Mobile Payment System in Kenya

Investigating Impact of Mobile payment System”M-PESA” on Saving and Loans Behaviour of Kenyans

Abstract

Mobile payments have been described as highly secure and convenient compared to the cash payment. The primary aim of this study was to investigate the impact of M-Pesa on credit and loans behaviour of Kenyans by focusing on how the Mpesa landscape has affected financial inclusion in Kenya. Mshwari is a platform that is offered by Mpesa to offer loans and savings services to Mpesa registered users. Safaricom and other digital credit service providers will benefit from this research by understanding competitive edge which comes with low-cost loans and credit service to Kenyans. This study was a mixture of both qualitative and quantitative study utilising purposeful sampling to sample 50 participants. It employed email questionnaires to interview 50 participants selected from the capital city Kenya, Nairobi. The results were analysed using Excel. It was found that respondents saved and borrowed to cater for small emergency expenses which is against the core purpose as to why Mshwari was invented. Mshwari was developed with an idea of funding small businesses. However, it was noted that the rate of saving and borrowing had increased over the past six months. Hence it was concluded that Mpesa impacted positively on credit and loans behaviour of Kenyans. This study recommends that future research should investigate how digital credit facilities influence the social and economic welfare of low-income earners in Kenya.

Keywords: M-pesa, M-shwari, Mshwari loans, Mshwari savings, Impact.

CHAPTER 1. Introduction

This is the first chapter that offers a broad view of the research. It illustrates how vital the investigation is in the application. It besides demonstrates how the research will contribute to knowledge on Mpesa money platform. Lastly, it presents the analysis, aim, objectives and research questions.

1.1 Background Information

Mobile payment is also called M-payment, mobile money transfer or mobile wallet which refers to technology of making transactions via a mobile devices such as cell phones (Hayashi, 2012). Mobile payments have been described as highly secure and convenient compared to the Cash payment. They do not require the user to have a bank account and hence suitable for both high and low-income earners (Winner, Bram, Marino, Obeysekare, & Mehta 2017, p5). Mobile money transfer is currently processing billion dollars each day as well as generating more than 2.4 billion dollars (GSMA 2017 p 5). There are over 690 billion registered users globally a 25% increase from 2016. Today, over 20% of all developments in mobile money transfer platforms offer pension, savings, and investment products (GSMA 2017 p 6). Globally, a typical mobile money customers will move about 188 dollars monthly. This means mobile money transfer has evolved as the most used payments platform.

In the case of Africa, mobile payment has simplified the process of making payments either when making purchases at the shop or sending money (Mol, Stadler, & Ariño 2017, p5). From finance, education, healthcare, to farming, mobile payment in Africa is spawning afresh generation of entrepreneurs who effort to reach more consumers, for instance, Mpesa (based in Kenya, East Africa) and South Africa’s SnapScan mobile payment. For Mpesa, M means “mobile” and “Pesa” means “money” in Swahili language. M-pesa is, therefore, the primary channel in which money gains mobility (Owuor 2013, p5). Mshwari refers to a paperless banking facility that is offered via Mpesa. It is a micro-credit product that permits the users to borrow money to complements their savings.

Kenya is a country in Africa with about 48 million people and covers 581,309 km2 in East Africa. Kenya’s economy has been boosted by telecommunication advancements and expansion over the years which have increased the ease of conducting business activities. The country began the use of mobile phone-based money transfer in 2007 after the launch of M-Pesa (Owuor 2013, p5). This service is offered by Safaricom network operator and allows the withdrawal, transfer and deposit of money as well as payment of goods and services across Kenya. Money transfer in Kenya takes place through banks, mobile phones, money orders, remittances, wire and electronic funds transfer among other methods. However, the mobile-based money transfers are the most commonly used notably M-Pesa which is convenient, accessible and reliable in Kenya is its country of origin (Owuor 2013, p6).

Since the application of mobile phones to send and receive money just came recently, the only studies conducted on the subject involve analysis in specific case studies, countries, or sectors. Thus, in this research, the researcher has investigated the impact of M-PESA on credit and loans behaviour of Kenyans to fill this gap because there is no study conducted on this problem.

1.2 Significance of the Study.

By investigating the impacts of M-PESA on credit and loans Behaviour of Kenyans, the insights from this study will be crucial to the business community of Kenya as well as mobile money service providers such as Airtel money and Safaricom. Safaricom will benefit from this research by understanding its competitive edge which comes with low-cost loans and credit service to Kenyans. It will be helpful to Safaricom and other service providers when making decisions on the infrastructural needs and products development that best fits Kenya market. Banking institutions will also benefit from collected information directly from consumers about experiences with loans and credit services from Mpesa and hence enable banks to implement strategies that will assist compete fairly with mobile service providers. Scholars would use this study for further studies while small businesses and banks can use it to educate themselves on matters concerning mobile money transfer. Mobile service providers in other nations will also find this study insightful as it illustrate why Mpesa has been successful in Kenya. Lastly, the study has made recommendations regarding future research most likely on other mobile money transfer services in Kenya such as Airtel money and thus an essential contribution to literature.

1.3 Aim

To investigate the impact of M-Pesa on credit and loans behaviour of Kenyans by focusing on how Mpesa landscape has affected financial inclusion in Kenya.

1.4 Research objectives

- To determine if the introduction of Mshwari by M-Pesa influence Kenyans behaviour of saving and borrowing loans by investigating if Mshwari increases formal saving and dropping of informal saving.

- To investigate if Mshwari combination offering of both loans and credit at low-cost impact Kenyans behaviour of borrowing and saving rather than the use of bank for same services.

1.5 Research Questions

- How does the introduction of Mshwari by M-Pesa influence Kenyans conduct of saving by investigating if Mshwari increases formal saving and dropping of informal saving?

- Does Mshwari combination offering of both loans and credit at low-cost impact Kenyans behaviour of borrowing rather than the use of bank for same services?

1.6 Study organization

Chapter 1 demonstrates how the research will contribute to knowledge on Mpesa money platform. Lastly, it proves the analysis, aim, objectives and research questions. Chapter 2 discuss scholarly papers that comprise of substantive findings, theoretical as well as methodological contributions related to mobile money payment or platform. Chapter 3 comprised of research design, sampling procedures, data collection tools and method of analysing data. Chapter 4 presents the finding, analyses and interpretation of data gathered in chapter 3. Chapter 5 is the discussion of the results by showing how the result agree or disagree with the literature review. Finally, chapter 6 is the summary of the entire study. It ends by offering recommendations.

CHAPTER 2. Literature

This is the second chapter that will be a text of scholarly papers that comprise of substantive findings, theoretical as well as methodological contributions related to mobile money payment or platform.

2.1 Definitions

Mobile money refers to electronic services of financial nature made through a mobile phone (Lohiya 2012, p 5). There exist three primary functions of mobile money, i.e. mobile transfers, mobile banking, and mobile payments (Krishnan 2014, p67). Mobile banking refers to the way a customer performs banking transactions at the convenience of his mobile phone or other portable electronic devices. Mobile payments also referred to as m-commerce is defined as the feature that enables unbanked people to sell or purchase commodities at a shop or store remotely by making use of their mobile wallet, a feature on their mobile phone instead of using cash (Jack and Suri 2011 p 7). A mobile wallet is an electronic account whose access is controlled by a personal identification number (PIN) where the mind is credited or debited the person immediately transacts (Jack and Suri 2011, p 7). Still, mobile transfer also referred to as money transfer or “person-to-person” or “P2P”- or “mobile remittances,” is a feature that enables a person without a bank account to send and receive small amounts of cash from any other user anywhere else whether in town, rural area, or even outside the country (Cornforth, Downing, and Reeve, Vodafone Ip Licensing Limited, 2013, p 45). In general, this study defines mobile money transfer as an electronic wallet technology where transactions are done via mobile devices such as a cell phone.

2.2 History of M-Pesa.

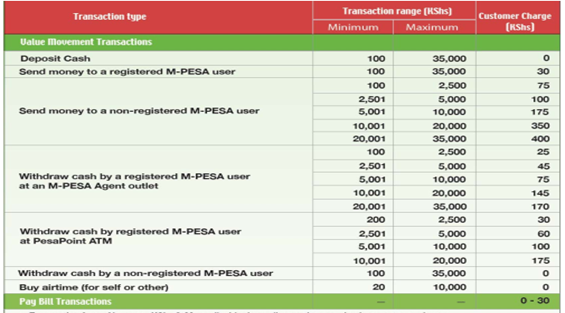

Safaricom, the largest mobile network company in Kenya and a member of the Vodafone group, launched M-Pesa, an innovation in the mobile banking services for the unbanked people in March 2017 (Munga, 2010, p1). From that time, M-Pesa service has grown in eminent proportions such that the gap it fills in the market is undoubted. Currently, about 30 million M-pesa service users spread in nearly ten countries use the service to pay and request for loans, make funds transfer across countries, shopping, and healthcare service bills (Uwamariya, Michalik, & Loebbecke 2016, p1). Show in figure 1 below is an M-Pesa fee schedule for withdrawal and transfer.

Figure 1: Fee Schedule

Source: (Mbiti and Weil, 2011)

2.3 Uses of M-Pesa and How it Works

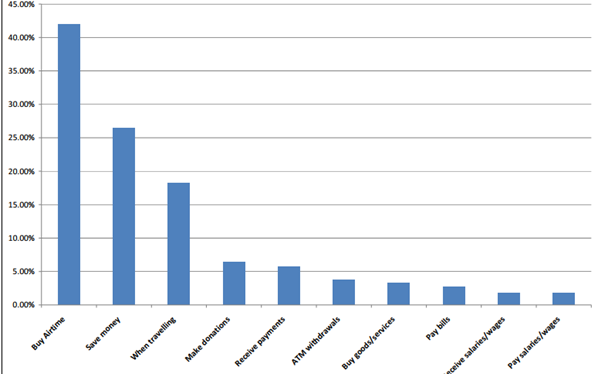

M-Pesa is used to conduct deposits and withdrawal transactions using mobile phones. Transactions occur at retail outlets which include banks and M-Pesa agents (Jack and Suri 2011, p 12). Moreover, the service enables transfer of money to various mobile phone users irrespective of the network used while at the same time allowing customers to buy airtime, pay bills, goods and services (Vodafon 2018, p4). According to Safaricom (2018, p19), M-Pesa allows mobile banking transactions whereby deposits, withdrawals and payments can be done to and from bank accounts using mobile phones. For instance, the World Bank Group (2011, p7) considers M-KESHO to be an M-Pesa product that provides comprehensive banking services including insurance, loans and interest accounts. M-Pesa services are in the Safaricom Sim Tool Kit which offers an Mpesa menu containing all the commands directing to available services for registered M-Pesa users (Vaughan 2008, p9). Illustrated in figure 2 below are uses of Mpesa.

Figure 2: M-Pesa Uses

Source: (Mbiti and Weil, 2011)

2.4 Micro level Economic Impacts of M-Pesa.

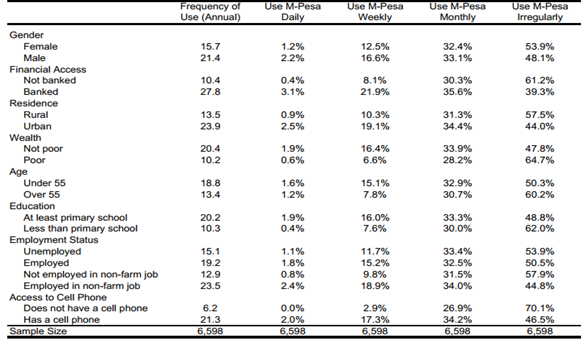

Mpesa has produced significant economic impacts in Kenya being the first mobile-based money transfer service in the world. CNBC Africa (2017, p 23) reports that M-Pesa has significantly decreased the transaction costs in the country. The average distance from an M-Pesa agent in Kenya is estimated to be 1.4 kilometres as of 2015 improving the availability of money transaction services (Jack and Suri2011, p 12). The investment sector has also been impacted by the availability of M-Pesa loans which have increased the access to money for investments and during hardships. The betting industry is driven by mobile phone transactions, and therefore the investment sector is supported by the service CNBC Africa (2017, p 23). Consequently, M-Pesa provides employment opportunities to many Kenyans which have reduced joblessness rates in the country since its inception (Jack and Suri 2011, p 12). This has increased the living standards and the economy of the country as it also generates revenue for the government (Jack and Suri, 2011, p 15). Shown figure 3 below are the frequencies of M-Pesa usage.

Figure 3: Frequency of M-Pesa Usage.

Source: (Mbiti and Weil, 2011)

2.5 Advantage/Disadvantage of Using Mpesa to Locals and the Government

2.51 Advantages of M-Pesa

M-Pesa facilitates poverty reduction because of improved financial behaviours. The service provides safer and easier saving and transaction services saving time cost (Munga, 2010, p3). Savings help in times of hardships and can also be invested to generate income. According to Vaughan (2008, p 10), M-Pesa has improved the Kenyan economy as well as the living standards of Kenyans. It has offered a reliable saving platform and saves time and cost used to access bank accounts through mobile banking and M-Pesa saving services (Munga, 2010, p4). Mpesa provides employment opportunities to Kenyans which increases the economic status of the country (Vaughan 2008, p 10).

2.52 Disadvantages of M-Pesa

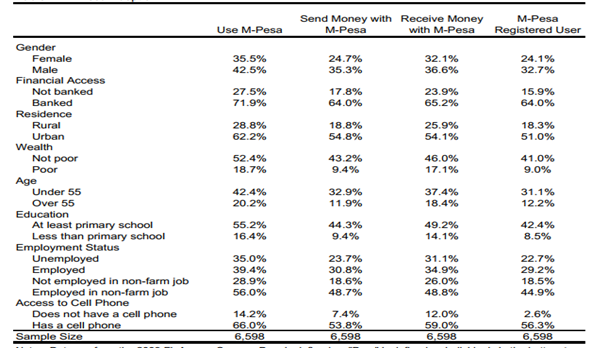

M-Pesa customers can lose money through fraud M-Pesa operators. There has been an increased report of physical theft from agents as well as through fraudulent individuals who obtain the customer’s details and conduct theft (Vaughan 2008, p 10). Sending money to wrong M-Pesa numbers makes customers lose cash particularly when the recipient declines to send back the money, and the network provider fails to reverse the transaction (Munga 2010, p4). Figure 4 below illustrated is M-Pesa adoption among Kenyans.

Figure 4: Mpesa Adoption

Source :(Mbiti and Weil, 2011)

2.6 M-Pesa Security Aspect between Sender and Receiver.

M-Pesa provides diverse services that involve money transfer. Therefore, Safaricom includes security measures that ensure that safe transaction between the sender and the recipient (Markovich, Markovich, Snyder, and Snyder, 2017, p 5). According to Safaricom (2017, p1), wrong M-Pesa transaction messages for unintended recipients can be sent to code number 456 for reversal of the transactions. Safaricom Company sends text notifications to their customers to facilitate the security of their services. On the other hand, the company encourages wrong recipients to return money received erroneously or contact the customer service to notify them of the transaction for reversal (Safaricom, 2017, p1). Moreover, the company provides M-Pesa services that help communicate with agents as well as offer transaction reports and statements for follow up of theft cases by the police. Additionally, M-Pesa delivers a notification that gives 25 seconds to transacting customers to help them cancel illegal transactions. The service allows the sender to press any key to cancel an operation that produces the name of the wrong recipient giving them a chance to correct the recipients’ number before the transaction is completed.

2.7 Mshwari

Over the most recent couple of years, Safaricom, Kenya’s greatest portable network, has propelled a few versatile money items. Among those connected to banks are M-Kesho, M-Benki, and M-Shwari (Ramah, 201 3 p5). The mobile items work in association with the formal banking sector to enhance budgetary limit among independent ventures and micro-credit groups. The Central Bank of Kenya gauges that more than Ksh 300 billion (approx. $3.5 billion) is not included within the formal banking framework, and a large number of Kenyans don’t utilize banking services (Ramah, 201 3 p5).

M-Shwari (signifying ‘calm’ in Kiswahili) is a consolidated funds and credits item propelled via a coordinated effort between Safaricom and the Commercial Bank of Africa (CBA). CBA issues the M-Shwari account, which in turn should be connected to an M-Pesa portable money account provided by Safaricom. The best way to withdraw from, or deposit into, M-Shwari is by means of the M-Pesa wallet. M-Shwari intends to extend and enhance the utilization and income advantages of M-Pesa by giving customers a facility to save and by offering loans past a client’s networks of companions and family. Overviews of M-Shwari clients affirm that they principally save and borrow to oversee variances in their income and to adapt to unexpected necessities. As illustrated in Figure 1, before the end of 2014 M-shwari boasted 9.2 million bank accounts (speaking to 7.2 million individual clients) and had dispensed 20.6 million in advances to 2.8 million borrowers (Kiiti and Hennink, 2016 p2).

2.7.1 Lock Savings Account

This is a bank account that permits M-Shwari clients to put something aside for a particular reason and a predetermined period. The money saved on the M-Shwari Lock Savings record will be kept in the account until the date of its maturity; the client decides the maturity date of his or her funds during the time of account opening. The maturity date ranges from a month to one tear. The client controls this development date after opening the record and ranges in the vicinity of one and a year. Clients can make a miniaturised deposit into this.

The M-Shwari Lock Savings account is perfect for clients searching for higher rates of interest and those wanting to fend off cash securely for one month to a half year. By the Banking (Amendment) Act 2016, all money saved on the M-Shwari Lock Savings Account will gain the interest of 6.65% PA being 70% of CBR (Safaricom, 2018 [online]).

Various M-Shwari clients had communicated an enthusiasm in putting something aside for a specific longer-term objective or a business related cost. The Lock Savings item gives an extra 1% interest for the customers deposit their money in a term account(at least one month; up to a half year). Clients are allowed to withdraw the saved income before the set term is due. However, they relinquish the extra interest payment. M-shwari, which was officially introduced in June 2014, attracted at least 103,000 customers by December 2014. Given the constrained confirmation to date of M-Shwari’s clients making significant savings, it will be a point of interest to check whether Lock Savings can affect longer-term savings behaviour. In any case, by March 2016, the original signs seemed positive. The Account balances for lock Savings were ten times more than the normal M-Shwari savings balances, with an average lock time of 3.8 months (FSD Africa, FSD Network, 2016 p1).

M-shwari has continued to develop in scale and has expanded formal monetary access to ever more indigent individuals. Most recent figures indicate that a more significant number of the M-Shwari customers is below Kenya’s national poverty line; and with 57% of M-Shwari users currently accessing a credit assignment, a large number of poor Kenyans would now be able to get to formal credit and also savings services (FSD Africa, FSD Network, 2016 p1).

The M-Shwari account is a ledger subject to full bank directions, including being liable to the Kenya Deposit Insurance Corporation (KDIC). The M-Shwari accounts sit on CBA’s budgetary articulation and are followed in a devoted banking framework connected to Safaricom’s information and the bank’s core banking framework. All withdrawals and deposits out of and into M-Shwari accounts are allowed to the client. Nonetheless, any transactions on the customer’s M-PESA mobile cash account, including individual-to-individual exchanges, transfers to different accounts, and withdrawal, are liable to M-PESA’s standard fees. Even though it is a bank account, the concurrence with Safaricom limits exchanges between M-Shwari accounts or with other ledgers, so all income moves all through the account through M-PESA (McKay, 2015, p20).

2.7.2 Mshwari Loans

The M-Shwari Loan Account is a small scale credit item which enables Kenyans to obtain cash whenever a need arises or to supplement funds towards a venture or enterprise. A one-time charge of 7.5% is demanded each loan given. For one to qualify for an advance, all that is needed is to have used M-PESA for at least six months, saved money with M-shwari and effectively utilised other Safaricom services, for example, data, voice, and M-PESA. To confirm the amount one can borrow, the person is supposed to M-Shwari, Loan, and then check Loan Limit. Kenyans can now borrow as low as Ksh. 100 and up to Ksh. 50,000 and enjoy a repayment period of 30 days.

2.7.3 Advantages of Lock Savings Account

There are no base reserve funds. There are no charges involved, and the interest rate is consistent amid the investment time frame and is computed and paid out month to month or at maturity. Again, the Lock time frame shifts from one month to a half year with regards to client needs (Safaricom, 2018 [online]).

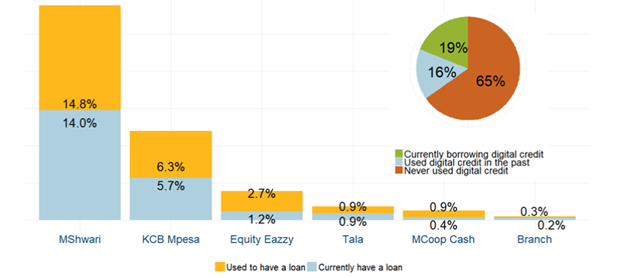

Nonetheless, M-Shwari has endured various defaults with 140,000 clients failing to repay their loans within the given period, which is usually 30 days. This means a non-performing advance rate of 3 per cent, below the average banking sector non-performing rate of 5 per cent (Were, 2014 [online]). Figure 5 below illustrates the usage of digital credit providers in Kenya.

Figure 5: Usage of Digital Credit Providers in Kenya

Source: (Totolo, 2018)

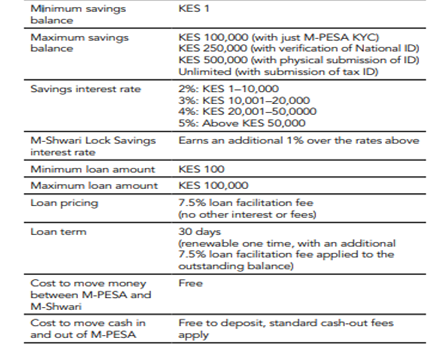

In the above figure, it is clear that Mshwari tops the list with 14.8% followed by KCB Mpesa and Equity Eazzy. The last in the list are bank branches. In Kenya therefore, most of digital credits are performed through Mshwari. Figure 6 below is a further description of what Mshwari offers in terms of interest, maximum and minimum savings.

Figure 5: Description of Mshwari

Source; (Safaricom, 2018 [online])

The emergence of the advanced credit market has raised worries about the danger of unreasonable borrowing and over-obligation among lower-income families. Digital credits are not difficult to obtain, and they are short-term, are attached to a high-interest rate, and are accessible from various bank and non-bank institutions. The review discovered that 14 per cent of digital borrowers were reimbursing different advances from at least one supplier at the time of the survey. This implies that more than 800,000 Kenyans were juggling several advanced credits. Having numerous advances isn’t a marker of debt distress, but it is vital to closely monitor the market going ahead and distinguish conceivable risks (Totolo, 2018 p2).

2.7 Theories Related to this Paper.

2.7.1 Financial Intermediation Theories

In their explanation on this theory, Allen and Santomero (1997, p1463) mention that banks have existed for many decades by offering services such as deposits, loan and saving money for economic agents who need capital. Banks and insurance companies have played a significant role in economic growth and development primarily in real estate development. According to (Allen and Santomero 1997, p1463) role played by the intermediaries such as banks in the finance sector are referred to as intermediation theory. Intermediation theory has been built on models regarding resource allocation on complete and perfect markets which suggest that frictions such as asymmetric information and transaction costs are crucial in understanding intermediation. For instance, fixed costs of evaluating assets mean that the intermediaries have the merits over individuals as they permit such costs sharable. Hence trading costs could mean that intermediaries can be diversified more than individuals. Even though transaction costs, as well as asymmetric information, have reduced, intermediations have on the other hand increased. Thus, the new markets for financial options are markets for the intermediaries rather than for individual firms.

In another case, (Mosota, 2015 p8) believes that financial market frictions which comprise of information asymmetry, as well as transaction costs, have a role in influencing decisions on physical and human capital occupations and accumulations. Hence, these markets frictions have a role in generating income inequalities that lead to poverty traps. However, access to finance happens to reduce these market frictions. Information asymmetry refers to a situation where a single party has access to better information than another party. Mosota (2015 p8) also argues that minimising financial market imperfections by expanding individual opportunities lead to a positive incentive effect. Hence irrespective of globalisation, financial services are controlled by information technology and deregulation, and regardless of robust price competition financial services have not declined in its importance. Nevertheless, it is still growing (Scholtens & Wensveen, 2003 p10). This lack of access to finance can lead to poverty as a result of inequality in incomes in the future leading to low growth. Hence, financial intermediaries have the following roles; provision of risk condensed agreements, attainment of information regarding borrowers, accumulating capital, simplification of the transaction process and cultivating corporate governance.

2.7.2 Finance Growth Theories

According to (Mosota, 2015 p8) in his explanation about theories of financial development argues that economic growth creates a productive environment through supply and demand effect. Mosota (2015 p8) believes that lack of finance leads to income inequality as explained in financial intermediation theories. Hence access to safe as well as affordable investment leads to the integration of socially and economically excluded peoples into the economy consequently actively and positively contributing to self-development and protecting themselves from economic shock (Mosota, 2015 p8). On the other hand, (Stolbov 2013, P2) presents that economists of the past stressed the importance of financial system components in the development of a stable economy while (Mosota, 2015 p8) believes that the development of financial markets reflects growth in other economic sectors such as manufacturing, trade etc. However, (Levine, 2005 p869) argues the cost of accessing information, making transactions and enforcing contracts creates incentives for the financial agreement, intermediaries and specific markets. Accordingly, there is a link between economic growth and commercial development. As a result, in summary, this theory stresses that law enforcement, information technology, information costs all combined facilitate the development of certain intermediaries, financial contracts, and markets.

2.8 Research gap

The introduction of Mpesa has resulted in more money available for Kenyans. The service offers a quick, safe platform to save, receive and send money at considerable costs than visiting the banks. Thus, increased mobile money technology has improved opportunities for financial inclusion. However, little is known regarding the use of mobile money by Kenyans regarding how it impacts their borrowing and saving behaviours. Hence this study will fill this gap. Another gap identified is that previous studies have not documented adequately on how mobile money transfers impact the social economy in Kenya. However, limited studies suggest that Mpesa could directly affect the economy as it increases money circulation by providing means of sending, receiving, saving and borrowing. Literature has not adequately documented how Mpesa has improved low incomes earners access to finance, but there is a wide range of studies on the contribution of mobile banking on financial access. Mpesa has led to the high circulation of money, but Mshwari has not been thoroughly researched as it is a new product by Mpesa.

CHAPTER 3: Research Methodology

Overview

This is the third chapter that illustrate how the research will be done by discussing the systematic and logic means to solve the research questions and achieve research objective. This comprised of research design, sampling procedures, data collection tools and method of analysing data.

3.1 Research design

To reach the study objectives, the research was a descriptive survey making use of questionnaires to collect data and purposeful sampling technique to select the participants. The study was a mix of qualitative and quantitative research design because the two complement each other. This research design was chosen because of its ability to illustrate and explain the relation between Mpesa services such as loan and saving on Kenyans saving and borrowing behaviour (Komen, 2016 p5). The method has the ability to analyse non quantified issues, it can integrate both quant and qualitative strands. It also uses less time because surveys can be conducted online. This method of research becomes the most appropriate for the qualitative research that relies on subjective opinions and judgemental experiences of M-pesa agents and Mpesa registered users (Cowman et al., p59).

3.2 Sampling participants

Purposeful sampling was employed became the researcher selected participants with regard to their knowledge or need of the study topic. Selection was done via social media by sending requests via Twitter or Facebook and when they accepted the requested, the researcher introduced research topic and requested for their participation in the study. Selected individuals were asked to request their friends to take part in the study. Also, the researcher requested for their phone numbers and emails for ease of communication. To be eligible for the survey the participants were to be residents of Nairobi, above 18 years old and registered Mpesa users. The participants in the study were 50 M-Pesa registered users sampled from Nairobi (capital city). According to (Komen, 2016 p10) participants size between 10- 50% is useful for a study. The participants are residents of Nairobi city. These participants were needed to have a prior experience on using M-Pesa such transacting, paying and borrowing money via M-Pesa. The sample selected provided information required to make generalisations for the whole population. The researcher explored the participants encounter with Mpesa by giving their experiences with credit and loans services. For the reason that interview questions were sent via email. The researcher called the participants before and after sending questions to inform them when they would send back the answers.Research consent form was submitted to the participants to make a decision whether to take part or not.

3.3 Data collection

Survey covered mostly participants experience with using loan and credit services offered by Mpesa. Also survey was relatively cheap and essential when describing the features of a large population (Nyakemwa, 2012 p 34). The method was considered more cost effective especially online administered survey (McGuirk, and O’Neill 2016, p 5). The investigation has been successfully in Kenya in a similar study by researcher such as (Otieno, 2006) and (Murugami, 2008) and thus it is applicable in this study.

For the research to meet criterion validity, the same stratified and purposive technique of sampling was applied all through the study. To ensure the reliability of the data collection method, a pilot test was conducted with a sample questionnaire and with the sampled population. Last but not the least, to improve reliability and validity, the researcher sent similar questions to participants.

3.4 Data analysis

The answers provided in the interviews and questionnaires was passed through an editing and cleansing process to make sure every entry was correctly assembled. The data collected was then be coded and fed into excel to be analysed for e.g. Percentages, mean, media etc. The study hence involved the use of descriptive statistics that assist in making a massive amount of data sensible and straightforward (Cowman, Björkdahl, Clarke, Gethin, and Maguire, 2017, p59).

3.5 Ethical consideration

Since this study used humans as participants, their confidentiality, consent, and protection of their information observed. For instance, the researcher did not ask for sensitive information like ID numbers or disclose their phone numbers and emails. Also, participants had a choice to taking part or not.

3.6 Study Limitations

There is microscopic study carried out on microeconomic impacts of M-Pesa in Kenya. Thus, the researcher was forced to limit the scope of this study regarding analysis and sample size due to lack of reliable data. On top of that, the lack of previous research acted as an obstacle in discovering trends and making meaningful correlations. Self- reported data which was used in this research and it is usually impossible to verify it independently; this means that researcher was relying on people’s opinions.

CHAPTER 4: Results

Overview

This is the fourth chapter that presents the finding, analyses and interpretation of data gathered in chapter 3. The main aim is it answer the research questions and achieve objectives.

4.1 Demographic data

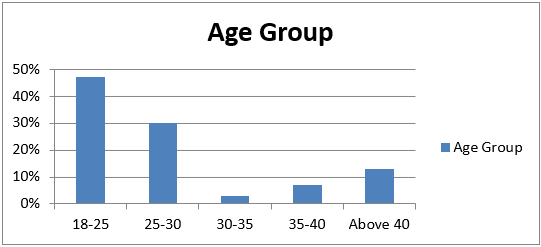

4.1.1 Participants’ Age

A total of 50 participants in the Capital city of Kenya, Nairobi were interviewed. From the analysis, most of the respondents were between the ages of 18-25 years at 47% while the least respondents were between the ages of 30-35 years at 3%. This age distribution is in line with the distribution of age among adults in Kenya which tend to be young populations. Figure 6 illustrates the participants’ age.

Figure 6: Participants’ age

Source: (Own development)

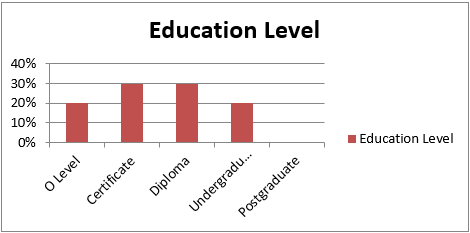

4.1.2 Participants’ Education

Mshwari users are educated with a higher percentage having higher education achievement. From the analysis, most of the respondents had certificate and diploma education levels at 30%. While there was no respondent with postgraduate qualifications. This means that most of the respondents had at least a secondary education. Therefore, it might mean that most of the users are young adults in school because this study was carried out in an urban area (Nairobi) which hold many universities, colleges and high schools such as Nairobi University, Daystar, Strathmore, USIU among others. It might also mean that respondents are graduates who are in the city looking for jobs or in their first jobs. Figure 7 illustrates Participants’ education

Figure 7: Participants’ education

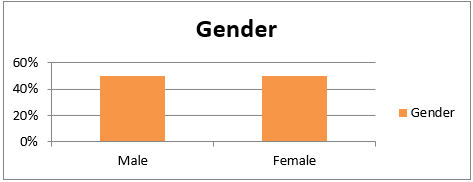

4.1.3 Participants’ Genders

Even though there was an equal distribution of Mshwari users regarding gender although there are some differences. From the analysis, 50% of the respondents were male while the other 50% were female. Majority of females have a regular job, some own shops and others small business. Majority of women (80%) have at least a secondary education. On the other hand, the majority of males (90%) have at least a secondary school and have regular jobs. Figure 8 presents participants’ gender.

Figure 8: Participants’ Gender

Source: (Own development)

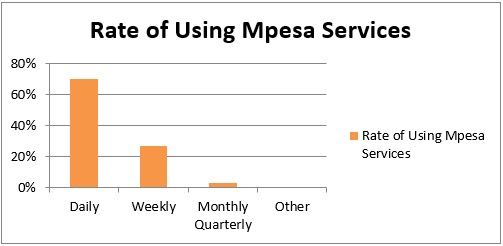

From the analysis, most of the respondents used Mpesa daily at 70%. While 27% of the respondents used Mpesa weekly and 3% monthly. Hence Mpesa has brought a transformative impact regarding mobile money services which have increased access to finance therefore lifting poor Kenyans out of poverty. Figure 9 illustrates the usage of Mpesa services among respondents.

Figure 9: Usage of Mpesa Services

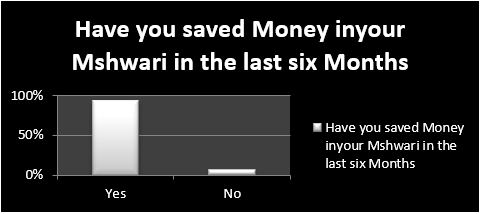

- Saving on Mshwari

From the analysis, the 93% of the respondents have saved money into their Mshwari accounts while 7% did not make any savings. From the response from the participants in this research, it evident that most people save on Mshwari to meet short-term needs while others save to meet any unforeseen circumstances that require small amounts of money. Only a few customers save for futuristic reasons. Mshwari users recognise and appreciate the distinction between Mpesa and Mshwari, though both are from Safaricom. The fact that Mshwari requires the customer’s consent to access or link with Mpesa is satisfying since money that is saved on Mshwari does not reflect on Mpesa. Figure 10 shows the rate at which respondents saved money in the past six months.

Figure 10: Rate at which respondents saved money in previous 6 months.

Source: (Own development)

From the analysis 50% of the respondents saved money to Mswari monthly, followed by weekly savings at 24%. Despite the massive wrong use of Mpesa, there is few customers use it to meet their long term goals especially business oriented goals. One participant in the research was happy to report that she had opened Mshwari account in 2016 and within one year, had saved 25000. She got the money from her ‘Chama’ (informal group) and her personal savings. In spite of the good experience with Mshwari, she still preferred her ‘Chama’. Another respondent in Nairobi asserted that Mshwari had helped him in saving enough money to start a restaurant as he said, “I saved 100,000 on Mshwari and started a restaurant using the money”. Figure 11 present how often respondents saved.

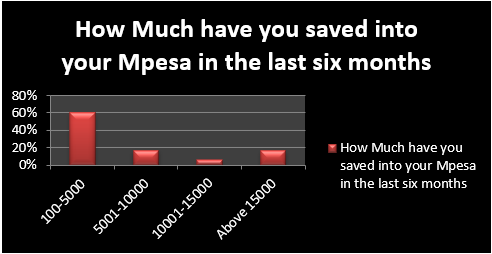

From the analysis, 60% of the respondents saved between kshs 100 and kshs 5,000 while 6% of the respondents saved between kshs 10,000 and kshs 15,000. Another observation from the research was that some people saved on Mshwari without any goals or targets to meet. Some said that they preferred saving the money as liquid assets, which they withdraw when the need arises. For example, some said that they could save money on Mshwari so that they could later retrieve it as airtime when they go broke. Few seemed to be transferring extra money from Mpesa to Mshwari as one respondent said, “Whenever I have less than 100 Ksh on Mpesa, I send it to Mshwari and withdraw it later when need be.” Figure 12 shows the amount to save in the past six months.

Figure 12: Amount Save in the Past 6 Months.

Source: (Own development)

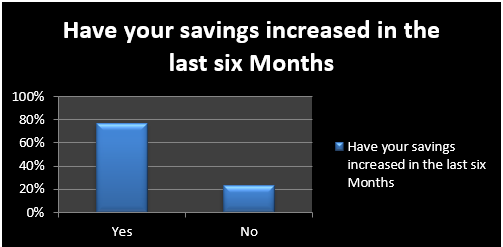

From the analysis, the 77% of the respondents increased savings into their Mshwari accounts. While 23% did not register an increase in savings. Most customers do not ideally know the credit scoring algorithm, but they recognise that savings increase the amounts they can borrow. “When you deposit any amount of money with Mshwari, you increase your chances of securing a loan with them,” one respondent said as he explained how he encourages his friends to save on Mshwari. From this, it is evident that most people save with the intention of using the money in current expenditure in the future and at the same time increasing their potential to borrow. Figure 13 presents the impact of Mshwari on saving.

Figure 13: Impact of Mshwari on Saving.

Source: (Own development)

It is also paramount to note that no respondent to more than one year to put money into their Mshwari account The reasons for borrowing according to popularity are as follows; completing short-term financial cycles, investment and business, current expenditure and meeting basic needs respectively. However, the poor may get poorer if they fail to know and recognise the fact that constant loans to meet basic needs makes life more expensive especially with the interests on loans.

From the analysis, 73% of the respondents have borrowed from Mshwari while 27% have not borrowed. Since the inception of Mshwari loans in the financial market, it has registered tremendous growth as the number of customers has increased over time. The customers borrow loans averaging around 1000-1280 and pay within 30 days. At that rate, it is evident that the customers borrow to meet small emerging financial needs that they did not expect or were not within their short-term budgets. During the research, one of the participants said that “I once took a loan of 2,000 to pay up my house help when my salary delayed.” Another one said, “ I save and borrow less than 2,000 from Mshwari to meet small needs like airtime” Another one added that “ I borrow from Mshwari when am out for shopping, and I need to purchase something yet I do not have enough money.” One more respondent said that “My son had fallen ill and I needed 1,000 to cater for the situation and therefore borrowed from Mshwari”.

From the responses above, it is clear that most people use the loans they borrow from Mshwari to meet small unexpected needs like impulse buying, airtime and sorting out emergencies- including sickness, which needs small amounts of money. These reasons for borrowing contradict the primary intention for Mshwari, which was, facilitating the smooth flow of business by providing a saving and loan platform. Figure 14 is an illustration of the rate of borrowing from Mpesa.

Mshwari customers have expressed their appreciation for the quick loans and the privacy associated with the service. They are specifically happy that they no longer need to borrow from friends and family. Such loans would take a lot of time and would bring about unnecessary social obligations. “I would advise my friends to use Mshwari because I am happy that I can borrow from the platform instead of family members and no one will know, “one participant said. From the analysis most of the respondents borrowed from Mshwari yearly at 37%, followed by monthly borrowings at 30%. Few respondents borrowed weekly at 10%. Figure 15 indicates how often respondents borrowed.

The results from the study indicate that most of the participants withdraw their Mshwari savings in less than one month and even some do it in less than a week after depositing. Therefore, there could be a link between the saving and borrowing behaviours. From the study, the significant reasons for saving varied from; saving for no specific reason, increasing the loan limit, and saving to meet a short-term need. However, few intended to save for any long-term goal. In spite of the saving trend, most Mshwari customers used it for borrowing purposes and not for savings. From the analysis 60% of the respondents borrowed between 100 and kshs 5, 000 from Mshwari in the last six months followed by borrowings of between 5001 to kshs 10,000 at 23%. Few respondents borrowed more than kshs 15,000 at 7%. Figure 16 shows that the amount of money borrowed.

From the analysis, 67% of the respondents said that their borrowings increased while 37% did not experience an increase in the number of borrowings. These results show that the majority of the users are financially resilient hence they can protect themselves against economic shocks. Although there are other loan lending services in Kenya, the respondents choose Mpesa because it was fast and if they repaid their loans on time next time they could borrow a higher amount. Mpesa offers credit to customers irrespective of them having a previous banking history customers can check loan limits and apply for a loan, and when approved, it takes a few seconds before they receive funds in their phone. Thee factor have promoted more borrowings from Mpesa. Figure 17 shows that borrowings had increased in the past six months.

The findings from the survey indicate that 75% of the borrowers settled their loans within a month while 20% paid within 60 days though with additional interest of 7.5% on the principal capital. The remaining 5% could not settle their loans within the extreme deadline of 60 days. The terms and conditions are that if a person defaults repayment within the 60 days, she or he is blacklisted and cannot access loans any more. However, none reported of being sure that they were blacklisted on Mshwari or CRB (Credit Reference Bureau). From the analysis, 83% of the respondents paid their loans on time while 17% did not settle on time. Figure 18 demonstrates the rate of repaying loans.

Most Mshwari customers concede that they are in the know of the existence of other complementary financial products, both formal and informal. They report that they still use different platforms and rarely use Mshwari. It has not replaced these arrangements. Most use more than one financial institution for savings and credit.

Most people still stick to using the bank as the significant financial institution however traditional it seems. A substantial percentage of the participants in the survey said that they only used Mshwari because it had features that were similar to the banks they never accessed. It is however noticeable that most people do not perceive Mshwari as a banking function, even though it is, and only views it as a subsidiary service of Mpesa.

Most Mshwari users only use the platform for short-term savings and credit. This state of affairs could be attributed to the fact that the repayment period is just the maximum of 60 days, which could be inappropriate for more massive loans. Moreover, Mshwari could register more growth if people got enlightened to the concept of the relationship between saving and borrowing as most of its customers do not understand. They, therefore, prefer using Mshwari as a financial discipline tool where they can save up some money and only withdraw when there is a need or borrow money to specific amounts to cater for short-term emergencies.

Mshwari faces stiff competition from other financial institutions especially banks and informal groups (Chamas). The Chamas pose a significant challenge since mostly interest on loans is calculated by reducing the balance. Also, there is no connection between savings and credit, and even the interactions during transactions are more friendly and informal. Family and friends also challenge Mshwari and just like the chamas, and they are preferred because there are no transaction fees and they are well known, unlike Mshwari which; has been on the market for around two years only and has charges attached to depositing and withdrawal since the money has to go through Mpesa.

The feedback from the participants in the survey shows that Mshwari is widely known and its advantages are well appreciated. These advantages range from “ ease of use”, “ ease of access”, “ safety and security”, “a bank better than the traditional bank”.

4.6.1 Awareness

Mshwari has become household affair with almost all the participant in the survey being familiar with its existence. They had been enlightened about it through various telecommunication media like television, radio and also social media. Others learnt about it through print media while friends had influenced others. A good number acquired from the marketing agents who were creating awareness about the product and registering new customers.

4.6.2 Security

Most Mshwari users were delighted by the fact that the service was very secure as they were guaranteed of their privacy and security for their money. The association of Mshwari to Mpesa- which is the most trusted leading mobile money service also makes people believe Mshwari even more. Respondents in the study also registered their acknowledgement of the fact that they no longer have to involve friends and family in their financial affairs of saving or borrowing.

Mshwari uses the Mpesa platform to receive and send money. Since Mpesa is widely used and trusted in Kenya, by extension users view Mshwari as a secure system to engage for financial services. Users reported that the security and privacy of the platform also lured people to use Mshwari.

4.6.3 Efficiency

Many Mshwari customers involved in the study emphasised in the privatised financial lifestyle that had been introduced by Mshwari. Mshwari replaced the traditional borrowing and saving behaviour that involved friends and relatives. These transactions had negative social implication to the point of causing conflicts. However, the respondents suggested some advancement to the system which included; Improved customer contact, increased products, increased rates for savings, and even an increase in the loaning amounts. They further associated the uptake of Mshwari with the existence of similar services of credits and savings in both formal and informal financial settings.

The Mshwari customers further praised Mshwari for its confidentiality about the financial behaviour of individuals. They also appreciated it because of its reliability regarding loaning and saving money for business, emergencies, and future personal needs. Others embraced Mshwari because of the interest their money gained upon saving. These benefits influenced others into subscribing to Mshwari.

4.6.4 Proper Marketing

Many clients were persuaded to use Mshwari through credible marketing platforms. These platforms included advertisements through telecommunication media specifically on TV and radio. Safaricom agents also played a significant role in attracting customers to the service as they even registered the customers to the program. The fact that the information was authorised and associated with Safaricom, Kenya ’s most famous and trusted communications brand, also helped build the trust in Mpesa and Mshwari among the customers.

4.6.5 The Wide Range of Advantages

Mshwari attracts many customers because of the many benefits it bears. These benefits include the ease of access, privacy and confidentiality, prompt disbursement of loans, and low-interest rates for the loans. Most customers prided in the fact that Mshwari is a different entity to Mpesa and therefore money saved on Mshwari is not reflected on Mpesa. The fact that it allows for savings and borrowing, unlike Mpesa gives it an extra advantage.

4.6Factors Leading to Poor Mshwari Adoption

4.7.1 Complicated Processes

Mshwari users mentioned some challenges they encounter while applying for Mshwari loans. One of them is that the company did not adequately communicate the process of using as well as the way eligibility is determined, and the amount one can borrow to the consumer. The second problem concerns the repayment of the loan. Although some borrowers agree that the loan amount is too small to be given 30 days of repayment, some complain that the one month repayment period is too short. Along gender lines, women highlighted having challenges with the repayment while men highlighted the smallness of the amount, illiteracy with the technology application, and network problems.

4.7.2 The Financial Sector Perceived Risks

Those who do not use the service highlighted the risk that comes with the financial sector as their main hindrance. For instance, they feared borrowing a loan and being unable to repay it at the end of the month when it matures. Still, some nonusers highlighted the fluctuations of their income as a hindrance as they are not sure of their ability to clear the loan upon maturation mentioning some of their friends who had taken loans and were unable to clear. Also, nonusers cited that Mshwari may have hidden charges plus the security of their money was not completely guaranteed. Some of them expressed fears that they might lose all their cash if the service is a con or their accounts were not adequately secure.

4.7.3 Insufficient Knowledge

Insufficient knowledge was highlighted as a significant barrier to Mshwari application. Since most Kenyans lack sufficient incomes to meet their needs, savings then becomes a new phenomenon and especially the culture of having savings accounts. The problem becomes worse when the knowledge of Mshwari is mentioned with its details of loan eligibility, the amount one can borrow, and the terms and conditions of repayment.

4.7.4 Lack of Interest

Several Mshwari nonusers mentioned that they did not have any interest in the service probably because the service was not attractive or they lacked funds to take advantage of its benefits. Some of the distasteful aspects of Mshwari that kept nonusers away are the small amount of money lent and the short repayment period. Some users mentioned using Mshwari for the savings but not for borrowing because the amounts were too small. Besides, nonusers lacked interest because they believed that they did not have money to save and thus lacked any to repay a loan. Also, some nonusers found no need to use the service and found Mpesa just enough for their financial needs. Finally, some of the respondents mentioned being busy with other things and did not have time to consider the service.

4.7.5 Illiteracy in Technology Use

Automatic barriers to Mshwari adoption were the lack of a cell phone and a Safaricom sim card because these are the primary devices to use Mshwari. Also, the accessibility of the service was another barrier. Some of the accessibility problems included lack of a Safaricom sim card, lack of a cell phone, inability to understand the language used in the application, failure to read and illiteracy in using the technology. Some nonusers mentioned that they do not own a cell phone and share one with other people which prevents them from using it for financial services like Mshwari. An example is when a nonuser expressed fears that without a private cell phone, it meant that the Mpesa account could be misused. Besides, problems with the network were highlighted making the service unreachable for some period. Lack of experience in using a mobile phone and lack of proper understanding of the English language could be compounded to technological barriers because the Mshwari app uses the English language.

4.7.6 Education

Low level of education in the Kenyan population means lack of technological, financial and language literacy. Illiteracy was high mainly among the female gender. Illiteracy led to increased skepticism and fear of becoming victims of deception and theft while using Mshwari. Financial and technological illiteracy was found to be correlated with the level of education.

Only a limited number of participants had any suggestions to improve their experience with Mshwari beyond ironing out the current disadvantages as mentioned above. Despite that, few provided several recommendations on how the service can be developed regarding customer experience. Some wanted the engagement between them and the service provider to be more comprehensive. Others suggested increasing the repayment period. One of them complained that “The repayment period seems short. It helps its users out while in need, but some people don’t repay on time because one month is a short period.”

Mainly, a big number of users recommended that the service provider hold more advertising campaigns to explain to the users on how Mshwari operates. The users also suggested that the company should incorporate an active customer service that works hand in hand with borrowers. The customer service should help borrowers to come up with plans for repayment as well as remind them about the repayment deadlines.

Still, some Mshwari users requested that the service can be offered separately from Mpesa so that security of their deposits can be guaranteed. In other words, some users wanted to have different Mpesa and Mshwari passwords and to be in a position to deposit funds directly to Mshwari without passing through Mpesa. Despite that, no one mentioned wanting to be denied the convenience that comes with moving money from Mshwari to Mpesa and vice versa. That is, the users want to access Mshwari without having to pass through Mpesa and still have the ability to access Mshwari through Mpesa.

On the other hand, other users suggest that limits should be increased, for instance, one of them said that “Safaricom need to consider increasing the loan limit to an attractive amount when someone saves a large amount of money. I have saved with Mshwari for long, but the rate at which my loan limit increases is very low.”

Another raised issues were about transparency at which Safaricom comes up with its algorithm. Therefore one of the respondents mentioned, “Safaricom need to consider improving communication with customers through increased transparency, and increasing the loan limit to an attractive amount when someone saves a large amount.”

According to the findings of the research, Kenyans learnt about Mshwari through Safaricom promotions, word of mouth, and media advertisements. It was also revealed that adoption of the Mshwari by customers depended on the awareness. Consequently, participants who did not know about the existence of Mshwari never signed up for it. Conversely, some knew about the product but decided not to sign up mentioning several barriers such as the perceived risk of security, accessibility, lack of interest as well as lack of adequate information. The customers who signed up said having heard about the service from other users as well as the Safaricom promotions. They cited the perceived advantages, ease of use and security of the service as their primary drivers for adoption. They, therefore, adopted and used it for the loans or savings or both. They considered the credits essential for meeting their financial needs as well as boosting their businesses. Despite that, they were not satisfied with the process of loan application as well as repayment terms and conditions. In particular, there were times when the customers were denied the loans are leaving them to use the service for savings only. The adopters used the service to save for emergency expenses, making huge purchases, and making short-term purchases such as mobile phone airtime. Some complained that the interest their savings gained in Mshwari was low.

Despite the many negatives, Mshwari has improved the lives of Kenyans since it was begun by enabling borrowing and savings. The participants termed Mshwari as a “transformational service” since it changed savings from being a preserve of the elite. Other adopters called it a ‘revolutionary service” by acknowledging that “we are experiencing a financial sector reinvention for the poor.”

Mshwari has provided a platform where the Kenyans can borrow funds within a few seconds and build creditworthiness that will guarantee them cheaper and huge loans within months. Although this shows a forward limp in the formal financial inclusivity, more research needs to be conducted for a deeper understanding on the impact digital credit facilities have on the economic and social welfare of low-income earners in Kenya.

However, even if the market for digital credit has grown significantly, it has not reached all Kenyans. It does not serve most Kenyans whose lives are characterised by fluctuating incomes like casual workers and farmers. For the service provider to enter this market niche, it will be essential to understand clearly their financial situations, the risks to their endeavours, and their daily liquidity requirements.

According to the study, most Kenyans are active in the use of Mshwari service to borrow money, save and withdraw from purchases with most of them having used the service in the past 60 days. Most digital credit facility users prefer Mshwari for depositing, withdrawing, storing, and borrowing small amounts of cash from other semi-formal and formal financial service providers. The findings also show that users consider Mshwari as a supportive/ secondary source of finances different from other groups and institutions that are perceived as first landings for savings and credit. There is a likelihood that the capping of the maximum amount one can borrow and the short duration of repayment limits the use of Mshwari to only solving quick financial ups and downs. The two features of Mshwari , I.e., a short period of refund and capping of the maximum amount one can borrow at a given time may give a chance for other financial credit facilities like Sacco’s, Chama’s, and traditional banks to thrive due to the massive amounts and the flexible repayment features they offer. The same possibility may be observed with borrowing from friends and family. The culture of lending within one’s social circles (family members, neighbour’s, friends, and acquaintances) in Kenya is in a way that repayment period may take several years and then payment is made in kind if it finally happens. For this reason, the repayment period of 30 days with Mshwari may go against this culture hence becoming unattractive. Also, the borrower is blacklisted from Mshwari service if they fail to clear the debt within 90 days making the service even more unattractive.

CHAPTER 5: Discussion

5.1 Utilization of Mobile Payment

The utilisation of mobile money as a new advancement in the financial service similarly accompanies some impact, in one way or the other, either on the merchant or the subscriber. However, the effect can be either negative or positive depending on its side effect. One ends up compelling and dependable when the individual gets the chance to account accurately for the services rendered by the service providers have managed to offer to the supporters of the mobile money services. In many cases, nevertheless, this has not been represented.

On Attributes of utilising mobile money exchange, the study came into a conclusion that saving with mobile banking is safe; carrying out transactions was quick and fast, and mobile banking was in a position to save without the knowledge of others. After the study done on mobile money transfer, it was discovered that the trustworthiness and safety of mobile money transfer profoundly impacted respondents’ mobile savings all things considered. Further, in agreement with (Wamaitha, 2016 p20) there was no risk of losing from deception or robbery while using mobile money transfer. The fact that mobile banking was a bank account made it reliable, and mobile money transfer could be trusted since only the client is allowed to access his or her account.

5.2 Impact of Mshwari on Saving

Furthermore, aside from filling in as a tool where people can store cash, mobile money frameworks have additionally been utilised as a saving vehicle particularly among the poorest in Kenya and contributed altogether in improving monetary incorporation to up to this point excluded segments of the population.

This study’s findings propose that advent mobile money in the country has affected the different practices of saving funds among low-wage earners in Kenya. To start with, it appears that mobile payment has been linked to a critical move from the act of saving cash with Chama or Saccos. These findings are in line with (Waweru, & Kamau, 2017 p7) who found that mobile money gives a more secure saving option. Waweru and Kamau (2017 p7) additionally contend that the act of saving cash in non-financial forms, for example, grains and animals anyway seem not to have been influenced by the initiation of mobile money in the rural regions these standards are usually practised.

However, this study seems to contradict with (Lipscomb, & Schechter, 2017 p5) who points out that the inauguration of mobile money, on the contrary, appears to have been linked with an expansion in the number of low salary workers who save their money with SACCOS and formal banks. This hints that mobile payment is in one way or the other connected to an improvement in financial inclusion for the low-income earners who had been financially excluded in the past. As per (Lipscomb, and Schechter (2017p 12) the capacity to keep cash in their investment accounts may likewise shield families from solicitations to loan some money to loved ones, so they might be more averse to lend money when they acquire access to the bank accounts. (Lipscomb, and Schechter (2017 p34), however, did not find that families utilised the chance to save in the Wari account to enlarge their investment funds or to lessen the need to lend or borrow. The savings intercessions had no factually massive effect on general savings stocks or acquiring or loaning flows.

The effect that Mpesa mobile money centres have on the micro unit (that is, safety, access, and cost of the transaction) is highly essential, particularly for the end user. Mpesa mobile money is viewed as a two-edged tool, which acts as a phone cum savings account, hence giving the individuals who do not have formal bank accounts a chance to engage in more effective and safer mechanisms. The service turns into a medium of exchange in an individual client’s regular financial life (Nandhi, 2012 p45). Reliance on expensive and risky choices in savings activities (keeping money at home has to a great extent lessened because Mpesa mobile account became a safe saving alternative. This mechanism of funds saving enhanced their trust in managing and saving money. Sparing and overseeing cash. Consequently, mobile banking became an undeniably advantageous technique for saving, allowing them to save time, energy and cost of transacting in a mortar and brick bank branch. Mpesa mobile banking account is subsequently a decent substitute to casual savings practices.

Various vital discoveries arose from (Nandhi, 2012 p3) overview are in concurrence with the outcomes of this examination. To start with, (Nandhi 2012 p3), when exploring the impacts of that mobile banking has on low income customers’ savings practices, the Indian encounter found that the capacity to save has improved for a more significant part of clients via EKO mobile banking by correlation with prior methods, for example, keeping money available. These casual types of investment funds regularly are defenceless to unnecessary and minor expenditures or claimable by companions/relatives. Second, EKO mobile banking has turned into an extremely viable, safe, and reliable savings tool for its clients; significantly, reliance on risky informal techniques has diminished for a significant number of clients who were beforehand subject to these practices for the absence of affordable and safe savings alternatives. Third, EKO mobile banking is seen as a decent substitute for both conventional banking and casual types of savings; in any case, it has not dissipated the requirement for these current savings instruments. EKO is utilised as one among the numerous different savings mechanisms-including informal techniques by a sizeable level of clients.

A large number of clients view mobile banking the better option for little savings. In the meantime, the fact that there exist transaction charges for withdrawals and deposits keeps a few clients from using Mpesa services. Hence, a significant minority of clients is worried about the conceivable increment in the transaction costs. This would possibly make the service less alluring to the individuals who are hoping to save in little sums of money. The results of this study also agree with (Nandhi, 2012 p4) who affirms that their capacity to save has expanded with the mobile banking services of EKO. Clients have given three critical purposes for this constructive outcome of mobile accounts on their overall behaviour with regards to savings. To begin with, keeping cash in the mobile minds is substantially more secure than keeping money on hand. Second, mobile accounts empower clients to stay away from unreasonable expenses and to save instead of spending, hence instilling better saving routines.

An intriguing finding of this study is that the clients come up with the uses of mobile money in their regular transactions. Mpesa mobile banking is applied as a corresponding device to existing savings exercise. For example, some Kenyans, to make month to month savings in a timely way, choose first to make the deposit into their mshwari accounts. Individually, a large number of clients save in Mshwari for the sake of emergencies. All the more critically, it is considered as a hearty substitute to numerous informal savings methods and a bank account. More importantly, the negative opinions of non-clients pertaining their saving limit talk from one viewpoint to their uneven income, then again lack familiarity with the capability of mobile banking for enhancing their financial opportunities. This lack of awareness raises the requirement for more innovative techniques for connecting with poor people and this by itself will guarantee their financial inclusion.

Informal methods of saving incorporate rotating saving and credit associations (ROSCA), saving with a team of companions, investment funds given to a family or companion for safety’s sake, and saving by putting away subsidies in a mystery place. While (Mbiti, and Weil, 2011 p18) synopsis statistics demonstrate that the number of people utilising informal techniques to save has expanded from 52 per cent to 72 per cent, this study disagrees with (Mbiti, & Weil, 2011 p18) by finding that M-Pesa diminishes the utilisation of informal saving methods. Nonetheless, in a different statement (Mbiti, and Weil, 2011 p19) contends that with low M-Pesa adoption rate, M-Pesa would lessen the pervasiveness of informal saving by 15 per cent, around a 30% decrease.

5.3 Impact of Mpesa on Borrowing

Loans in Mshwari range from Ksh. 100 and extend to the individual customer’s loan limit. The loans are payable with 7.5% p.m. interest on the principle loan. Due to the linkage between Mpesa and Mshwari, Mshwari services have influenced more people to use Mpesa. All these services are accessible on mobile phones and therefore the spill over effect of using Mpesa and Mshwari is that there is an increase in the usage of mobile phone technology in the country.

Moreover, the mobile phone technology has accommodated the linking of bank accounts to the mobile money services and therefore customers are able to access their bank accounts via the mobile phone and can deposit, withdraw and even pay bills from their mobile banking accounts. These features have helped the mobile money industry register tremendous growth in a very short period of time. For instance the daily transactions on these services have increased from 10,000 to 100,000. In 2017 alone, the total amounts of deposits from Mpesa to KCB bank amounted to Ksh 59 Billion while the withdrawals from KCB through Mpesa totaled to Ksh 66 Billion and a further Ksh 1 billion was transacted in the form of paying bills to KCB account owners. With such developments, it is evident that Mpesa has resulted in extensive usage of mobile phone technology among Kenyans.

With the mobile money services, both the banked and the unbanked population can easily send and receive money at all times regardless of their location (Ndegwa, Raphael, 2014 p21). The products within the mobile money services include mobile banking, airtime purchases, mobile money transfers and even the mobile wallet which; allows one to send, save, receive, deposit and pay money to whatever points at any time.

Mobile money services have enabled people from all walks of life access financial services even without bank accounts. There are diverse studies that are in agreement with this current researcher such as (Bold, Porteous, and Rotman, 2012; Dias & McKee, 2010). Bold et al (2012 p24) argue that financial inclusion in the Sub-Saharan Africa is slowly being achieved through the access to mobile money financial services. The mobile money services can be classified in to Mobile banking and mobile payment as these two are the broad categories of services offered through the mobile phones (Dias and McKee, 2010 p45).

Dias and McKee (2010 p56) further established that mobile money services have been embraced widely by the unbanked populations of Kenya and South Africa; to an extent that the people using these services exceed the banked persons by far. In addition, Wakoba, (2012 p10) found out that over Ksh. 185 Billion was being transacted over Mpesa, which was only 68% of the total money involved in the mobile money market in the country.

In a study “Adoption of Mobile Payment Technology by Consumers” by Garrett, Rodermund, Anderson, Berkowitz, & Robb (2014), Garrett et al (2014 p2) results are in agreement with results of this current study. The results establish that mobile money services has had the following impacts; the extensive adoption of mobile payments, the introduction of expensive debts, financial indiscipline which includes overspending, impulse buying and taking unnecessary loans as they seek financial convenience.

5.4 Mshwari VS Other Financial Tools

Thus study is in agreement with Lipscomb, & Schechter (2017 6) who established that mobile money services are beneficial to households as people can save on these platforms. Additionally, Households have taken advantage of these services to reduce the chances of lending to friends and family. However, existing research shows different opinions on the extent to which these new financial service help in changing the existing saving and lending behavior. Duflo, Glennerster, & Kinnan, (2015 p7) argue that a new bank would displace informal lending services whereas Angelucci, Karlan, & Zinman, (2015 p18) prove that a new banking service would increase the rate of borrowing among the target market.

In Kenya, Mpesa has saved most people the stress of unsafe methods of sending money including; sending trough friends, courier and parcels among others. These methods would take long before the money reaches the recipient and there was the risk of the money being lost.

There has been a heated debate on the impact of Mpesa on the financial market industry. Some argue that it replaces the informal groups while others are of the idea that such mobile money services work as a substitute or in coordination with the formal financial services. In agreement with this study, Jack and Suri (2011 p43) establish that more than three quarters of Mpesa customers embrace the service because it provides a platform where they can securely save their money. Again, in agreement with (Morawcyznski and Pickens 2009 p4) is that research has established that Mpesa has replaced the traditional and informal ways of home savings since the customers can save in their Mpesa accounts.

Mpesa has advanced over the years and the development is marked by the invention of new products that influence more people to formal financial services. According to Demirguc-Kunt and Klapper (2012 p89), traditionally, people failed to engage in the formal financial services mainly because the institutions were far. Over time, banks, beginning with the Equity bank, have partnered with Mpesa to offer a savings account such as M-Kesho (Zhu, 2014 p76). This development has seen more than 36 banks partner with Mpesa to allow customers access their bank accounts- where they can deposit, save and withdraw money through the M-banking domain on Mpesa.

5.6 Factors Causing High Adoption

One common finding between this study and (Mpiani, 2017 p3) is that the liquidity and speed of mobile money are significant strengths. The assets owned by people of the low economic class are in the form of valuable objects (for example gold and livestock), and these are most of the time illiquid. When a crisis strikes the poor, these assets become difficult to realize which makes their value to go down. There is a belief that mobile money is very convenient and accessible making it the best way to transact cash and deliver financial services due to its reliability. Compared to the traditional method of cash transactions where people hold liquid cash, mobile money is believed to facilitate quick sending and receiving of money and getting cash whenever one needs it. If the market gets flooded with people expecting to convert their valuable assets to cash at the same time, then the improved mobile money services will facilitate that.

In another case, this study is also in agreement with (Wamaitha, 2016 p5) on mobile money convenience where the study discovered that benefits of mobile banking for instance convenience in savings significantly increased the participant’s propensity to save. Also, mobile banking is acting like a bank account with the added advantages of receiving updates via messages and the ability of the agent to serve the customer even if he or she has closed the counter.

5.7 Factors Leading to Poor Adoption

This study is in agreement with (Hocutt, 2011 p2) that discovered that breakdowns in technology and technical inefficacies cause the system to be inefficient as a whole. This takes place because of the technical inefficiencies in the particular stages that make up the process the most significant challenge being poor network since transactions involving mobile money depend strongly on the network availability. Because of the failures in technology becoming frequent and preventing the mobile money services from running smoothly, the loyal customers become dissatisfied and start looking for better alternatives which they switch to. However, there are possible strategies and measures to solve these failures.

The service providers of mobile money services are putting a lot of effort to upgrade the network to 3G and 4G to address the problem of failing systems with the aim of improving service delivery. Therefore, the only method that seems to work both for the user of mobile money services and that is cost –effective for the merchant is the frequent upgrade of the network and its constant maintenance. Some of the challenges the merchant has to address which were the risks the system identified include the inability to transact because of poor network connectivity, agent’s insufficient liquidity, complicated and confusing user interfaces, poor customer recourse, the possibility of fraudsters that target mobile money users, and lack of adequate protection and data privacy.

5.8 Theory application