to enhance the success margin. The table below details the value chain of Tesla.

| Firm Infrastructure | ||||

| HRM | ||||

| Innovations | ||||

| Procurement | ||||

| Inbound Logistics | Operations | Outbound logistics | Marketing and Sales | Services |

MARGIN

Table 2: Value Chain of Tesla

In summary, Tesla has a Human resource management, which links to the high innovation aspect of the company, supported by the procurement, to enhance that the company has a better margin in the market. The activities under procurement are to ensure that the service delivery of the company is top notch, in the car manufacture industry, which in turn earns the company a competitive margin.

4. Strategy Evaluation

The merger of Tesla and Solar City, the electric car and solar energy company was to maximize the potentials of both the companies. Since the two are pioneers of clean energy, the merger was to enhance the use of electric cars and solar energy all over the world, thus, working as a single entity would enhance the marketing capabilities and new interventions such as the solar powered cars. The strategy is assessed in this section through Sustainability, Accessibility, and Feasibility (SAF) Tests as shown in Appendix 3.

4.1 SWOT Analysis

With the current image of internal and external environment of Tesla, the SWOT analysis is as follows

Strengths

- High differentiation of product with other car manufacturers; electric powered vehicles.

- Diversification in the products portfolio, the Powerpack.

- Integrated manufacture of the battery at their Gigafactory.

- Improving of customer base through the strong marketing policies.

Weaknesses

- Limited experience in the new products.

- Little profitability of the company.

- Single supply of batteries for sales of the battery powerpacks.

Opportunities

- Exploration of related market opportunities through the expansion of the company’s’ ecosystem.

- Growing interest of reducing consumption of fossil fuels.

Threats

- UK exit from European Union.

- High competitions in the car manufacture market.

4.2 Sustainability

The analysis of sustainability of the company entails a consideration of the strengths and opportunities that affects Tesla through the TOWS matrix as shown below.

| External Opportunities

1. Exploration of related market opportunities through the expansion of the company’s’ ecosystem. 2. Growing interest of reducing consumption of fossil fuels. |

External Threats

1. UK exit from European Union. 2. High competitions in the car manufacture market. |

|

| Internal Strengths

1. High differentiation of product with other car manufacturers; electric powered vehicles. 2. Diversification in the products portfolio, the Powerpack. 3. Integrated manufacture of the battery at their Gigafactory. 4. Improving of customer base through the strong marketing policies. |

Strategic Options

The growing interest in reduction of fossil power consumption and the high differentiation of Tesla company in the car manufacture industry becomes a strategic opportunity in the merger to create manufacture of solar powered cars. |

|

| Internal Weaknesses

1. Limited experience in the new products. 2. Little profitability of the company. 3. Single supplier of batteries for sales of the battery powerpacks. |

Table 3: TOWS Analysis of Tesla

After the construction of the TOWS analysis table as shown on table 3 above, the merger of Tesla and Solar city is deemed a much welcomed merger. There is a rapid change in the world with a bid of enhancing a clean and secure environment. The United Nations Environmental program spearheads policy implementations that enhance protection of the environment including use of fossil fuels as a source of energy. In the bid, most of the fuels burnt by vehicles are meant to be more environmental friendly. Tesla has a chance to run the car industry with their products, electric cars. The merger with the SolarCity shows the engagement of the company in ensuring safe environment through clean energy, solar power. The merger will provide new markets for the company’s products, Chris (2016), through referrals of Tesla clients to the solar products.

4.3 Acceptability

Acceptability of the company is addressed through the power/interest matrix (see Appendix 5). Through the presentation of a power/interest matrix according to Ackermann and Eden (2011, p. 43), the key stakeholders of Tesla and SolarCity are identified, and their interests in the merger. As detailed by Robert (2016), the key players of Tesla and Solar City are the investors, who own shares in the companies and have an interest in the profitability. In the merger, the companies, as detailed by Chris (2016), assures of profitability from the merger as they anticipate of $150 million in cost in a years-time after the merger. SolarCity shareholders are also promised to receive 0.11% of shares from Tesla after the merger. Therefore, it is clear that Tesla has identified the key players and their interest, thus, worked towards ensuring their satisfaction.

4.4 Feasibility

The merger of Tesla and SolarCity aimed at enhancing profitability of the companies’ through innovations on sustainable energy for the Tesla Company. Tesla aimed at ensuring that they get the best energy provision systems as well as empower their battery productions through the linkage with the solar power. The Gigafactory is a confirmation of the strategy through production of low cost batteries integrated with the solar power. There is high innovation potentials in Tesla Company, which enhances the chances for success in the merger. Tesla ensures that they have competent employees, who help driving the company to success, and profitability, improving the engagement in stakeholders to ensure that there is availability of finance for the company’s functioning. Therefore, the venture will be successful as there is relevant profitability, staffing, as well as stakeholder engagement in both Tesla and SolarCity to enhance success.

Peachy Essay is a well reputed dissertation writing company that has all your requirements at heart. Our company genuinely offers the following services;

– Dissertation Writing Services

– Write My Dissertation

– Buy Dissertation Online

– Dissertation Editing Services

– Custom Dissertation Writing Help Service

– Dissertation Proposal Services

– Dissertation Literature Review Writing

– Dissertation Consultation Services

– Dissertation Survey Help

Students working on case studies or might need academic help, might find our custom Case Studies Writing Services helpful.

Also look at some of our business services

– Business Essay Writing Service

– Business Dissertation Writing Services

– Business Report Writing

– Business Assignment Help

– Business Planning Writing Service

– Business Assignment Writing Service