Strategic Analysis of Netflix; Capstone Project

Executive Summary

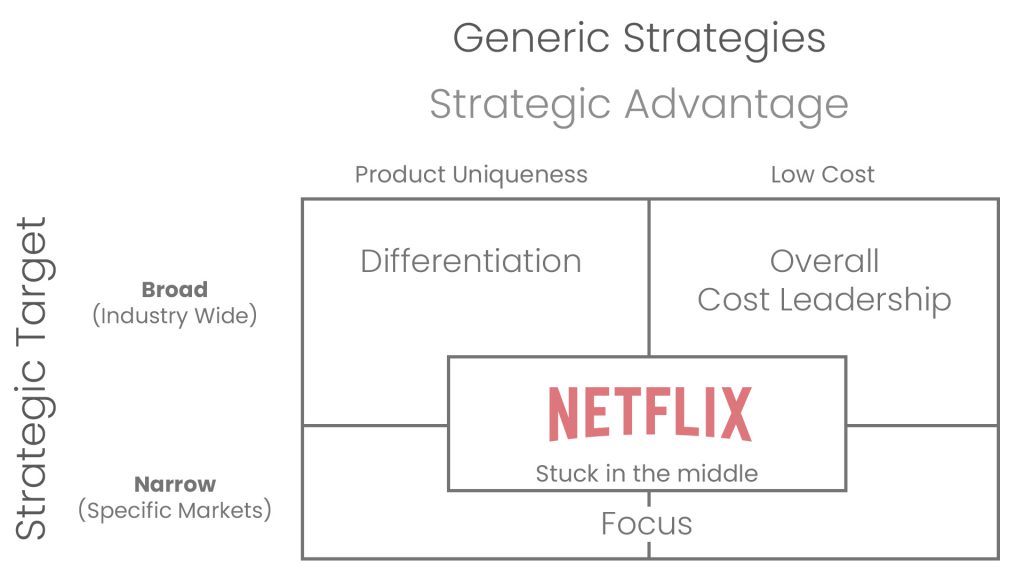

Although the TV and film industry has become more competitive as a result of the emergence of numerous TV and movie distribution companies in recent years, Netflix has remained the top choice for TV and movie streaming. Using secondary information from financial documents, authoritative referencing materials, company websites, and peer-reviewed articles, the project focused on how Netflix has remained the top choice for TV and movie streaming by keeping its competitive strategy viable and made recommendations for sustaining the competitive advantage and for strategic planning. Netflix’s strategic analysis through SWOT analysis, PESTEL analysis, and Porter’s Five Force analysis revealed that Netflix is currently in a good position in maintaining its competitive advantage. However, technology, industry, ethical issues, and leadership and collaboration issues keep on evolving, which necessitates Netflix to continue innovating. The strategies that Netflix can use to sustain its competitive strategy are technological innovations, exploiting the ad-based model, alliances, ethical compliance, environmental compliance, penetrating into new markets, expanding the product mix for growth, Diversification into new markets and industries, transformational leadership and decision-making model, continuous improvement of the streamer’s display system on its user interface, refreshing content library, and providing more interactive videos.

Introduction

Statement of Problem/Opportunity

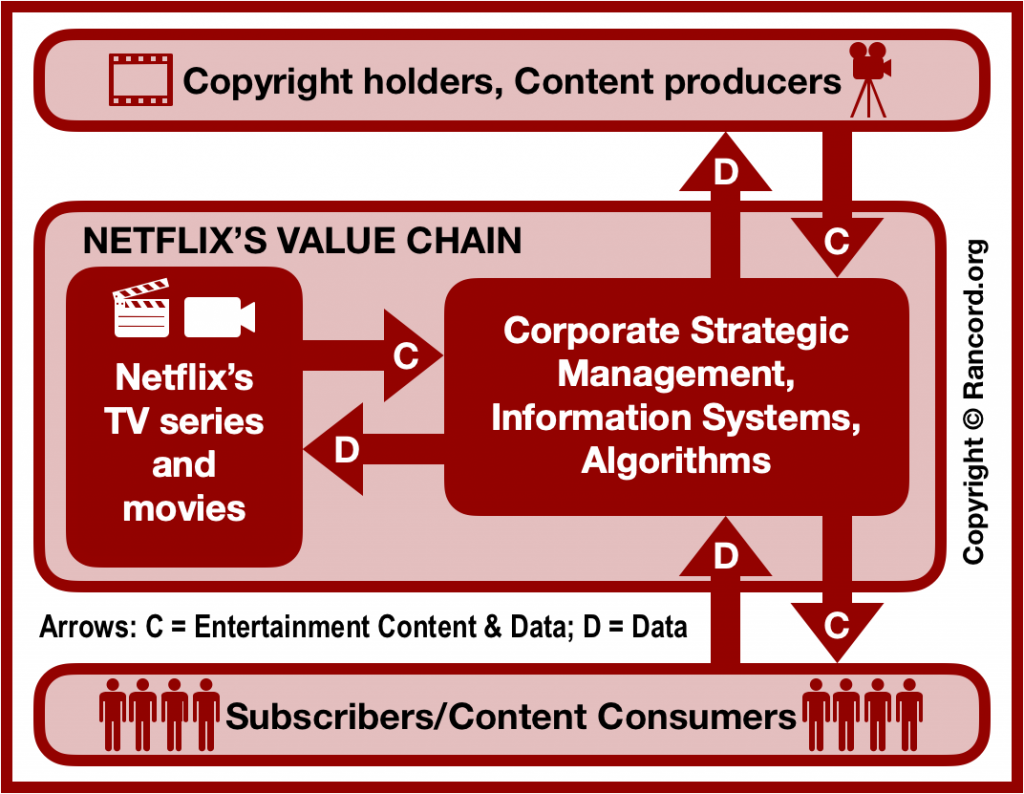

In the TV and film industry, a competitive advantage places a company in a greater business position than its competitors. Netflix, Inc., an internet streaming content provider, is one of the companies with a competitive advantage in the TV and film industry. When compared to its industry competitors, a competitive advantage helps it to achieve more subscriptions and better pricing. With more than 200 million paying subscribers as of the end of 2020, Netflix is the world’s biggest premium streaming service (Netflix Inc.). Other internet entertainment service providers, such as Amazon Prime Video, Disney Plus, and Apple TV, are threatened by the company’s rivalry. Netflix has risen to prominence as a major provider of internet streaming entertainment in recent years (Hallinan & Striphas, 2017). Based on the information provided, there is an opportunity to examine how Netflix has Based on the provided information, there is an opportunity to determine how Netflix has remained the top choice for TV and movie streaming by keeping its competitive strategy viable and to make recommendations on sustaining its competitive advantage and strategic decision making.

Background, Context, and Significance of Study

Netflix was founded in 1977 in the California town of Scotts Valley by Marc Randolph and Reed Hastings. In 1998, Netflix launched a more website based on the conventional pay-per-rental format. Later on, the same year, the company established the monthly subscription system. The company continued to increase sales of movies and by 2005, it had sold more than 35,000 titles and was shipping a million DVDs in a single day. In 2007, Netflix reached 1 billion sales for DVDs and in the same year, the company discovered an opportunity in the internet and launched the internet streaming capability for the on-demand movies and TV shows. As at the end of 2020, it had approximately 203.69 million paying subscribers globally (Netflix Inc, 2021). Its major competitors are Amazon Prime Video, Disney Plus, and Apple Tv.

The TV and film industry has become more competitive as a result of the emergence of numerous TV and movie distribution and companies in recent years, with each company seeking to become the leading internet entertainment service provider. However, Netflix remains the most preferred internet entertainment service provider with more than 200 million subscribers by the end of 2020. Netflix is rivaled mainly by Amazon Prime Video with about 150 million paying users, Disney Plus with more than 100 million subscribers, and Apple TV Plus with approximately 33 million subscribers (Flint and Maidenberg, 2020). Netflix’s competitive strategy has been based on its effective pricing of services, which has optimized its content spend and providing high quality services at a more competitive price than its rivals.

Giant and small companies are still looking to get ahead of today’s competitive market, which includes so many changes in the television and film industry. It is therefore important to understand the competitive strategy of Netflix relative to its competitors, and to make recommendations for sustaining the competitive advantage of the company, for it to become difficult to duplicate or exceed, and remain superior in the long-term.

Scope of the Research

The project focuses on how Netflix has remained the top choice for TV and movie streaming by keeping its competitive strategy viable since its foundation in 1997 to the present, and make recommendations for remaining the most competitive in the future. It will focus on how Netflix’s growth has disrupted the film industry’s environment for content creators, sellers, and customers, as well as what Netflix competitive edge has become in transforming a century-old industry. The recommendations made can be used for strategic planning and continuous improvement.

Financial documents, authoritative referencing materials, websites, and peer-reviewed articles will be used to collect information for the chosen topic. These are secondary sources that include information and ideas from other researchers and scholars. These sources will be used to provide information that will be used to inform strategic analysis of Netflix relative to its competitors. The information will be used to measure performance and set targets using models such as SWOT analysis, PESTEL analysis, and Porter’s Five Forces Analysis. The University Library’s historical database section, The Wall Street Journal, The Harvard Business Review, Google books, journals, and direct information from the Netflix Company’s website can all be used to perform analysis. Netflix’s financial statements will be retrieved from their website or on Google Finance. Other sources of information include Google books, professional contacts, the company’s website, SEC filings, and annual reports. If it is a scholarly article or a peer-reviewed journal article, the data will be no more than five years old, and two years if it is a market report or financial report.

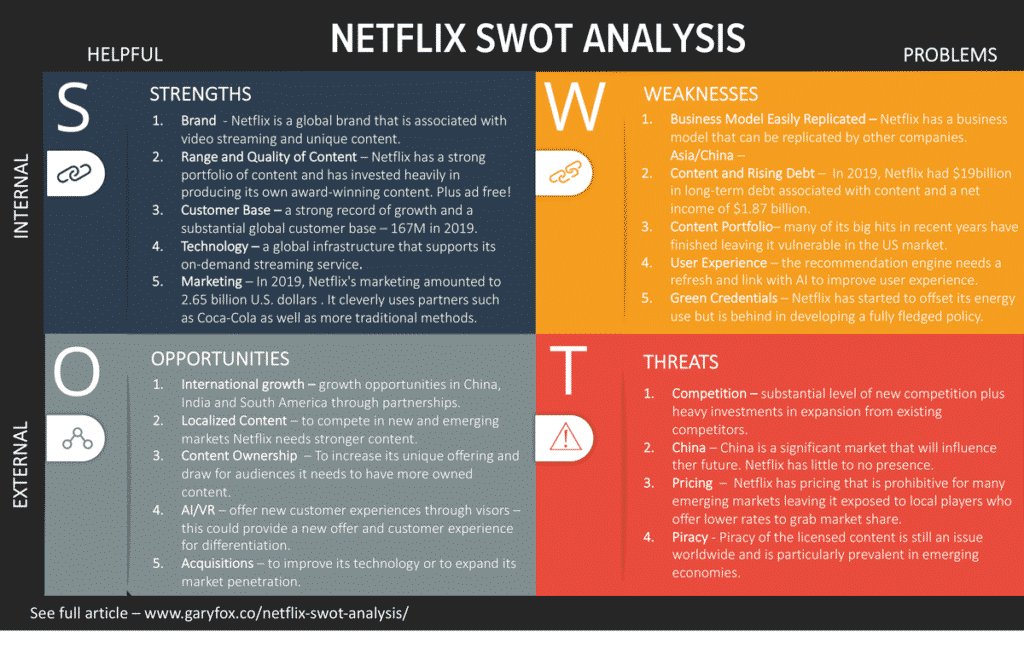

Strategic Analysis of Netflix

SWOT analysis serves as a framework to assess the competitive position of an organization and in the formulation of a business strategy. This analysis includes the internal and external environmental factors, besides a company’s present and potential opportunities (Sadq, 2017). Netflix Inc.’s growth and competitiveness can be attributed to the company’s strategic strengths and competitive advantages, which have allowed it to expand globally and dominate the TV and film industry. The overall competitive advantages are one of the company’s SWOT elements’ overall outcomes. Netflix Inc.’s business continues to flourish and leverage on opportunities, thanks to SWOT analysis, in spite of the negative impact of the company’s weaknesses and threats in the industry.

Strengths

Netflix’s main strength is its user interface. Many people choose to watch different shows on Netflix because of its excellent user experience. The platform is simple to use, manage, and has a technology driven user interface. It has a simple user interface that can be tailored to the user’s preferences and use. It offers a variety of tips depending on the user’s preferences and is both easy to use and appealing. Another advantage is the affordable pricing. Netflix’s pricing strategy has earned it an advantage over its rivals. Netflix’s plans are reasonably priced and have excellent value. For an inexpensive monthly fee of $8.99, subscribers can view an unlimited number of movies on DVD or by streaming (Flint and Maidenberg, 2021). It costs less than cable network movies or cinemas, plus it has a larger range. Subscribers can upgrade to premium plans for higher-quality Ultra HD (4K+HDR) streaming for $15.99 a month.

Netflix is a well-known company with a strong brand. Within a short period of time, it has gained household recognition. Forbes rated Netflix as the fourth most admired company in 2019 (Pontefract, 2019). Netflix is available in over 190 countries and has a global user base. Netflix has over 200 million subscribers, which gives the company a lot of influence when it comes to acquiring premium content from studios. Another strength is customer-centric service. For many years, clients have been asking for an offline alternative to view Netflix while travelling or when there is a weak internet connection. Netflix responded by introducing a download now option that allows consumers to watch their favorite shows offline.

Weaknesses

Netflix Inc. has a replicable business model, which is a weakening internal strategic factor. Competitors may, for example, use the same business model to build an on-demand web video distribution network. Another weakness is Netflix Inc.’s reliance on content producers. As a result of this internal factor, its business is vulnerable to the impact of the approaches used by the producers it relies on. Furthermore, the company is dependent on Internet service providers to assess consumers’ connectivity speeds, which is a crucial factor affecting consumer loyalty with Netflix (Modgil, et al., 2020).

Opportunities

Growing through product mix expansion is one of Netflix’s opportunities. For instance, the organization could facilitate the production of new entertainment content in diverse forms and make the accessible on the web platform or through its app on mobile. Another opportunity for Netflix is market penetration, particularly given the on-demand lack of substantial presence in territories like China. Netflix’s marketing mix has an impact on market penetration. Furthermore, Netflix has the opportunity to diversify by acquiring an interdependent company that can help it boost its overall competitiveness and performance (Flint and Maidenberg, 2021).

Threats

Competition is an external strategic factor that is a barrier to optimizing the company’s sales and profitability in the internet streaming service provision. Furthermore, infringement that occurs when there is copyright and trademark infringement pose a challenge to Netflix because it encourages users to access pirated content rather than that offered via the company’s website or mobile applications. This external factor increases competition for users’ time to view the content (Sadq, 2017). Furthermore, from a resource-based perspective, cybersecurity issues are a threat due to Netflix’s use of information technology. As a result of this external competitive element in the internet video entertainment industry, private and confidential client information could be exposed.

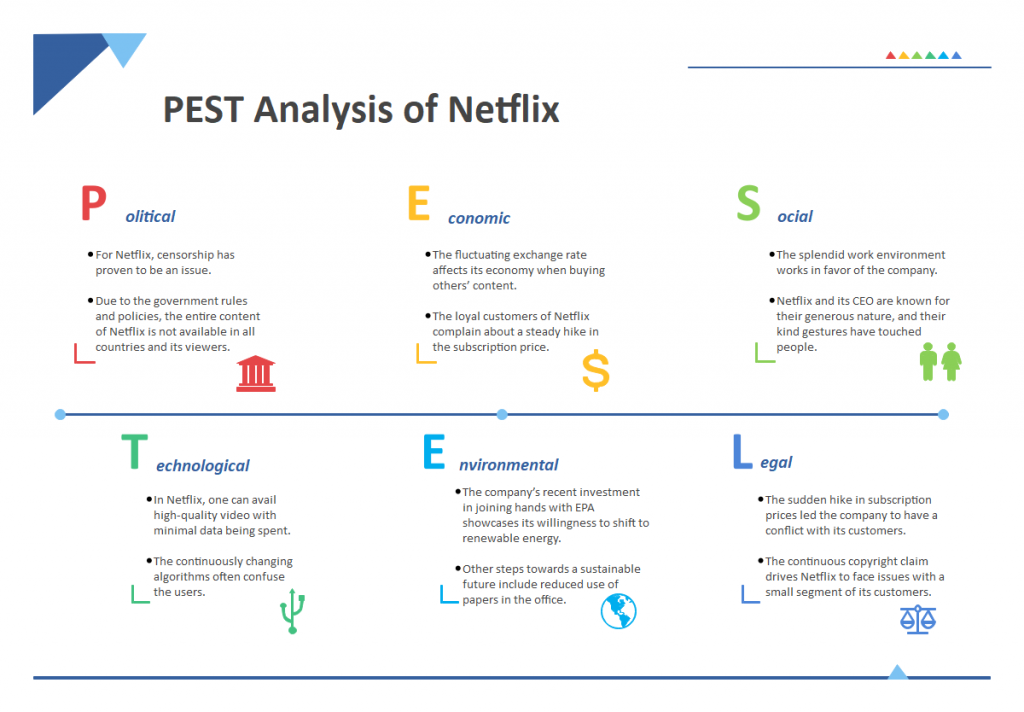

PESTEL Analysis

PESTEL analysis scrutinizes and monitors the macro-environmental factors with a substantial effect on the performance of an organization. Netflix is the most popular subscription service in TV show and movie streaming with a worldwide reach. Netflix continues to rise in popularity and sales as global demand for streaming content increases due to growing usage of the internet and mobile devices (Modgil, et al., 2020). This PESTEL analysis looks at how macro-environmental factors impact Netflix’s business globally.

Political

The first political factor that has an immediate influence on Netflix use is a lawsuit lodged by AT&T with the Federal Communications Commission. The goal of this petition is to restrict the use of internet streaming platforms such as Netflix. In Europe, the European Union passed a different legislation that has an effect on Netflix’s content. According to Modgil, et al. (2020), this regulation requires that any media service provider in the EU must generate content that meets a 30% inclusion of pure European material. Netflix is also required to pay a 26% tax as per this law, which also applies to the conventional media companies.

Economic

In the context of Netflix Inc., economic considerations have a direct impact on is global business. Due to massive growth of world economies and the increase in employment opportunities, people tend to spend more on being entertained. As a result of an impressive performance by the global economy, people have embraced the spending habit on services such as streaming movies and TV shows through the web, a service which Netflix provides efficiently Sadq (2017). Notwithstanding, the outbreak of the COVID-19 pandemic led to a global economic downturn, but Netflix has seen increased number of users subscribing to their services.

Socio-Cultural

Netflix’s popularity in the United States is largely due to a shift in people’s entertainment consumption habits. Conventional media services are being replaced by online streaming channels, primarily Netflix, in the region. The United States has had record figures, and has left the cable movie companies suffering in terms of profitability. In other nations, such as the United Kingdom, almost a third of the population has also switched. Another cultural trend influencing Netflix use is the shift away from larger screens and toward smartphones and tablets as the main entertainment access devices. Since conventional cable does not provide such services, Netflix is quickly becoming the most popular streaming platform (Turner, 2019).

Technological

Technology has spurred innovation increased competition between rival companies, and is integral to Netflix’s operations. According to Sadq (2017), there are many technology-based developments and innovations being performed within Netflix’s offices at all times. Purchases of 4K televisions have skyrocketed in the U.S. and other parts of the world. Netflix has put in place systems to ensure that subscribers can watch TV shows and movies in 4K quality. Netflix’s latest translator ranking system is another recent technical innovation.

Environmental

Due to corporate social responsibility (CSR), companies have to be responsible of their impact on the environment. One of the components of corporate social responsibility is environmental CSR that aims at decreasing the harmful effects of the company’s processes on the environment. Consequently, environmental CSR builds a good reputation and perception within the communities that a company operates in, which boosts its brand image. All technology companies must take proactive measures to reduce the amount of greenhouse gases released into the atmosphere by their activities. Modgil, et al. (2020) claim that Netflix uses a large number of data centers to ensure as little environmental harm as possible. Netflix has been petitioned by a number of environmental activists to use renewable energy to power its data centers, particularly in The United states.

Legal

With changes in legislations in the Tv and film industry across the globe, companies such as Netflix are concerned with the efforts of regulators in establishing a robust system to regulate this industry. According to Flint and Maidenberg (2021), a class action case was filed against Netflix due to public relations misunderstanding. Netflix intended to increase the price of subscriptions, but failed to shed light on the impact on the existing clients, which led to confusion. Netflix was required to execute certain safeguard measures to prevent the users outside the U.S. from hacking and pirating content exclusively meant for the U.S. from its platforms to avoid infringement claims from content creators on their platform.

Porter’s Five Forces Analysis

The Porter Five Forces Analysis will provide insight into Netflix’s industry by assessing the magnitude of all forces that have an impact on how it plans its strategy and generates profits.

Threat of New Entrants

Companies such as Apple, Disney, and Amazon have decided to launch platforms for streaming their own content so as to rival Netflix. The threat of new entrants is high. In spite many users having a multitude of subscriptions, they may terminate them at any moment and opt for services from new companies entering this market (Fagerjord and Kueng, 2020).

Bargaining Power of Suppliers

Suppliers affiliated with Netflix have a high bargaining power. Due to the fact that there are only a few companies that create content for entertainment, there is a high degree of control when it comes to pricing. Netflix has to be conscious of the volume of acquired assets that it might lose as control shifts from cinemas to producers. Netflix, on the other hand, is an experienced and dependable service in its own right (Wall Street Journal, 2021). Netflix will be mindful of the amount of acquired assets they will lose as control moves from cinemas to producers.

Bargaining Power of Buyers

Many internet streaming platforms are being launched, increasing the power and control of the users paying to access these services. The Tv and film industry has a low-price sensitivity. Close to all services are priced at comparable price, which makes viewers to be primarily concerned with the content quality. Netflix was priced at $12.99 a month, Amazon Prime $8.99, and Disney Plus $6.99 (Dysenhaus, 2020). Users have power to end their subscriptions at any time because they are not on a contractual basis, meaning that more control is in the hands of the buyer, making buyers bargaining power high.

Threat of Substitute Products

With the development of a new product or service that solves a customer need in a distinct manner, the profitability of the Tv and film industry is negatively affected.

With conventional broadcast Tv services declining, particularly among young people, who are increasingly preferring to subscribe to streaming, there is a low threat of substitute products for Netflix (Fagerjord and Kueng, 2020).

Competitive Rivalry

Fierce competition among the companies in the Tv and film industry leads to price fall, and has an adverse effect on the profitability of this industry. Competitive rivalry for Netflix is high. Turner (2019) argues that although rivals such as Amazon and Disney can provide extra services in exchange for clients’ subscription fees, others are withdrawing Netflix’s video content to feature on their own platforms.

Ethical Considerations for Netflix and the TV and Film Industry

There are many different laws governing the television and film industry, including contracts, ethics, and legal rights. Issues, such as employment legislation, copyright and intellectual property, and confidentiality, will be considered when addressing the legal and ethical issues of the TV and film industry.

Employment legislation is a set of regulations that shield employers from discrimination based on characteristics like sex, race, religious beliefs, ethnicity, and age. It also makes sure that employees are working in an environment that is safe and healthy. It also means that all workers’ confidential information is secure and confidential. Acts such as The Employment Rights Act, The Equal Pay Act of 1970, and The National Minimum Wage Act of 1998, to name a few, present these laws (Butchart, and Har-Gil, 2019). If these laws are not enforced, it will reflect poorly on the organization, and the individual who violated them will face disciplinary action. Employees are usually issued warnings before being dismissed after receiving a certain number of warnings.

Copyrights are regarded as the foundation of the TV and film industry. Copyrights safeguard creators’ or owners’ rights by prohibiting illegal use of their original creations. A lengthy list of credits appears at the end of the film to provide an idea of the number of people associated with the project. It is an infringement to make a copy of an original film without the owner’s consent. When a film is turned into a videocassette without the consent of the right owners, this is known as video piracy. Trademarks play an important role in film as well. To protect their movie title, main actors, and other film features, producers use trademarks.

In the film industry, confidentiality is upheld to ensure that a company’s or its employees’ intimate and private information is not made public without their expressed permission. When both the employer and the employee sign a contract, that ensures that legal consequences will be imposed if the contract is violated (Rizzo and Flint, 2021). Financial penalties, personal constraints, and authoritative warning or orders against the film company in court are all possible outcomes of violating the confidentiality contract.

Leadership and Collaboration for Netflix

Netflix’s corporate culture encourages greater accountability and openness among team members, as well as individual decision-making. Netflix, like the rest of the TV and film industry, seeks to recruit only the best employees (Bowers, Hall, and Srinivasan, 2017). Effective leadership has been a key factor in Netflix’s growth since its establishment. Currently, the company utilizes a transformational leadership style, in which the leader collaborates with teams to recognize desired change, develops a mission to inspire change, and introduces the change together with the dedicated members of the employee team. Ted Sarandos, the current CEO of Netflix, took over from Reed Hastings in 2020. From 1998 to 2020, Reed Hastings served as the CEO of Netflix, which he co-founded. A transformational leader is someone like Reed Hastings (Flint, 2020). Reed has grown the business from a DVD operations company in 1998 to a massive media conglomerate. After its inception, the company’s portfolio has grown by more than 200 percent.

Netflix’s Human Resource policies illustrate how workers contribute to a healthy working atmosphere by performing with zeal. Netflix employees can set out a plan for their bosses and have as much personal time as they would like. There are no formal performance reviews; instead, staff and administrators discuss performance during their daily meetings. Netflix workers earn market-based salaries with no incentives. However, they are given a choice to accept their salary in terms of company shares. It is the duty of leaders to create a decision-making mechanism. Leaders must decide when decisions are made within the company, how much involvement and influence workers have in the process, and the best decision-making strategies. Netflix, in particular, encourages its workers to make wise decisions when faced with ambiguity (Pontefract, 2019). It empowers its employees to make decisions not just in the short run, but also in the long term. Due to effective leadership, the company has experienced a year-on-year growth of revenue and debt is not an issue for it. For instance, Netflix’s annual revenue in 2019 amounted to approximately 25.2 billion US dollars (Annual Report, 2019).

In terms of collaboration, Netflix has collaborated with networks, television programs, and film creators to stream their content as a subscription-based service. Netflix would not exist if it did not have the licensure freedom to broadcast those shows and films. The company could have resulted into creating all the shows on itself so as to have broadcasting rights, but this option lacks feasibility since Netflix requires a large number of shows to attract the necessary subscriber base. Netflix collaborated with corporations including The Walt Disney Company and Epix to provide its subscribers with a diverse range of content (Netflix Inc., 2021). Since the number of subscribers continues to rise, both Netflix and its partners benefit with huge profits and have year-on-year growth of revenue. Netflix pays for the rights to broadcast shows and films, while users pay subscription fees to offset the overhead and generate profit.

Recommendations

Currently Netflix is at good position in maintaining its competitive advantage. However, technology, industry, ethical issues, and leadership and collaboration issues keep on evolving, which necessitates Netflix to continue innovating. The following recommendations can be used by Netflix to sustain its competitive advantage and to improve its strategic decision making. With the implementation of these recommendations, Netflix’s competitive strategy will become difficult to duplicate or exceed, and remain superior in the long-term.

- Exploit the advertising-based business model to boost its revenues. This model has been adopted by other companies such as Amazon, Google, and Facebook, that are experiencing a year-on-year growth of revenue.

- Refresh its content library and provide more interactive movies and Tv shows. Netflix can expand its content through signing of more contracts with interdependent film distributors. Moreover, since Netflix has the capability to produce its original content, it should continuously refresh its content library and provide more interactive movies and Tv shows.

- Form more alliances with telecommunication providers. Partnering with telecommunication companies can expand Netflix’s capacity to offer bundle packages in different territories. Partnerships with local broadcasters are also important.

- Penetrate into new markets. Netflix should enter into markets where there is a low presence and a high demand of streaming services, such as China.

- Expand the product mix for growth. Netflix should develop new forms of content for entertainment to be accessed through its website or mobile applications.

- Diversification into new markets and industries. Netflix should acquire mire complementary companies to improve its strategic positioning and performance.

- Continuous overhaul of its website user interface. Due to technological developments and change in user preferences, the user management of video previews should be improved on a logical basis. The display system should be continuously made more efficient to aid ease of navigation and selection.

- Ensure powerful recruitment and retention of employees through transformational leadership and compliance to ethical issues such as employment law, copyright, and confidentiality.

- Compliance with environmental laws such as the reduction of Carbon Footprint. This will save money for the company in return by avoiding petitions that result into financial penalties for the company.

Conclusion

Netflix has been incredibly competitive in transitioning and developing over time in order to respond to changing client needs. Though their original DVD-by-mail business model worked well, the popularity of internet streaming forced them to change. The company has remained competitive over the years, in spite of fierce rivalry from other service providers such as Amazon Prime Video, Disney Plus, and Apple Tv. Netflix’s strategic analysis reveals that its competitive strategy relative to its competitors is effective. The strategic analysis has also revealed that Netflix is well positioned in terms of maintaining a competitive advantage. However, the company should continue sustaining its competitive advantage to make sure that it is not replaced as the top customer choice for Tv show and move internet streaming services. Some of the strategies that Netflix can use to sustain its competitive strategy are technological innovations, exploiting the ad-based model, alliances, ethical compliance, environmental compliance, penetrating into new markets, expanding the product mix for growth, diversification into new markets and industries, transformational leadership and decision-making model, continuous improvement of the streamer’s display system on its user interface, refreshing content library, and providing more interactive videos. With the implementation of these strategies, its competitive strategy will be difficult to duplicate or exceed, and remain superior in the long-term.