Stripe Company; A Fintech Marketing Strategy

Stripe is one of the biggest Fintech companies around the world. In 2019, Forbes ranked the firm in the first position in the list of the most valuable companies in the US (Taulli). The company has continued to grow in both capital and attention owing to its exceptional marketing strategies as well as the boom in demand for the Fintech services in the US market. Research on the company’s marketing strategies explains its current position and possible advancements in the future.

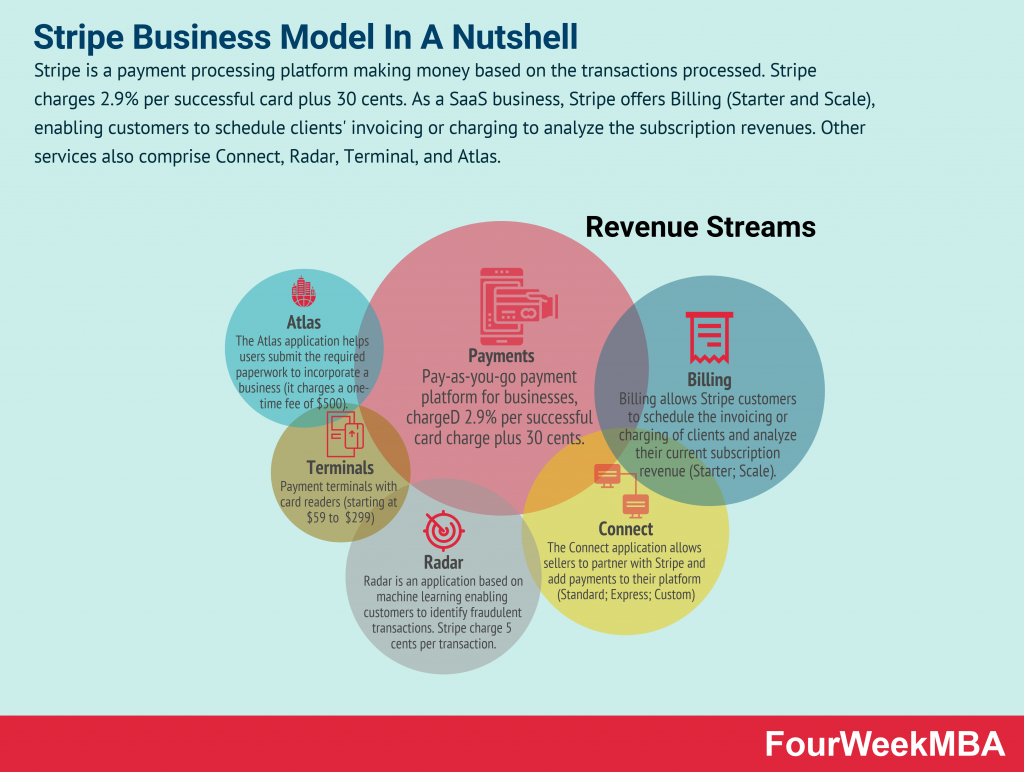

The basics of Stripe reveal its rapid rise to be the top company. The company was started in 2010 as an online service to assist small online traders in their payment processes. Some of the largest contributors to its starting capital include Y combinatory, Peter Thiel, Andreessen Horowitz, and Sequoia Capital. The company has grown in both size and capacity. It now serves major companies, such as Amazon and Microsoft. Some of the areas in which it continuously records good performance include point-of-sale software, credit card issuance. It also does well as a billing platform for businesses that rely on subscription.

Marketing strategy, theories, and concepts applied in the US

One of the marketing strategies that Stripe used in the US is the consumer decision-making process. The strategy involves five steps of analyzing and satisfying the needs of the consumers available in the specific market (Stankevich 7). The first step is need recognition. It involves the realization of a need amongst consumers. The marketers of a firm seek to create an imbalance between the present status of the consumers and their preferred status. It is by so doing that they create an urge amongst consumers to seek a service that will bridge the imbalance. Firms reap from the consumers’ urge to purchase that which will minimize or eliminate the imbalance (Stankevich 10). It is in this way that Stripe identified the opportunity of creating online financial services that consumers in the US market needed to get to their desired state. For example, recognizing that small scale traders need easily accessible business loans.

The company then followed through the other stages in the marketing strategy. The next process involved information search. The stage of information search involves seeking information regarding the available alternatives that have the potential to satisfy the needs (Stankevich 10). It is in this stage that the consumers identified Stripe as one of the companies that are capable of satisfying their online financial needs. Stripe capitalized on this by identifying the type of consumers available in the specific market. For example, identifying that there are small scale traders. The third stage involves the evaluation of alternatives. Potential customers base their decisions on metrics such as prices, quality, and quantity, amongst others. Stripe identified the more specific needs of the consumers at this sage. The fourth step involves the actual purchase action (Stankevich 11). It is in this stage that Stripe learned the buying behavior of consumers. The final step involved the evaluation of post-purchase satisfaction. The feedback of consumers further taught Stripe the areas in which it needed to improve its services.

Stripe has also been using the SWOT analysis to inform its marketing activities. It analyses the strengths, weaknesses, opportunities, and threats of a business (Sammut‐Bonnici 2). The company invests a lot in research and development. The research department has been doing well in making sure that the company has the right information on which it can act. It is from the researches that the company identified its strength in the ability to attract developers. The company’s idea was attractive to people who were well versed in the finance and technology industries, such as Peter Thiel and Elon Musk (Taulli). It is from them that it gained the funding to start and market itself. Having such popular persons in the team was also an advantage to the general outlook of the company. Consumers in the US market had confidence in the company’s ability to deliver. The weakness of the company was, however, that the company did not initially have a good name in the beginning. It found it hard to find trust with the name Slash Dev Slash Finance as compared to its equal, DevPay.

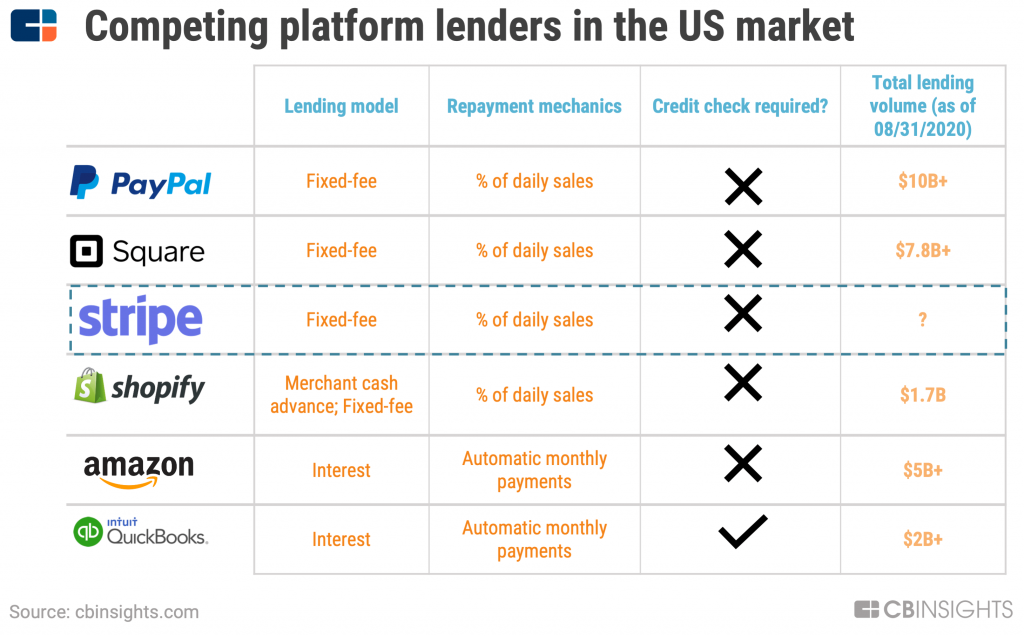

The company also analyzed the market for available opportunities. One of the most notable was the unavailability of tools for developers. The company identified that developers in the US had a hard time making any significant progress in their coding activities. The available companies were insufficient in client satisfaction since they lacked features such as modern codebases, client libraries, APIs, and documentation (Taulli). It is from these inadequacies that the owners saw an opportunity to create a user-friendly payment company. The company, however, faced the threat of the presence of large players in the market. The traditional companies posed a lot of competition to the novice company. The huge players in the market at the time included PayPal and Authorize. Good research and proper implementation have, however, enabled the company to grow exponentially within a short period of about a decade and become the leading Fintech in the US.

Tactical Marketing decisions introduced by the business

One of the outstanding tactical marketing decisions of Stripe was to create a service that solved more problems than those of the existing firms (Taulli). Stripe was careful not to replicate what was available in the market. It identified that other service providers in the fintech business had deficiencies that inconvenienced consumers. For example, other payment companies offered services that made it hard for people to pay for things online. The services did not serve the purpose that was supposed to be catered for by such economic infrastructure. Stripe identified that there was good communication, but payment services lagged in serving clients online. The company sought to solve the problem by creating a developer-focused platform. Its services allow for instant set-up and scalability. By so doing, it solved a problem in the market, and the users of online payments responded well to the service.

The decision to serve the market differently was also manifest was reducing the workload involved in online payments. Stripe identified that other companies were reluctant to provide users with what they needed (Taulli). Instead, they left them to do a lot of work for themselves. For example, the available payment infrastructure used the traditional technology that was cumbersome in accepting credit cards. People used the legacy banking structure despite its slowness, complexity, and high cost of service. The effect was negative on e-commerce. Stripe sought to change the e-commerce infrastructure by revolutionizing the way people worked with it. The company created a platform in which it reduced the workload that people had in the background activities. For example, it eased the work of developers by allowing them to create accounts where they could copy and paste while instantly seeing the results (Taulli). The company’s decision to ease e-commerce activities attracted a large number of customers.

Another well-planned strategy was using a new distribution model. The company decided to be different from other similar firms by selling to developers as opposed to companies. It identified opportunities in being an improved alternative of the existing companies, such as PayPal and Authorize (Taulli). Majoring on the part of the market populated by developers was advantageous in that it created a community of loyal persons. Developers using the platform had a good experience in both the frontend and backend activities. It eased their work by far and gave them an expert image. By so doing, the developers felt attracted to use the company’s services as opposed to any other (Meral 262). The ability of the firm to appease developers was successful in that it created a self-sustaining community. It would have been harder for the company to do the same for companies. The benefits would have been less than what the company has realized so far.

Stripe’s strategy of using a subtle approach to market expansion is also outstanding. The company has been embarking on small calculated steps of growth. The first step was seeking credibility amongst developers (Taulli). It did so by simplifying the process of integrating the payment features into apps and websites. Developers only needed a few lines of code to complete the processes. The credibility gathering stage was set to take a long time. It, however, gave the organization the reward of loyalty and credibility. The firm has been protecting its credibility base as it establishes dominance in other areas using the same strategy of simplicity. It has been expanding using the small calculated steps over the years that it has been in operation. Protecting the areas gained and expanding with the same calm energy is of significance to the business (Bahador 4). It has enabled it to maintain the statuses previously gained while also gaining new customers who are loyal to the business.

Analysis of the main components of the marketing mix

Stripe has been using a transparent pricing strategy since its inception. The company has gained popularity amongst its customers for being open about its prices. Doing so has enabled it to rise above the competition (Taulli). Most other companies still use the traditional method of opaque pricing. Their customers constantly complain about what they think is swindling done by the companies. For example, some customers complain of hidden charges that are imposed on them by surprise in what seems like a scheme to extort them (Thabit 103). The strategy makes the companies look bad to their customers. As a result, it is unlikely for them to develop the right level of loyalty to the services offered by Stripe’s competitors. Stripe is not the cheapest in the market. Its transparency has, however, improved its ability to gain and retain a loyal customer base. The outright statement of prices and absence if termination fees, for example, give people the confidence that the company is customer-focused.

One of the communication strategies that has helped Stripe to succeed is the reliance on word-of-mouth communication. Word of mouth communication is advantageous in that it amasses positive feelings about a firm and its services (Huete-Alcocer 12). The company has successfully made several steps in mastering the art of effortlessly spreading information about its services. It embarked on the strategy since its establishment. The company used the first years to establish dominance in the market by ensuring that its customers got better experience than what they received from other firms. The ability to build a reputation through positive information spread has proved that the strategy was suitable and fruitful. The company has continued to rely on this communication strategy to date. It continues gaining popularity despite working behind the scenes. The strategy is different from that of other companies, such as PayPal, which communicate by inserting themselves in the purchasing process.

- Logistics

Fintech delivers its services to its customers through the internet. The company has all the logistics features of a Fintech firm. Its service delivery activities resemble those of other Fintech companies in numerous aspects. They are, however, more and busier due to the magnitude of activities in the large company. The absence of major differences means that the company barely has any competitive advantages in the delivery of its services. It is, for this reason, likely to have the same level of competitiveness as other companies in the industry. Changes in the logistics aspect of the industry may, however, reveal differences in the future.

- Supply chain management

Stripe uses the usual supply chain of a Fintech company. The firm is the basic producer of various fintech services that companies, as well as individuals, use to perform various online payment activities for their businesses. It enables a procure-to-pay system on its cloud-based software (Rogers). It allows people to customize the platforms they want for their businesses. It also supports the activities of various businesses in online transactions, such as supporting subscription services and invoices. For this reason, the company is considered as the producer of raw materials in the supply chain. It is equally a part of the main service. The advantage of the company in so doing is that it surpasses other companies in service provision. Being part of both the raw and finished services makes it competitive in the market.

- Product Development

Stripe develops products that have the potential to be positively received in the market. The company uses the strategy of first researching on the services that are available in the market. It is from this point of information that the company develops products that better satisfy the needs of the market (Babin 15). The strategy was first manifest in the founders’ actions. They channeled their frustrations with the available services towards the development of better ones that better serve the needs of consumers. The strategy is advantageous in that it produces products that are of superior quality and competitive in the market. It is through this strategy that the company has fast grown to the top position in the US and around the world. The strategy has the potential to help the company get a wider customer base as the company covers a wider range of the demanded services.

Potential obstacles in maintaining competitive advantages

Stripe faces a potential challenge in regulation. Governmental authorities concerned with finance and technology have several demands that have to be met for a Fintech company to remain in business (Harroch). The regulatory bodies set high bars that threaten the continued existence of such firms. Failure to meet them jeopardizes the growth of the organization. Stripe is well established in the Fintech business. The company is, however, subject to all the regulations placed in different countries. The change of regulations, according to geographical changes, threatens the ability of the company to maintain its competitiveness in different jurisdictions. Also, there is a possibility of some countries placing restrictions to support the local industries. Such occurrences threaten the ability of Stripe to thrive around the world.

Another potential deterrent to maintaining a competitive advantage is the presence of larger financial brands. Stripe has been revolutionary in its dealings. It is for this reason that it has been successful. However, the Fintech industry already has better-established players, such as PayPal and Goldman Sachs (Harroch). They pose competition owing to their widespread establishment as well as expertise in handling changes in the market. The competition threatens the possibility of newer entrants, such as Stripe, to maintain their competitiveness in the future. Worse still, other companies are entering the Fintech market owing to its attractiveness in offering good profits. Companies such as Amazon are expanding into the financial industry. They are likely to provide more disruptive services and dethrone Stripe from the current heights of competitive advantage. The rapid increase in the number of players in the Fintech industry means more competition in the future and the potential decline of some firms.

The marking strategies of Stripe have helped the firm to gain the top position in the Fintech industry. The company has dominated the market through the use of calm strategies that have disrupted the Fintech industry for a positive change. It embarks on both intensive and extensive research to establish the needs of consumers. It is from the informed position that it produces the desirable products, prices them with transparency, and sells them online. The company relies on the power of word of mouth to market itself and its products. It is through these strategies that it has gained a competitive advantage in the Fintech industry both in the US and around the world. It is, however, likely to face vagaries that may hinder its ability to sustain the competitive advantage in the future.